As the top of 2022 approaches, a large number of bitcoin proponents are questioning whether or not or not the underside is in so far as the official finish of the crypto winter is worried. The present bitcoin bear run simply entered the longest backside formation for the reason that 2013-2015 bitcoin bear market. Furthermore, analysts word that a lot of the technical backside indicators used to foretell bitcoin costs have didn’t forecast whether or not or not the underside is in.

Rainbows and S2F: The Listing of Technical Indicators That Did not Predict Bitcoin’s Backside

A month in the past, crypto supporters celebrated enduring one of many longest and harshest bitcoin bear markets for the reason that 2013-2015 bitcoin bear market. On the time, the 2013-2015 bitcoin bear run was the longest downturn however at present, the present crypto financial system’s contraction interval is ready to surpass the 2013-2015 crypto retrenchment.

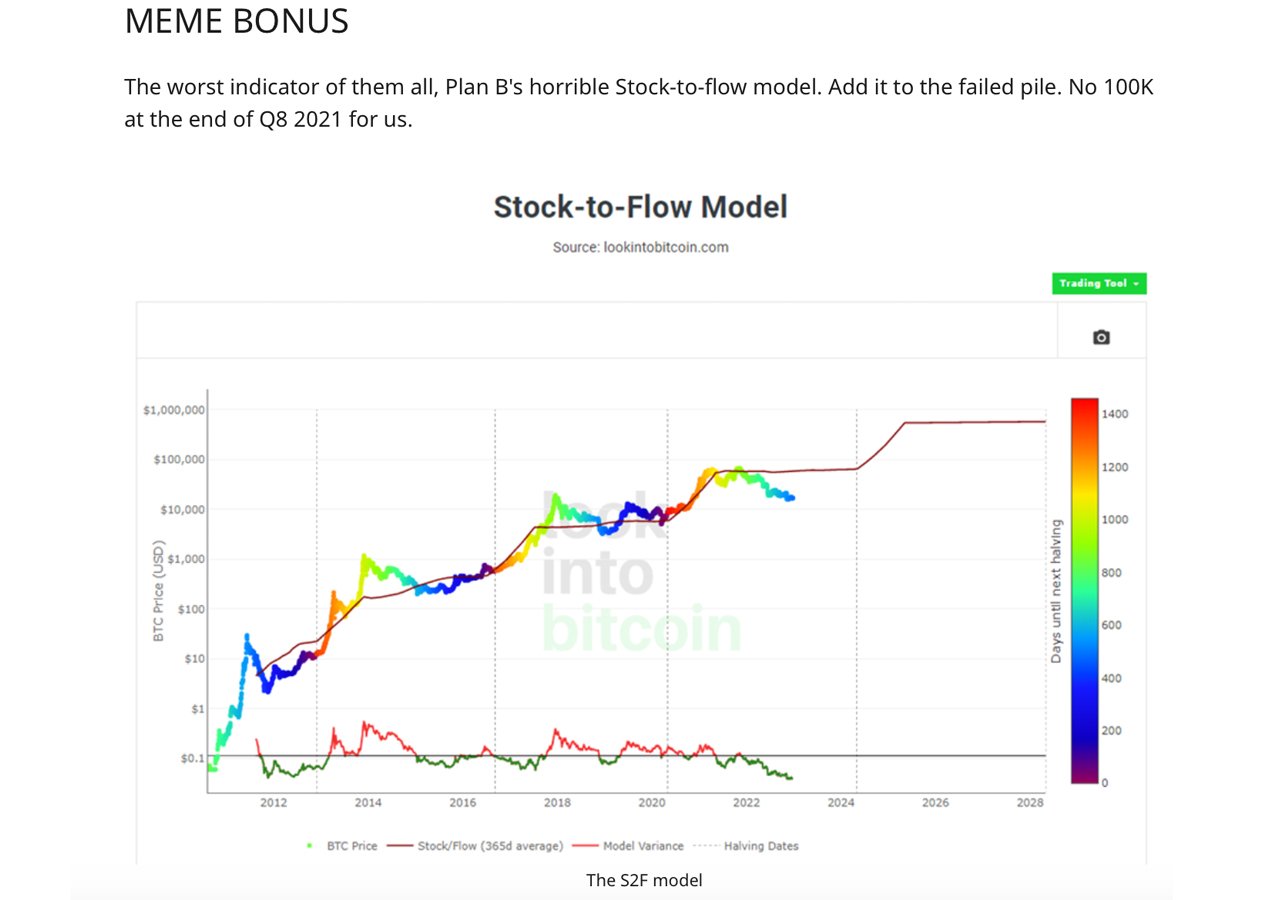

Along with the longest backside section, Bitcoin.com Information reported 144 days in the past how numerous technical indicators failed this yr to foretell bitcoin’s future U.S. greenback worth. One of many largest worth mannequin failures talked about this yr was the stock-to-flow (S2F) mannequin, which was denounced by Ethereum advocate Anthony Sassano and ETH-co-founder Vitalik Buterin final June.

“We’d like extra ache earlier than we make a backside”

My man, we have seen:

– a prime 3 trade collapse

– 2 prime VCs within the house get liq’d

– 2 prime 10 cash w/ a $60B+ mcap go to zero

– lending market worn out

– Bitcoin down ~80% from ATH

– alts down 90-99% from ATHWhat extra would you like?

— Ok A L E O (@CryptoKaleo) December 22, 2022

With all of the so-called ‘biggest’ technical indicators failing miserably, many crypto proponents are nonetheless writing discussion board posts and social media threads about bitcoin’s confounded backside. For example, on Dec. 27, the Twitter account Crypto Noob tweeted: “Bitcoin is presently buying and selling within the oversold zone. Which is traditionally the place the underside types. Do you assume BTC has bottomed out?”

Questions and posts like these are littered throughout crypto-focused boards and social media platforms like Fb and Twitter. On Reddit, the subreddit discussion board r/cryptocurrency contains a submit that highlights how technical backside indicators have failed, and the writer of the submit particulars that the analysts have “no clue” and this time “IS totally different.”

The submit’s writer “u/Beyonderr” explains how eight technical indicators weren’t dependable to bitcoin merchants this yr. For instance, the weekly RSI (relative energy index) was purported to sign oversold ranges and bitcoin’s backside, however Beyonderr says “this was not true this yr.”

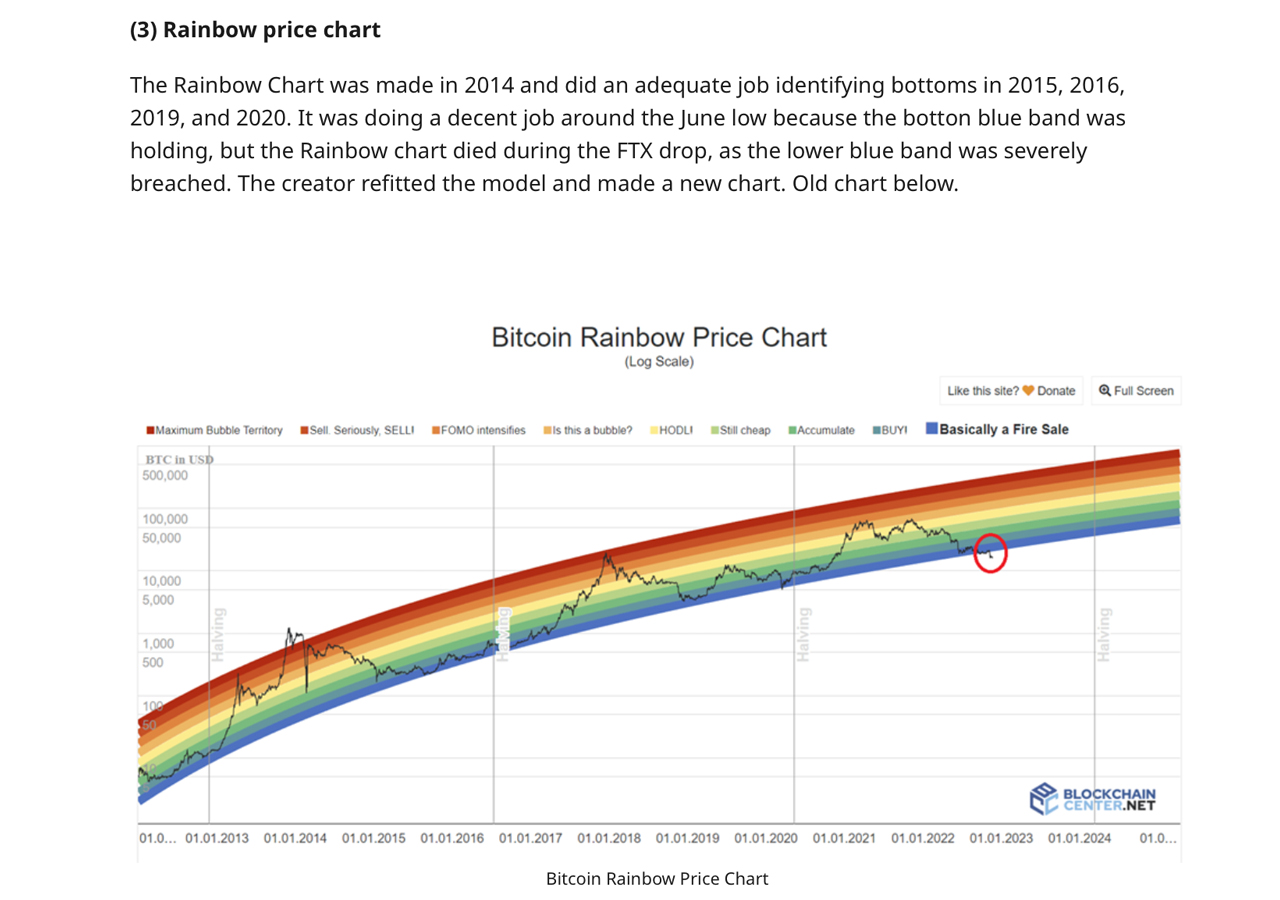

Different unreliable technical indicators Beyonderr talked about embrace the month-to-month MACD (shifting common convergence/divergence), the Rainbow worth chart, the 200-week shifting common, the 100-week shifting common X 20-week shifting common, the Pi cycle indicator, the Hash ribbons indicator, and the typical share drawdown from a cycle’s excessive.

Furthermore, Beyonderr mocked the S2F worth mannequin by calling it the “Meme bonus” indicator. “The worst indicator of all of them, Plan B’s horrible Inventory-to-flow mannequin. Add it to the failed pile,” Beyonderr wrote. The submit on r/cryptocurrency additionally talked about that there could also be 4 indicators that counsel the underside “may be in,” not less than in keeping with Beyonderr.

The indications Beyonderr cited embrace indicators like “time available in the market,” the “Puell A number of,” the “Mayer A number of,” and the “MVRV Z-score.” In the meantime, a large number of individuals on social media platforms like Twitter wholeheartedly imagine the underside is terribly near being in, however up to now most technical indicators have simply been unreliable deviations.

What do you consider the failed technical indicators that might not predict bitcoin’s backside? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.