Ethereum value has been within the purple for the previous few days, hovering round its lowest stage since June 2023 amid international financial uncertainty. Ethereum, the world’s second-largest cryptocurrency and the most important altcoin by market cap, has crashed by almost 13% within the month to this point however stays 37% greater within the 12 months to this point. At press time, ETH was buying and selling 1.15% decrease at $1,639.80. Ethereum’s whole market capitalization has slipped over the previous 24 hours to $197 billion, whereas the full quantity of the asset traded over the identical interval jumped by greater than 60%.

Fundamentals

Ethereum value has been buying and selling sideways for the previous few days amid weak crypto market sentiment and issues in regards to the Fed’s financial path. Bitcoin, the most important cryptocurrency by market cap, has dropped beneath the essential stage of $26,000, weakening the crypto market sentiment additional. Altcoins equivalent to XRP, Cardano, Solana, Cardano, Polygon, and Shiba Inu amongst others, have dipped by greater than 2% every over the previous week.

Information by Coinmarketcap reveals that the worldwide crypto market cap has declined to $1.05 trillion, with the full cryptocurrency market quantity growing by 38% for the day. Bitcoin’s dominance has remained unchanged over the identical interval. The Crypto Concern and Greed Index reveals an excessive concern stage of 35, indicating that traders are about to promote irrationally.

The US greenback index, which measures the efficiency of the buck in opposition to six main currencies, was barely unchanged at 104.135 on Monday, barely beneath its highest stage since June. The US Treasury yields have been additionally within the purple on Monday, with the yield on the benchmark 10-year Treasury yield decrease at 4.228% and the 30-year Treasury word at 4.27%.

Buyers have remained targeted on the remarks made by the Federal Reserve chair Jerome Powell final week in the course of the Fed’s annual Jackson Gap retreat. Powell famous that the inflation price stays excessive above the policymakers’ 2% goal and that additional rate of interest hikes have been wanted to attain their goal. In response to the CME FedWatch Device, markets anticipate an 80% likelihood of the Fed pausing its hike marketing campaign in its subsequent assembly in September, however the chance of a 25-basis level hike in November is at 51%.

Markets will probably be carefully watching a number of key financial knowledge slated to be printed later this week, trying to find clues on the financial outlook. The Shopper Board Shopper Confidence for August is anticipated to be printed on Tuesday, with the Q2 quarterly GDP set to be launched on Wednesday. Moreover, the Fed’s favourite inflation gauge, the core Private Consumption Expenditures (PCE) Index knowledge for July is due afterward Thursday.

Ethereum Value Technical Outlook

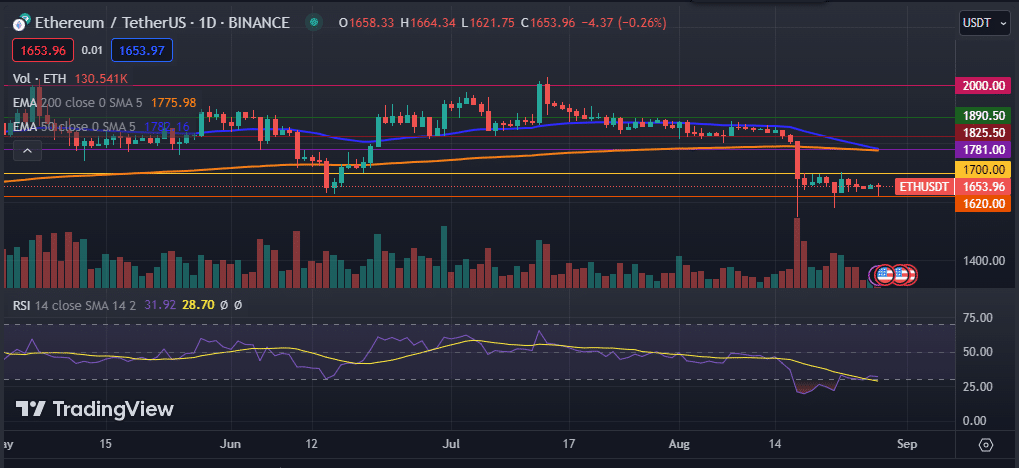

Ethereum value has been buying and selling sideways for the previous few days, failing to clear the vital stage of $1,700 in opposition to the US greenback. The asset has been range-bound, buying and selling between the tight vary of $1,680 and $1,645. As seen on the day by day chart, Ethereum stays beneath the 50-day and 200-day exponential shifting averages, in addition to the 50-day and 100-day easy shifting averages. The asset’s value is going through a possible demise throughout, which occurs when the 50-day EMA crosses beneath the 200-day EMA.

As such, I anticipate the Ethereum value to proceed shifting sideways within the ensuing periods because it struggles to search out course. ETH might begin a recent decline if it breaks beneath the rapid help stage of $1,620. Conversely, a flip above the key hurdle at $1,700 might pave the way in which for additional value will increase.