Bitcoin worth has been comparatively steady over the previous few days after volatility picked up through the weekend, pushing the value decrease by greater than 3%. On the time of writing, the flagship cryptocurrency, Bitcoin, was buying and selling at $26,255.55. Because it continues to dominate the crypto market, rating 1st, its whole market capitalization barely declined over the previous day to $5.12 billion. Moreover, the full quantity of BTC traded over the identical interval slumped by greater than 32%.

Financial Issues

Knowledge revealed on Tuesday confirmed that the Convention Board Shopper Confidence Index declined in September to 103.0, down from a revised 108.7 in August. This was its lowest degree since Might 2023 and marked two consecutive months of decline. The Current State of affairs Index, which measures shoppers’ evaluation of present enterprise and labor circumstances, rose barely to 147.1 from 146.7.

The Expectations Index, which measures the shoppers’ near-term prospects for enterprise, earnings, and labor market circumstances, dipped to 73.7 in September, down from 83.3 within the prior month. The Expectations Index fell under the essential degree of 80, which indicators a recession throughout the subsequent 12 months. Shopper fears of a looming recession additionally ticked greater in September amid the short-term financial contraction anticipated within the first half of 2024.

Focus can be on Fed Chair Jerome Powell’s speech on Thursday which is probably going so as to add volatility and create a bearish surroundings for merchants. As such, traders should be cautious this week when coping with cryptocurrencies. This comes after the US Federal Reserve determined to pause its rate of interest hike marketing campaign in final week’s assembly, suggesting that one other hike is due this 12 months. In keeping with the CME FedWatch Instrument, markets are pricing in an 83% probability of one other pause in November, elevating expectations for a 0.25% hike in December.

Bitcoin Worth Technical Evaluation

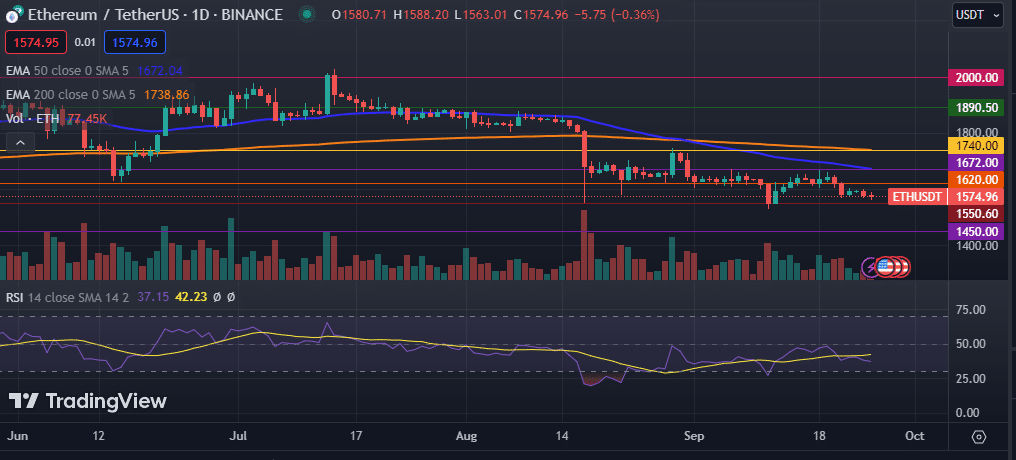

Bitcoin worth has been on a downward trajectory for the previous few days, dropping under the pivotal assist degree of $26,500. Regardless of a number of makes an attempt, the digital asset has did not flip the key resistance hurdle at $27,500, prompting a retraction. The prevailing circumstances counsel a steady decline in Bitcoin worth, presumably breaking under the essential assist of $26,000 within the ensuing classes.

As seen on the every day chart, the premier cryptocurrency stays under the 50-day and 200-day exponential shifting averages, in addition to the 50-day and 100-day easy shifting averages. Its Relative Energy Index (RSI) is at 45, under the sign line and the impartial degree. The Bollinger bands have narrowed over the previous few days, hinting at a decline in volatility, with the higher band barely above the EMAs.

Consequently, a breakout above the hurdle on the $26,900 degree, might push the value greater towards $27,000 and subsequently $27,500. Nevertheless, failure to interrupt above the aforementioned degree would possibly pave the best way for an additional decline to the rapid assist at $25,825.60 and probably $25,330.