Decentralized finance (DeFi) has been one of many focal factors of the crypto trade. That is solely getting extra true as years go by, with an increasing number of initiatives, people, and funds coming into the area.

It’s clear that DeFi has grown exponentially in nearly all of its metrics previously couple of years, from the variety of protocols that function within the area, by means of the entire worth locked (TVL), and all the best way to the variety of customers benefiting from numerous platforms.

This report will cowl the efficiency of DeFi within the bearish 12 months of 2022, in addition to decipher what the area has to supply within the coming months and years. Let’s get into it!

The Development of DeFi

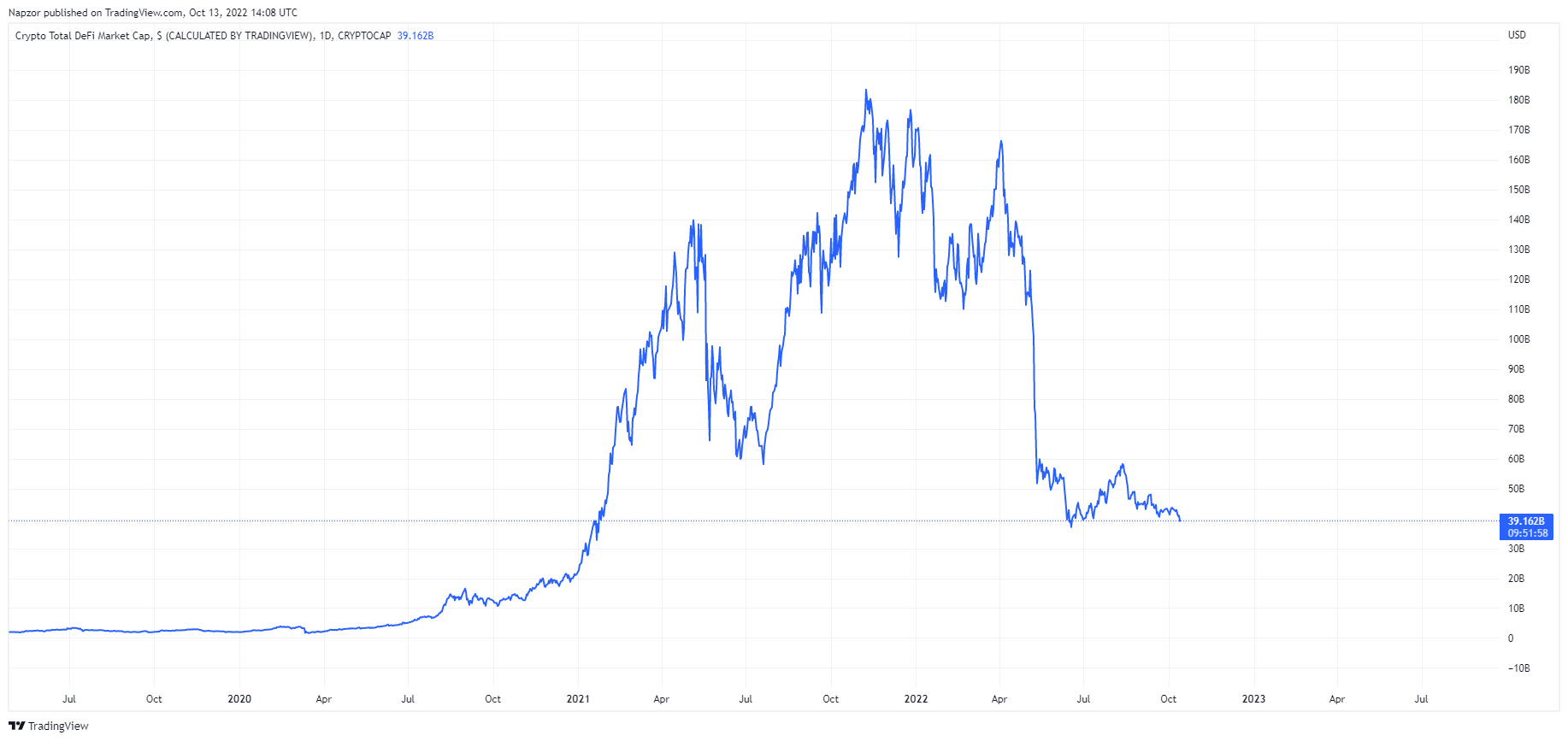

Market Capitalization

Since early 2020, the DeFi ecosystem has exploded in progress, with its market cap reaching over $26 billion by the top of 2020. This progress has continued all through 2021, with the best level reaching as excessive as $199 billion.

Nevertheless, as 2022 got here with a lot of financial unrest and a crypto bear market, DeFi has pulled again towards the $40 billion mark.

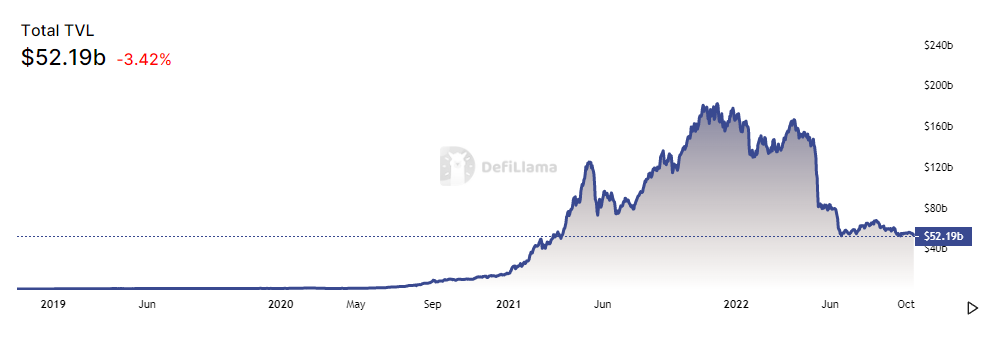

Whole Worth Locked (TVL)

Once we have a look at the complete worth locked in numerous protocols, we may even see almost the identical picture as earlier than – however the chart might idiot you!

As a matter of truth, whereas the greenback worth of tokens locked inside DeFi protocols has been following the DeFi ecosystem market cap, if we issue out the value fluctuations, we may even see that the variety of precise cryptocurrencies locked remained nearly the identical. In truth, the greenback worth of DeFi in TVL is now bigger on a per-dollar foundation than it was nearly ever was. Because of this, in the course of the bear market, folks had been nonetheless locking their property in DeFi protocols – they had been simply doing so with inexpensive cryptocurrencies.

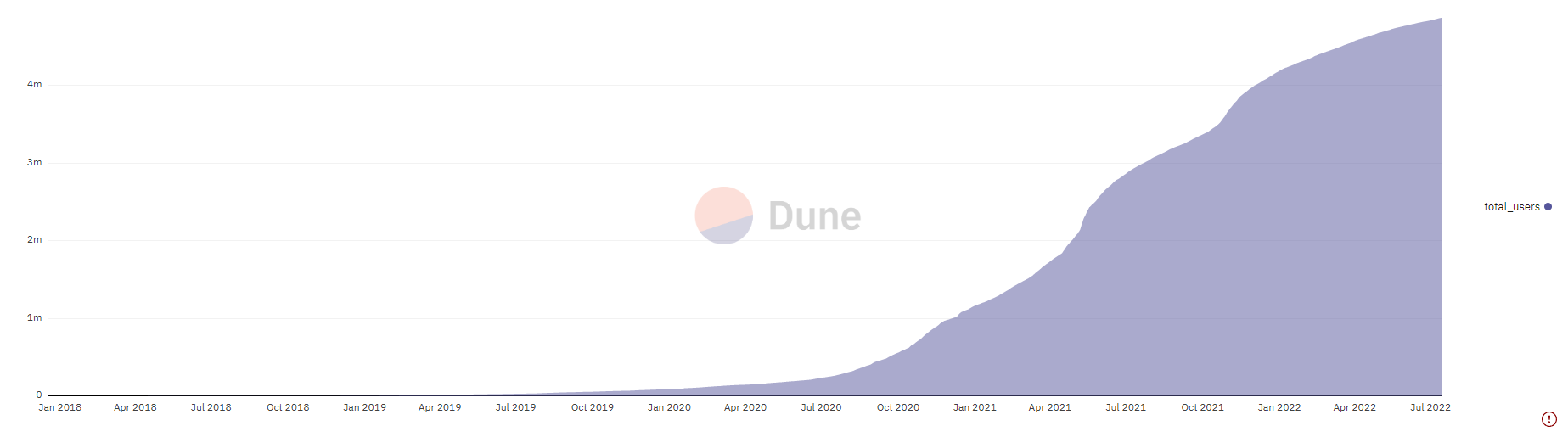

Addresses Taking part in DeFi

We may even see a special story if we have a look at the variety of addresses collaborating in numerous protocols. The information as soon as once more exhibits a gradual enhance all through 2020 and early 2021, but additionally all through 2022 regardless of the bear market setting in.

This upward-facing pattern appears to proceed, doubtless resulting from the truth that most of the early adopters and energy customers of DeFi protocols are nonetheless collaborating, whereas new customers will slowly coming again because the market turns into extra secure.

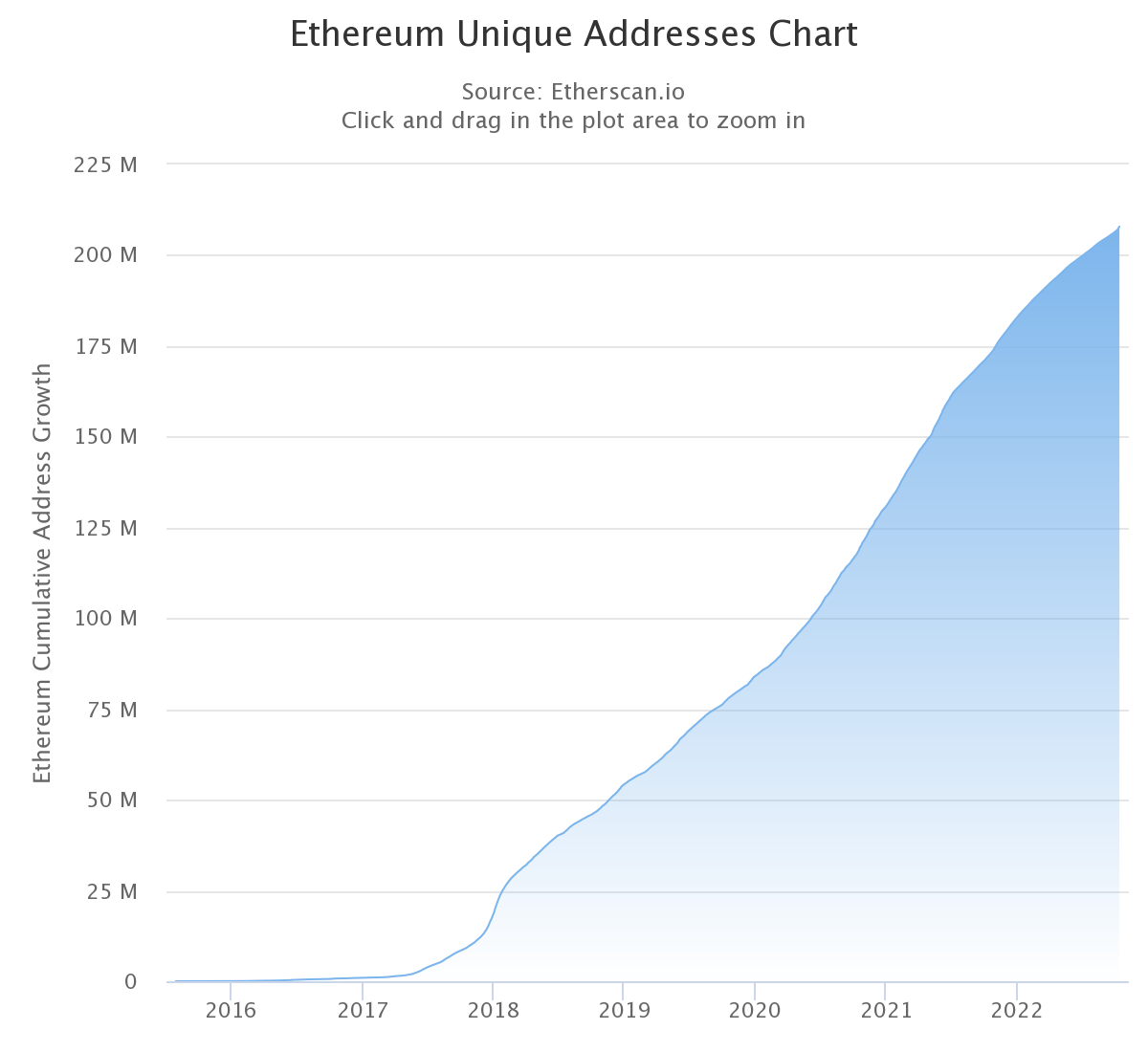

Distinctive Ethereum Addresses

Since many of the DeFi protocols are presently constructed on Ethereum, it’s additionally essential to take a look at the variety of distinctive addresses interacting with Ethereum.

The information exhibits a gradual enhance all through the years, which exhibits that individuals nonetheless transact and function throughout the ecosystem regardless of the present bearish outlook.

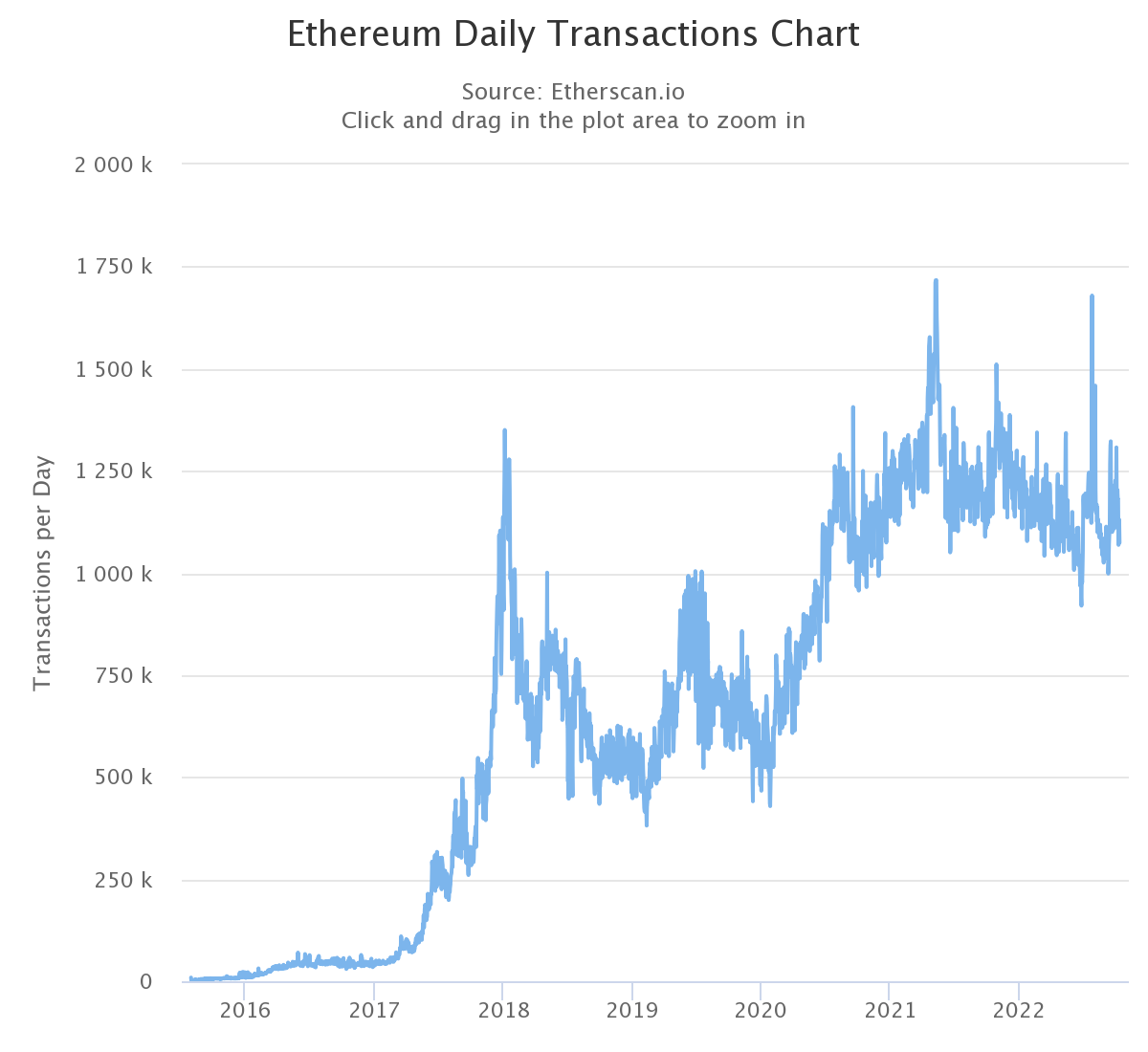

Ethereum Transactions Per Day

If we have a look at the variety of transactions per day on Ethereum, we will see that, regardless of some fluctuations, the common has been clearly transferring towards the upside.

That is one other nice indicator that persons are truly utilizing the blockchain regardless of its uptrends and downtrends – and a big proportion of transactions are most certainly linked to the DeFi ecosystem.

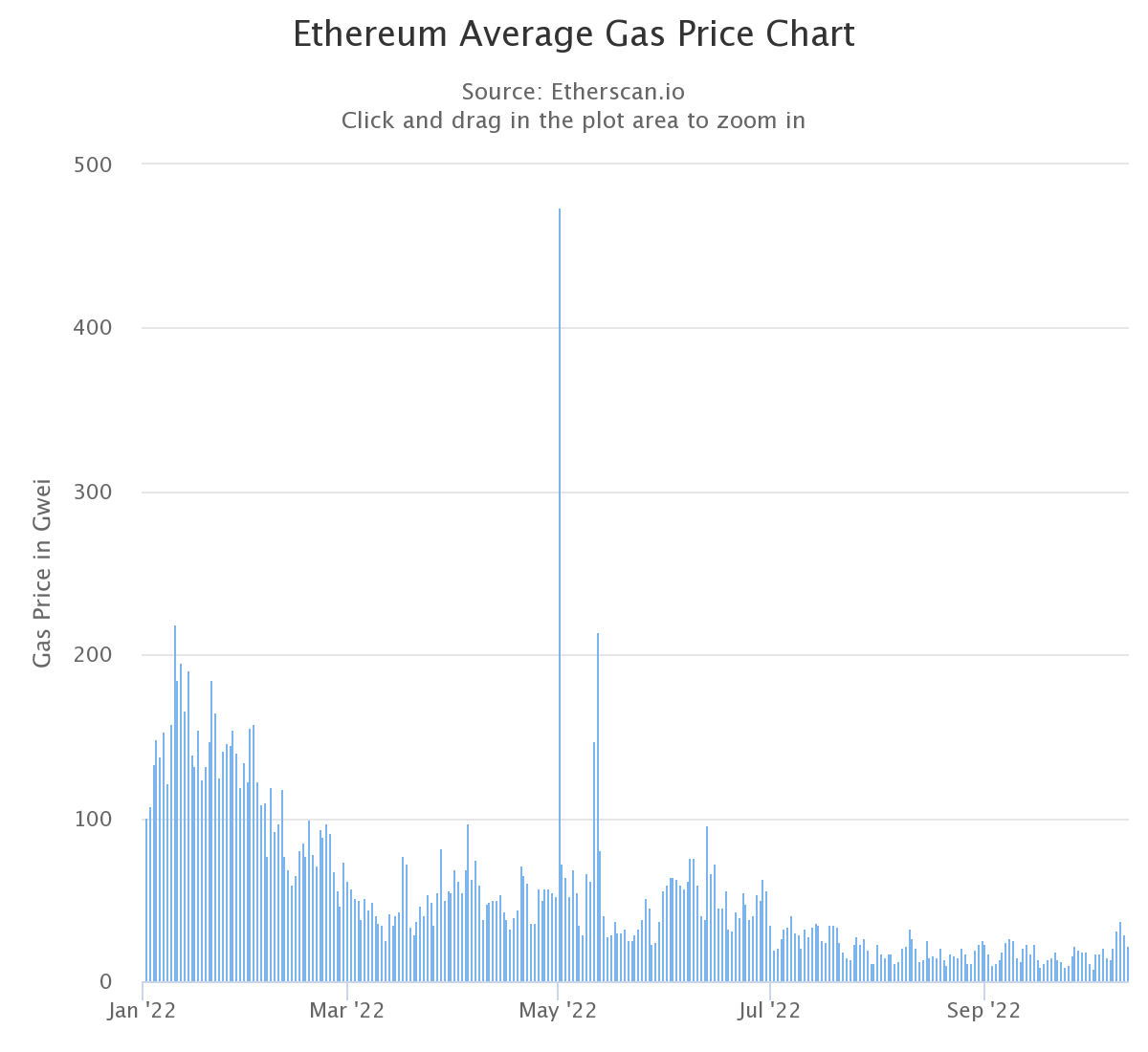

Ethereum Gasoline Charges

Relating to Ethereum’s gasoline charges, we will see a gradual descent in common gasoline costs in 2022. There are quite a few causes for this. A few of the important causes embrace the ETH value drop that resulted in much less ETH transferring round, as folks shifted extra in the direction of different cryptocurrencies for each day transactions.

The bear market additionally slowed down DeFi barely, which lowered the general gasoline charges on Ethereum because of this.

The present common gasoline value presently comes as much as 22 Gwei, with the height in 2022 reaching near 500 Gwei.

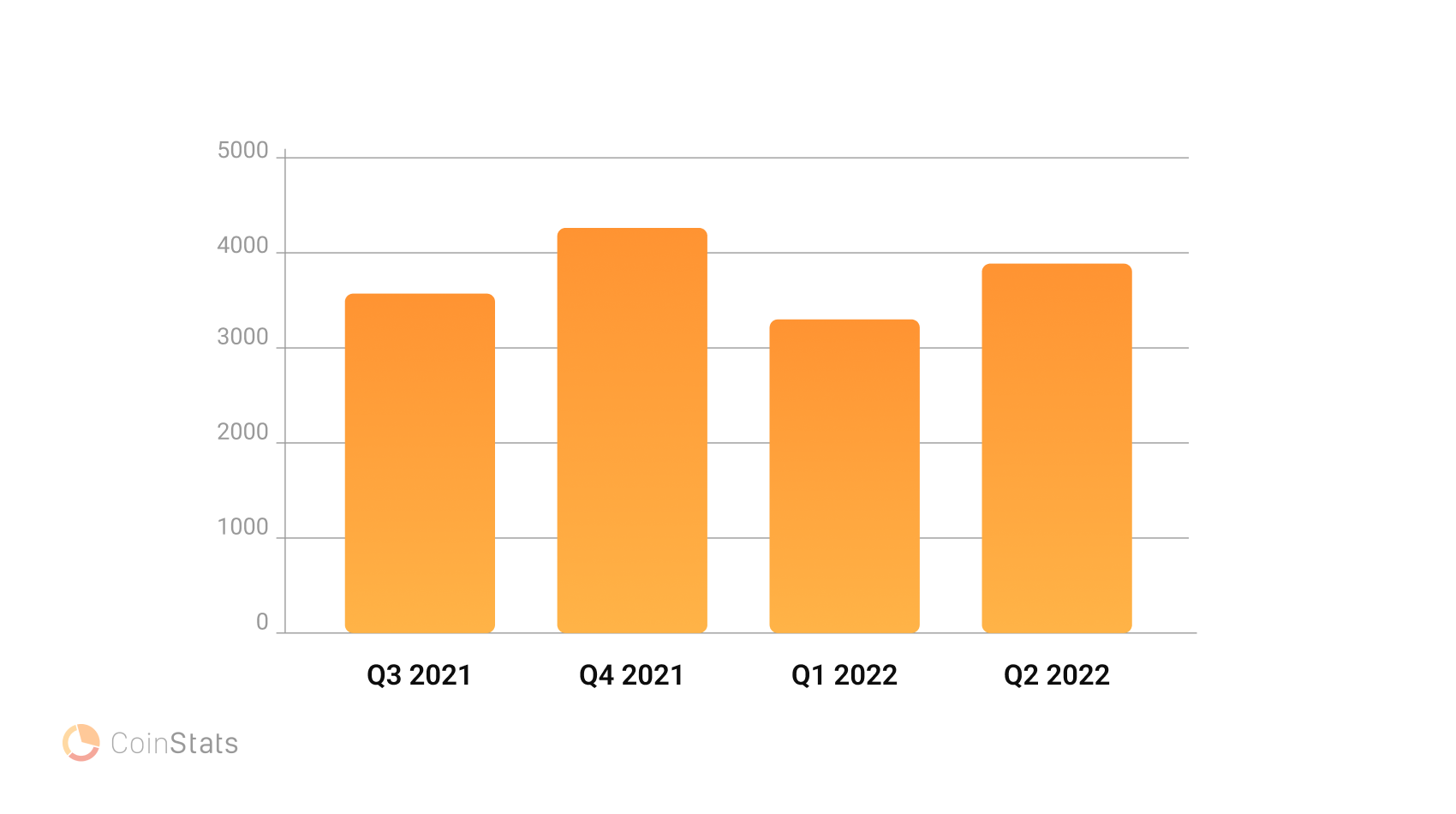

Giant Ethereum Customers

If we check out the variety of Ethereum whales on CoinStats, we will see that the numbers between Q3 2021 and Q1 2022 don’t differ an excessive amount of – and the identical goes for This autumn 2021 and Q2 2022.

Because of this, regardless of the market downturn and Ethereum being value much less, the variety of precise whales held up fairly nicely, much more so if we consider that holders would want far more ETH to be thought of whales in greenback worth now.

Ethereum Transfering to Proof-of-Stake

As we all know, Ethereum has moved from its proof-of-work consensus algorithm to a proof-of-stake one. This transition was sluggish and painful, however the transition was pretty seamless.

Whereas this occasion might not have had a direct impression on DeFi protocols and platforms, it’s value noting that it might probably result in elevated curiosity in Ethereum and, because of this, DeFi protocols constructed on prime of it.

It’s because, as soon as Ethereum 2.0 is totally operational (and the transition to the PoS consensus algorithm is only one a part of it), the blockchain will help far more transactions, with its creator Vitalik Buterin mentioning a throughput of 100,000 transactions per second. If Ethereum comes even near it, we may even see extra widespread adoption of DeFi due to drastically lowered charges.

Moreover, the barrier to entry for Ethereum’s blockchain validation’s “passive revenue” might be a lot decrease as customers received’t be needing to costly mining gear, however quite merely stake their ETH and take part within the community’s consensus. This might result in an inflow of latest customers, in addition to a rise within the value of ETH (which might, in flip, result in a rise within the worth locked in DeFi protocols).

The Growth of Different Blockchains

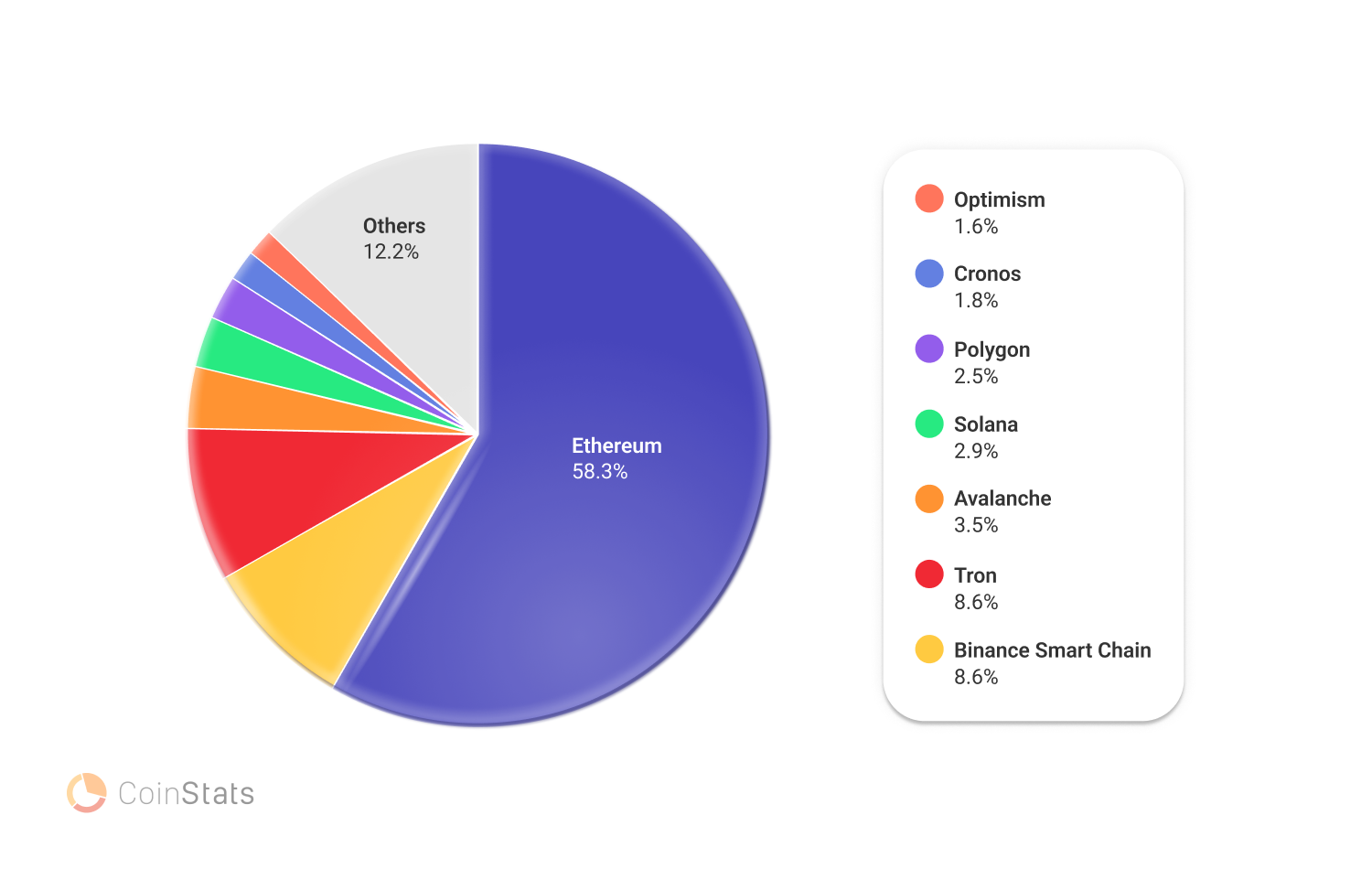

With the immense progress of DeFi protocols comes the necessity for different blockchains to supply comparable companies. Whereas Ethereum nonetheless stays the go-to blockchain for many DeFi protocols, different chains are slowly however certainly catching up.

A few of the most notable ones embrace Binance Good Chain, Avalanche, and Solana, in addition to layer 2 options like Polygon or non-EVM blockchains like Cosmos, with the market nonetheless ready for Polkadot and Cardano. These protocols supply comparable companies to Ethereum, however with considerably decrease charges. This is because of the truth that they use a special consensus mechanism (PoS vs. PoW), which requires much less computational energy and is thus cheaper to run.

These protocols are additionally capable of deal with extra transactions per second than Ethereum, which is essential for the scalability of DeFi protocols.

As an increasing number of customers are searching for alternate options to Ethereum, we may even see a major shift of DeFi protocols to those different blockchains within the coming months and years.

When having a look on the complete worth locked by blockchain, we will see that each Binance Good Chain and Tron are inching nearer to the ten% mark. That is not at all an insignificant worth, because it exhibits that persons are considering non-Ethereum blockchains.

Notable Blockchain Initiatives

Let’s discover a number of the several types of blockchains, and what they’ve to supply to the market.

Different EVM Blockchains

Interoperability between blockchains is likely one of the largest hurdles that the trade is attempting to cross. Ethereum digital machine (EVM) compatibility is an efficient start line in fixing this problem, with a number of the most notable blockchains presently being Avalanche, Binance Good Chain, Fantom, and Polygon.

Avalanche

Avalanche is an EVM-compatible blockchain that makes an attempt to enhance scalability with out compromising pace or decentralization.

The platform consists of three blockchains, particularly:

- The Change Chain (X-Chain) – used for creating and buying and selling property.

- The Contract Chain (C-Chain) – used for good contract creation.

- The Platform Chain (P-Chain)- used for coordinating validators and Subnets.

Avalanche implements a Directed Acyclic Graph (DAG) optimized consensus protocol as an alternative of the normal PoW or PoS consensus mechanisms.

The core worth proposition of Avalanche is that it improves and optimizes already-established ideas, whereas additionally enabling customers to create personalized various blockchains referred to as Subnets.

Avalanche’s hottest DeFi platforms are Aave (a multi-chain lending platform), adopted by Benqi, and Dealer Joe.

Binance Good Chain

Binance Good Chain is Binance Change’s model of Ethereum. Its functionalities are precisely the identical, with slight adjustments solely seen below the hood. It runs on a Proof of Stake Authority (PoSA), making it arguably barely extra centralized, but additionally extra secure by way of gasoline charges.

BSC turned common in the course of the Ethereum gasoline price hike, however has maintained relative reputation regardless that Ethereum’s gasoline charges have been on the decline.

Binance Good Chain’s hottest DeFi platforms are Pancake Swap, adopted by Venus and Alpaca Finance.

Fantom

Like different Ethereum alternate options, Fantom goals to offer extra scalability and decrease prices than Ethereum. Nevertheless, Fantom comes with one distinctive performance: customers can create and deploy their very own unbiased networks as an alternative of relying solely on Fantom’s important consensus layer. Every utility constructed on the Fantom blockchain works as its personal blockchain, whereas additionally having fun with the safety, pace, and finality of the dad or mum Fantom blockchain.

Fantom runs on an Asynchronous Byzantine Fault Tolerant (aBFT) Proof of Stake (PoS) consensus mechanism, which maintains the operational effectivity of your entire community.

Fantom’s hottest DeFi platforms are SpookySwap, adopted by Beefy and Beethoven X.

Polygon

Polygon is a layer-2 community that provides to the Ethereum blockchain. Because of this it goals to assist Ethereum develop in throughput whereas not altering the unique blockchain layer.

Polygon has introduced quite a few wonderful partnerships, and has maintained a gradual improvement path.

Polygon’s hottest DeFi platforms are Aave, adopted by Quickswap and Curve.

Polkadot

Polkadot is a blockchain community that gives safety and interoperability by means of shared state.

Because of this the layer of abstraction between Ethereum and Polkadot is remarkably completely different for builders.

In Ethereum, builders write good contracts that every one execute on a single digital machine, referred to as the Ethereum Digital Machine (EVM). In Polkadot, nevertheless, builders write their logic into particular person blockchains, the place the interface is a part of the state transition perform of the blockchain itself.

Nevertheless, there shouldn’t be any main variations from the consumer perspective, as Polkadot could possibly be thought of an augmentation and scaling answer for Ethereum, quite than its competitors.

Though its core chain is not going to have good contract performance, Polkadot will help EVM good contract blockchains to offer compatibility with current contracts.

Different Non-EVM Blockchains

We even have to say blockchains that aren’t Ethereum-compatible, as they aren’t utilizing the identical programming language. These blockchains are barely completely different from the aforementioned ones as they’ve a bigger distinction in functionalities when in comparison with Ethereum.

Cosmos

Whereas Ethereum has a rollup-centric roadmap, aiming to scale a single, highly-decentralized settlement layer through quite a few of Layer 2’s, Cosmos goals to create an “web of blockchains,” or an interoperable community of sovereign, application-specific blockchains.

Cosmos is extremely suited to constructing application-specific blockchains which can be optimized for operating just one utility. These embrace the biggest Cosmos chain, Osmosis, in addition to dYdX Chain.

Cardano

Cardano is a decentralized PoS blockchain designed to be a extra environment friendly various to PoW networks. Created by Charles Hoskinson, considered one of Ethereum’s co-founders, Cardano goals to enhance scalability, interoperability, sustainability, rising prices, power use, and sluggish transaction instances of present blockchains.

The venture has launched good contract performance with its Alonso replace in 2021, however the present infrastructure and an unpopular programming language are placing Cardano on the again foot, at the least till future updates.

DeFi Hacks and Safety Breaches

DeFi hacks have been a rising downside within the cryptocurrency area over the previous few years. Whereas many hacks have been carried out on centralized exchanges, DeFi protocols have additionally develop into a goal for malicious actors.

Quite a few hacks occurred in 2022, with hackers stealing $615.5 million from Ronin, $602.2 from Poly Community, $362 million from Wormhole, $181 million from Beanstalk, $140 million from Vulcan Solid, $570,000 from Curve, and most not too long ago $100 million from BNB Chain and $100 million from Mango Markets.

This places the entire funds stolen from DeFi protocols to over $3 billion simply in 2022.

Decentralized finance as a complete is definitely an excellent various to conventional centralized finance, nevertheless it nonetheless has a methods to go by way of security and safety.

What Will DeFi Convey within the Future?

Conventional monetary programs have been round for hundreds of years, and they’re unlikely to go away anytime quickly. Nevertheless, the rise of decentralized finance protocols constructed on prime of blockchains represents a seismic shift in how we work together with monetary companies.

Within the coming years, we’re more likely to see much more progress within the DeFi area, as extra protocols are constructed, and extra customers flock to the area seeking higher charges, decrease charges, and elevated safety.

Let’s try the largest contributors to the current enlargement of DeFi!

Conventional Finance is Getting into DeFi

With the current increase in DeFi protocols, it’s no shock that conventional finance is beginning to take discover.

Some of the notable examples is the entry of huge banks into the area. JPMorgan, as an example, has been actively concerned in growing Quorum, an Ethereum-based enterprise blockchain platform. The financial institution can be a member of the Enterprise Ethereum Alliance, which is engaged on requirements for companies utilizing Ethereum.

Equally, HSBC has been testing a blockchain platform for commerce finance, whereas ING has been concerned in a number of blockchain-based provide chain financing initiatives.

The entry of conventional finance into the DeFi area is an indication that the trade is maturing, and that these establishments are recognizing the potential of blockchain-based monetary protocols.

It’s additionally value noting that, as conventional finance enters the area, we’re more likely to see an inflow of latest customers and a rise within the quantity of property being locked into DeFi protocols.

Conventional Finance coming into the DeFi area is definitely one factor we must always search for within the coming months and years.

The Rise of Decentralized Exchanges

Some of the essential parts of the DeFi ecosystem are decentralized exchanges, which permit customers to commerce cryptocurrency with out the necessity for a centralized middleman.

Uniswap, 0x, and Kyber Community are a number of the hottest protocols on this area, they usually have been essential within the current enlargement of DeFi. It’s because they supply customers with a straightforward technique to commerce crypto property, with out having to undergo a centralized alternate.

What’s extra, these protocols are additionally built-in with many DeFi protocols, which permits customers to commerce between completely different property simply.

For example, Kyber Community is built-in with MakerDAO, permitting customers to transform DAI into ETH simply. That is essential as a result of it permits customers to commerce between completely different property with out having to go away the MakerDAO ecosystem.

Equally, Uniswap is built-in with a lot of protocols, together with Compound, Balancer, and Curve. This enables customers to commerce between completely different property simply, with out having to go away the DeFi ecosystem.

The rise of decentralized exchanges is an indication that the DeFi ecosystem is maturing, and that customers have gotten extra snug with buying and selling in a decentralized surroundings.

What’s extra, it’s doubtless that we’ll see much more progress on this area within the coming months and years, as extra protocols are constructed, and extra customers flock to the area.

The Development of Governance Tokens

One other signal of the maturity of the DeFi ecosystem is the rise of governance tokens. These tokens give holders a say in how a protocol is run, and they’re an essential a part of the DeFi area.

MakerDAO, as an example, has the MKR token, which supplies holders the flexibility to vote on issues just like the rate of interest for the DAI stablecoin. They’ll additionally take part in auditing the protocol. Compound has the COMP token, which operates in a really comparable manner.

The rise of governance tokens is an indication that customers have gotten extra snug with decentralized protocols, and that they’re keen to place their belief in these protocols. What’s extra, it’s doubtless that we’ll see much more progress on this area within the coming months and years, as extra protocols launch their very own governance tokens, and attempt to push away from centralized governance.

DeFi and Blockchain Gaming

There are greater than 2 billion players worldwide, spending over $159 billion per 12 months. By 2025, that quantity is predicted to develop to roughly $256 billion. With an increasing number of folks dedicating hours to this medium of leisure, each gamers and creators would naturally need to monetize the trade additional.

A method that sport studios and builders are attempting to monetize the sector can be by means of blockchain gaming. Within the case of blockchain gaming, the video video games are linked to a blockchain, not a central server, with gamers “mining” tokens by performing sure duties within the sport.

Well-liked DeFi protocols might be wanted to permit for in-game transferability, and game-based cryptocurrency house owners would most likely need to earn a return on their property.

A survey by Toptal confirmed that 62% of players and 82% of builders acknowledged they had been fascinated with creating and investing in digital property which can be transferable between video games. Since then, the crypto world has caught as much as their needs.

In 2019, Ubisoft created HashCraft, the primary blockchain online game printed by a big studio. These days, a number of titles have been launched.

Since then, the area has shifted extra in the direction of the Metaverse, with main gamers like Decentraland and the Sandbox main the sport. Moreover, as NFTs have introduced themselves because the spine of the Metaverse area, we might see numerous massive firms creating their very own NFT initiatives, together with Coca-Cola, Pepsi, Adidas, McDonald’s, Nike, Disney, and lots of extra.

Whereas many understand it as quirky, the area of blockchain gaming (and particularly the Metaverse and NFTs) is definitely one thing we must always look out for within the coming months and years.

Remaining Phrase

We consider that the DeFi ecosystem will proceed to develop in each dimension and complexity, providing customers all kinds of choices. Because the area matures, we anticipate to see a lot of protocols emerge as leaders of their respective fields, whereas others might be pressured to adapt or die.

Ultimately, DeFi continues to be in its early days, and it stays to be seen what the long run holds for this revolutionary new sector. Nevertheless, one factor is for certain – decentralized finance is right here to remain.

If you wish to learn extra insightful content material, head over to our weblog or join our e-newsletter.

Thanks for studying!