Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin threw a wave of pleasure because it crossed the $23k worth goal a few days again, consequently pulling above $24k as properly; resulting in an overjoyed crypto market. The celebration, nevertheless, was fairly short-lived as bitcoin’s worth dropped again to hovering between the above-mentioned worth ranges. Traders are actually curious as to the place the frontrunner crypto is headed within the close to quick time period, and if it’ll cross the $25k stage anytime quickly. Effectively, let’s discover out.

Bitcoin Worth Hovers Between $23k and $24k After Hinting A Doable $25k

The worth of Bitcoin noticed a major enhance not too long ago, reaching the $24,000 stage for the primary time since August. This sudden soar in worth coincided with a broad rally in shares, notably the Nasdaq, in addition to a drop in U.S. Treasury yields and the U.S. Greenback Foreign money Index (DXY). Regardless of this optimistic pattern, many traders and analysts stay cautious as they anticipate a pullback in costs earlier than stabilization.

The day earlier than the soar in Bitcoin worth, the Federal Reserve raised its benchmark rate of interest, which some noticed as a dovish transfer. Nonetheless, Fed Chairman Jerome Powell famous that though inflation seems to be slowing, it nonetheless stays elevated and extra proof is required earlier than the central financial institution can confidently say inflation is approaching its 2% goal.

Ethereum additionally noticed a surge in worth, virtually reaching $1,700, the very best since September. Nonetheless, if it doesn’t break by way of the $1,700 resistance stage, a correction might happen.

On Friday, there was some revenue reserving in Bitcoin and different main altcoins after the rate of interest hike by the U.S. Federal Reserve. Bitcoin dropped 2% however remained above the $23,000 mark, whereas Ethereum dropped greater than 2% however held above the $1,600 stage. Different altcoins confirmed blended outcomes, with some buying and selling decrease and some buying and selling larger. The whole buying and selling volumes have been flat, slipping just one% near $61.25 billion.

The $24k goal was deemed fairly essential by market analysts because it opened doorways for the token to succeed in $25k and proceed to rise from there. Nonetheless, the newest contraction has raised some scepticism in direction of these theories.

Bitcoin Technical Evaluation

The world’s largest cryptocurrency Bitcoin is predicted to see a “golden cross” quickly. This technical occasion occurs when the 50-Day Easy Transferring Common crosses above the 200-Day SMA, which is usually considered as a bullish signal by merchants. So long as the value of Bitcoin doesn’t see a major drop, the golden cross is predicted to happen within the coming week.

Just lately, Bitcoin’s worth has seen a surge of over 40% for the reason that begin of the 12 months. Nonetheless, the cryptocurrency confronted a drop on Friday as market volatility elevated earlier than the discharge of the U.S. non-farm payroll stories. The 14-day relative energy index was unable to interrupt a key resistance stage, resulting in a drop within the worth of Bitcoin.

As of now, the index is below the 70.00 help stage. If it fails to carry, there’s a probability of the value transferring beneath $23,000. Within the medium to long run, Bitcoin has damaged by way of a falling pattern channel, indicating a slower price of decline or a extra horizontal pattern.

The token is between help at $21,400 and resistance at $25,000, and a definitive break by way of one in every of these ranges will dictate the route Bitcoin follows. With a optimistic quantity stability and RSI above 70, the foreign money is exhibiting robust optimistic momentum and an additional enhance is predicted. Nonetheless, a excessive RSI worth may additionally point out the coin is overbought and a response downwards is feasible. On a purely technical entrance, Bitcoin is assessed as impartial for the medium to long run.

Will Bitcoin Push Again Up?

After a difficult market crash in 2022, Bitcoin (BTC) has made a powerful begin to the 12 months 2023, with over a 40% enhance in worth over the past month, making it the most effective January efficiency since 2013 and the best-performing month since October 2021.

The present market circumstances are believed to be bullish for Bitcoin, with a potential finish to the tightening monetary circumstances and potential rate of interest cuts by the tip of 2023. Based on a number of on-chain and technical indicators, the underside of the bear market in 2022 seems to have handed.

Traders have been unfazed by the current Fed choice to hike rates of interest, with the upcoming US jobs report anticipated to be the following catalyst for threat. Crypto merchants are assured heading into the report and are on the lookout for alternatives to check Bitcoin’s resistance round $24,000, and even push it to close $25,000.

The underside in $BTC is a double walled fulcrum sample. Extraordinarily uncommon. The 2X goal is mid 25’s. pic.twitter.com/NfffzbniO5

— Peter Brandt (@PeterLBrandt) January 29, 2023

At current, Bitcoin is buying and selling at $23,480 with a market cap of $493 billion. If the value strikes above the essential resistance of $24,300, its subsequent goal might be $25,000. Seasoned dealer Peter Brandt has additionally predicted that the Bitcoin worth may rise to $25,000 within the close to future, citing a “double-walled fulcrum sample” available in the market.

Knowledge additionally exhibits that merchants are optimistic about the way forward for Bitcoin costs, with the long-short ratio and lending charges indicating that bulls are in management. Nonetheless, some specialists warn that this overconfidence might sign that the present crypto rally is constructed on weak technical and elementary foundations, forming a brand new bubble.

Now that the Fed’s rate of interest hike is out, the long run worth motion of Bitcoin will drastically rely upon macro developments. As for the chart patterns, the present worth motion of Bitcoin resembles its worth efficiency every week again. Which has been constant for some time. If that information is to account for, then it’s protected to say that the $25k worth goal for Bitcoin isn’t too far.

Meta Masters Guild To Outperform Market Leaders

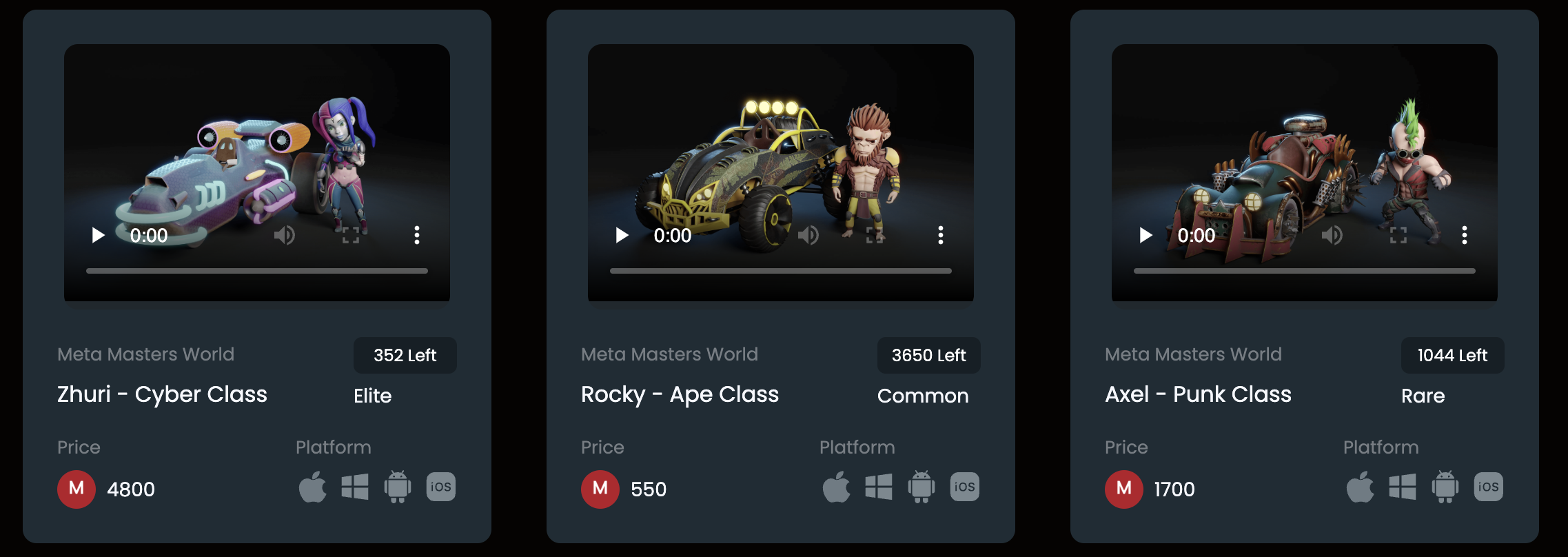

Meta Masters Guild is an distinctive new undertaking that would deliver innovation to cell gaming and generate earnings for early traders. It goals to fight the frequent unethical practices within the gaming trade and supply a unified crypto platform for cell video games.

The MEMAG token is an integral a part of the ecosystem and can be used for transactions, rewards, and buying and selling throughout the video games. The MEMAG presale has already raised $2.7 million and is in stage 5 of its presale, with a restricted time left to speculate at a reduced worth.

The main focus is on the fastest-growing and most worthwhile market within the cell gaming trade, which is estimated to generate a income of $172 billion in 2023. The undertaking presently has three video games below improvement, overlaying varied genres, and are deliberate for launch with new titles added commonly.

The MEMAG token can be listed on main exchanges and platforms post-presale, with a demo of Meta Kart Racers and NFT characters anticipated by the tip of 2023. It is a promising alternative, so don’t miss out on investing in MEMAG earlier than the value rises.

Learn Extra:

Battle Out (FGHT) – Latest Transfer to Earn Undertaking

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Reside Now

- Earn Free Crypto & Meet Health Targets

- LBank Labs Undertaking

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Be part of Our Telegram channel to remain updated on breaking information protection