Bitcoin worth has been struggling to interrupt above the essential resistance degree of $26,500 for the previous few days. The premier cryptocurrency has slumped by greater than 13% within the month thus far however stays 56% increased within the 12 months thus far. Bitcoin’s complete market cap is a formidable $503 billion, down by greater than 20% in comparison with its highest degree thus far this 12 months of $612 billion. On the time of writing, the Bitcoin worth was buying and selling 1.50% decrease at $25,797.25.

Fundamentals

Similar to most altcoins, Bitcoin, the largest cryptocurrency by market cap, has been in consolidation mode in latest buying and selling classes amid a powerful bear market. Ethereum, the most important altcoin by complete market cap, has been hovering under the vital resistance degree of $1,700 after going through a powerful rejection on the degree. In accordance with Coinmarketcap, the worldwide crypto market cap stays decrease at $1.04 trillion, whereas the entire crypto market quantity elevated barely over the past day.

The Crypto Worry & Greed Index, which is a key measure of the crypto market sentiment by its individuals, was at a concern degree of 37 on Friday. It is a slight decline from the concern degree of 40 recorded earlier this week. Moreover, it signifies that the danger urge for food amongst traders has inched decrease in comparison with final month’s impartial degree of 49.

Focus will now be on the US Federal Reserve forward of its two-day coverage assembly slated for the 19th and 20th of September. US Treasury yields have been within the pink for the previous two buying and selling classes as traders assessed the opportunity of additional charge hikes by the central financial institution amid stronger-than-expected financial information.

Financial studies launched on Thursday signaled a rise in inflationary pressures and a tighter labor market, fueling issues that the Fed’s rate of interest hike marketing campaign may not be over but. The US greenback is hovering round its highest degree since March 2023, buoyed by the resilient US financial information. At press time, the US greenback index, which measures the efficiency of the buck towards different main currencies, was buying and selling increased at 105.

In accordance with the CME FedWatch Instrument, markets are pricing in a 93% probability of the Federal Reserve leaving rates of interest unchanged in its September assembly. Notably, expectations for a charge hike in November are roughly 43%. An surroundings of upper rates of interest is often bearish for danger belongings, significantly cryptocurrencies.

Bitcoin Value Outlook

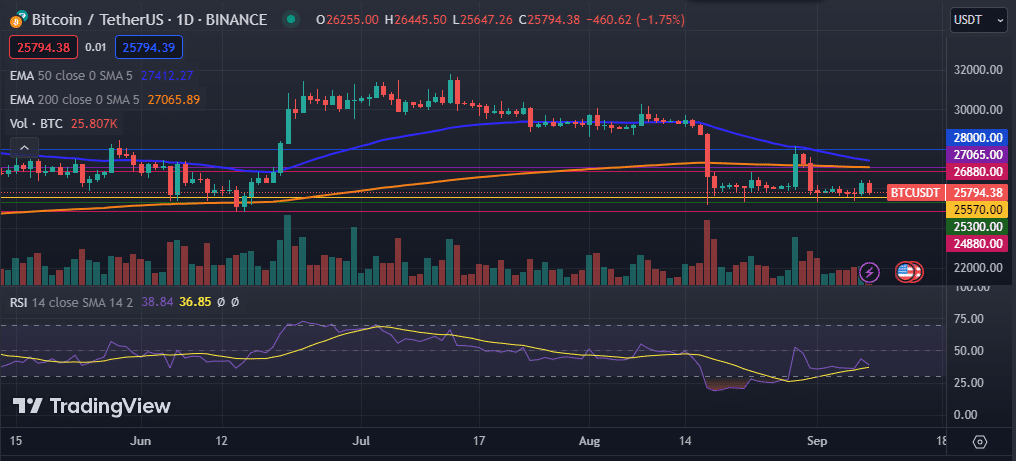

The every day chart reveals that the Bitcoin worth has been range-bound for the previous few days, buying and selling between the tight vary of $25,300 and $26,220. The digital asset hit an intraday excessive of $26,445.50 earlier on Friday earlier than pulling again. Bitcoin stays under the 50-day and 200-day exponential transferring common, amid a looming dying cross, which often indicators a bearish market.

Moreover, the BTC/USD pair stays under the 50-day and 200-day easy transferring averages. The Bollinger bands have narrowed as seen on the every day chart, pointing to low volatility. Its Relative Energy Index (RSI) stays under the impartial zone, hinting at a rise in promoting stress.

As such, I anticipate the Bitcoin worth to stay under the essential resistance degree of $28,000 within the brief time period. Particularly, the vary between $25,300 and $26,880 might be value watching within the ensuing classes. A flip above the higher vary may pave the best way for additional features to the 200-day EMA at $27,065. Conversely, a transfer under the decrease vary may give bears sufficient momentum to push the value decrease to June’s low at $24,880.