Constancy Investments’ world macro director Jurrien Timmer says {that a} recession might spark an enormous rally for Bitcoin (BTC).

Timmer tells his 167,000 followers on the social media platform X that present high-interest charges want to say no for Bitcoin to place up large good points.

“What is going to hold driving it?

First, the macro narrative wants to vary from restrictive to accommodative.

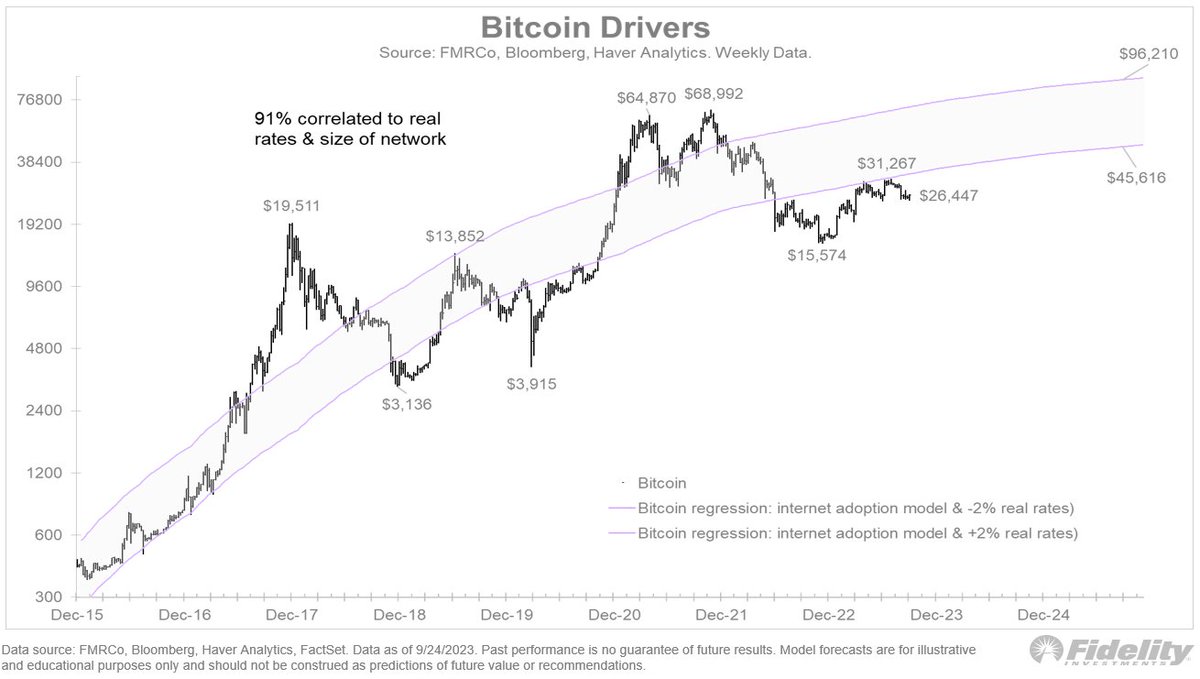

Under is a regression mannequin that lays out a worth band primarily based on a typical adoption curve and a spread of actual charges (from -2% to +2%).”

The macro professional’s chart makes use of a worth vary derived from the Bitcoin adoption price primarily based on the previous adoption price of the web and an actual rate of interest vary between 2% and -2%, which is nominal curiosity minus inflation.

Taking a look at his chart, Timmer believes that Bitcoin’s transfer to the upside could solely be to the $45,616 stage in direction of the top of 2025. Nonetheless, if rates of interest come down, his chart suggests Bitcoin might see a excessive of $96,210 earlier than 2025 involves an in depth.

The macro professional believes {that a} recession would trigger the Federal Reserve to pivot after which traders would probably view gold and Bitcoin as secure haven investments, driving the belongings’ costs increased.

“If and when that long-elusive recession lastly hits, and the Fed pivots for actual, Bitcoin and gold may very well be considered as high-powered hedges.”

In keeping with Timmer, Bitcoin might print good points within the subsequent market cycle no matter how the inventory market performs.

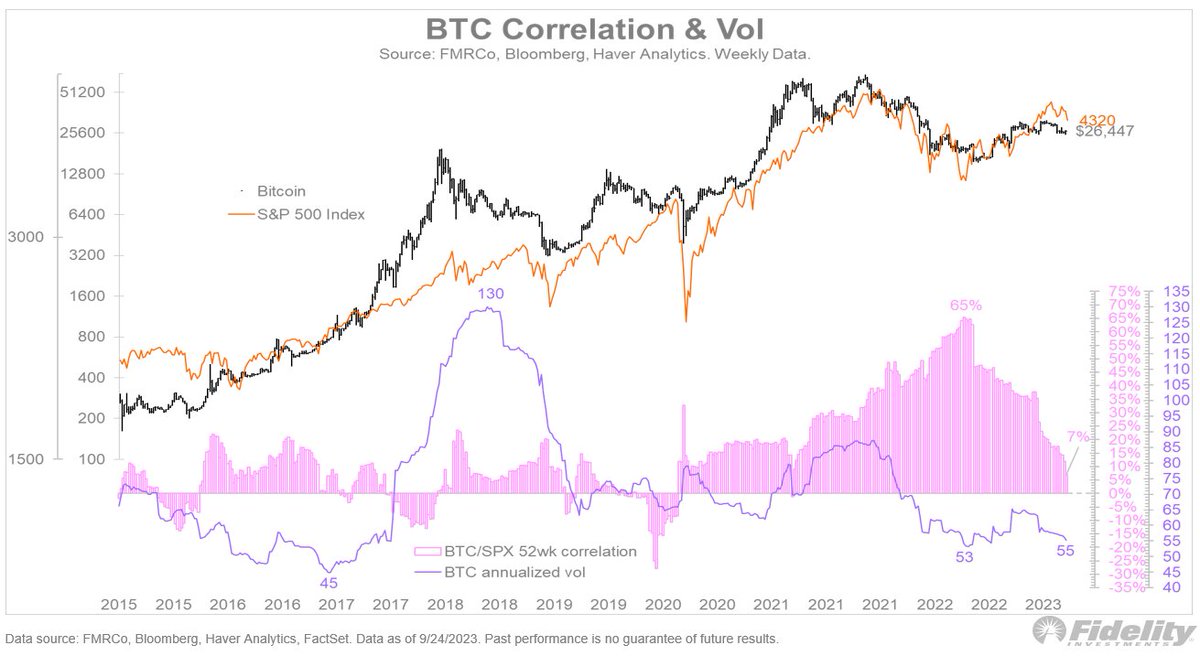

“Bitcoin has grow to be much less correlated to equities, and fewer unstable. Its annual volatility has declined from 85 in 2021 to 55 (which continues to be excessive), and its 12-month correlation has fallen from 65% to solely 7%. So Bitcoin would possibly present uncorrelated returns within the subsequent market cycle.”

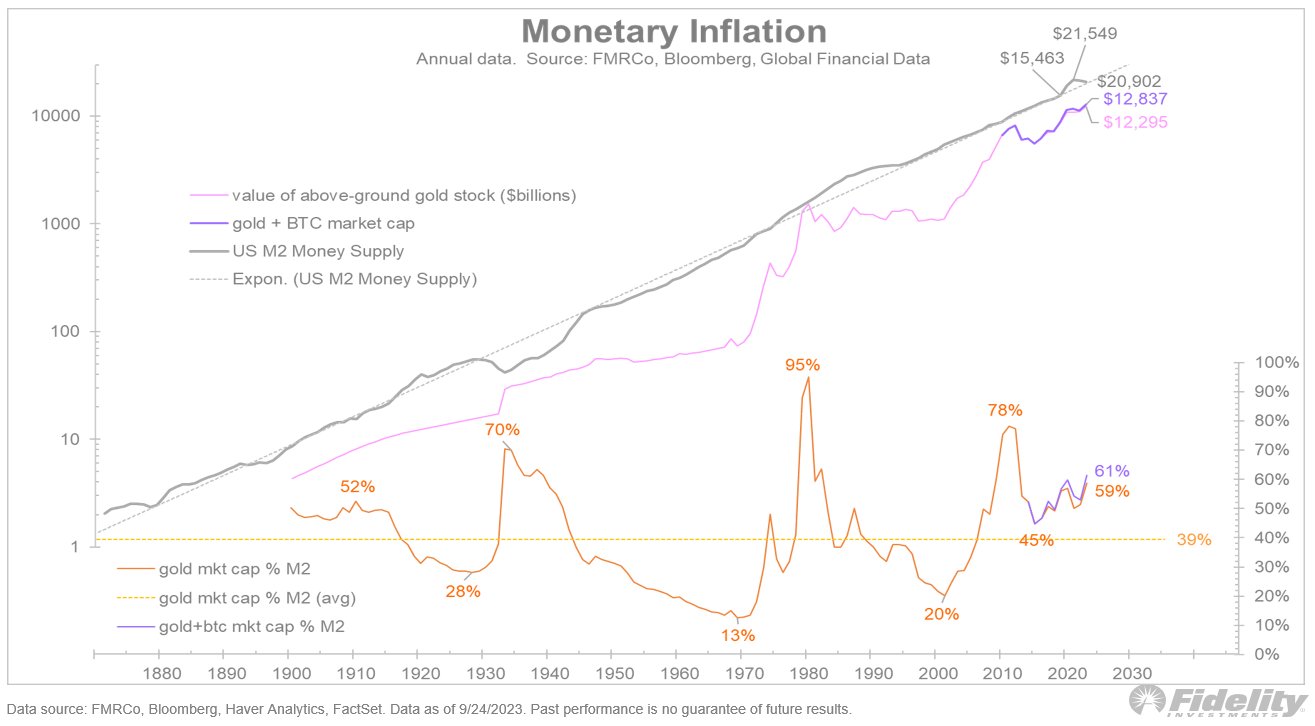

The macro professional additionally says that for Bitcoin to succeed in new all-time highs, the Federal Reserve might want to inject extra liquidity into the markets, which it did through the Covid-19 pandemic to prop up the economic system by way of quantitative easing, also referred to as printing cash.

“Bitcoin bulls want the cash printers to go to work once more. The cash provide exploded in 2020-21, a situation by which gold bugs and Bitcoin bulls thrived. When the cash provide grows sooner than its long-term development price, gold’s market share has gone up.”

Bitcoin is buying and selling for $26,931 at time of writing, down 0.5% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney