Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin at the moment seems to be heading again to $23k, after crossing the $24k stage as soon as on Thursday. Reviews from skilled merchants recommend that if Bitcoin fails to maintain the $23k stage, it may be headed for a close to backside. How true is that this? Let’s discover out.

Bitcoin Again To $23k After $25k Not In Sight

The crypto market just lately noticed a combined response in buying and selling following Federal Reserve Chairman Jerome Powell’s announcement that inflation is beginning to ease and the Federal Reserve’s 0.25% improve in rates of interest.

Whereas Bitcoin noticed a decline of 0.82% to achieve $23,450, Ethereum broke previous the $1,600 barrier. With a 24-hour buying and selling quantity of $20.58 billion, which is near the place it was yesterday, Bitcoin continues to carry out nicely.

Not too long ago, Bitcoin exceeded even essentially the most optimistic worth predictions and reached new heights. After testing the $22,500 help on February 1st, it gained 6.5% in simply 5 hours and hovered across the $24,000 stage earlier than dripping again under the value stage. It’s price noting that the 40-day correlation between Bitcoin and the S&P 500 remains to be above 75%.

Then again, Ethereum has been hovering across the $1,680 resistance stage for nicely over a few weeks now. Regardless of the uncertainty out there, the optimistic development in Ethereum’s worth chart and bullish investor outlook in direction of ETH derivatives give rise to the potential for the value of Ethereum reaching $1,800 and even surpassing that by the top of subsequent month.

Market Sentiment Shares A Bearish Outlook For Bitcoin

Bitcoin’s worth has been steadily trending above the $23,000 stage, reflecting the token’s bullish development in current weeks. The present development is basically pushed by the USA Federal Reserve’s current adoption of a dovish financial coverage stance. Nonetheless, not all buyers are on board with this bullish development, as many expect a decline within the worth for digital belongings.

Coinmarketcap’s Worth Estimates present perception into investor sentiment, and the most recent spherical of predictions exhibits a bearish outlook for Bitcoin. This characteristic on the platform permits particular person customers to submit their worth expectations and offers an estimate of all of the predictions. The median estimation for February got here out to a worth of $20,000, a 14.69% drop from the present worth. If this prediction proves correct, it might end in a major decline for Bitcoin.

The bearish sentiment extends past simply the month of February, and buyers expect a decline in worth for the subsequent 5 months. The median estimate for March got here out to a worth of $19,500. Out of the 34,000 votes collected, the typical estimate was $20,203.57, whereas the median was a lot worse at $19,659.

It’s vital to notice that whereas Worth Estimates are a useful gizmo to gauge investor sentiment, it isn’t a assure of future worth actions. Market sentiment and investor sentiment are two separate issues, and market circumstances can change quickly, resulting in fluctuations in worth.

Whereas Bitcoin’s worth continues to development above $23,000, many buyers expect a worth decline. Nonetheless, the cryptocurrency market is understood for its volatility, and any variety of components might affect the value within the coming months. Traders ought to leverage their private analysis on a token earlier than making any funding selections.

Technical Evaluation Says In any other case

There was ongoing debate just lately about whether or not the present upward development of Bitcoin is sustainable. Regardless of this, the digital forex remains to be exhibiting indicators that recommend its worth could proceed to climb. As an illustration, it’s buying and selling nicely above key transferring averages.

Moreover, Bitcoin has now established help simply above the $23,000 stage, indicating that the bulls stay in management. Regardless of not reaching the $24,000 mark, the cryptocurrency nonetheless maintains sufficient momentum to presumably retest that stage. With buying and selling volumes of over $21 billion within the final 24 hours, so long as help stays above $23,000, the probability of a major dip is low.

In the meanwhile, Bitcoin is buying and selling at round $23,470 and has seen a 0.02% drop within the final 24 hours, however a 2.08% improve over the previous seven days. Not too long ago, it fell for a 3rd straight day after hitting a excessive of $24,262, its highest level since August of final yr.

In accordance with the 14-day relative power index, Bitcoin’s current decline has put the index at 68.41, barely above the 68.00 help stage that it maintained yesterday. Ought to this ground not maintain, it might end in continued bearish sentiment and push the value under $23,000.

As mentioned within the evaluation for final month, the sideways motion was predicted for Bitcoin after its sharp rally in January, which is strictly what was noticed this week between $21,800 and $23,800. A possible breakout above the $23,800 resistance might end in a optimistic week for merchants, with the subsequent resistance stage at $25,400. With a number of failed makes an attempt to interrupt this resistance, the possibilities of a profitable breakout have elevated.

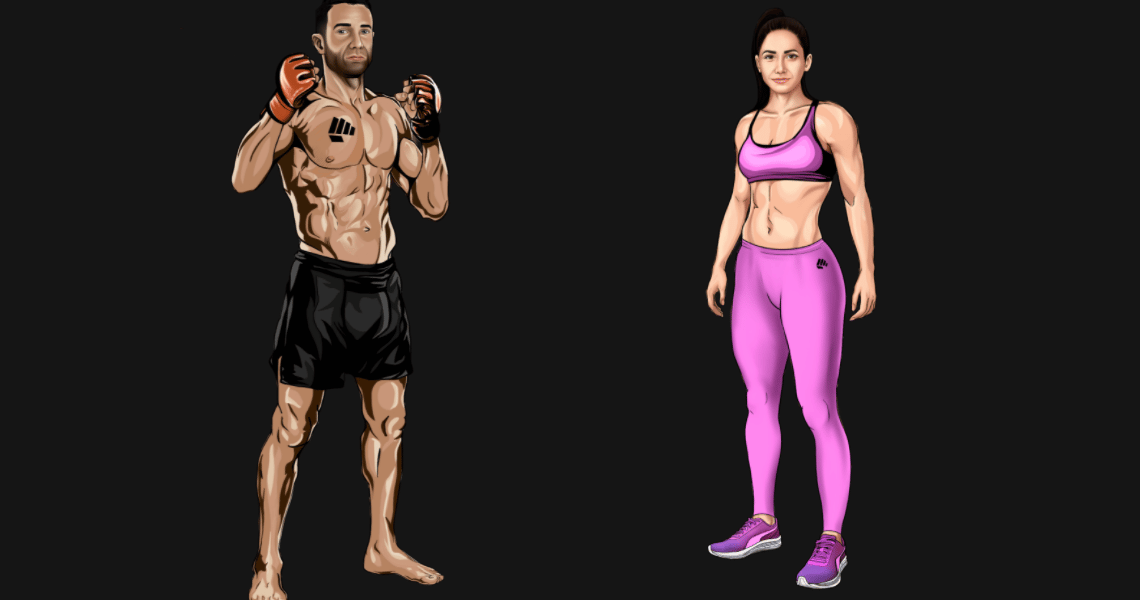

No Extra Excuses For A Wholesome Way of life With Battle Out

Traders on the lookout for a promising new cryptocurrency within the rising “move-to-earn” (M2E) area of interest might want to check out Battle Out. This distinctive mission goals to gamify health and weight reduction by way of an app. As soon as downloaded, customers will be capable to construct a profile and obtain customized exercises from high coaches, full with HD movies demonstrating every train.

When a exercise is completed, the app will monitor the person’s progress and reward them with REPS, FightOut’s off-chain forex. REPS can be utilized to buy gadgets from the Battle Out retailer, corresponding to dietary supplements and attire. Moreover, Battle Out has its personal ERC-20 token, FGHT, which can be utilized to purchase extra REPS and has thrilling future plans, together with serving because the transactional forex for the Battle Out Metaverse.

Battle Out is at the moment present process a presale of FGHT tokens, that are at the moment priced at $0.01949 and include bonuses of as much as 50% primarily based on the funding quantity and vesting interval.

Battle Out units itself other than different M2E tasks like STEPN, because it affords a extra complete strategy to monitoring and rewarding health with none costly NFT buy-ins. The Battle Out app, set to launch in Q2 2023, will leverage smartphone and wearable know-how to observe bodily efficiency and have its personal in-house tokenized financial system.

The presale of the FGHT token has already raised $3.88 million and is anticipated to checklist on centralized exchanges in April at $0.033 per token. This might result in potential paper positive aspects of round 100% for early buyers. With Battle Out’s bold objectives to create an built-in web3 health expertise and purchase gyms the world over’s main cities, it might be a sensible funding alternative.

Associated Articles

Be a part of Our Telegram channel to remain updated on breaking information protection