Up to date on February 20, 2023.

The Elliott Wave Principle buying and selling technique is taken into account a sophisticated technical evaluation method that may provide in-depth understanding of worth actions. This principle means that worth modifications observe some long-term patterns. If merchants handle to establish them, it could improve their buying and selling technique. At present we are going to have a look at the fundamentals of this method and see the way it could also be utilized in buying and selling.

Elliott Wave Principle Defined

Again within the Nineteen Thirties an American economist Ralph Elliott began analyzing hourly, each day, weekly, month-to-month and yearly worth charts of assorted indices. His objective was to establish constant patterns available in the market exercise. He believed that there was a cause for each worth motion. So he went by charts overlaying 75 years of inventory market information to show his principle.

After years of analysis, Elliott concluded that regardless that market exercise could typically appear random and scattered, in actuality it follows sure guidelines. Which implies that merchants could possibly use them to attain their buying and selling goals.

At the moment, the Elliott wave principle buying and selling ideas are seen as a common set of market habits patterns. The Elliott wave buying and selling outcomes could depend upon understanding the ideas of this principle, so let’s go over the primary concepts.

What Are Elliott Waves?

Buying and selling with the Elliott wave principle entails monitoring waves – a collection of repeating worth actions. The idea means that costs observe 2 principal wave patterns: impulse (motive) and corrective.

Impulse (Motive) Waves

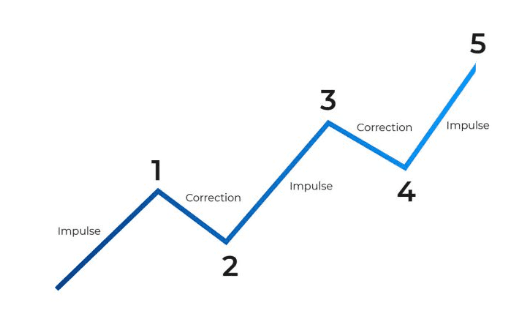

Impulse (motive) wave sequence consists of 5 smaller waves: 3 giant worth actions within the path of the uptrend and a couple of corrections.

These waves are labeled waves 1, 2, 3, 4 and 5 respectively.

To establish these waves accurately, merchants ought to be mindful the next guidelines.

✍️

- The third wave (second impulse wave) is normally the most important of the sequence. Waves 1 or 5 can’t be longer than wave 3.

- Wave 2 by no means goes past the low of wave 1. It’s sometimes 60% the size of the wave 1.

- The excessive of wave 3 should be larger than the excessive of wave 1 (in any other case it’s vital to start out the wave rely once more). The waves needs to be making progress.

Corrective Waves

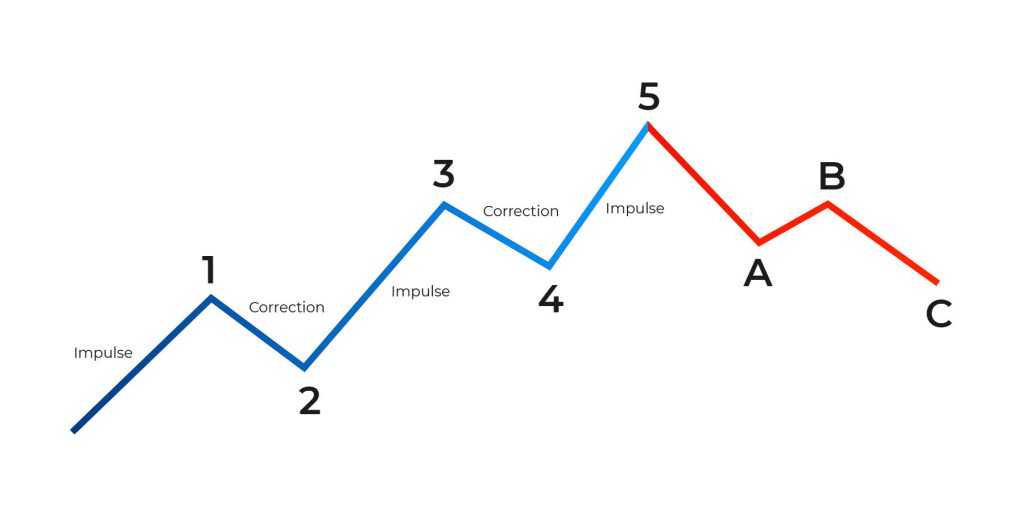

The corrective wave sequence, in keeping with the Elliott wave principle buying and selling ideas, consists of three waves: an impulse down, a correction to the upside and one other impulse down. These waves are labeled A, B and C. As a rule, corrective waves A, B and C normally finish within the space of the prior wave 4 low.

Each motive and corrective waves might be seen within the image above. It is very important take note of the size of the waves in addition to their proportions.

Easy methods to Use Elliott Wave Principle for Buying and selling?

When buying and selling with the Elliott wave principle, it’s essential to remember the principles of the waves sequence described above. It will not be simple to establish these patterns immediately, as there are a lot of guidelines to remember. Nevertheless, you might learn to use the Elliott waves accurately and get extra correct outcomes over time.

What you must bear in mind is that, in keeping with the Elliott wave buying and selling ideas, costs transfer in cycles. Which means you could possibly predict an upcoming worth reversal. After which use this info to open or shut a deal on the optimum second.

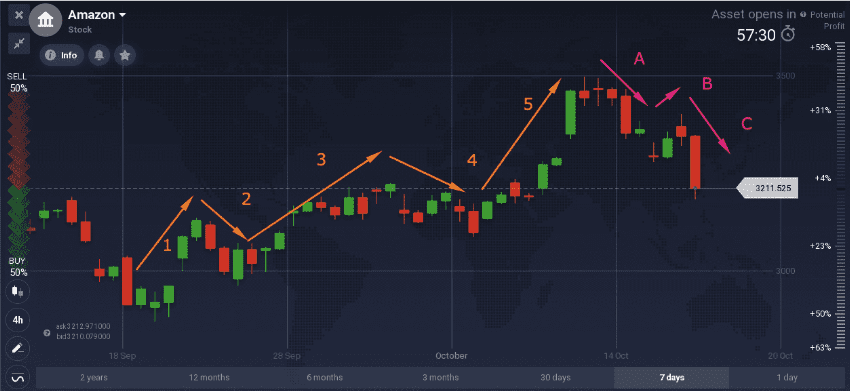

For instance, such a construction might be discovered on a month-to-month chart on the Amazon inventory. It’s clearly seen that the value first climbed upwards in a cycle of 5 waves, adopted by 3 corrective waves.

Discovering the waves and analyzing the chart on this approach could assist merchants make buying and selling selections. As an example, they might select to enter an extended (BUY) place through the pullbacks (corrective waves) of an uptrend. By doing this, they may be capable of “journey” the next uptrend as the value rises to the following excessive.

In relation to instances the place the Elliott wave downtrend is revealed, it could be potential to open a brief (SELL) commerce throughout corrective waves in a downtrend. This may increasingly enable merchants to probably profit from the market trending down. Nevertheless, it is very important notice that there isn’t any assure of 100% appropriate indications.

✍️ FAQ

Does Elliott Wave Principle Work in Foreign exchange?

The Elliott wave principle buying and selling ideas are mostly used for inventory buying and selling. Nevertheless, it could even be utilized to technical evaluation of various property, together with Foreign exchange.

Can I Use the Elliott Wave for Intraday Buying and selling?

The Elliott wave buying and selling ideas could provide useful insights into long-term worth actions. Nonetheless, if merchants handle to establish recurring patterns in worth modifications, they might learn to use the Elliott wave principle of their intraday buying and selling as properly.

Is the Elliott Wave Principle Correct?

When utilizing any technical evaluation software, understand that they don’t present any type of certainty about future worth motion. However they might be useful in predicting potential worth actions. Contemplate combining buying and selling with the Elliott wave principle with different types of technical evaluation, together with technical indicators, to establish particular alternatives.

Put up Views: 1,321