The U.S. Federal Reserve raised rates of interest by 75 foundation factors (bps) after the Federal Open Market Committee (FOMC) assembly on Oct. 2, bringing the Federal Funds Price to three.75 – 4%.

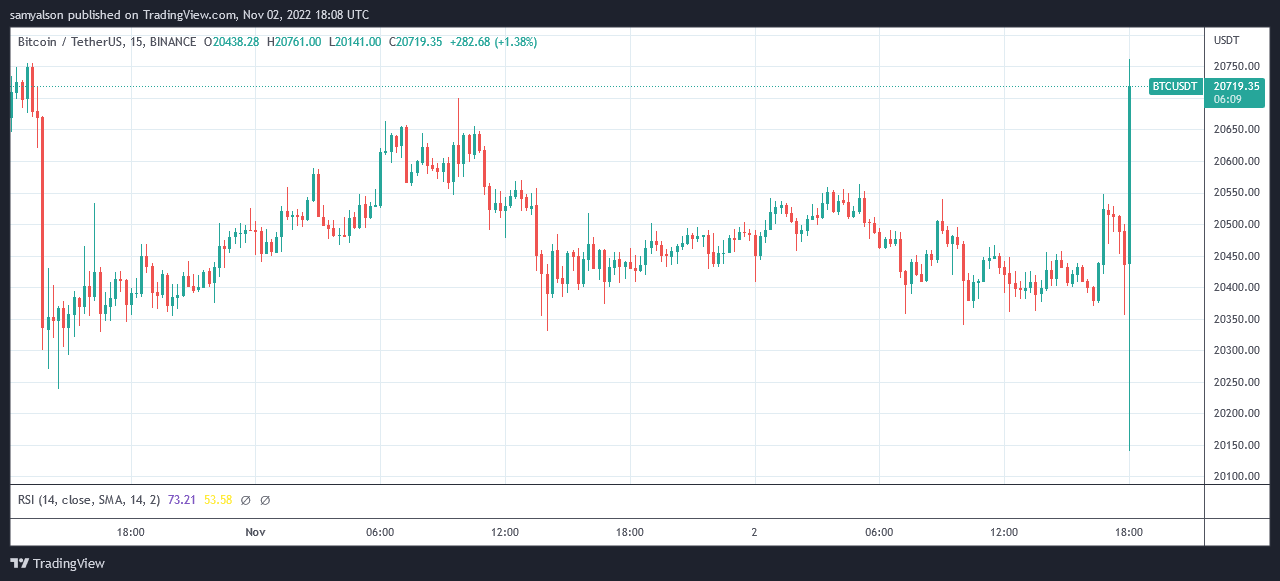

Bitcoin reacted with a direct 3% swing to the upside, topping out at $20,700 on the 18:00 (UTC) candle.

The Fed presses forward with hike program

Following the Sept. 21 FOMC assembly, the Fed enacted a 3rd consecutive 75 bps improve.

Since then, further stress to keep up the tempo of price hikes has come from a buoyant U.S. jobs market, up by 263,000 jobs for September, and the newest Bureau of Labor Statistics report displaying worse-than-expected Shopper Worth Index (CPI) information.

Bruce Kasman, the Chief Economist and Head of World Financial Analysis at JPMorgan, lately advised Bloomberg that job development must sluggish to 100,000 a month for the subsequent two to 3 months earlier than the Fed may even contemplate taking its foot off the fuel.

Kasman stated, in his view, it’s affordable for the Fed to pause rates of interest at 4-4.5%.

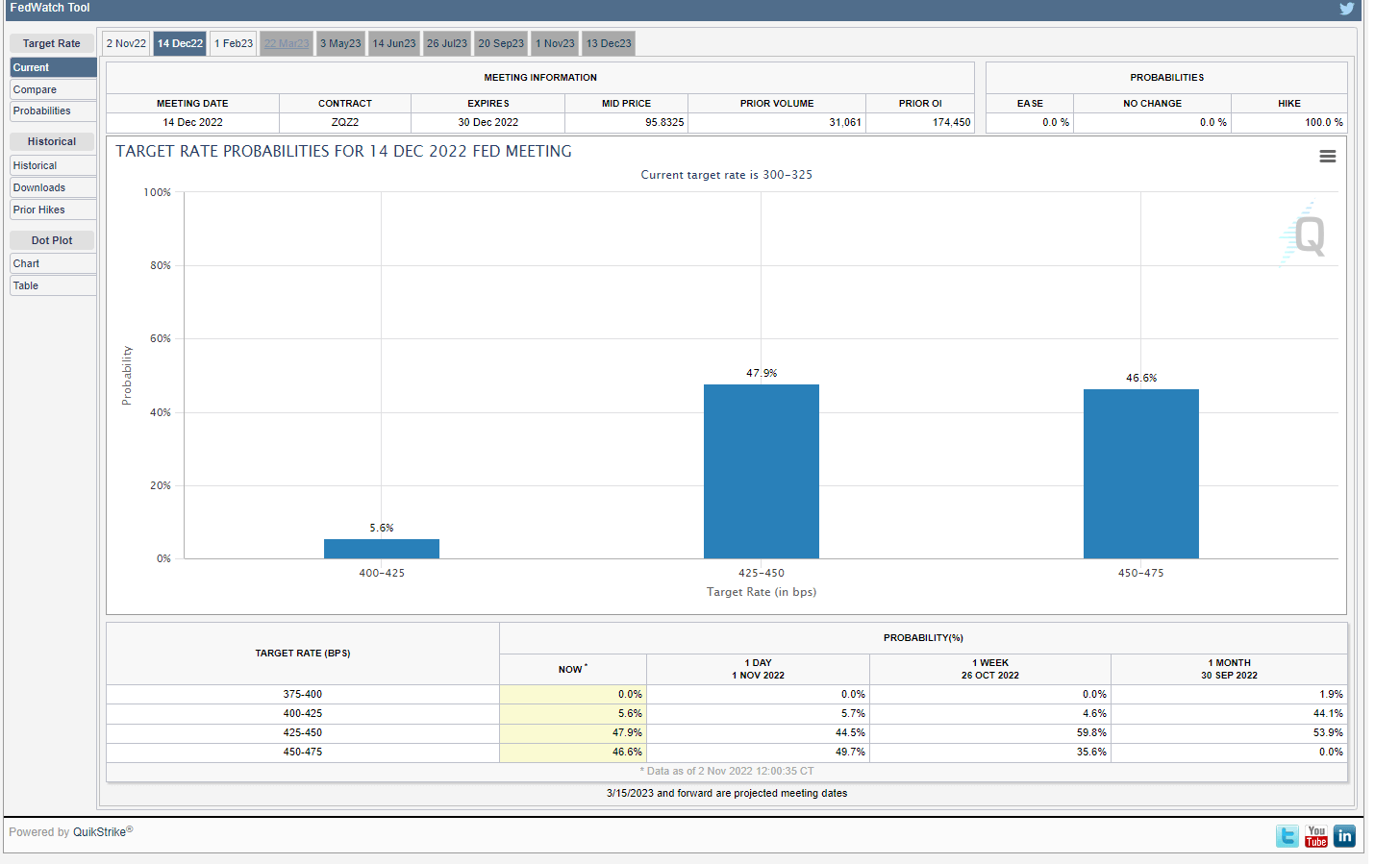

Earlier than at this time’s announcement, expectations have been for a 75 bps hike, making at this time’s hike a non-event, based on CryptoSlate Analyst James Van Straten.

As a substitute, Van Straten stated the main target is on the subsequent FOMC assembly, scheduled for Dec. 14-15. Primarily based on this final result, the market can gauge whether or not the Fed intends to decelerate with the tempo of price will increase.

At present, the market is 50/50 on whether or not December’s choice will yield a 50 or 75 bps improve.

Bitcoin spikes to $20,7000

Within the run-up to the speed announcement, Bitcoin started trending decrease from a neighborhood prime of $20,550. This was adopted by a drop to $20,144 on the previous 15-minute candle.

As soon as the announcement was made, Bitcoin moved to $20,700, making up for all the earlier losses. Nevertheless, it stays to be seen whether or not this uptick will be sustained to interrupt out of its slender buying and selling band.