That is an opinion editorial by Kent Halliburton, President and COO of Sazmining.

Although the intention of the Bitcoin white paper was to usher in a monetary revolution by introducing the primary efficient peer-to-peer digital money system, we’re now seeing the inception of Bitcoin’s second revolution: Power.

Bitcoin miners function power consumers of final resort, can work from anyplace and can activate and off with practically infinite flexibility. As such, bitcoin mining can render viable renewable and distant power sources that will have in any other case been unprofitable. Moreover, miners can convert waste power into digital gold, drastically curbing humanity’s emissions drawback. Curiously, these enhancements to our relationship with power are already underway, even earlier than bitcoin has advanced into the following world reserve asset. Might or not it’s that Satoshi Nakamoto’s unspoken power revolution really takes maintain earlier than the primary revolution of a peer-to-peer money system? Though we are able to’t know with certainty, the info means that could possibly be the case.

The Power Revolution Good points Steam

Although imperfect, the most effective metric for evaluating Bitcoin’s financial and power revolutions is progress. Let’s have a look at progress charges between the whole variety of bitcoin holders and the whole hash charge of all bitcoin miners. Hash charge, the whole computational energy utilized by miners to course of bitcoin transactions and earn new bitcoin, serves as a good proxy for miners’ power consumption. Nonetheless, this nonetheless doesn’t give us direct knowledge about bitcoin mining’s more and more optimistic results on the power sector. In spite of everything, if better power consumption by bitcoin miners merely corresponds to better demand for power, then Bitcoin won’t have brought about a paradigm shift in our relationship with power in any respect. However, as we’ll see, the energetic advantages of bitcoin mining have risen together with Bitcoin’s power consumption.

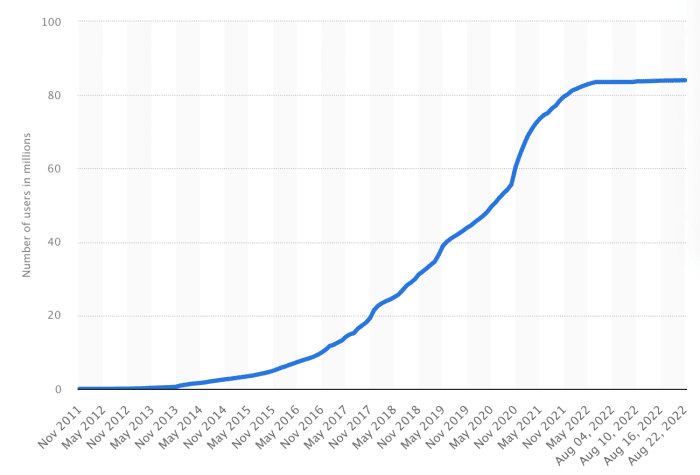

Whole variety of Bitcoin customers over time (supply)

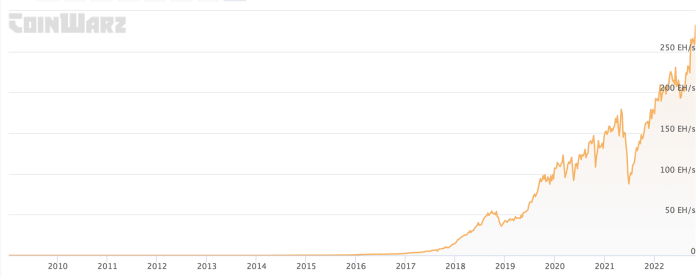

Whole hash charge of the Bitcoin community (supply)

As you’ll be able to see within the first chart, the variety of bitcoin customers elevated at a fast charge till mid-2021, when the speed of progress slowed. The drop in adoption roughly corresponds with bitcoin’s worth drop from over $61,000 to beneath $32,000. Whereas the hash charge additionally crashed round this time, it steadily climbed again and continues to succeed in new heights. Though bitcoin adoption has slowed, the community’s power consumption and mining exercise continues to develop considerably.

As talked about earlier, bitcoin mining’s improve in power consumption alone doesn’t inform us that Nakamoto’s second revolution is underway. To argue that, we have to know the way a lot of that power comes from renewable, waste and stranded power. The Bitcoin Mining Council’s Q3 2022 report explains that bitcoin mining’s sustainable electrical energy combine is almost 60% as of October 2022, up by about 3% from a yr in the past. Bitcoin miners buy renewable power as consumers of final resort; they don’t seem to be consuming power that will have been purchased by different customers. Moderately, they buy the power exactly when there’s little demand from others, rising the profitability — and subsequently the viability — of renewable power sources internationally. As bitcoin mining’s renewable power consumption will increase, so does the worldwide marketplace for clear power.

Future Indicators Of Nakamoto’s Revolutions

Along with measuring the variety of bitcoin holders (or wallets) in existence, one other metric by which to gauge the success of Nakamoto’s financial revolution is the variety of transactions per unit of time that contain bitcoin.

The Lightning Community, a Layer 2 know-how designed to make bitcoin transactions low cost, fast and user-friendly, is rising in prominence as bitcoin evolves from a retailer of worth right into a medium of change. The variety of transactions executed on the Lightning Community per unit of time shall be an easy indicator of bitcoin’s progress as a financial instrument.

As increasingly power initiatives reap the benefits of bitcoin mining, Nakamoto’s power revolution shall be measured by monitoring all the following:

- Tonnes of carbon dioxide equal decreased per unit of power consumed by bitcoin miners per unit of time.

- Wattage output by stranded power sources that will have been unviable within the absence of bitcoin mining.

- Wattage output by intermittent (and renewable) power sources that will have been unviable within the absence of bitcoin mining.

As we obtain extra knowledge about each the Lightning Community and the intersection between bitcoin mining and the power sector, we will examine how a lot every of Nakamoto’s revolutions is progressing over time. As said earlier, though there’ll by no means be a single second at which both revolution could have formally come to move, we’ll a minimum of be capable of measure the pace at which every is progressing.

What We Now Know About The Twin Revolutions

Present knowledge signifies that the expansion of bitcoin house owners has slowed relative to the expansion of mining. If these tendencies proceed and if bitcoin miners’ renewable power combine continues to be among the many greenest on the planet, then Nakamoto’s second revolution may certainly overtake his first. Bitcoin may purchase a fame as a major asset within the battle towards world warming, rivaling its rising fame as the following world reserve asset.

Nakamoto’s unintended power revolution will proceed to develop in drive. Thankfully for humanity, it doesn’t matter which of Nakamoto’s revolutions is going on quicker. All of us win with drastically improved cash and power.

It is a visitor publish by Kent Halliburton. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.