Former Coinbase govt Balaji Srinivasan is making a critically daring Bitcoin (BTC) prediction primarily based on his perception that the US greenback might comply with within the footsteps of a fiat foreign money that collapsed a few hundred years in the past.

Final week, Srinivasan caught the eye of crypto merchants after inserting a million-dollar wager that Bitcoin will skyrocket to $1 million in simply 90 days.

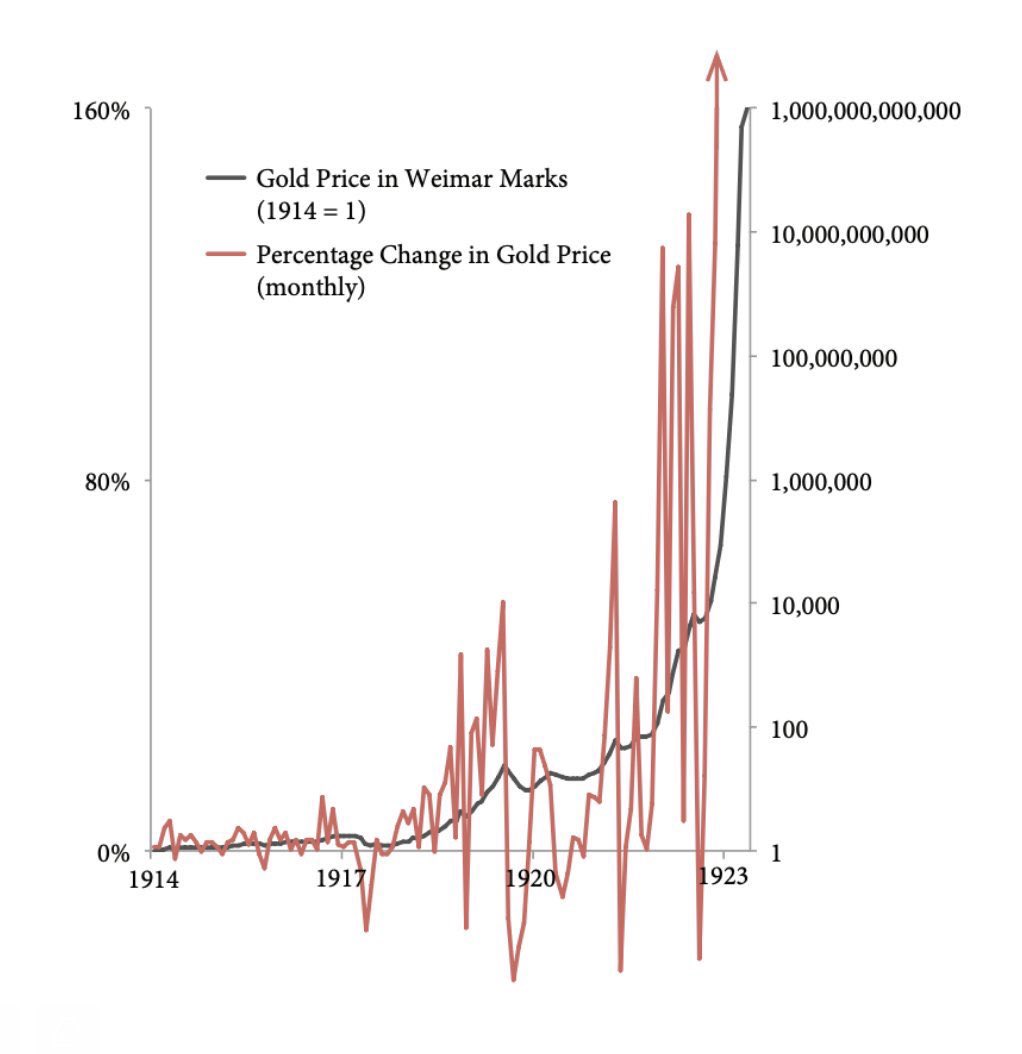

Now, the previous Coinbase chief govt officer is doubling down on his extraordinarily bullish Bitcoin stance as he tells his 847,700 Twitter followers that the US greenback might quickly mirror the state of Weimar marks following the defeat of Germany in World Battle I.

“Think about this graph, however in quick ahead. That’s what occurs when folks exit a failing fiat foreign money and enter gold. On this case, they’ll exit the greenback and enter digital gold. The wager isn’t a technique to make cash. It’s a technique to alert harmless greenback holders: get to Bitcoin.”

In 1923, the Weimar marks collapsed attributable to a interval of hyperinflation which noticed its worth plummet in opposition to the US greenback. Throughout that point, one greenback was equal to 1 trillion marks.

Srinivasan can also be blaming the Federal Reserve for the present banking disaster that led to the collapse of Silicon Valley Financial institution (SVB), Signature Financial institution and Silvergate. In accordance with the angel investor, the Fed bought US treasuries to banks after which raised rates of interest at a historic tempo, a transfer that negatively impacted the worth of the bonds.

“Many individuals tried to pin SVB on tech scapegoats. As if your small business checking account bankrupted a $200 billion financial institution. The Fed was after all the offender. Promote bonds to everybody, promptly devalue them, cowl up the next insolvency, and deny accountability.”

In accordance with Srinivasan, the world will witness large adjustments this 12 months catalyzed by the devaluation of the greenback.

“This 12 months could also be one for the books…

The devaluation of the greenback.

The rise of Bitcoin.

The worldwide flippening to the East.

Even for somebody who was occupied with these developments, the tempo of change will really feel shockingly, disorientingly quick. It jogs my memory a little bit of the early 1900s. In 1910, you continue to had 9 royals assembly. The previous world of princes was nonetheless round and seemingly immortal. However underneath the floor, expertise had modified all the pieces. And the twentieth century roared into existence a number of years later.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney