When the market is in a downturn, some merchants determine to pause buying and selling and simply wait out the storm. However others would possibly see bear markets as a chance to attempt new buying and selling strategies. Some of the in style is brief promoting. Allow us to see how quick promoting works and why it could be most well-liked when the market is down.

What’s Quick Promoting?

On the subject of buying and selling, usually there are two methods to go: both open an extended or a brief place. With the previous, merchants count on costs to rise and hope to profit from the motion. With quick promoting, it’s the reverse. When merchants go quick, it means they’ve some purpose to imagine that the asset’s worth is perhaps declining.

How Does Quick Promoting Work?

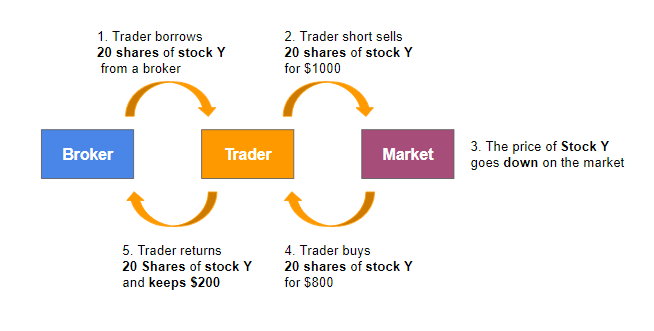

Usually, when somebody opens an extended place, they purchase property. Nevertheless, quick promoting in buying and selling includes going quick on property they really don’t personal. So that they borrow them from a dealer. They count on the worth to drop, so they are able to return these property and hold the distinction. Quick promoting is offered on a wide range of property, together with Shares, Foreign exchange, Cryptocurrencies, commodities. To grasp the idea of quick promoting on shares, check out the instance under.

Nevertheless, with CFDs – Contract for Distinction – there’s no want to purchase or promote property themselves. As a substitute, merchants deal with attempting to foretell the path of worth motion. In case of quick promoting, the reply is “down”. In case your prediction is appropriate, you could obtain a optimistic end result.

Why Attempt Quick Promoting?

Buyers and merchants might have a lot of causes to show to quick promoting. Listed below are the most typical ones.

Attempt to Profit From a Falling Market

Usually, merchants try to purchase property at a lower cost after which promote at a better one. However with a bear market, when costs are dropping throughout the board, this isn’t doable.

Quick promoting affords an alternate: to first promote property at a better worth after which purchase them again when worth declines. This manner, there is no such thing as a want to attend for the market to recuperate: it could be an opportunity to have a optimistic end result whereas it’s nonetheless down.

Apart from, a unstable market causes greater worth fluctuations. This would possibly present extra short-term buying and selling alternatives than a secure market can supply. Nevertheless, volatility might convey alongside further dangers. So ensure that to contemplate them earlier than making your transfer.

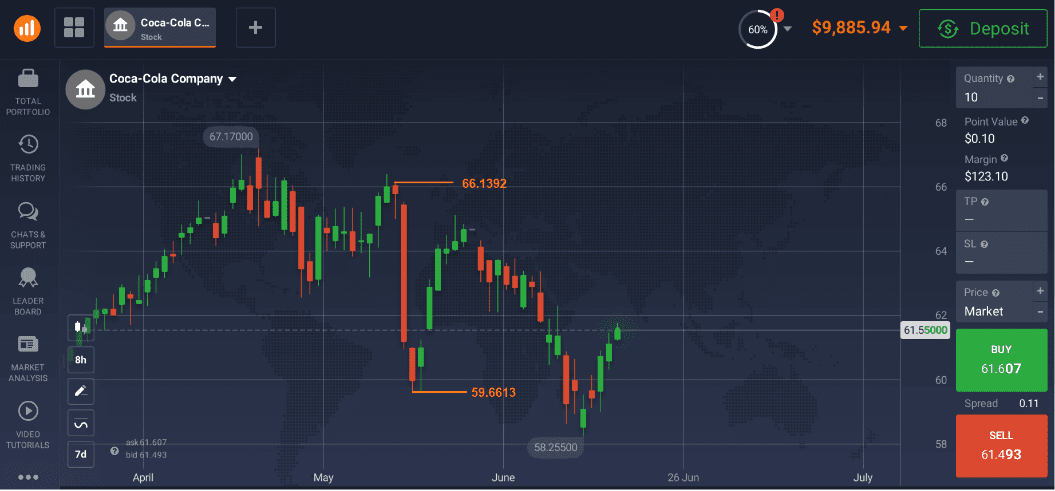

Right here is an instance of inventory worth fluctuations which will have been part of quick promoting on inventory method. You could discover that the inventory worth of Coca-Cola Firm dropped over a course of simply two days. If a dealer have been to appropriately predict this motion, she or he may need been capable of quick promote this inventory and get a optimistic buying and selling consequence.

Hedging

Quick promoting may additionally be used as a hedging software to guard capital from short-term market volatility. To realize that, merchants would possibly open a place in the wrong way (quick) to the one they have already got (lengthy). This manner, if the worth continues to say no, they might use the revenue from the quick place to handle losses from the lengthy one.

Quick Promoting with CFDs: Professionals and Cons

Allow us to now define the primary benefits of quick promoting with CFDs and the potential dangers.

Professionals

Smaller Funding

Some of the vital advantages of quick promoting with CFDs is a chance to commerce the worth distinction. There is no such thing as a want to purchase the asset itself, which frequently requires a smaller funding. For example, on IQ Possibility merchants have an opportunity to make offers ranging from $1.

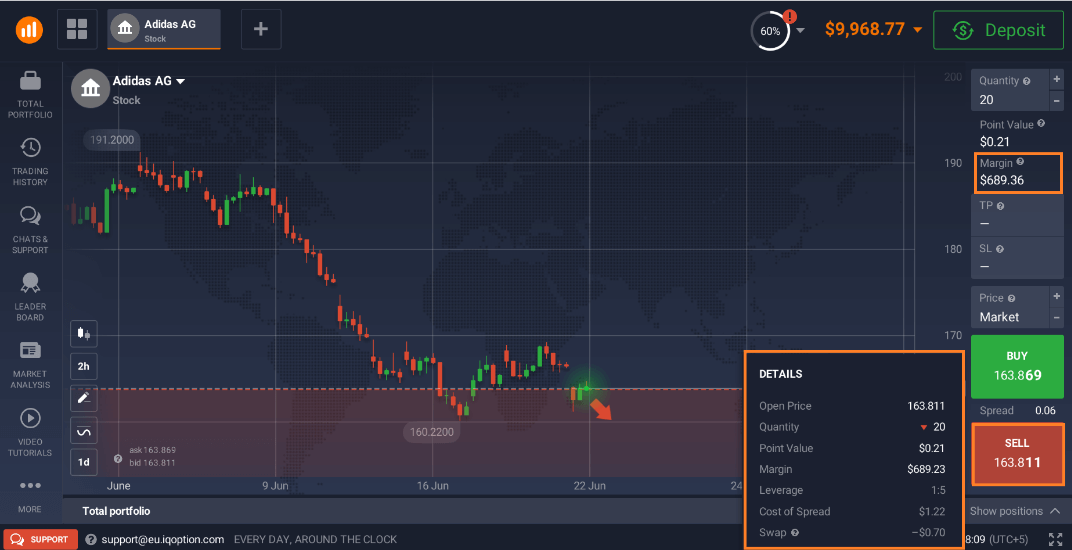

Leverage

Buying and selling CFDs typically includes having a margin account, the place merchants might use leverage to open bigger positions. The primary idea of margin buying and selling is the power to commerce with funds bigger than the preliminary deposit. This will likely give merchants an opportunity to get larger returns on their investments. Nevertheless, you will need to take into account that utilizing leverage may additionally result in greater losses. So you need to weigh the dangers earlier than making use of it to your offers. To study extra about margin buying and selling, try this text: Margin Buying and selling: How Does It Work?

When buying and selling with margin, you will need to fastidiously monitor the margin ranges. If an asset’s worth immediately goes up, you may need so as to add extra funds to your account, thus placing extra of your capital in danger. This can be required to keep up the open place.

To maintain observe of your trades and by no means miss the proper time to exit a deal, you could apply Cease-Loss and Take-Revenue ranges to your trades. Check out this video with step-by-step directions on how you can use these instruments.

Availability

When the market is declining, quick promoting is on the rise. So there could also be many merchants on the market seeking to quick a restricted variety of property. Some may not be accessible to an everyday dealer. Nevertheless, with CFDs this downside doesn’t exist: as you don’t buy any property, it is vitally onerous to expire of them.

Cons

Quick promoting is just not risk-free: there are just a few vital issues to contemplate earlier than appearing.

Doubtlessly Excessive Losses

When somebody buys an asset (open an extended place), the bottom worth it might get to is 0. For example, if somebody purchased some inventory for $100, the most important loss which will happen is $100. It could not be doable for the inventory worth to drop decrease. Nevertheless, with quick promoting in buying and selling, the losses would possibly doubtlessly proceed. There is no such thing as a restrict on how excessive the worth might go: it might hold rising for an extended time frame.

Some brokers present threat administration instruments that merchants might use to handle losses. For instance, on IQ Possibility, if a shedding CFD place reaches -50%, it would routinely shut.

Quick promoting with CFDs might supply fascinating alternatives but additionally excessive dangers, particularly when utilizing leverage. It could considerably enhance the income, however it additionally makes the trades riskier and would possibly result in greater losses. So ensure that to evaluate the margin and leverage charges earlier than pushing the “Promote” button within the traderoom.

Backside Line

Quick promoting might provide an opportunity to commerce on a falling market. When quick promoting with CFDs, this method might supply fascinating buying and selling alternatives and doubtlessly larger returns. Nevertheless, it carries a number of dangers too, so each dealer ought to think about them to make an knowledgeable determination. Threat administration instruments, similar to Cease-Loss and Take-Revenue, is perhaps helpful to handle potential losses.