Good residence power startup Tado has raised €43 million ($46.9 million) in a spherical of funding led by Trill Impression Ventures, as the corporate pursues plans to turn into worthwhile in 2023.

The elevate comes a 12 months after the German firm introduced plans to go public (“deSPAC”) through a particular function acquisition firm (SPAC), plans that in the end did not materialize after Luxembourg-based shell firm GFJ ESG Acquisition I SE pulled out of the deal in September.

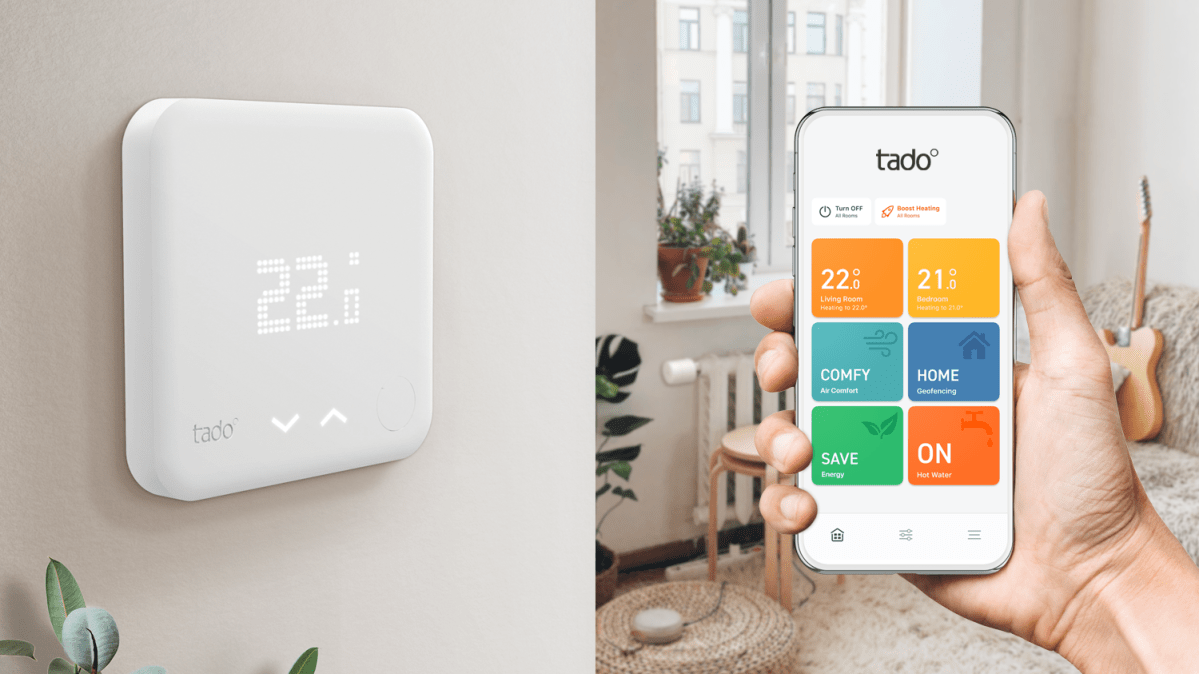

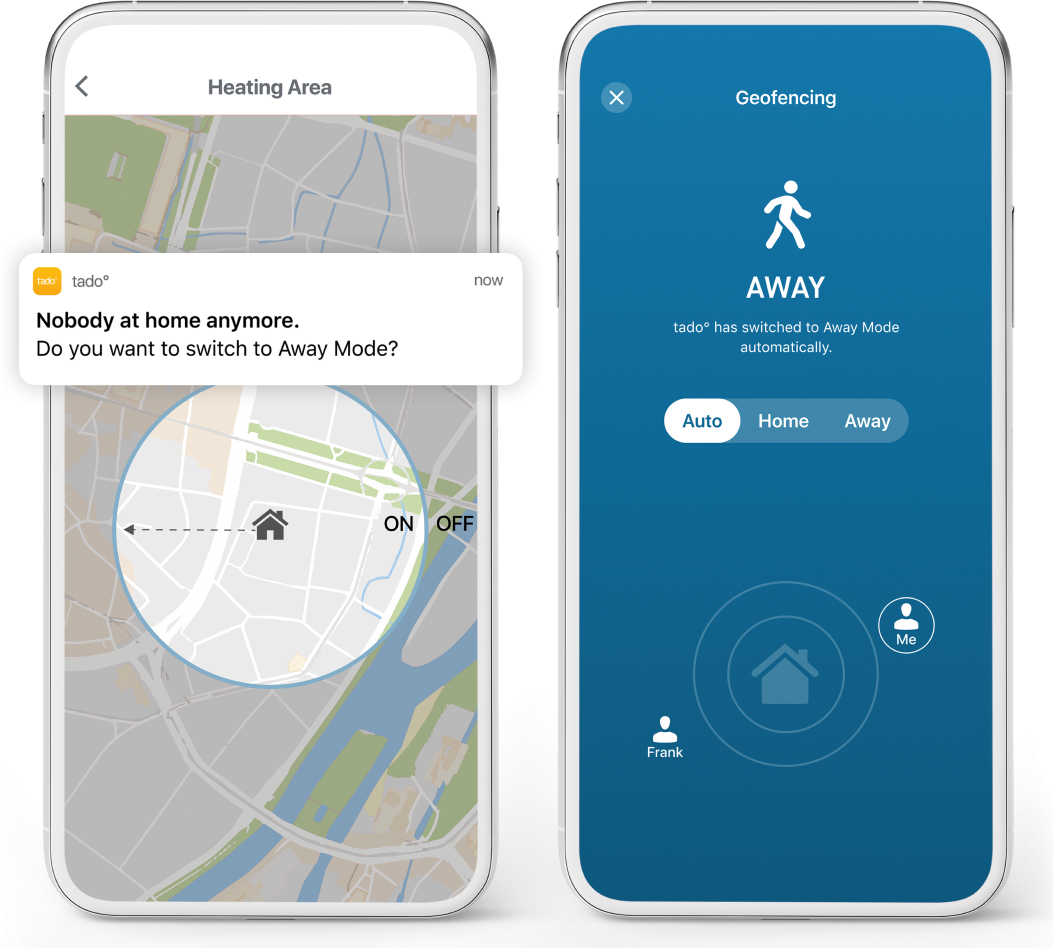

Based in 2011, Tado is finest recognized for its sensible thermostats and platform for managing residence heating and cooling methods. The platform contains geofencing smarts which controls a house’s temperature primarily based on whether or not anybody’s in the home, whereas it could additionally detect and alert customers about open home windows.

Tado: Geofencing in motion Picture Credit: Tado

Headwinds

Before now, Tado had raised almost $160 million in funding, with notable buyers together with Amazon plowing cash into the corporate, to not point out industrial manufacturing big Siemens and power agency E.On.

Greater than a decade on since its inception, it appeared that Tado and its big-name backers have been on the right track to realize their huge exit final 12 months after revealing plans to land on the Frankfurt inventory trade with a €450 million ($490 million) valuation in tow. Nevertheless, Tado and its SPAC accomplice revealed in March that they have been “adjusting” the enterprise worth to round €400 million ($436 million) attributable to “present market volatility,” earlier than the deal lastly went the way in which of the dodo six months later.

Little extra was revealed concerning the causes behind this, although it was affordable to imagine that with tech valuations plummeting and financial headwinds driving main downsizing efforts throughout nearly each sector, Tado and GFJ ESG Acquisition merely obtained chilly ft as a result of timing of all of it.

“We determined to finish ongoing discussions associated to a deSPAC with GFJ ESG Acquisition I SE attributable to present public capital market circumstances,” Tado’s chief product officer Christian Deilmann defined to TechCrunch. “We worth and admire our partnership with GFJ ESG, and share related objectives in the direction of constructing a extra sustainable future for Europe and the world.”

And so Tado has as a substitute chosen to double down on its latest development, which in 2022 it claims noticed it move 3 million sensible thermostats offered since its beginnings. With a recent $46.9 million within the financial institution, the Munich-based firm mentioned that it’s seeking to scale its enterprise in two methods — one among which entails interesting to prospects seeking to counter rising power prices by way of combining so-called “time-of-use” power tariffs with its sensible thermostat merchandise.

Time-of-use tariffs primarily encourage customers to make use of electrical energy at particular occasions when it’s cheaper, and Tado acquired an organization referred to as Awattar final 12 months that gives energy load-shifting by way of such tariffs

“We’ll double down on serving to our prospects to scale back heating bills,” Deilmann mentioned. “Up to now, our focus was on decreasing power demand, now with our sensible power tariffs we additionally assist to scale back the price of power. With a wise power tariff, particular warmth pumps are managed in a approach that they keep away from operating throughout hours of a day through which power costs are excessive. Every part occurs robotically within the background whereas all the time sustaining an ideal room local weather.”

Moreover, Tado mentioned that it’s planning to work with actual property firms that handle rental properties, which may assist Tado scale.

Emergency exit

Whereas it’s not possible to disregard the widespread layoffs which have permeated the know-how business for the previous 12 months, Tado mentioned that it has to date not needed to downsize in anyway, and doesn’t count on to take action.

“We presently have 200 workers at Tado, with nearly all of workers primarily based in our Munich headquarters,” Deilmann mentioned, including that it additionally has distant staff within the U.Ok. and Austria.

Nevertheless, all this leaves one lingering query. As a 12 12 months outdated firm with round $200 million in funding, some kind of exit appears somewhat overdue — its earlier spherical of funding in 2021 was meant to be its last elevate earlier than it explored a sale or public itemizing. So can we count on an IPO — SPAC or in any other case — sooner or later?

“While we do need to take into account the general public itemizing of Tado sooner or later, we have now no updates on this regard, whether or not publicly itemizing ourselves, or through a SPAC,” Deilmann mentioned. “Our present focus is to proceed our robust development observe of doubling enterprise on a yearly foundation, whereas turning worthwhile in 2023.”

Along with lead investor Trill Impression Ventures, Tado’s newest spherical of funding included participation from Bayern Kapital, Kiko Ventures, and Swisscanto (Zürcher Kantonalbank).