- The court-appointed impartial examiner for Celsius’ chapter case filed the ultimate report earlier in the present day.

- The report discovered that the bankrupt crypto lender used buyer deposits to fund withdrawals on a number of events.

- Buyer funds have been additionally used to prop up the value of CEL, the lender’s native token.

- Founder and former CEO Alex Mashinsky cashed out over $68 million by inflating CEL’s value.

Shoba Pillay, the impartial examiner who has been wanting into Celsius’ funds and conduct, filed the last report within the U.S Chapter Court docket for the Southern District of New York earlier in the present day. The report was long-anticipated by clients of the bankrupt crypto lender and different stakeholders who’ve carefully adopted the developments on this high-profile chapter case.

Celsius used buyer deposits to fund withdrawals

In September 2022, chapter Decide Martin Glenn appointed Pillay because the examiner to analyze a number of allegations made by Celsius’ clients and collectors. These included mismanagement of customers’ funds and a possible Ponzi scheme at play. The examiner’s report discovered that the crypto lender misled its traders and clients by working in a considerably completely different method than the one specified by its contract.

Moreover, the examiner said within the report that Celsius lacked the required threat administration features and the liquidity threat framework that an organization of its measurement ought to have had in place.

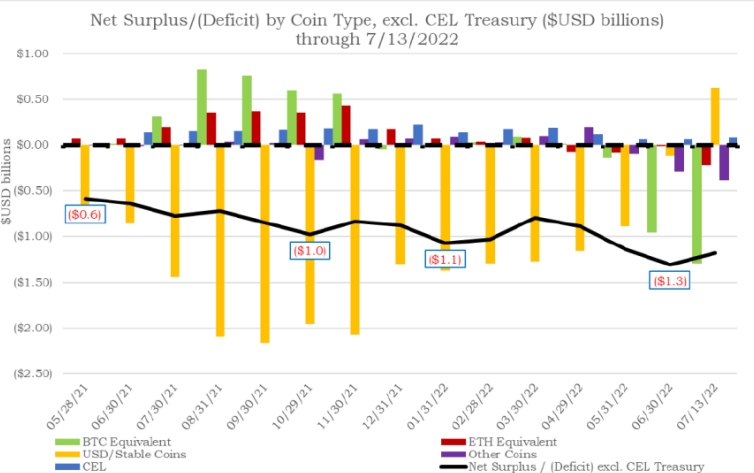

In keeping with the examiner, Celsius used buyer deposits to fund the mounting withdrawal requests within the run-up to the withdrawal halt in early June 2022. On a number of events, wallets that contained new person deposits have been used to “prime off” the frictional wallets that have been used to facilitate buyer withdrawals. Moreover, the processing of withdrawals regardless of the liquidity points

“Celsius’s issues didn’t begin in 2022. Fairly, severe issues dated again to at the least 2020, after Celsius began utilizing buyer belongings to fund operational bills and rewards”

Unbiased Examiner Shoba Pillay.

The report additionally make clear the shady actions surrounding CEL, Celsius’ native token. Celsius posted buyer deposits as collateral to take out stablecoin loans. These stablecoins have been used to fund the corporate’s operations and to amass BTC and ETH, which have been subsequently used to fund CEL buybacks.

In keeping with the examiner, Celsius repeatedly used stablecoins acquired by buyer funds to prop up the value of CEL. In April 2022, Celsius’s Coin Deployment Specialist described Celsius’s observe of “utilizing buyer secure cash” and “rising brief in buyer cash” to purchase CEL as “very ponzi like.” When requested by the corporate’s former Vice President of Treasury in regards to the supply of money getting used to fund CEL purchases, the Coin Deployment Specialist replied, “customers like at all times.” The liquidity induced from these buybacks helped Celsius founder and former CEO Alex Mashinsky money out greater than $68 million by CEL gross sales.