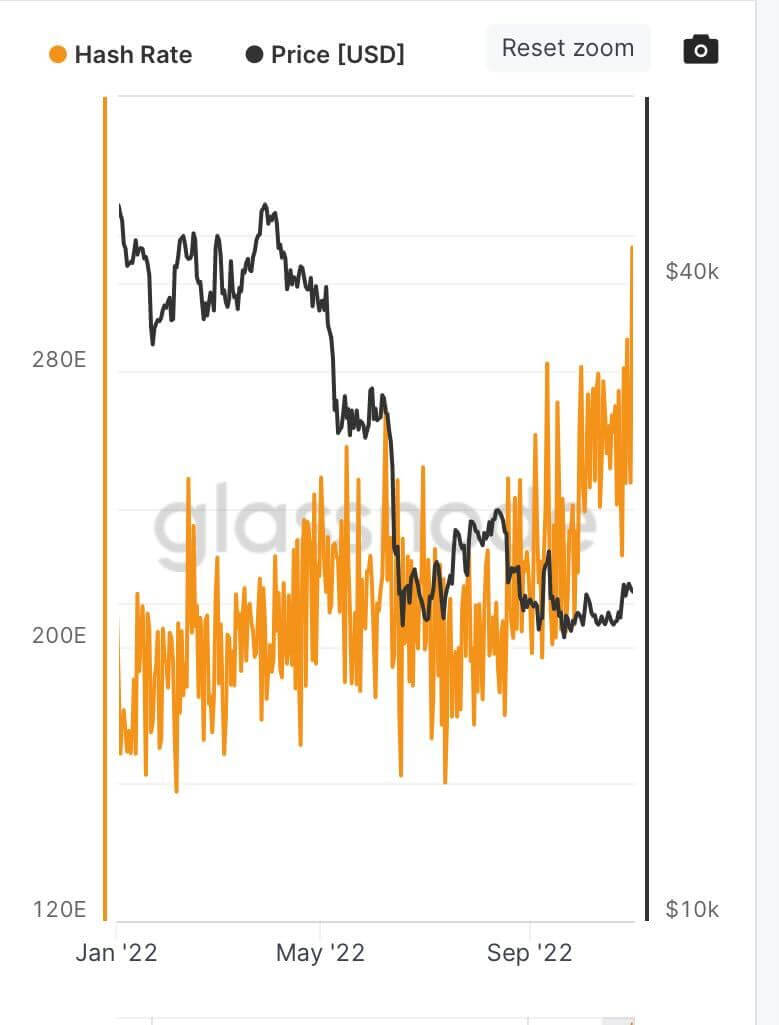

Bitcoin’s hashrate has hit a brand new all-time excessive of 331EH/s, in accordance with information from Glassnode. Traditionally there was a unfastened correlation between hashrate and Bitcoin’s worth spurring debate as as to if hashrate follows worth or vice versa.

The spike in hashrate comes at a troublesome time for miners as some wrestle to fulfill debt funds following Bitcoin’s 70% drawdown from $69k. Additional, analysis performed by CryptoSlate signifies that there could possibly be additional capitulation.

Ought to the rising hashrate enhance pattern proceed and not using a additional leg up in worth, a second capitulation might happen as miners promote their Bitcoin. An analogous scenario occurred in June when miners offered roughly 20,000 BTC.

Hashrate safety

The upside to an ever-increasing hashrate is the potential for a 51% assault on the community decreases. With a hashrate of 313EH/s, an attacker would want roughly 1.9 million Antminer KA3 (166Th) miners.

In 2018 it will have value simply $1.4 billion to conduct a 51% assault on bitcoin when the price to mine 1BTC was simply $8,000. Right now the hashrate has elevated by 900%, and due to this fact the community is that rather more safe. Even in 2018, a foul actor would have wanted 2.4 million top-of-the-range ASIC miners to carry out the assault.

Nonetheless, whereas the rise in hashrate has made the community safer, it additionally leads to increased prices for mining Bitcoin. The next hashrate means a better community problem and, thus, a discount within the BTC generated per kW of vitality.

Bitcoin Miners

When the price of mining Bitcoin overtakes the worth, miners usually face liquidity points. The problems come up from myriad elements, together with margin calls, money circulation, and different normal working prices. Because of this, Binance Pool launched a $500 million fund to assist “distressed mining property.”

Nonetheless, funding in Bitcoin mining exhibits little signal of slowing down. A number of mining firms, comparable to CleanSpark, are in search of new buyers as they bought 3,83 miners from Argo. Riot broke floor at a brand new 1GW mining facility, Nice American Mining was acquired by Crusoe Power, and Compass Mining signed a deal on a brand new 27MW mining heart.

New innovation within the mining area consists of Material Methods’ new liquid-cooled mining machines, a mining funding entity from Greyscale, and Block launching a brand new mining unit buying former Argo CTO.

Whereas the short-term image could also be ominous for Bitcoin miners, there’s little proof of long-term bearish sentiment.