HodlX Visitor Submit Submit Your Submit

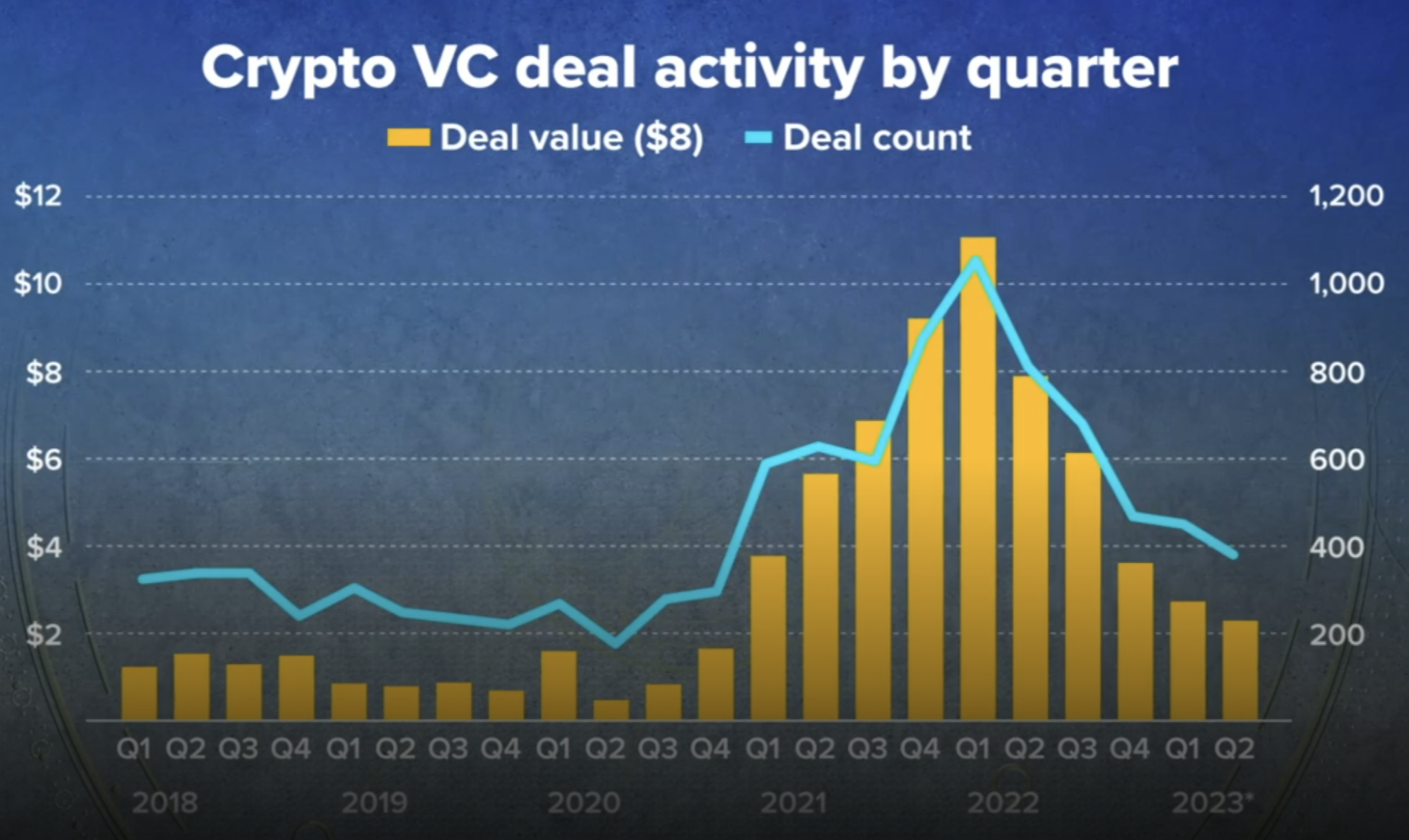

Within the second quarter of 2023, crypto funding exercise decreased to its lowest stage because the fourth quarter of 2020.

In response to PitchBook’s newest report, international enterprise capital investments in crypto firms have dropped by 14.7% by way of deal worth and 16.3% by way of the variety of offers accomplished.

This marks the fifth consecutive quarter of declining crypto funding exercise.

Regardless of that, blockchain infrastructure tasks continued to draw the biggest investments.

LayerZero raised a $120 million Collection B spherical, valuing the corporate at $3 billion, whereas WorldCoin raised a $115 million Collection C.

Gensyn and Collectively additionally raised important Collection A rounds at $43 million and $20 million respectively.

Nevertheless, the general pattern in valuations and deal sizes is erratic. Seed rounds noticed an 18.1% enhance, whereas early- and late-stage rounds have been down by 20.3% and 15.8% respectively.

The valuations of down-rounds and later phases have been initially greater however have drastically declined on account of the small pattern measurement and the truth that down-rounds are stored non-public.

Over all phases of the funding cycle in 2023, the median deal measurement has decreased by lower than 10%, with seed, early-stage and late-stage offers every averaging $2.3 million, $5.1 million and $10 million respectively.

Supply: PitchBook

In response to Robert Le, crypto analyst at PitchBook, the second half of 2023 will see an uptick in VC investments.

Le mentioned,

“Traders have been slowing down the funding tempo, however they’ve been having conversations with loads of totally different firms, founders and groups to essentially perceive what’s being constructed on the market.

“Now they’re beginning to get comfy and perceive what alternatives are on the market. So, we do suppose that buyers shall be extra comfy later this 12 months.”

Moreover, he famous that regardless of the correlation between the crypto funding exercise and crypto costs, it doesn’t exist every day because the crypto asset class is up total this 12 months.

Le added,

“General, Bitcoin, Ethereum and loads of giant crypto asset costs have been up this 12 months, and we expect that’s going to hold over to personal markets later this 12 months.”

To additional bolster the crypto market, the infrastructure layer should mature earlier than utility layer tasks might be constructed on high.

That is just like the event of cloud and cell computing, which noticed the likes of Uber and Airbnb come later after the core infrastructure was established.

It is because of this that blockchain infrastructure is at the moment attracting the biggest investments.

Whereas a lot of challenges stand in the best way of the crypto business’s rise, together with continued regulation uncertainty and main crypto firms’ failures, the business is maturing and people challenges will finally be addressed, leading to fast development and innovation for the market.

Maria Carola is the CEO of StealthEX.io, an prompt, non-custodial cryptocurrency change with over 1,300 belongings listed. After graduating the College of Vilnius, Maria spent nearly a decade within the crypto area, working in advertising and marketing and administration for a wide range of blockchain tasks together with wallets, exchanges and aggregators.

Observe Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney