The financial coverage of the Federal Reserve (FED) continues to be the all-determining issue for each the monetary markets worldwide and Bitcoin. With this in thoughts, all eyes are at the moment on November 02, when the following Federal Open Market Committee (FOMC) assembly is scheduled.

Nonetheless, whereas that is an exterior market danger, there’s additionally an inner market danger at the moment growing that shouldn’t be underestimated from a historic perspective: a Bitcoin miner capitulation.

The decrease Bitcoin falls and the longer the worth stays on the present stage, the extra stress is placed on Bitcoin miners’ margins by a divergence of worth and hash charge.

Bitcoin’s Mining Problem Reaches A New ATH

A have a look at the Bitcoin mining problem adjustment that occurred yesterday reveals that it elevated once more by 3.44%. This follows the historic adjustment of October 10, when the mining problem elevated by 13.55%.

#Bitcoin mining problem has simply elevated by +3.44%, making one other new all time excessive as hash charge continues to soar.

Miners are relentless. pic.twitter.com/4GEyHxYoZ8

— Dylan LeClair 🟠 (@DylanLeClair_) October 24, 2022

The problem is up to date roughly each two weeks to account for the fluctuating hash energy on the community and to make sure a minting of recent Bitcoins roughly each 10 minutes (block time).

Yesterday’s adjustment is thus prone to put additional stress on already struggling miners who’re seeing dwindling income. Will Clemente, co-founder of Reflexivity Analysis, asserted that “miners are the most important intra-Bitcoin market danger proper now IMO”.

A compelling principle for the regular rise within the hash charge, he says, is {that a} well-funded participant is making an attempt to squeeze out inefficient miners and purchase their property on a budget, “Rockefeller-style”.

Consequently, a miner capitulation might happen. Throughout this occasion, the non-profitable miners must promote each their mining {hardware} and their holdings of Bitcoins. On a big scale, this might set off a big promoting stress on the Bitcoin worth, as seen with previous miner capitulations.

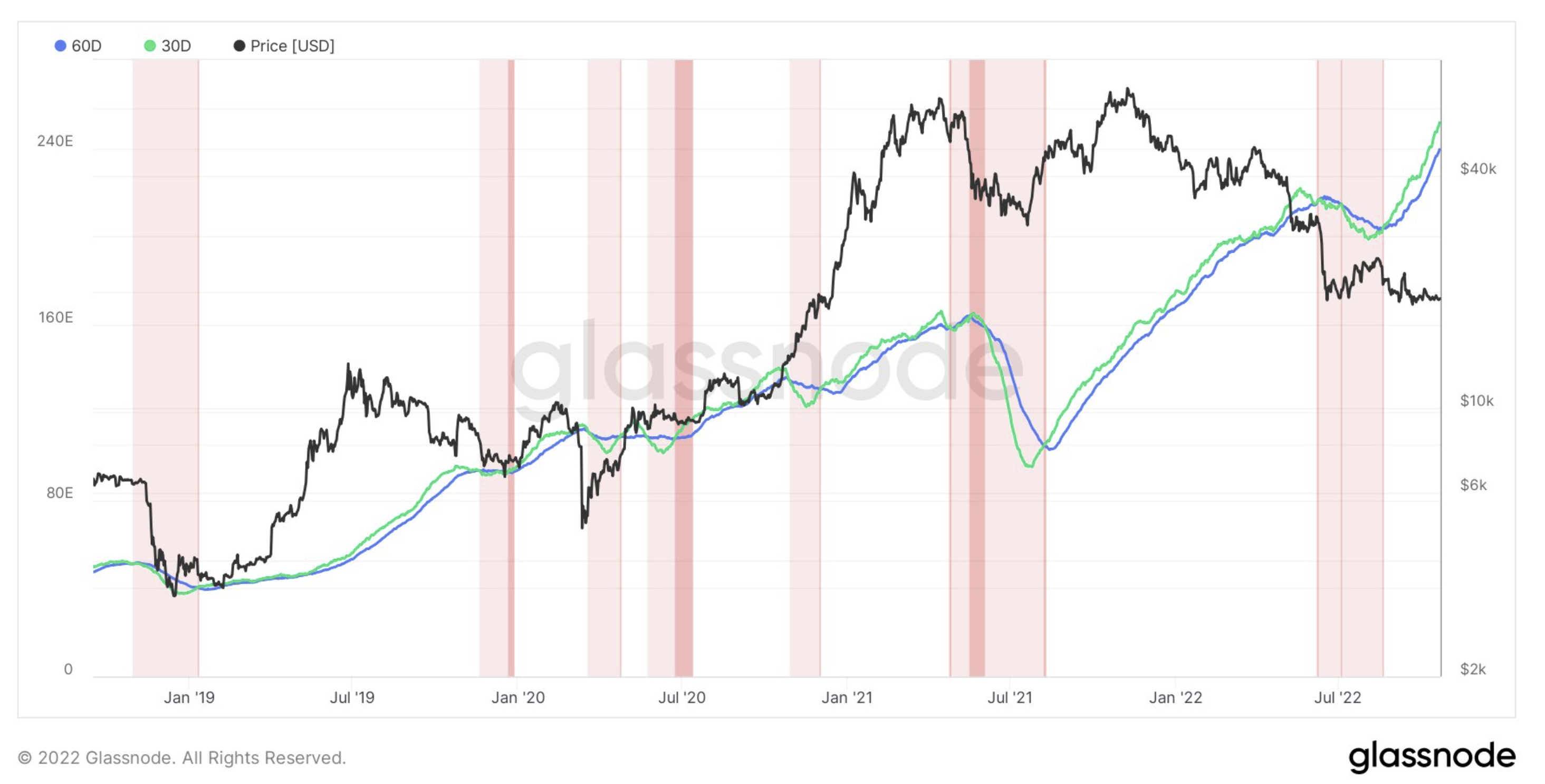

Clemente acknowledged that the chance of a second miner capitulation after the primary interval in June is rising. The main indicator to observe are the hash ribbons.

Clemente concluded:

Interested by who this entity(s) is that feels that it’s advantageous to mine with BTC worth down 70%, vitality costs excessive, & hashprice at all-time lows. Marvel if its a big participant(s) with extra vitality or entry to dirt-cheap vitality. […] That’s why I’m so curious as a result of this must be somebody with extraordinarily low vitality prices. Haven’t seen any nice solutions up to now.

Massive Identify Bitcoin Miners In Bother?

Dylan LeClair, senior analyst at UTXO Administration and co-founder of 21stParadigm additionally famous that the hash worth, or miner income per TeraHash, not too long ago handed the 2020 all-time low. If historical past repeats from earlier bear markets, the worth decline has simply begun, he mentioned.

As well as, he revealed that he has heard “some juicy rumors flying round about some massive title Bitcoin miners being in bother right here”.

The continued mounting stress on Bitcoin miners can finish in two eventualities, in keeping with him. Both that is the underside. “The dearth of vol reveals apathy from sellers. Prolonged consolidation/accumulation interval,” LeClair acknowledged.

Nonetheless, the state of affairs thought of extra probably by the analyst is that BTC has at the moment reached a stage like $6,000 in 2018/2019. If hash charge continues to soar, then the rising stress will end in a miner capitulation occasion.

At press time, the BTC worth continued to lack volatility and lingered round $19,300.