HodlX Visitor Submit Submit Your Submit

The invention of Bitcoin was a technological breakthrough that disrupted the established order. When Bitcoin was first created, central banks thought they might safely ignore it.

As Bitcoin adoption gained momentum, central banks have been compelled to concentrate and attempt to perceive what Bitcoin means for the roles of central banks and the know-how they use.

Lately, central banks have converged on the perspective that there are features of Bitcoin that they will and may incorporate into their processes and underlying software program.

CBDC (central financial institution digital foreign money) is a catch-all time period for a central bank-issued foreign money that comes with components of cryptocurrencies into its working mannequin.

Since cash is already digital, why are governments contemplating CDBCs

Central bankers and authorities officers declare CBDCs promote monetary inclusion by providing the unbanked easy accessibility to secure cash.

Additionally they state that CBDCs will improve cost efficiencies, decrease transaction prices and make it simpler for governments to enact financial and monetary coverage.

Along with these claims, CBDCs supply governments two advantages that shouldn’t be ignored CBDCs improve the state’s monetary energy over residents, they usually function a surface-level competitor for personal sector improvements like Bitcoin.

Implementing a CBDC dangers destabilizing giant sectors of the financial system, which explains why persons are uneasy concerning the concept in nations like the US.

Additional, they symbolize a gentle technological improve to fiat cash not a breakthrough in financial know-how like Bitcoin.

CBDCs are nonetheless the identical inflationary fiat currencies as earlier than, albeit absolutely digital and fewer personal.

In distinction, shoppers are drawn to Bitcoin due to its distinctive financial qualities and its censorship resistance.

Fortuitously, CBDCs are usually not a menace to Bitcoin. In reality, CBDCs could even hasten Bitcoin’s adoption.

What are CBDCs

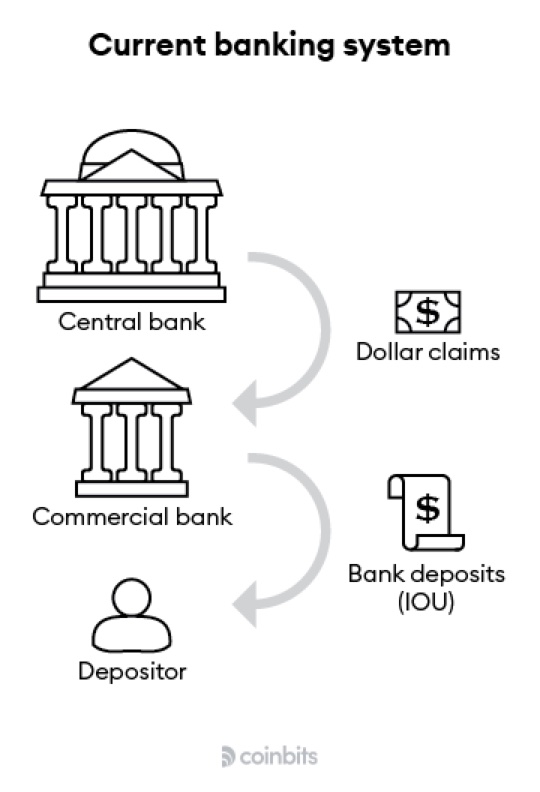

In the US, the Federal Reserve creates {dollars}. These {dollars} include a mixture of bodily money and reserve balances held by banks on the Fed.

Customers use a mix of bodily money and digital {dollars} represented as deposits of their financial institution accounts.

Nevertheless, digital {dollars} held in client financial institution accounts differ from these held by banks on the Federal Reserve.

Digital {dollars} in client financial institution accounts truly symbolize claims to {dollars} banks maintain with the Fed.

Customers can not instantly use these {dollars} as a result of solely monetary establishments can entry them.

We don’t discover the distinction between digital {dollars} claims to order balances and precise {dollars} as a result of the US banking system is at the moment solvent and safe sufficient that the excellence has no day-to-day penalties for now.

Pre-CBDC banking mannequin within the US

CBDCs differ from digital {dollars} as a result of they’re precise {dollars} produced by the Fed, not claims to {dollars} held by banks on the Federal Reserve.

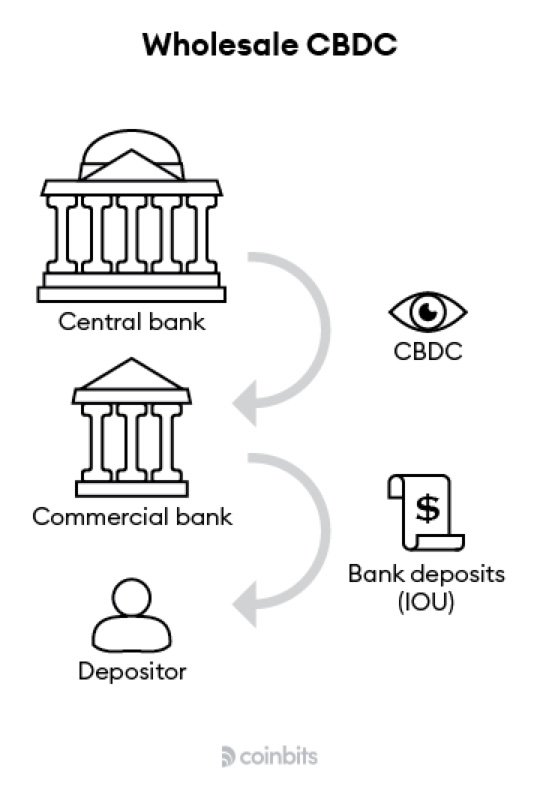

There are two avenues for central banks when implementing CBDCs wholesale and retail.

Underneath a wholesale mannequin, CBDCs emulate financial institution reserves. The CBDC can be the financial good that’s deposited within the accounts that banks and different monetary establishments maintain on the Federal Reserve.

Banks would then present a illustration of these {dollars}, seemingly rehypothecated, in client financial institution accounts.

Wholesale CDBC mannequin

As Nik Bhatia describes in ‘Layered Cash,’

“Central banks may situation a digital foreign money within the type of wholesale reserves, which might solely be accessible to banks… The digital reserves possibility has the potential to modernize monetary infrastructure for the banking system, nevertheless it gained’t affect how society interacts with cash.”

In distinction, retail CBDCs would function digital money for shoppers. Consider a FedWallet app that allows you to spend CBDCs identical to some other cryptocurrency.

Whereas the wholesale mannequin wouldn’t considerably change the established order, the retail route would upend the mechanics of the present banking system.

Retail CBDC mannequin

Variations between the retail and wholesale fashions matter. As illustrated above, with a retail CBDC, Individuals would have a direct checking account with the Fed with out business intermediaries.

Given the unpredictable affect a retail CBDC would have on the American banking system, the Federal Reserve is concentrated on growing a wholesale CBDC as a substitute.

Contrasting with that method, nonetheless, the Biden-Harris administration reported on the feasibility of a CBDC system within the US and prompt there could also be a rising political urge for food for retail CBDCs.

The report states that “all ought to have the ability to use the CBDC system” and “the CBDC system ought to broaden equitable entry to the monetary system.”

Because the wholesale mannequin doesn’t broaden entry to the monetary system, the Biden-Harris report indicators that politicians intend to discover the retail possibility.

CBDCs face issues

Enterprise lending

CBDCs face competing objectives. An vital perform of business banks is directing funds towards funding tasks via loans.

If CBDCs efficiently divert funds from the personal monetary system, entrepreneurs danger dropping entry to capital as CBDCs crowd out conventional banks.

Due to this fact, CBDCs would both compel governments to imagine the lending function of business banks or scale back companies’ entry to capital.

Additional, governments are ill-equipped to make funding selections. After they do, the financial system is impeded at finest and severely broken at worst.

Teachers present an answer to this drawback of directing funding in an financial system run on a retail CBDC, specifically, to supply low CBDC rates of interest to disincentivize large-scale CBDC accumulation.

Nevertheless, this raises a query f residents should be disincentivized from utilizing CBDCs for one of many key use instances for cash, why introduce them? The reply is unclear.

This inherent contradiction would possibly clarify why over two-thirds of public remark letters in response to the Federal Reserve’s proposal for a CBDC view the thought negatively.

Privateness

By eradicating business banks as monetary mediators, CBDCs supply governments unique management over every citizen’s checking account.

Authorities officers not should work with business banks they will restrict, censor or cease monetary transactions for any motive.

For this reason CBDCs increase pink flags for privacy-minded people.

At this time, in China, DCEP (Digital Foreign money/Digital Funds) permits the Folks’s Financial institution of China to surveil residents’ on a regular basis transactions.

Combining the DCEP with China’s social credit score system provides the federal government the ability to work together instantly with client financial institution accounts based mostly on political desire.

Even in Canada, which isn’t overtly authoritarian, Prime Minister Justin Trudeau froze the financial institution accounts of people that participated in and even financially supported protests in opposition to mandated COVID-19 vaccinations.

The programmability of CBDCs can be regarding. They permit central bankers to program financial coverage instantly into the cash folks use day by day.

For instance, going through an financial disaster, central banks may resolve to vary the code for {dollars} in order that they expire in the event that they aren’t spent inside an allotted time-frame, forcing folks to spend them on consumption to ‘stimulate’ the financial system.

Authorities officers appear to be unaware of those dangers or no less than unwilling to debate them. As an alternative, CBDC proponents reward their potential for programmability and surveillance.

Even placing apart privateness drawbacks, the patron case for CBDCs is unclear. They don’t alleviate monetary issues, resembling inflation, nor do they promote monetary inclusion.

Additionally they don’t symbolize a technological breakthrough as a result of the combination of applied sciences that they rely on is already utilized by the Bitcoin community.

As William Luther and Andrew Bailey be aware,

“The usual case for a CBDC rests on the mistaken concept that we’d like new digital cash for our new digital world. A lot of our cash is already digital although business financial institution deposits and transfers are recorded on computer systems, not paper ledgers.”

Bitcoin until higher, not going away

In ‘American Banker,’ Rob Blackwell describes the menace this fashion,

“If bankers are usually not cautious, they could discover themselves on the dropping finish as they watch the Fed create an alternative choice to federally insured deposits.”

One can assume the business banking foyer will oppose CBDCs in full drive, introducing one other hurdle.

Additional, whereas business banks are typically unpopular with shoppers, it’s questionable whether or not shoppers would favor interacting with central banks distant monolithic establishments which can be all however assured to have even worse customer support.

Whereas central bankers write papers and preach about digital foreign money shoppers don’t want, Bitcoin adoption will proceed for one motive it’s merely one of the best type of cash ever invented.

CBDCs don’t threaten Bitcoin. In reality, insofar as they introduce extra danger, uncertainty and privateness considerations to the present monetary system, the arrival of CBDCs could even gasoline additional adoption of Bitcoin.

David Waugh is a enterprise growth and communications specialist at Coinbits. He beforehand served because the managing editor on the American Institute for Financial Analysis.

Comply with Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney