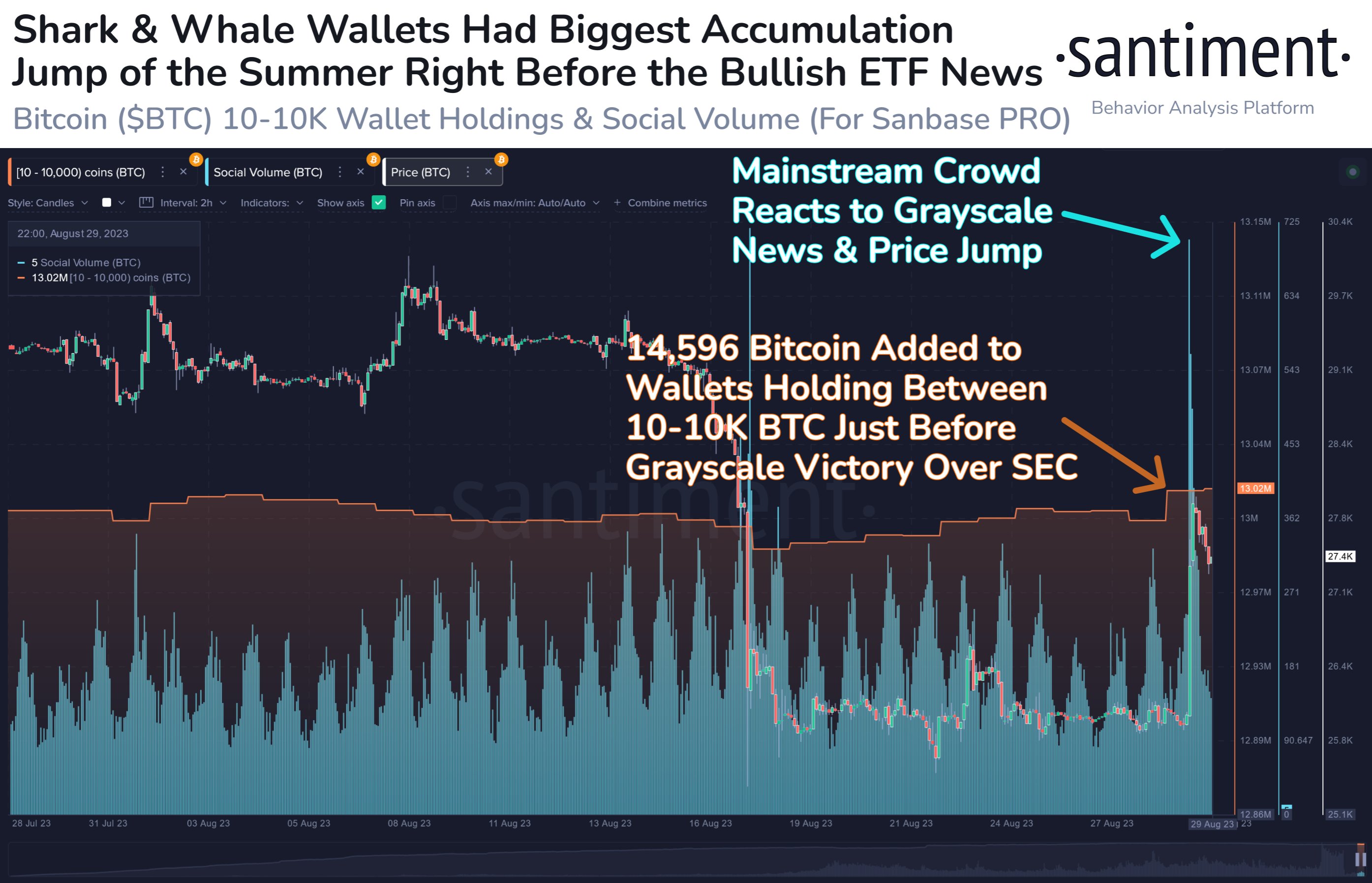

Analytics agency Santiment finds that crypto whales managed to buy Bitcoin (BTC) within the day main as much as Grayscale’s courtroom victory over the U.S. Securities and Change Fee (SEC).

Santiment suggests sure whale and shark addresses “could have identified a factor or two” about Grayscale’s authorized win earlier than it was introduced, noting that wallets holding between 10-10,000 BTC collected a collective $388.3 million value of Bitcoin the day earlier than the information breaking.

Bitcoin jumped from buying and selling round $25,964 earlier than the Grayscale victory to a excessive of $27,975 within the hours afterward, a rise of greater than 7.7%. The highest-ranked crypto asset by market cap has since misplaced a portion of these good points and is buying and selling round $27,275 at time of writing.

Earlier this week, a federal choose dominated that the SEC should rethink Grayscale’s utility to transform the Grayscale Bitcoin Belief into an exchange-traded fund (ETF). Grayscale initially sued the SEC in June 2022, claiming that the regulatory physique’s rejection of their ETF utility was discriminatory. The choose mentioned the SEC must rethink the corporate’s utility to keep away from arbitrariness and inconsistency.

Santiment additionally notes that old-school BTC onerous fork altcoin Bitcoin Money (BCH) was one of many greatest beneficiaries of the Grayscale information. BCH jumped from buying and selling round $190 on Tuesday morning to a excessive of $225.29 later that day, a rise of greater than 18.5%.

The 18th-ranked crypto asset by market cap additionally misplaced a few of these good points on Wednesday and is buying and selling at $214.47 at time of writing.

Grayscale presents publicity to BCH by way of its Grayscale Bitcoin Money Belief.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney