Each previous has a gift, and each current has a future. Conversely, each current is formed by its previous, and each future is formed by the current. Bitcoin is presently a disruptive powerhouse within the international finance sector; what might be its previous? Let’s discover out.

Bitcoin, the world’s first decentralized digital forex, has a historical past spanning over a decade. It has modified our ideas about cash, worth, and monetary transactions.

From its mysterious beginnings in 2009 to its meteoric rise to fame and fortune and its subsequent descent into the mainstream, Bitcoin historical past is among the most intriguing tales of our time.

On this article, we’ll have a look at Bitcoin’s value historical past, Bitcoin costs from 2009 to 2022, elements that have an effect on Bitcoin costs, and the long run forward.

The Origins of Bitcoin

Bitcoin was created in 2009 by an unknown particular person or group utilizing the pseudonym “Satoshi Nakamoto.” The origins of the forex are shrouded in thriller, and to at the present time, nobody is aware of for sure who created it.

We do know that the primary block of Bitcoin was mined on January 3, 2009, and it contained a message that learn, “The Instances 03/Jan/2009 Chancellor on the point of second bailout for banks.” This message referenced a headline within the Instances newspaper within the UK, which reported that the federal government (central financial institution) was contemplating a second bailout for the banking trade.

The message was seen as a political assertion by some, suggesting that bitcoin was created in response to the monetary disaster on the time. Others noticed it as a intelligent piece of promoting designed to generate curiosity and curiosity within the new forex.

Regardless of the motivation, bitcoin shortly gained a following amongst tech fanatics and libertarians who noticed it as a approach to bypass the standard banking system and take management of their funds.

Bitcoin Worth Historical past: 2009 to 2012

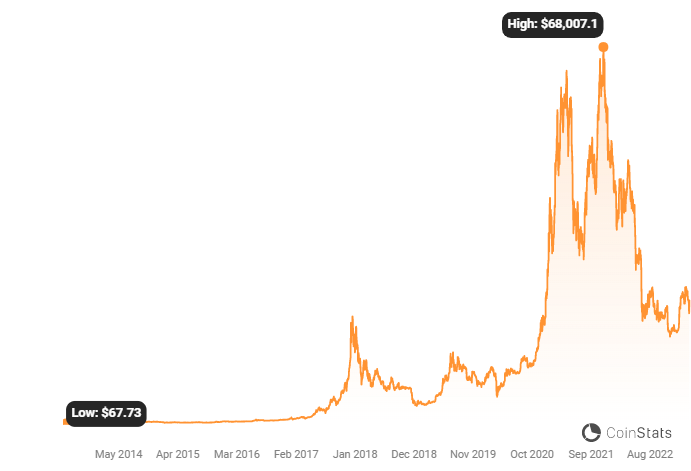

Bitcoin was price little or no in its early days. The primary market worth of Bitcoin was in 2010 when Laszlo Hanyecz (a Floridian programmer) purchased two Papa John’s pizzas for 10,000 bitcoins. On the time, that was equal to about $25 — that means one bitcoin bought for $0.0025. At this time, those self same 10,000 bitcoins could be price greater than $300 million.

In 2010, the primary Bitcoin alternate was launched, known as Mt. Gox. It was a Japanese-based alternate that shortly grew to become the go-to place for individuals to purchase and promote bitcoins. In 2011, Bitcoin started to rise as extra individuals began to take discover of the forex. By June of that 12 months, the value had reached $31, however Bitcoin dropped to round $2 afterward.

Bitcoin’s value began to climb once more in 2012, reaching $13 in January. The rise continued, hitting a peak of $266 in April. Nonetheless, this was short-lived, and bitcoin fell shortly to round $70. This sudden drop was attributed to a number of elements, together with the chapter of the Bitcoin alternate Bitfloor and a hack that noticed 24,000 bitcoins stolen from the alternate, BitInstant.

Bitcoin Worth Historical past: 2013 to 2017

Regardless of the setbacks of 2012, bitcoin continued to realize recognition, and the value started to rise once more. Bitcoin hit an all-time excessive of $1,242 in November 2013. This was largely attributable to mainstream companies’ rising acceptance of Bitcoin, equivalent to on-line retailer Overstock.com, which started accepting Bitcoin transactions.

Nonetheless, Bitcoin started to drop once more, and by the tip of 2014, it had fallen to round $300. This was partly because of the collapse of Mt. Gox, the biggest cryptocurrency alternate on the time. In February of that 12 months, the alternate introduced that it had misplaced 850,000 bitcoins, price round $450 million on the time. Regardless of this setback, Bitcoin gained traction, and its value rose once more.

By 2016, the value of Bitcoin had risen to round $400, and it continued to climb over the following 12 months. In Could 2017, the value reached $1,500; by June, it had surged to $2,500. This was largely attributable to a rising curiosity from buyers and bitcoin customers, who noticed bitcoin buying and selling as a probably profitable funding alternative.

In August 2017, Bitcoin’s value continued by way of the $4,000 mark, and by December, it had reached an all-time excessive of $19,783. This sudden surge in worth was largely because of the rising mainstream acceptance of Bitcoin and a wave of speculative funding from people hoping to money in on the cryptocurrency craze.

Bitcoin Worth Historical past: 2018 to 2022

BTC Worth in 2018 📉

At first of 2018, Bitcoin was round $13,000. Nonetheless, this was the beginning of a downward pattern that might proceed for many of the 12 months. By the tip of January, the value had dropped to round $10,000; by mid-February, it had fallen under $8,000. In March, the value briefly climbed again as much as round $11,000, however this was short-lived, and by April, the value had dropped to round $6,500.

All through the remainder of the 12 months, Bitcoin’s value fluctuated between $6,000 and $10,000, with occasional spikes and dips. The 12 months’s lowest level got here in December when the value dropped to round $3,200. This was a big drop from the earlier 12 months’s all-time excessive, and plenty of buyers who had purchased bitcoin at its peak have been left with important losses.

One of many key elements that contributed to the decline in Bitcoin’s value in 2018 was regulatory uncertainty. Governments worldwide have been grappling with learn how to regulate cryptocurrencies, and there have been issues that elevated regulation might negatively affect the worth of Bitcoin. Moreover, there have been issues about safety and scalability points with the bitcoin community, which led to a insecurity within the cryptocurrency.

BTC Worth in 2019 📊

The beginning of 2019 noticed Bitcoin’s value hover across the $3,500 to $4,000 vary. Nonetheless, in April, the value out of the blue jumped to round $5,000; by the tip of June, it had once more climbed to round $13,000. This sudden value enhance was largely attributed to optimistic information in cryptocurrency, such because the announcement of Fb’s Libra undertaking and elevated institutional adoption of cryptocurrencies.

Nonetheless, this upward pattern was short-lived, and by the tip of the 12 months, Bitcoin’s value had once more fallen to round $7,000. Regardless of bitcoin volatility, 2019 was a 12 months of relative stability for Bitcoin in comparison with the earlier 12 months.

BTC Worth in 2020 📈

In 2020, the world was hit by the COVID-19 pandemic, which had a big affect on the worldwide economic system and monetary markets. Bitcoin’s value was not immune to those results, and in March, the value dropped by over 50% in simply in the future, falling from round $8,000 to round $3,800. Nonetheless, by Could, the value had recovered to round $9,000, and by the tip of the 12 months, it had jumped to round $29,000.

The sudden drop in Bitcoin’s value in March 2020 was largely attributed to the broader market sell-off and panic brought on by the COVID-19 pandemic. Nonetheless, the following restoration and development in Bitcoin’s value may be attributed to numerous elements, together with elevated institutional adoption of cryptocurrencies, the rising recognition of Bitcoin as a hedge towards inflation, and the rising notion of Bitcoin as a retailer of worth.

BTC Worth in 2021 💣

Bitcoin’s value continued to climb up initially of 2021, reaching round $40,000 in early January. Nonetheless, this was just the start of a dramatic enhance in value that might see Bitcoin attain new all-time highs. By the tip of February, the value had climbed to over $50,000; by mid-April, it had reached an all-time excessive of above $68,000.

The surge within the value of BTC in 2021 was largely pushed by elevated institutional adoption, with corporations like Tesla and Sq. investing important quantities of cash into Bitcoin. Moreover, the rising recognition of cryptocurrencies instead funding and retailer of worth, mixed with low-interest charges and the potential for inflation, led many buyers to see BTC as a lovely funding alternative by way of Bitcoin futures, buying and selling, proshares Bitcoin technique ETF, and so on.

Nonetheless, Bitcoin’s volatility was once more displayed in 2021, with the value experiencing important dips and spikes. By the tip of Could, the value had fallen to round $30,000; by mid-July, it had fallen under $30,000. Nonetheless, by the 12 months’s finish, the value once more climbed to round $50,000.

BTC Worth in 2022 💪

In 2022, Bitcoin began to expertise one other market downturn. The value began the 12 months at round $48,000, regularly dropping with every consecutive decrease excessive it made. With increasingly promoting stress, the value ended up on the low of simply above $16,500 till pushing again up in 2023.

As of December 2022, the value of Bitcoin was round $16,600.

In conclusion, Bitcoin’s value historical past from 2018 to December 2022 has been characterised by important volatility, occasional spikes, and dips. Cryptocurrency has confronted numerous challenges, together with regulatory uncertainty and scalability points, however has additionally seen elevated institutional adoption and rising recognition instead funding and retailer of worth.

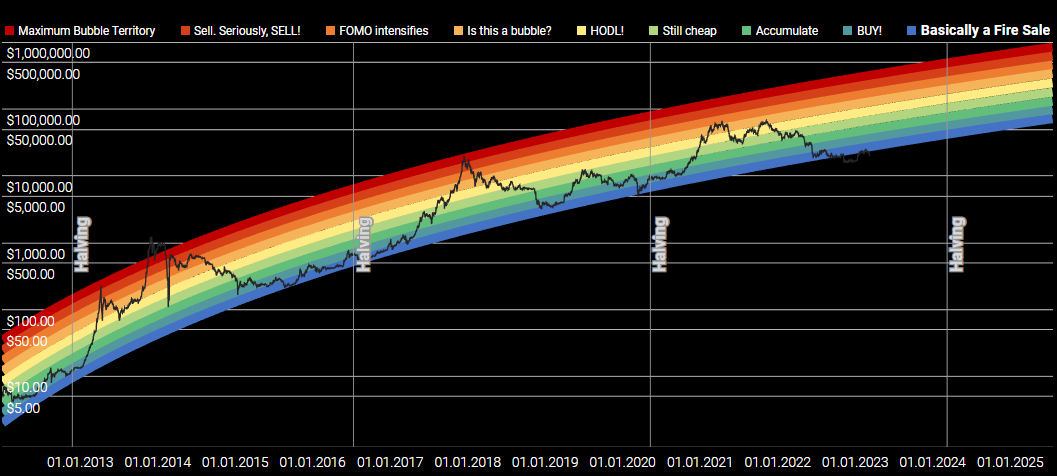

Trying forward, it’s troublesome to foretell the place Bitcoin’s value will go. The cryptocurrency market is notoriously risky, and plenty of elements can affect the value, together with regulatory modifications, technological developments, and modifications in investor sentiment. Nonetheless, there are some causes to be optimistic about bitcoin’s prospects.

Elements Affecting The Worth of Bitcoin

Let’s talk about the assorted elements that have an effect on the value of Bitcoin and the way these elements work together to affect the worth of the digital forex.

Provide and Demand

Some of the elementary elements that have an effect on bitcoin’s value is provide and demand. Bitcoin has a set provide, with a most of 21 million bitcoins that may ever be created. This shortage has helped to extend demand for the cryptocurrency, and consequently, bitcoin continues to rise over time.

Numerous elements, together with the extent of adoption, media protection, and investor sentiment, affect the demand for Bitcoin. When extra individuals develop into excited about BTC and wish to put money into it, the cryptocurrency demand will increase, rising the value. Equally, when fewer persons are excited about it, demand decreases, and the value falls.

Media Protection

One other important issue that impacts the value of Bitcoin is media protection. The cryptocurrency is commonly featured in information tales, with studies on its value actions and any developments within the Bitcoin blockchain expertise that underpins it.

Constructive information from the Bitcoin Basis and media protection, significantly from mainstream media retailers, can enhance demand for Bitcoin, which may push up the value. Alternatively, unfavorable media protection can result in a lower in demand, and this may trigger the value to fall.

Regulatory Modifications

Regulatory modifications also can have a big affect on the value of Bitcoin. Nations worldwide have various acceptance of cryptocurrencies, and regulation modifications can affect the adoption of Bitcoin.

For instance, suppose a big authorities publicizes that it’s going to ban cryptocurrencies or implement strict rules. In that case, this may trigger a lower in demand, and the value of Bitcoin could fall — as we noticed in China. Conversely, suppose a authorities publicizes it is going to be extra lenient with rules or acknowledges bitcoin as a reputable forex. In that case, this may enhance demand, and the value could rise.

Mining Problem

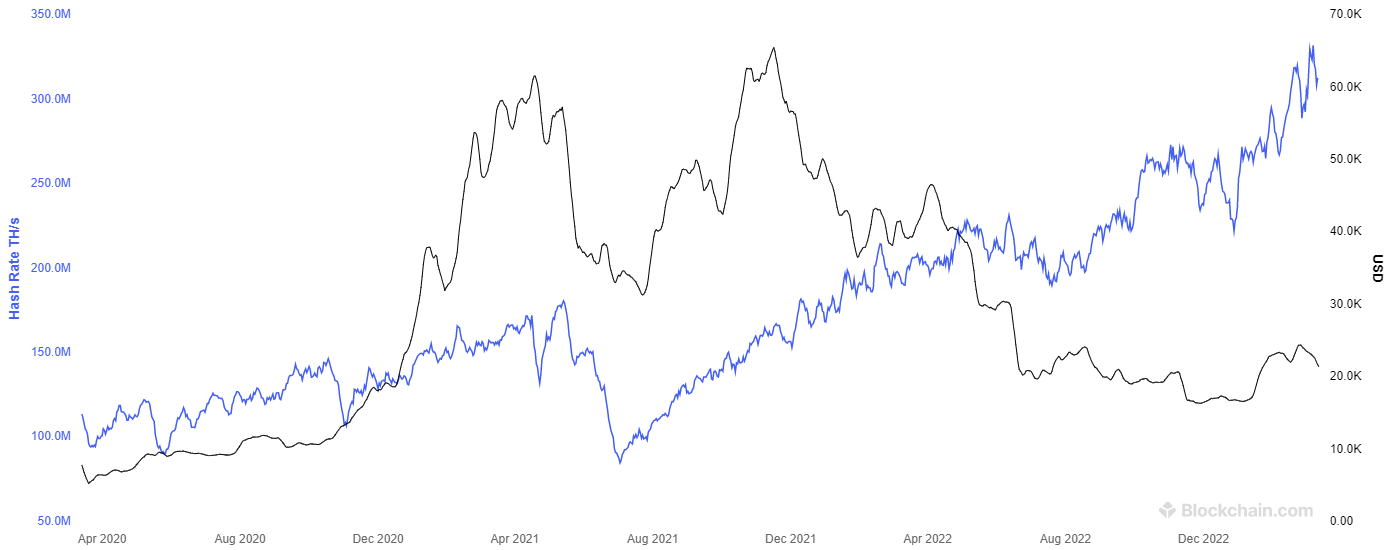

Bitcoin mining is the method by which new bitcoins are created, and transactions are verified. It’s a advanced course of that requires important computational energy and power consumption.

The issue of mining Bitcoin is a measure of how arduous it’s to create a brand new block within the Bitcoin blockchain. The mining issue will increase as extra miners compete to confirm transactions and create new blocks. This will affect the provision of Bitcoin, because it turns into more durable to mine, and the price of mining will increase.

When the mining issue will increase, some miners could resolve it’s now not worthwhile to mine Bitcoin and should cease mining. This will result in a lower within the provide of Bitcoin, which may drive up the value. Conversely, if the mining issue decreases, extra miners could begin mining, rising the provision of Bitcoin and reducing its value.

Market Sentiment

Market sentiment refers back to the total feeling amongst buyers a couple of specific asset. Numerous elements, together with media protection, social media discussions, and normal financial situations, can affect it.

When market sentiment is optimistic, buyers usually tend to put money into Bitcoin, which may enhance the value. Conversely, when market sentiment is unfavorable, buyers could also be extra cautious, resulting in a lower in demand and a fall within the value.

General Financial Situations

Lastly, the general financial situations also can affect the value of BTC. In occasions of worldwide monetary disaster and financial uncertainty, buyers could search for different property to put money into, and Bitcoin could also be seen as a haven asset.

Equally, throughout financial stability and development, buyers could also be extra keen to tackle higher-risk investments, and demand for Bitcoin could fall.

As well as, the worth of Bitcoin is commonly in comparison with conventional currencies, such because the US greenback. Modifications within the greenback’s worth can affect the value of Bitcoin, as buyers could select to carry Bitcoin as a hedge towards inflation or forex devaluation.

A posh vary of things influences the value of Bitcoin. Understanding these elements is essential for buyers trying to put money into Bitcoin, as it will probably assist them make knowledgeable selections about when to purchase or promote the cryptocurrency.

Regardless of BTC’s classification as a dangerous asset, many buyers are drawn to it attributable to its potential for prime returns and its distinctive place as a decentralized and borderless forex. Because the world turns into more and more digital, the demand for Bitcoin and different digital property will possible proceed to develop, and the elements influencing their value will develop into much more necessary.

The Way forward for Bitcoin

The way forward for Bitcoin stays unsure, however many consultants and analysts imagine it is going to proceed to develop in recognition and worth within the coming years. Some predict that the future value of Bitcoin might attain $100,000 and even $1 million per coin within the close to future.

Nonetheless, there are issues about the way forward for Bitcoin, significantly regarding regulation and environmental issues. Governments worldwide are starting to crack down on cryptocurrencies, which might restrict adoption and utilization in sure nations. Moreover, technological points equivalent to scaling and safety might pose future challenges for the bitcoin community.

There are additionally rising issues concerning the environmental affect of Bitcoin mining. Bitcoin mining requires a big quantity of power, resulting in issues about carbon emissions and their environmental affect. Some consultants imagine that bitcoin mining might develop into unsustainable in the long term if different power sources are usually not developed.

Regardless of widespread criticism, many individuals stay optimistic about the way forward for bitcoin and different cryptocurrencies. They see them as a possible different to fiat currencies and a approach to conduct transactions securely and privately.

One of many key drivers of Bitcoin’s costs within the coming years is more likely to be continued institutional adoption. Extra corporations and monetary establishments will possible put money into BTC and different cryptocurrencies as they develop into extra mainstream.

Moreover, the rising recognition of decentralized finance (DeFi) and non-fungible tokens (NFTs) is more likely to drive additional innovation in cryptocurrency. This might result in new use circumstances and elevated demand for Bitcoin.

Whereas the way forward for Bitcoin stays unsure, its affect on the world of finance and economics is plain. It has opened up new prospects for people and companies and challenged conventional notions of cash and worth.

As we glance to the long run, it is going to be fascinating to see how Bitcoin and different digital property proceed to evolve and alter how we take into consideration cash and transactions. Whereas challenges and issues should be addressed, the potential advantages of those applied sciences are too nice to disregard.

Conclusion

Bitcoin’s value historical past is a captivating story spanning over a decade. From its mysterious origins in 2009 to its meteoric rise to fame and fortune in 2017 and its subsequent descent into the mainstream, Bitcoin has captured the creativeness of tens of millions of individuals all over the world.

Whereas Bitcoin costs have fluctuated wildly through the years, it stays a preferred funding alternative for many individuals. Some see it as a possible different to conventional currencies, and there’s a rising motion of individuals utilizing Bitcoin and different cryptocurrencies to conduct transactions and retailer their wealth.