Introduction

The U.S. greenback’s reign because the reserve forex of the world may very well be coming to an finish. CryptoSlate’s newest market report explores the de-dollarization of the world to seek out what position Bitcoin will play within the international financial system.

The U.S. greenback has been the chosen medium for worldwide commerce and the worldwide reserve forex for 79 years. The Bretton Woods Settlement of 1944 established gold as the premise for the U.S. greenback and pegged different currencies to the greenback’s worth.

It was the primary time in historical past {that a} group of countries negotiated a world financial order, which proved profitable within the years following World Struggle II. The system was secured as a result of the U.S. owned over half of the world’s gold reserves.

Nonetheless, financial restoration in Europe and Japan decreased the U.S.’s dominance in international commerce. As well as, an overvalued greenback attributable to inflation and rising public debt pushed the U.S. to droop the greenback’s convertibility into gold in 1971.

Because the greenback’s worth was now not tied to gold, the Federal Reserve was tasked with sustaining the forex’s worth. The central financial institution, nonetheless, did not protect the greenback’s worth and commenced growing the cash provide, which prompted the forex to lose two-thirds of its worth within the following decade.

The devaluation of the greenback has continued nicely into the twenty first century.

In 2023, the greenback’s place as the worldwide reserve forex is in jeopardy, And whereas its dominance over the worldwide market has been shaken up to now, the hazard has by no means been so nice.

This report explores the macroeconomic occasions inflicting the greenback’s fragility, the implications of a weak greenback, and Bitcoin’s place in a de-dollarizing international financial system.

A scorching potato: no person needs the greenback

The worldwide monetary disaster in 2007 exacerbated the rising development of de-dollarization. In 2007, China launched the China Worldwide Cost System (CIPS), which enabled cross-border funds to be settled in yuan. In 2010, China and Russia signed a bilateral forex swap settlement, permitting them to commerce in their very own currencies.

In 2014, BRICS international locations, which embody Brazil, Russia, India, China, and South Africa, created the New Growth Financial institution. The novel monetary establishment was launched to supply different sources of financing for growing international locations, decreasing their dependence on the greenback. As well as, the E.U. created an SPV to facilitate commerce with Iran in euros, bypassing U.S. sanctions on the nation.

Final month, China and Russia reaffirmed their 2020 settlement to extend the usage of the ruble and yuan for commerce. The deal is ready to extend the usage of the ruble and yuan, which already account for two-thirds of the commerce deal funds between the 2 international locations.

Overseas commerce isn’t the one means international locations want to ditch the greenback.

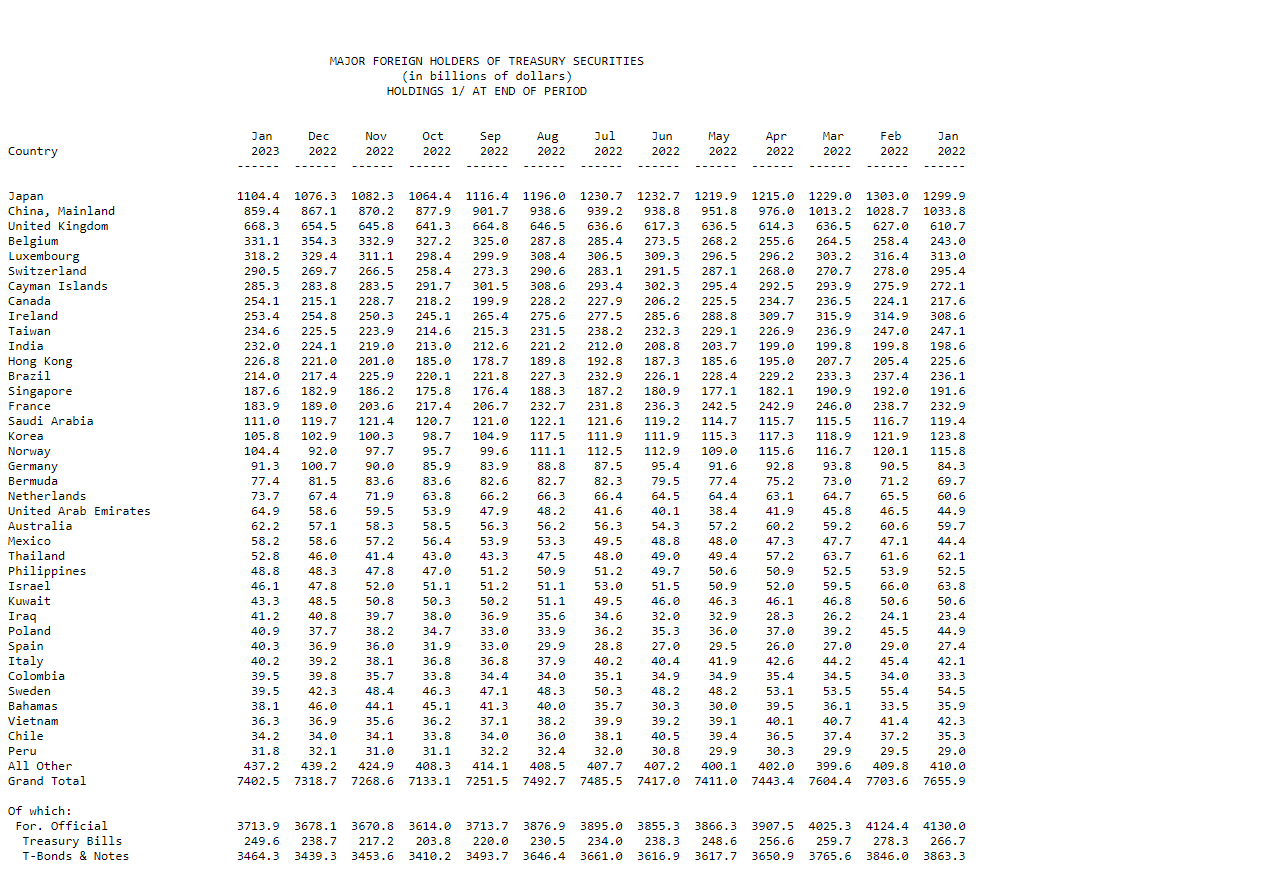

U.S. Treasury holdings as soon as thought-about the most secure and most liquid property on this planet, have turn out to be a geopolitical scorching potato.

Final yr, international demand for treasuries dropped by round 6%. This represents a notable lower in demand following two years of aggressive shopping for after the COVID-19 pandemic.

Nonetheless, rising rates of interest have made these bonds much less worthwhile. Virtually each main nation bought off its treasury holdings over the past yr,

Knowledge from the Federal Reserve confirmed that international holders bought off over $253 billion value of treasuries up to now yr.

Ballooning steadiness sheets spell hassle for the greenback

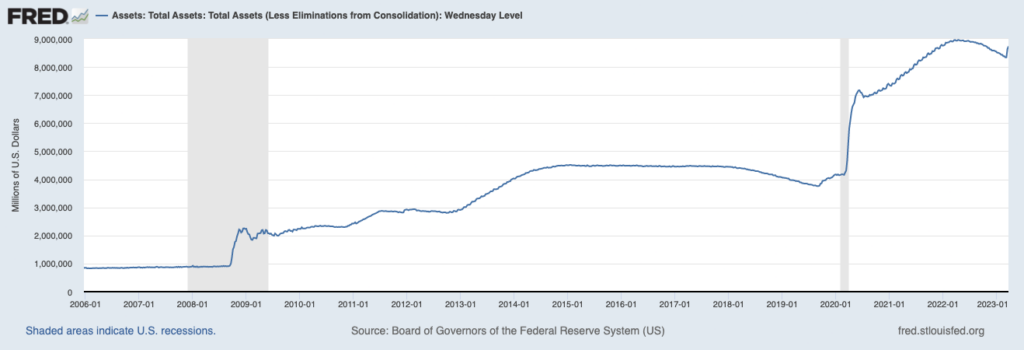

Whereas central banks worldwide have been growing their steadiness sheets in response to the COVID-19 pandemic, nowhere was this as aggressive and harmful as within the U.S.

Within the 4 months because the starting of the pandemic in March 2020, the Federal Reserve elevated its steadiness sheet by over 72%, including over $3 trillion to its property.

The aggressive liquidity injection into the monetary system proved to be unsuccessful. The quantitative easing spree took lower than two years to show into inflation, with items and providers within the U.S. seeing document development into 2023. In a rustic with as a lot debt because the U.S., inflation can rapidly erode the worth of presidency bonds and trigger rates of interest to soar.

A declining worth of presidency bonds pushes home and international bondholders to dump their holdings and even undergo losses to put the capital into extra worthwhile investments.

Overseas holders of U.S. treasuries have bought off their holdings to ditch their dependence on the greenback and turned to different currencies just like the yuan and ruble. Home holders, however, moved away from long-term bonds into short-term treasuries, as they supply a greater yield that outpaces the rising inflation.

All roads result in Bitcoin

Bitcoin has lengthy been touted as a secure haven asset.

Nonetheless, it wasn’t till a full-blown banking disaster started looming over the U.S. that the worldwide market started noticing.

Bitcoin’s mounted provide and decentralized infrastructure put its holders in command of their funds. With the power to independently confirm transactions, self-custody cash, and facilitate uncensorable, cross-border transactions, it’s slowly changing into an asset of selection for a lot of trying to hedge towards authorities interference.

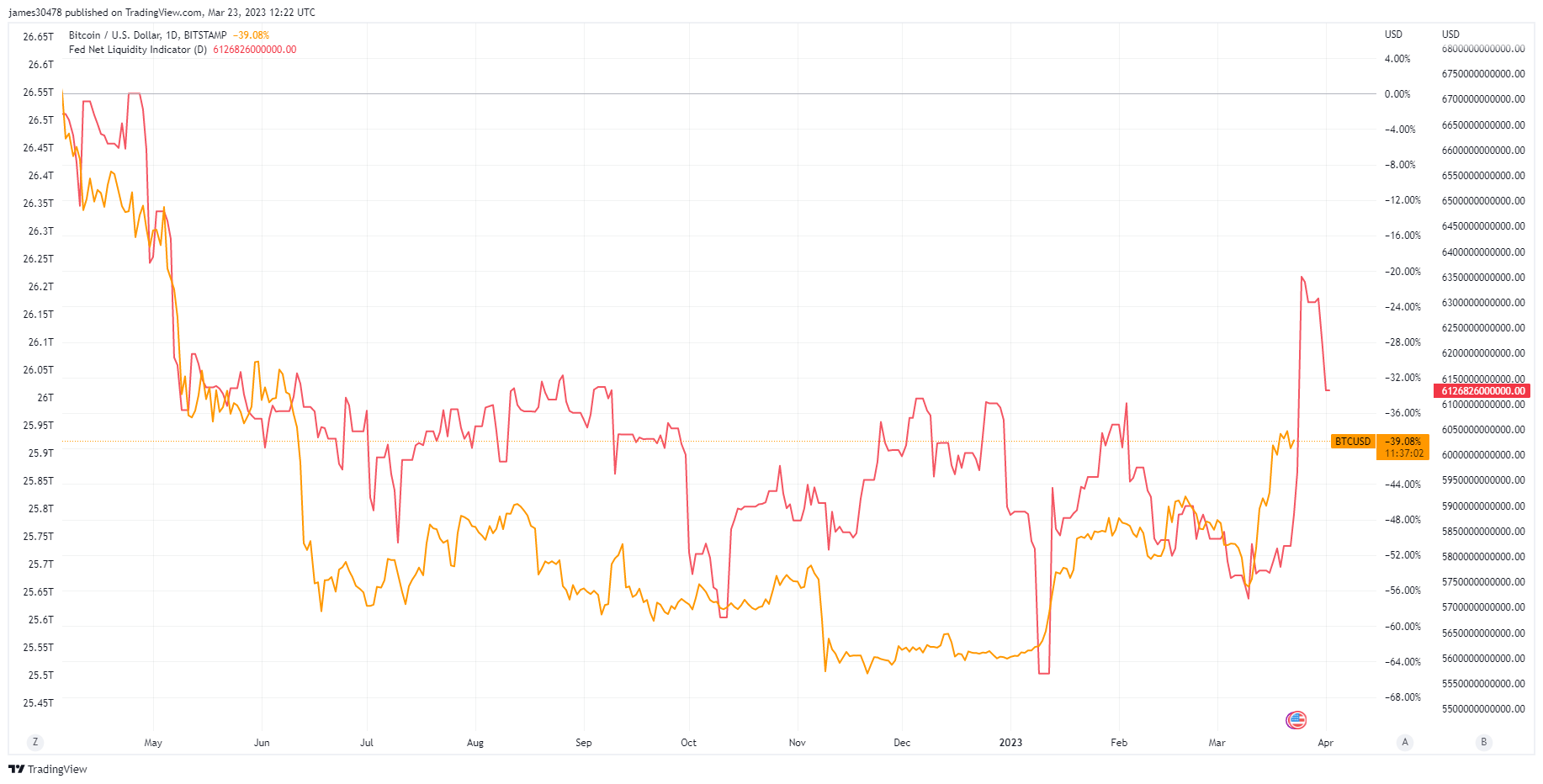

Its volatility appears to be value the price for a lot of buyers. That is evident in its rising correlation with the market’s liquidity. Knowledge analyzed by CryptoSlate confirmed that Bitcoin’s worth adopted the rises and drops within the Federal Reserve’s web liquidity — which means {that a} vital chunk of the market’s newly injected liquidity retains flowing to Bitcoin.

Bitcoin’s position within the international financial system will proceed to extend as extra weaknesses in conventional markets are revealed. Nonetheless, whereas its use in growing international locations has already been confirmed, developed markets just like the U.S. are but to see its worth.

Continued greenback erosion will push many retail and institutional buyers to Bitcoin. Nonetheless, the asset’s dominance over the market will rely upon the U.S. authorities’s regulatory strain, as many count on a fierce battle to stifle its unfold.

When inflation factors the way in which, all roads certainly result in Bitcoin. The query is how lengthy the market wants to succeed in the end line.