That is an opinion editorial by Mickey Koss, a West Level graduate with a level in economics. He spent 4 years within the infantry earlier than transitioning to the Finance Corps.

I really like listening to Greg Foss on podcasts, particularly after I’m gearing up for a heavy useless raise or one thing like that. His no-nonsense talks about bonds simply actually will get my blood flowing and my thoughts targeted. However after I ship stuff like that to my much less finance-minded buddies, they usually have bother understanding what he’s speaking about.

Right here’s my try at some doubtlessly oversimplified math to elucidate the debt spiral.

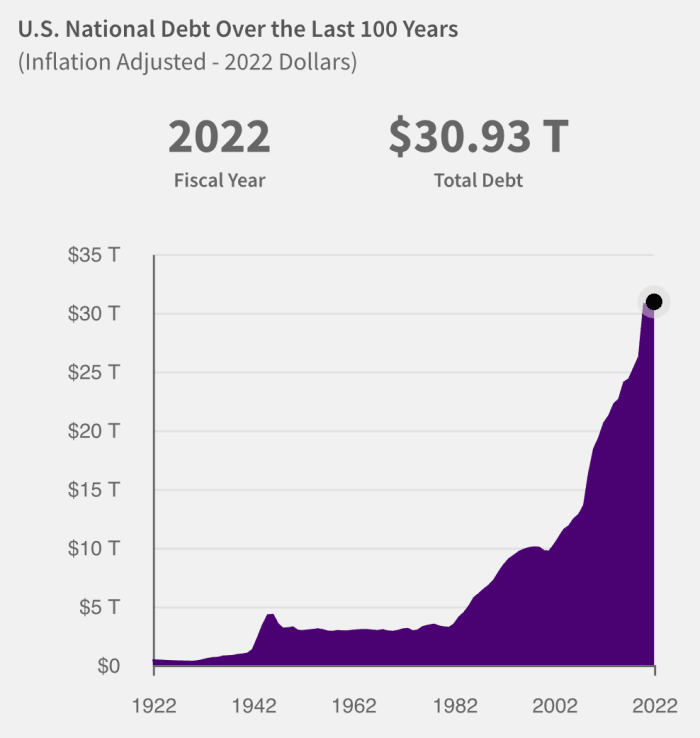

“What Is The Nationwide Debt“ from the U.S. Treasury

U.S. Federal Debt

As of October 13, 2022, the USA has $31,144,952,729,330.20 value of excellent debt. That is up to date each day by the Treasury. To make the maths slightly extra easy, let’s simply name it $30 trillion. In any case, what’s one other trillion, give or take?

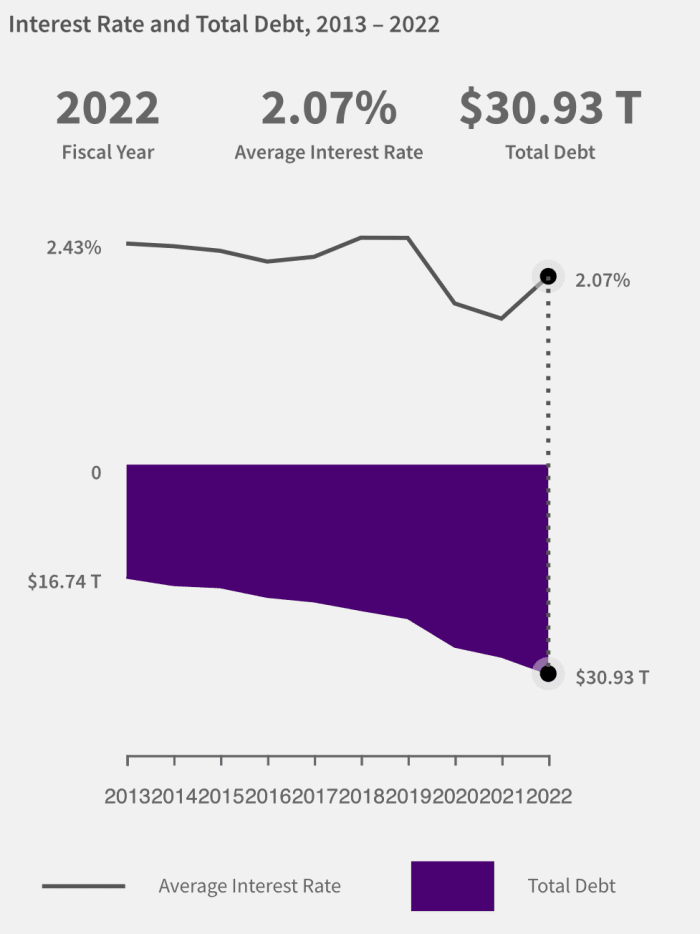

Treasury Common Curiosity Charges as of September 30, 2022

This means a $621 billion annual curiosity fee on the debt this 12 months. The Washington Put up estimates $580 billion. Let’s cut up the distinction and name it $600 billion.

In the event you’ve been paying consideration, the Federal Reserve is aggressively elevating rates of interest and the market is equally aggressive in bidding up yield on authorities debt.. Each foundation level that’s added to the typical charge on U.S. authorities debt will add about $3 billion in extra curiosity expense. That’s if the debt stays at its present degree.

That sadly will not be going to occur. At the moment, the annual finances shortfall sits at $946 billion per 12 months with no indicators of ever going to zero. Since that is the case, not solely will the U.S. authorities must concern extra debt at a charge of practically $1 trillion extra per 12 months, it will likely be doing so whereas rates of interest are going up quick.

The upper rates of interest go, the extra curiosity on the debt shall be required to be paid. The extra curiosity on the debt required to be paid, the bigger the deficit will get. The bigger the deficit will get, the extra debt have to be issued. Extra debt issued, extra curiosity on debt. Even when the Fed dropped charges again to zero, the debt would proceed to develop at a compounding charge due to the character of the deficit.

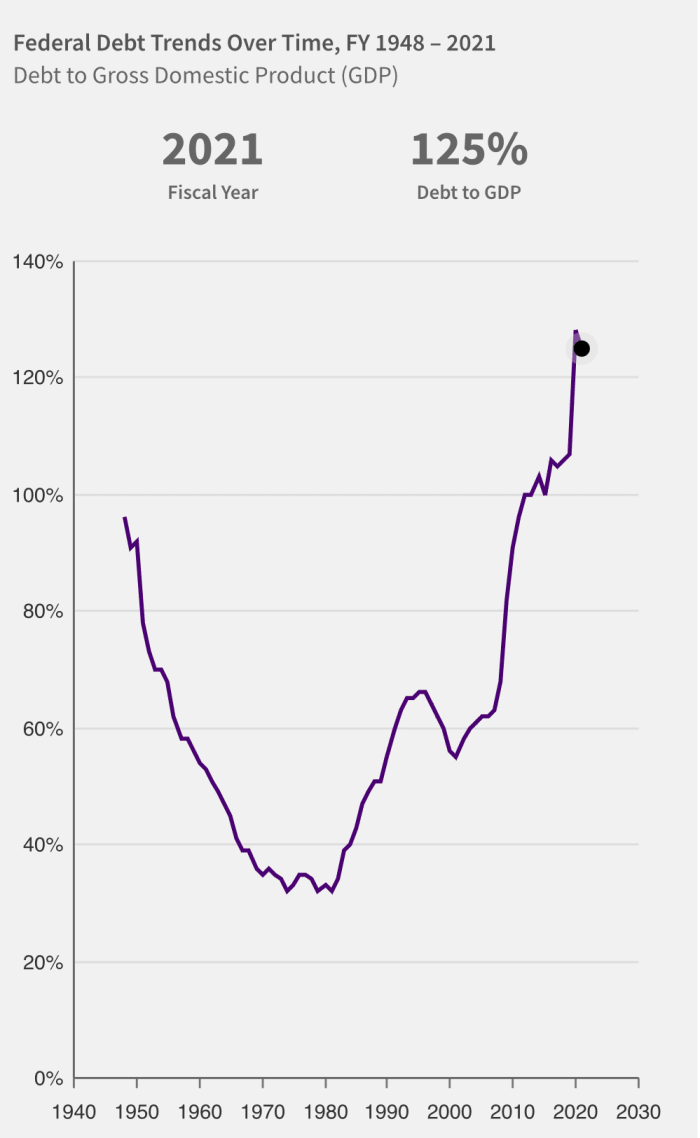

“What Is The Nationwide Debt“ from the U.S. Treasury

Much more regarding is the above graph depicting the debt as a proportion of gross home product. The upward slope of the road because the mid-Eighties implies that the debt has been rising sooner than the financial system for many years.

The character of the perpetual finances deficit ensures that this example is an inevitability; the Fed is simply accelerating it in the meanwhile. Debt begets extra debt so long as the deficit exists.

Hopefully you get it now. That is what Greg Foss means by a debt spiral. The debt by no means really will get paid off; it simply retains getting rolled over, rising at a compounding charge. On this trajectory, it should begin to speed up.

Bitcoin Is Safety

Primarily based on math alone, the Federal Reserve can not proceed to lift charges for for much longer, nor preserve them this excessive as a result of the curiosity on the debt will develop into fully unmanable. There’s a lot to be stated a couple of Fed Pivot and when they are going to resolve to taper their taper to decrease rates of interest again down. When will they really do it? I’m unsure, however the Fed should finally drop charges again right down to try to sluggish the bleeding. And when it does, the rally that the bitcoin value could have goes to soften your face off.

Whereas I’m not significantly within the value anymore — not like some — I’m involved with on a regular basis folks having the ability to hop on the bitcoin life raft earlier than it shoots off into house.

Absolute shortage is an absolute crucial in a world bereft of financial shortage. Be a great buddy: assist folks grasp this idea, as a result of most don’t perceive what’s coming.

It is a visitor publish by Mickey Koss. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.