Bloomberg Intelligence senior macro strategist Mike McGlone says Bitcoin (BTC) could possibly be staring down the barrel of a 60% value plunge.

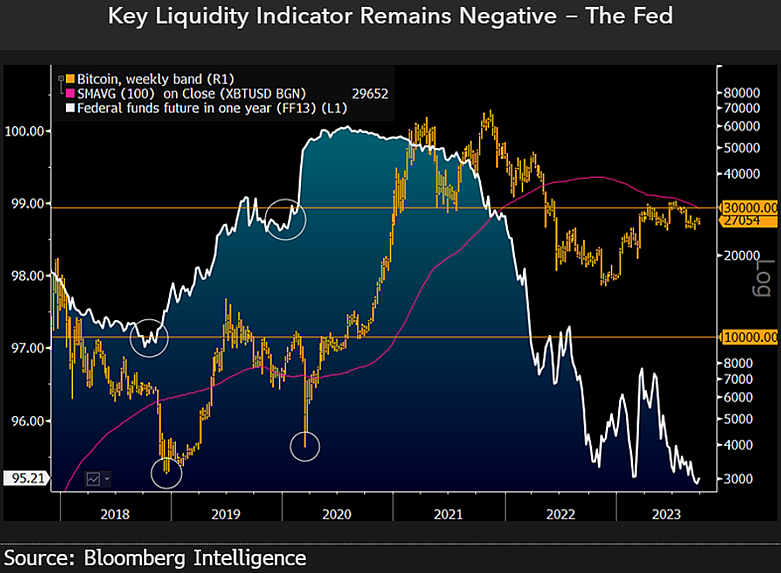

McGlone says the important thing indicator for BTC is that liquidity stays destructive and world charges proceed to rise “regardless of recession indicators.”

The analyst nonetheless believes the US will endure a recession by the top of 2023. He notes that Bitcoin’s pivotal resistance is the $30,000 degree, and he says the highest crypto asset has “dangers tilted towards $10,000.”

McGlone additionally says the most important danger for the crypto sector general could be strain from a stock-market drawdown associated to a recession.

“Crypto weak point in 3Q (third quarter) could also be a restoration blip or a recession leaning. Our bias is the latter, as virtually all danger belongings gained in 2023 and rolled over into the quarter. Most central banks are nonetheless tightening regardless of contraction indicators within the US and Europe, and the property disaster in China, with deflationary implications.

The Bloomberg Galaxy Crypto Index’s (BGCI) relative underperformance might replicate truth adjustments for an asset class raised on zero rates of interest. Spiking US Treasury yields in 1987 topped the week earlier than the crash, whereas crude’s peak was in July 2008. We see parallels. Bitcoin swoons have preceded Federal Reserve pivots, which can underscore the crypto’s main indicator attributes and what may be wanted to revive liquidity.”

BTC is value $27,705 at time of writing, up 1.33% previously 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney