Tom Emmer, Republican Congressman for Minnesota, wrote a letter to the Chairman of the Federal Deposit Insurance coverage Company (FDIC), Mark Gruenberg, on March 15 expressing his issues concerning the latest closures of digital asset and tech-centered banks like Silvergate, Signature Financial institution, and Silicon Valley Financial institution.

FDIC weaponizing banks

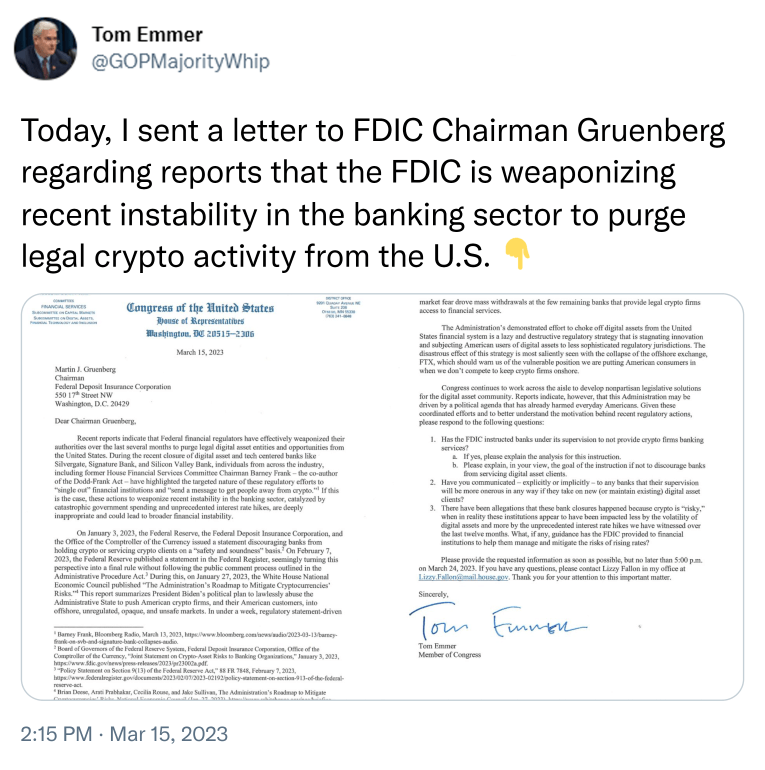

Emmer shared the letter on Twitter, declaring that “the FDIC is weaponizing latest instability within the banking sector to purge authorized crypto exercise from the U.S.” The Congressman believes federal monetary regulators have weaponized their authority to purge authorized digital asset entities and alternatives from the U.S., resulting in broader financial instability.

Within the letter, he additionally questioned the allegation that the FDIC instructed banks to not present crypto companies with banking companies and requested whether or not they have communicated to any banks that their supervision shall be “extra onerous” in the event that they tackle new or keep current digital property shoppers.

He additionally requested what steering the FDIC has offered to monetary establishments to “assist them handle and mitigate the dangers of rising charges,” evaluating the “dangerous” volatility in crypto with the present state of conventional property.

Emmer is in search of solutions to his questions by March 24, to grasp the motivation behind latest regulatory actions higher. The Congressman urged the FDIC to information monetary establishments to assist them handle and mitigate the dangers of rising rates of interest as an alternative of concentrating on digital asset entities.

Trade response

Each Gemini co-founders Cameron and Tyler Winklevoss shared the tweet because the twins proceed to push for extra exact and related crypto regulation inside the U.S. As well as, Gemini acknowledged on March 13 that “all Gemini buyer U.S. {dollars} are held at JPMorgan, Goldman Sachs, and State Road Financial institution,” distancing itself from the contagion fallout from SVB, Signature, and Silivergate.

Others have adopted in Emmer’s sentiment as Signature board member Barney Frank has additionally made a number of assertions indicating that the closure of Signature Financial institution is linked to cryptocurrency. For instance, in a CNBC on March 13, Frank claimed that the financial institution’s shutdown sought to convey a forceful stance towards crypto.

As well as, Messari founder, Ryan Selkis, acknowledged on March 13 that Signature was nonetheless solvent.

“Signature was wholesome. NYDFS went rogue in shutting them down, and stunned even the FDIC. It’s focused.”

Nonetheless, on March 14, the New York State Division of Monetary Providers (NYDFS) introduced that the Signature Financial institution closure had nothing to do with cryptocurrency, straight contradicting Emmer’s claims. Nonetheless, round 30% of Signature’s deposits have been associated to crypto corporations, indicating vital publicity to crypto markets.

Additional, different business feedback on the letter raised issues that nothing tends to return of such techniques; as Mark Jeffrey from the Throughout the Chains podcast acknowledged,

“It looks as if you guys don’t have any actual energy to really DO something about this — besides write imply letters and scold individuals in ‘hearings’. In the meantime, individuals like Gary Gensler and this man run round vandalizing every little thing on a monster scale.”

In abstract

The closure of digital asset and tech-centered banks has raised issues amongst business specialists and lawmakers. As well as, Congressman Tom Emmer’s letter to the FDIC Chairman has make clear the potential weaponization of regulators’ authorities to purge authorized crypto exercise from america.

Whereas some business insiders imagine that the latest closures of banks like Signature are linked to cryptocurrency, others have contradicted these claims. It stays to be seen whether or not Emmer’s letter will lead to any motion from the authorities. Nonetheless, it highlights the necessity for extra clear and extra related crypto laws within the U.S. because the business appears to be like for steering from regulatory our bodies to handle and mitigate dangers whereas fostering innovation and development.