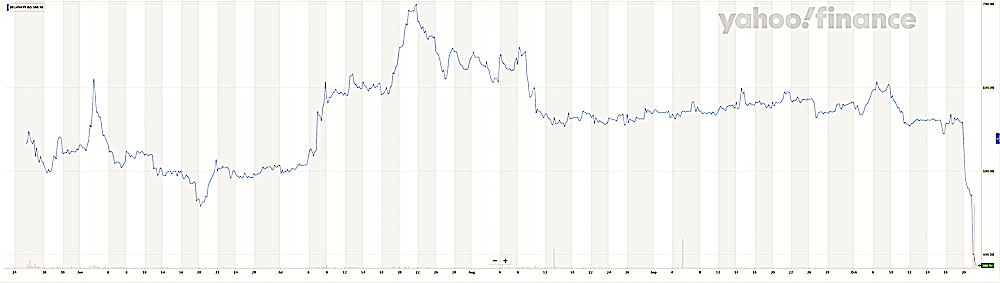

Shares of Delhivery have dropped by over 32% since Thursday, tumbling beneath its difficulty worth from Could, after the Indian logistics agency posted muted quarterly enterprise progress this week.

Delhivery stated this week that its provide chain service and truckload enterprise volumes had shrunk within the quarter ending September. Shares of Delhivery plunged on the information, dropping from 562 Indian rupees ($6.8) apiece to as little as 382 Indian rupees ($4.62) earlier than slight restoration. Delhivery’s difficulty worth was 487 Indian rupees, whereas its shares rose to report excessive of 708.45 Indian rupees in July.

The tumble has pushed the market cap of Delhivery to beneath $3.4 billion, solely barely above the $3.2 billion valuation that it assumed within the pre-IPO financing spherical and beneath the $4.2 billion valuation within the secondary transaction amongst its traders a 12 months in the past.

The lock-in interval for its pre-IPO shareholders lifts on November 10, which can see extra voluminous promoting. The corporate counts SoftBank, Tiger International, Instances Web, The Carlyle Group, Steadview Capital and Addition amongst its backers.

Picture Credit: Yahoo Finance

Delhivery has assured traders that it’s on the trail to restoration. The corporate stated it has made “adequate capability investments in FY22 and early FY23 to maintain our present price of progress and count on new mega-gateway and sorter selections solely by early FY24.”

“As inflationary pressures and repair disruptions attributable to monsoon ease throughout the nation we count on enchancment in volumes, income and repair margins going ahead,” it stated in its quarterly report printed on the native inventory exchanges.

Friday caps a tough week for Indian startups which have gone public previously 12 months and a half. Nykaa, a style e-commerce market, which has thus far carried out the very best among the many tech startups, is buying and selling solely barely above its difficulty worth. Shares of on-line insurer Policybazaar, whose lock-in interval for pre-IPO traders additionally lifts subsequent month, have misplaced over 60% in worth from the difficulty worth.