Fast Take

- As Q1 has ended with a exceptional Bitcoin efficiency of over 70%, it’s value analyzing the spot vs. derivatives pattern over Q1.

- The community is far more healthy on the finish of the quarter than after we began again in January.

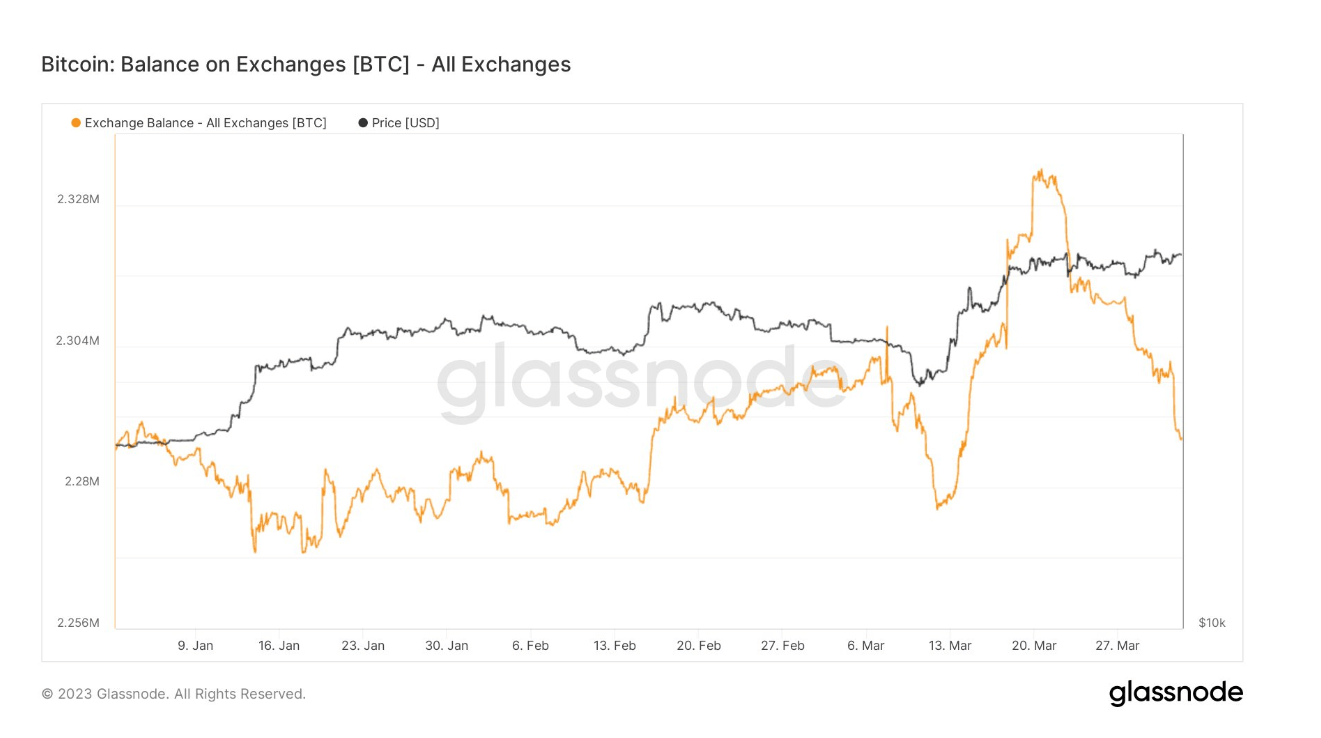

- The trade steadiness is now flat year-to-date, with roughly 2.28 million Bitcoin on exchanges, and demand began to return after the SVB collapse.

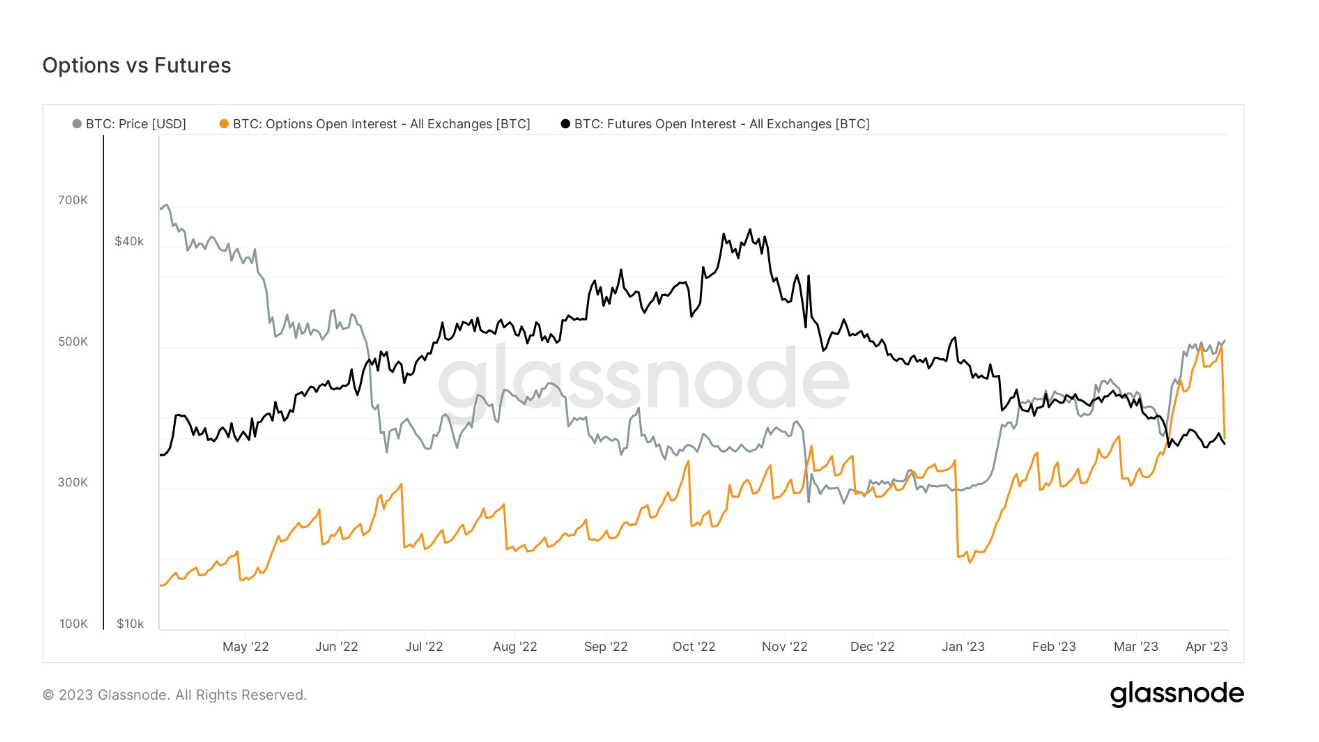

- Futures’ open curiosity is now at a one-year low, with roughly 300,000 Bitcoin liquidated from the 2022 peak in October.

- Final, choices open curiosity noticed a record-breaking quantity of $4 billion value of choices expiring on March 31. Roughly 130,000 Bitcoin have been unwound in contracts from the trade Deribit.

- The rally in Bitcoin value has been pushed by spot demand in current weeks.

The put up Evaluating Bitcoin’s spot and derivatives markets in Q1 2023 appeared first on CryptoSlate.