Bloomberg Intelligence’s senior macro strategist Mike McGlone warns that Bitcoin’s (BTC) parabolic ascent during the last decade or so seems to be eerily just like the 1929 inventory market bubble.

McGlone says that the high-interest price atmosphere reminds him of the situations that led to the collapse of the inventory market in 1930.

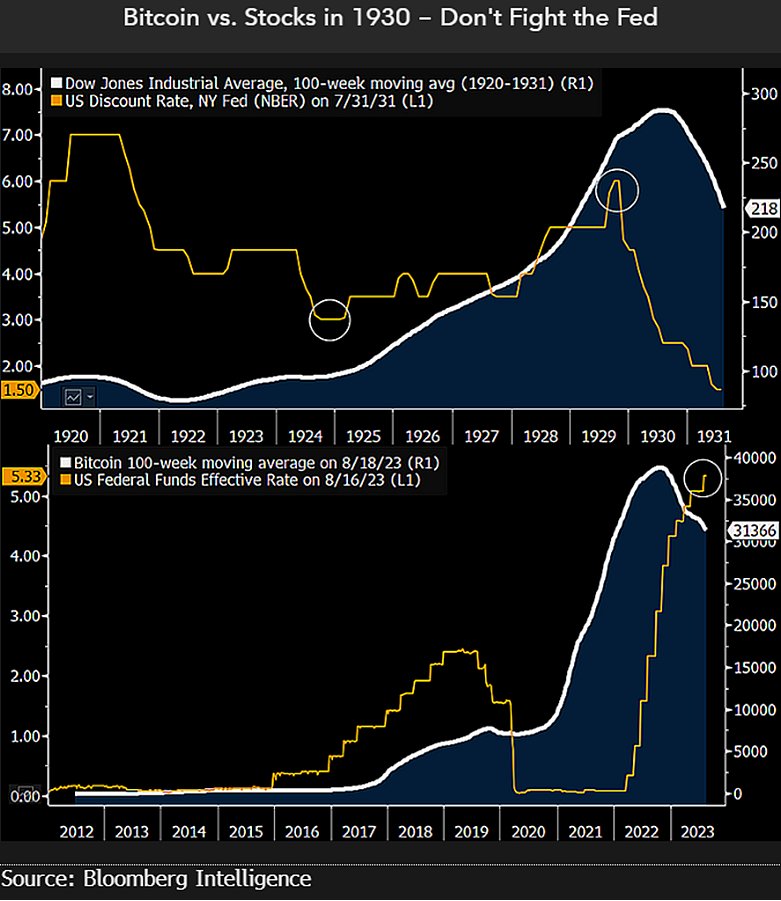

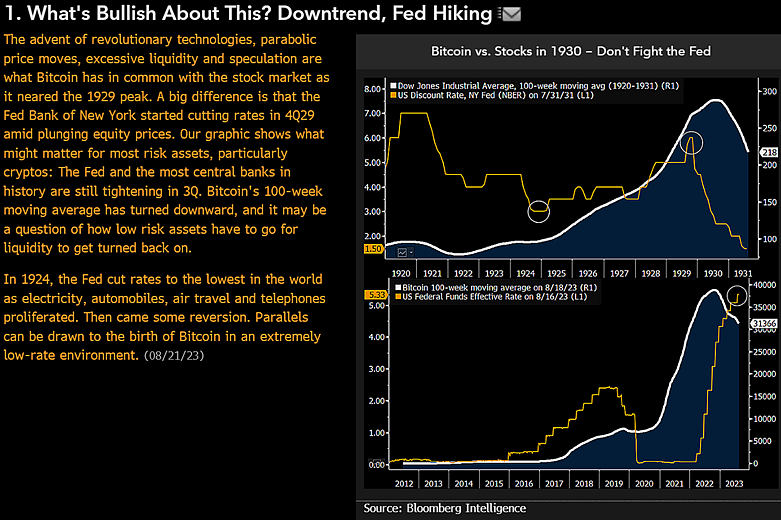

The analyst shares a graphic exhibiting how the US low cost price peaked in 1929 simply earlier than the 100-week transferring common of the Dow Jones Industrial Common (DJIA) rolled over.

The US low cost price is the rate of interest charged to banks on loans collected from the Federal Reserve.

The graphic additionally exhibits the steep rise within the Fed’s rate of interest during the last yr or so with Bitcoin’s 100-week transferring common witnessing a downtrend.

“Among the best-performing property in historical past and a number one indicator – Bitcoin – seems just like the inventory market in 1930. Statistician and entrepreneur Roger Babson started warning about elevated fairness costs properly earlier than economist Irving Fisher proclaimed a ‘completely excessive plateau’ in 1929. The Fed tilts our bias towards a stance just like Babson’s.”

McGlone additionally highlights that the start of Bitcoin is paying homage to the tech developments about 100 years in the past when electrical energy, automobiles, air journey and telephones proliferated. Based on the Bloomberg analyst, the parabolic rise of Bitcoin and the emergence of revolutionary applied sciences within the Twenties each got here at a time when the Federal Reserve saved rates of interest low.

“What’s Bullish About This? Downtrend, Fed Mountain climbing…

The appearance of revolutionary applied sciences, parabolic value strikes, extreme liquidity and hypothesis are what Bitcoin has in widespread with the inventory market because it neared the 1929 peak. An enormous distinction is that the Fed Financial institution of New York began slicing charges in 4Q29 amid plunging fairness costs.”

At time of writing, Bitcoin is buying and selling for $26,020.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney