Because it had been, every thing we find out about finance has been radically reworked by the actualization of blockchains, cryptocurrencies, DeFi, and sensible contracts. The decentralization flu spreading by the sector has led to ideas that even dreamers would have had hassle imagining only a decade in the past.

Many issues not possible with conventional banking at the moment are attainable with decentralized finance. Specializing in borrowing and lending, conventional finance is characterised by collateralized loans solely. With TradFi, you must current a number of bodily belongings or liabilities as collateral to have the ability to entry a mortgage. Decentralized finance, however, has eradicated third events nearly utterly. Anybody with a telephone, web entry, and a little bit little bit of crypto now has entry to collateralized and uncollateralized loans.

This text discusses one of many largest gamers in DeFi lending and borrowing, Compound Finance.

What’s Compound Finance?

Compound Finance is essentially much like a financial savings account. The key distinction right here is that the financial institution controls your conventional financial savings account with guarantees of ridiculous annual curiosity returns and all of the shadiness that comes with them. Contrarily, Compound Finance is a decentralized holding account that lets you generate curiosity in your crypto belongings with out third-party interference.

The place it will get attention-grabbing with Compound Finance is that you may lend your locked-up crypto financial savings. By doing so, you will get some juicy curiosity paid for lending. Then again, locking up your crypto funds within the protocol provides you entry to borrow as much as 80% of your complete financial savings.

Ethereum blockchain sits because the pioneer of decentralized finance because it first launched sensible contracts and an ecosystem that facilitates the event of decentralized purposes. So, it is sensible to seek out the Compound protocol on Ethereum. This mechanically means the governance token of Compound Finance is an ERC-20 token.

Compound Finance may facilitate trades, transfers, and utility in a number of DeFi purposes. As a DeFi lending protocol, compound finance is an algorithmic cash market protocol. It may be in comparison with an open marketplace for cryptocurrencies. The platform permits customers to deposit cryptocurrencies, earn curiosity, and borrow belongings in alternate for his or her deposits. It makes use of sensible contracts to automate the administration and storage of the platform’s capital.

With Compound Finance, there isn’t any want for lenders and debtors to haggle over the phrases as they’d in a extra conventional context. Each events solely must instantly talk with the Compound protocol, which manages the collateral and rates of interest. Do not forget that Compound Finance eliminates third events? Subsequently, crypto belongings are held in sensible contract protocols known as liquidity swimming pools, not with an middleman.

The rates of interest on Compound Finance for lenders and debtors are algorithmically adjusted based mostly on provide and demand. Greater demand and restricted provide result in greater rates of interest, and vice versa. Final however not least, Compound is a permissionless protocol, which implies that anybody, wherever on the planet, can connect with Compound and earn and pay curiosity with a web3 pockets.

Who Based Compound?

Robert Leshner and Geoffrey Hayes, serial enterprise homeowners, established Compound.

The famend enterprise capital corporations Andreessen Horowitz and Bain Capital Ventures, the enterprise capital division of the consulting agency Bain, contributed $8.2 million to Compound’s funding spherical in 2018.

In 2019, Compound raised an extra $25 million from most of the identical buyers along with some new ones, notably Paradigm Capital, a fund established by a Coinbase co-founder.

How Does Compound Finance Work?

We’ve extensively touched on the preliminary query of “What’s Compound Finance?” Let’s additional think about how Compound DeFi protocol works.

The working technique of lending or borrowing crypto with Compound Finance begins with connecting your web3-enabled pockets like Metamask to the Compound protocol. By default, any crypto fund deposited is locked up within the protocol (any ERC-20 token supported by Compound). Performing any exercise would require you to unlock your crypto asset for interplay. Within the case of a number of ERC-20 deposits, a consumer selects which token he needs to work together with after which proceeds.

It is very important word that each deposit into the Compound protocol is tracked within the type of cTokens, which is Compound’s native ERC-20 token. cTokens signify or are equal to your stake within the liquidity pool.

As an illustration, cETH is created once you put ETH into Compound. The Fundamental Consideration Token (BAT) is reworked into cBAT upon deposit. Should you deposit a number of cash, each will accrue curiosity at its charge. In different phrases, cBAT will earn the rate of interest for cBAT, and cETH will earn the rate of interest for cETH.

cTokens are redeemable. That’s, you possibly can convert them again to the unique token you deposited and withdraw at will. You solely get the equal of your stake within the liquidity pool. cTokens accrue curiosity and improve in worth when the quantity borrowing the underlying asset grows within the open market. Holding an ERC-20 token is all it takes to earn curiosity on Compound.

Lending with Compound Finance

You have to lend some cryptocurrency to the Compound protocol as your first important Compound motion. This motion allows you to use different functionalities of the platform, akin to borrowing. Compound calls for collateral earlier than permitting you to borrow from the protocol, identical to different well-known lending and borrowing companies. Provided belongings will accrue curiosity per the protocol, however you gained’t be capable to redeem the crypto asset whereas borrowing.

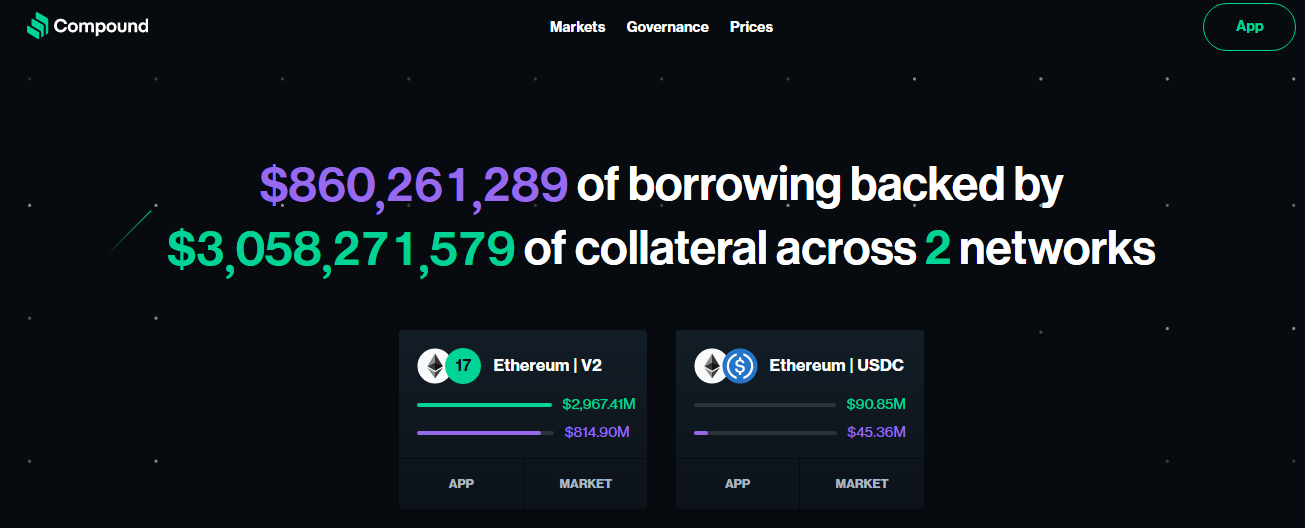

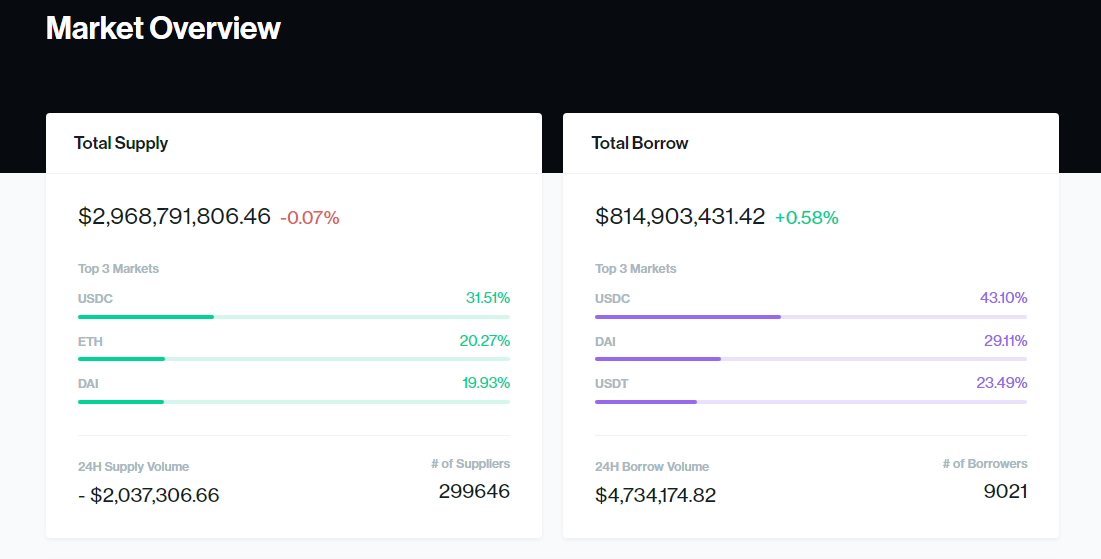

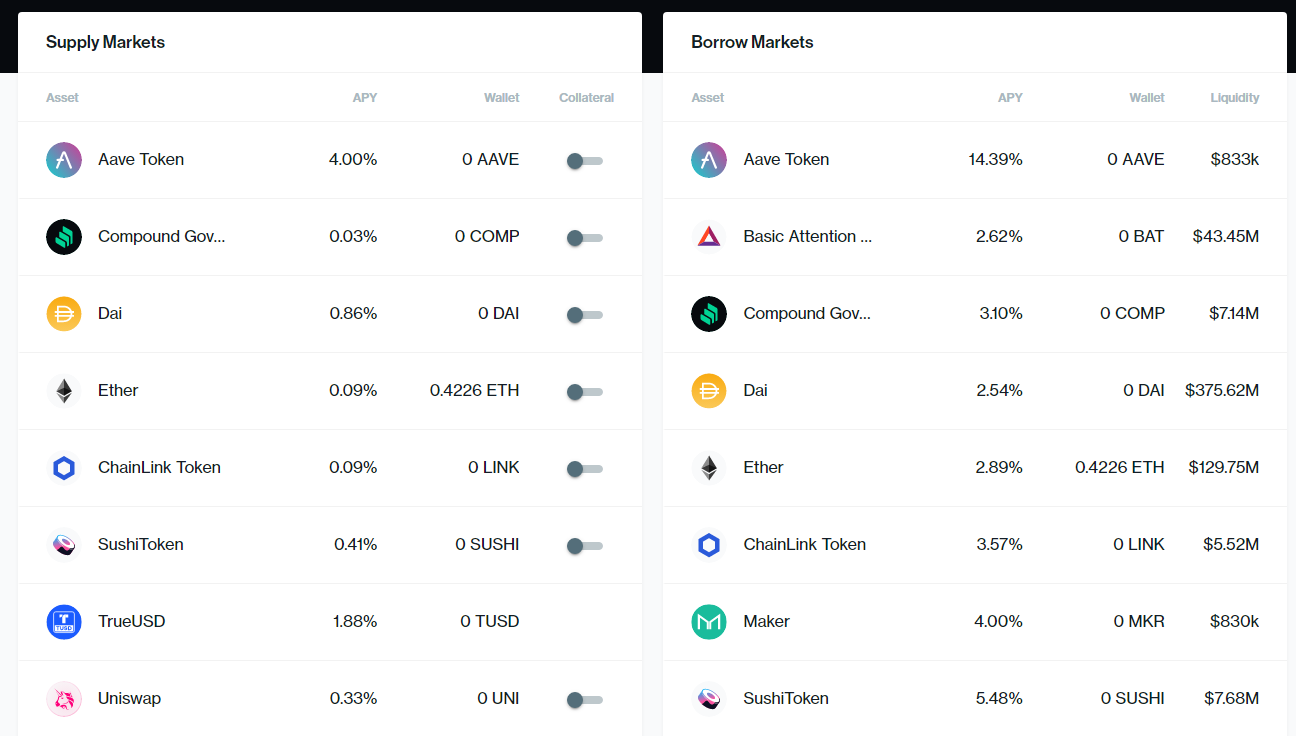

Compound’s V2, the preferred model as of proper now, affords a choice of about 20 totally different altcoins, amongst which the highest 5 are USD Coin (USDC), DAI, Ether (ETH), Wrapped Bitcoin (WBTC), and Tether (USDT). Essentially the most regularly used swimming pools for lending and borrowing are these based mostly on Ether (ETH) and well-known stablecoins like DAI, USDC, and USDT.

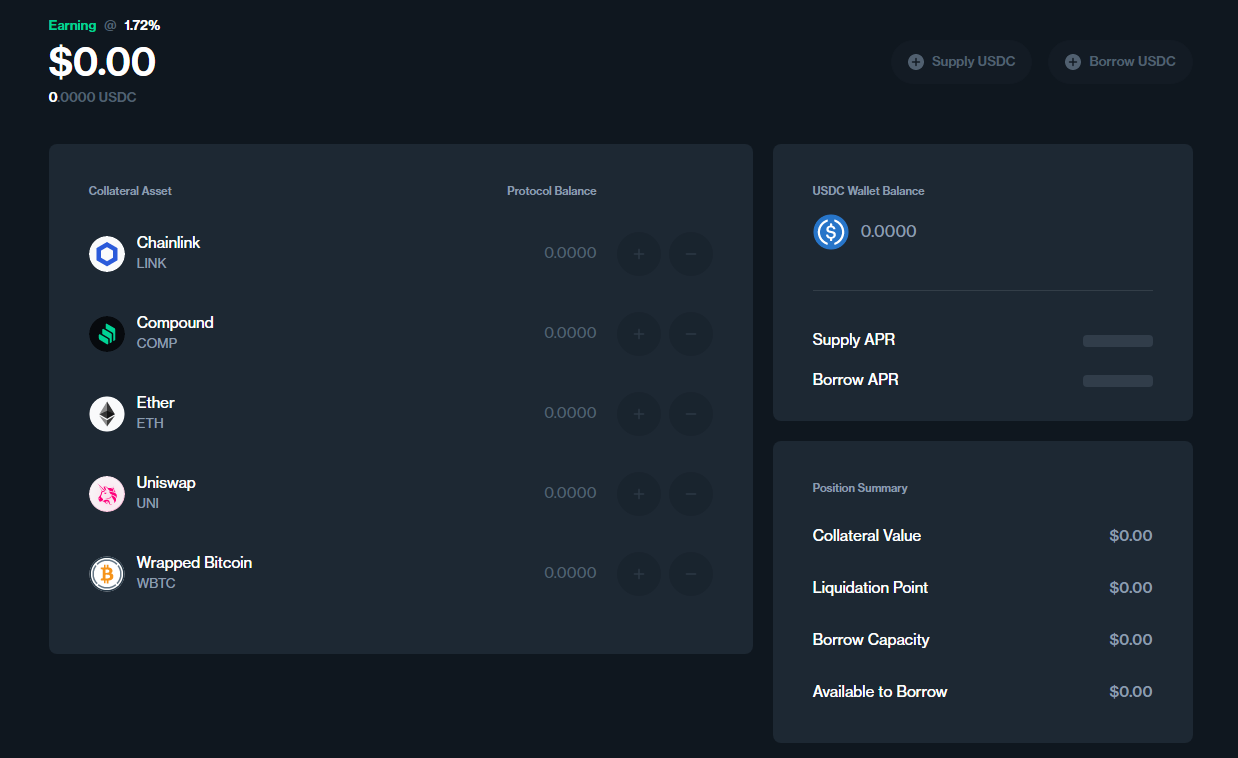

Compound’s V3 affords a restricted quantity of crypto belongings you possibly can provide. There are simply 5; Ether (ETH), Wrapped Bitcoin (WBTC), Compound (COMP), Chainlink (LINK), and Uniswap (UNI).

Lending is a straightforward course of. To start out supplying capital, unlock the asset you want to present liquidity for. Then, signal a transaction utilizing your pockets. The belongings are added instantly to the pool and instantly start to accrue curiosity. The belongings at the moment are reworked into cTokens at this level.

Borrowing with Compound Finance

You’ll have an approximated borrowing capability as quickly as you’ve lent some cash to the Compound protocol. Based mostly on this, Compound lets you borrow cryptocurrency as much as a predetermined quantity. Your accessible credit score is calculated in USD equal.

Within the case of a number of deposits, your general borrowing capability will probably be calculated based mostly on all the cryptocurrencies you will have lent to the protocol.

When borrowing funds, it’s worthwhile to take note of the collateral ratio. The collateral ratio provides you the share of the crypto you possibly can borrow based mostly in your deposited crypto belongings. For example, if the collateral ratio for Ether (ETH) is 75%, you possibly can borrow as much as 75% of all the quantity you will have deposited in ETH. The collateral ratio for many altcoins ranges from 60% to 85%.

Which means, much like different DeFi lending protocols, Compound’s protocol works on the precept of over-collateralization – the place a borrower has to provide extra crypto than the quantity he borrows from the pool to keep away from liquidation. The platform can proceed to retain its tried-and-true stability due to this meticulously maintained over-collateralization.

Curiosity Charges on Compound Finance

The extent of market liquidity has a direct influence on rates of interest. The provision and demand will decide how these charges change in real-time. When there’s quite a lot of liquidity, rates of interest are low. Rates of interest rise as demand will increase, encouraging new manufacturing and debt payback.

Every time an Ethereum block is mined, the rate of interest on Compound is accrued as annual curiosity. Each 15 seconds, the worth of cTokens rises by an element equal to 1/2102400 of the annual rate of interest.

Compound Tokens – COMP and cTokens

cTokens

On the Compound platform, cTokens are a vital utility instrument. These tokens, which serve primarily as your proof of deposit, are given to you once you provide capital to the pool.

As a substitute of being utilized to the preliminary cryptocurrency you invested, all curiosity earned on the cash you’ve lent is added to your cTokens. These tokens are, subsequently, synthetic belongings whose worth will increase over time.

Since cTokens are merchandise of the Compound protocol, they haven’t any use case outdoors the Compound ecosystem. Making an attempt to make use of them outdoors the confines of Compound is like taking a fish out of water.

COMP

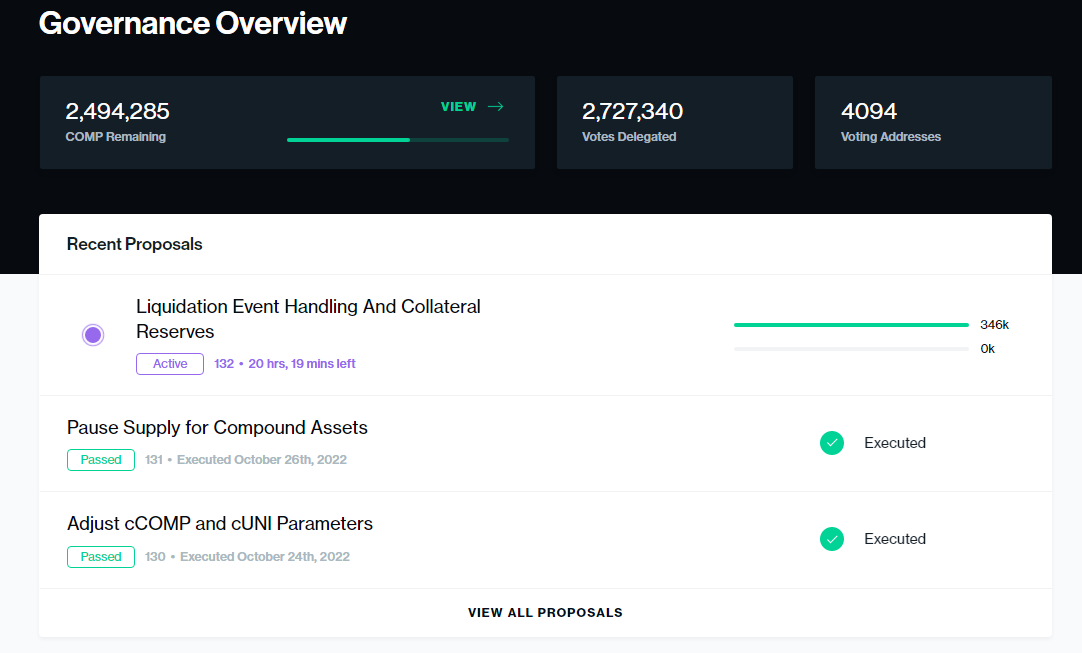

The first and native cryptocurrency of Compound is COMP. The first objective of the COMP token, an ERC-20 commonplace coin, is governance. House owners of COMPs have the choice to forged a vote or delegate a vote on any important protocol updates. By market cap, the native COMP governance token is now the ninth-largest governance crypto.

COMP Token – Circulating Provide

There’s a complete provide restrict of 10 million COMP. Lower than one-third of the utmost provide is presently in use.

Over 4 years, customers of the Compound protocol will obtain 4.2 million tokens. The stockholders of Compound Labs, Inc. will get about 2.4 million COMP. The founders and present Compound crew will obtain one other 2.2 million COMP tokens with a 4-year vesting interval.

Compound Finance Execs and Cons

Execs

Completely different incomes alternatives

Compound provides customers the prospect to lend numerous sorts of cryptocurrencies. This is a bonus as a result of you possibly can earn curiosity on all cryptocurrencies you provide to the pool. Relying on the coin or token, lenders have a variety of liquidity pool choices with various charges of return. Lenders additionally obtain curiosity on common each 15 seconds when utilizing this platform. The curiosity obtained can compound, growing charges of return.

On Compound’s platform, yield farming is one other various, implying an opportunity to revenue from a excessive annual proportion yield. Many buyers function as debtors and lenders to acquire essentially the most COMP tokens when utilizing Compound.

Examined Safety

Within the ecosystem of cryptocurrencies, safety is crucial, and Compound provides it high emphasis. Effectively-known auditors, together with Path of Bits and Open Zeppelin, have carried out quite a few safety audits on the platform and located the platform’s coding to be reliable and able to securing community calls for.

Zero Buying and selling and Slippage Charges

One other good thing about utilizing the Compound platform is that there are not any slippage or buying and selling prices, saving shoppers from paying exorbitant commissions on their trades. That isn’t the usual on a number of competing platforms, which frequently cost totally different charges for buying and selling the cryptocurrency or finishing up different transactions.

Zero Restrict On Supplying and Borrowing

Compound doesn’t impose minimal borrowing or supplying standards, not like many rival platforms. This enables for larger consumer participation within the mortgage market and permits lenders to earn curiosity on even small token investments.

Cons

It’s Not Person-Pleasant

Compound has a steep studying curve and isn’t as user-friendly as different platforms. It could be difficult to navigate for brand spanking new crypto customers and requires not less than a fundamental understanding of the crypto area. This restricts utilization to solely seasoned cryptocurrency followers extra able to navigating that area.

Restricted Tokens

Moreover, constructed on Ethereum, the Compound platform has a restricted choice of tokens. There are fewer than 10 tokens on the Compound platform, which is way decrease than most of the platforms competing with it. The platform is barely accessible to people interested by these alternate options because of the tokens’ shared Ethereum blockchain basis.

Conclusion

Compound Finance is without doubt one of the largest DeFi lending protocols on Ethereum. It’s a nice match for anybody trying to earn curiosity from their crypto belongings by lending and borrowing. Customers can collateralize their crypto belongings to borrow as much as 85% of their locked funds.

The gradual elimination of third events from the finance sector opens up potentialities that create monetary inclusion for the unbanked in methods made solely attainable by the Web. Decentralized Finance has created an ecosystem of decentralized monetary companies, and tasks like Compound protocol assist us take part and revenue from that ecosystem.

Be taught extra about cryptos, keep up to date with the markets, and seamlessly handle your crypto portfolio on CoinStats at present.