On March 2, 2023, FTX debtors launched their second stakeholder presentation, which accommodates a preliminary evaluation of the now-defunct cryptocurrency alternate’s shortfalls. The most recent presentation reveals a big shortfall, as roughly $2.2 billion of the corporate’s whole belongings have been present in FTX-related addresses, however solely $694 million is taken into account “Class A Belongings,” or liquid cryptocurrencies resembling bitcoin, tether, or ethereum. As well as, John J. Ray III, FTX’s present CEO, acknowledged that the debtor’s effort had been important, and he added that the alternate’s belongings have been “extremely commingled.”

A Preliminary Abstract of What Contributed to FTX’s $8.9 Billion Shortfall

FTX debtors and CEO John J. Ray III have launched a complete presentation documenting FTX’s shortfalls. The preliminary report mentions the cyber assault that occurred the day after FTX filed for Chapter 11 chapter safety on November 11, 2022. In a now-deleted Telegram chat channel, FTX US common counsel Ryne Miller described the alternate being hacked and that the platform was unsafe. The preliminary shortfall evaluation refers to this particular cyber assault all through.

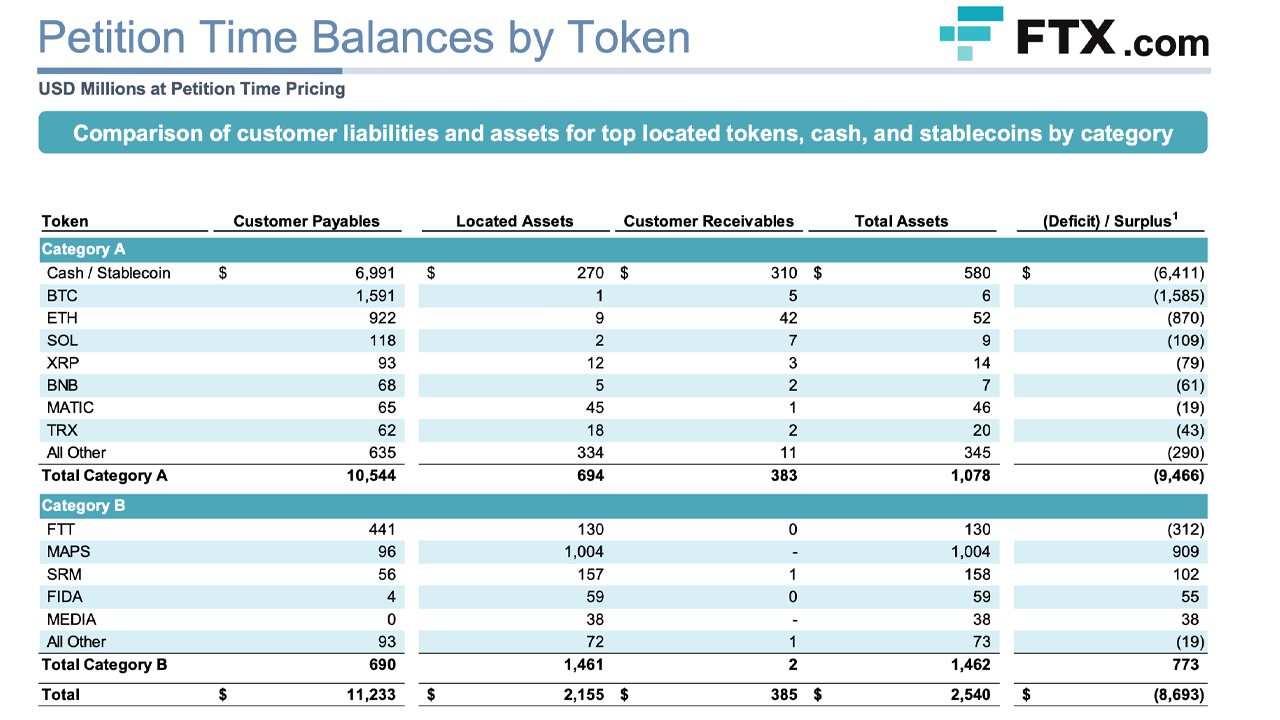

The report additionally mentions that each FTX and FTX US usually held digital belongings in sweep wallets that weren’t segregated for particular person clients. The debtors famous that as a result of cyber assault, the corporate’s computing setting was secured and “stays topic to sure restrictions,” limiting entry to essential knowledge. The report categorizes FTX’s holdings into two teams: “Class A Belongings,” which have bigger market caps and buying and selling volumes, and “Class B Belongings,” which don’t meet the liquidity necessities of Class A Belongings.

Nevertheless, regardless of figuring out all of the belongings, an $8.9 billion shortfall stays. “There’s a substantial shortfall on the FTX.com alternate on the time of the petition, outlined because the distinction between digital asset claims on the FTX.com ledger and digital belongings accessible to fulfill these claims,” the report states. “The shortfall is especially important for Class A Belongings. Solely a small amount of money, stablecoin, [bitcoin], [ethereum], and different Class A Belongings stay in wallets preliminarily related to the FTX.com alternate.”

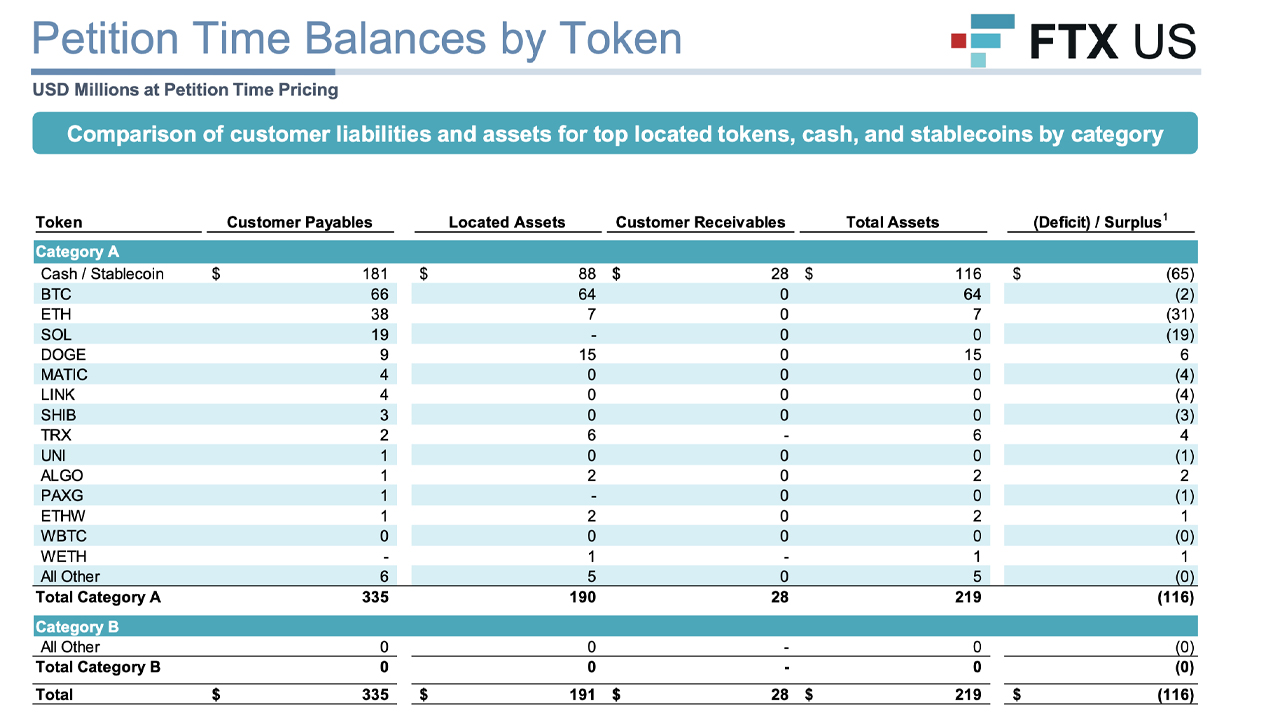

The report additionally notes that whereas the shortfall at FTX US was substantial, it was smaller than that of the worldwide alternate. In a press launch, CEO Ray shared his ideas on the presentation and talked about that funds have been commingled and record-keeping was insufficient.

“That is the second in what the FTX Debtors anticipate might be a sequence of displays as we proceed to uncover the information of this case,” Ray mentioned in a press release. “It has taken an enormous effort to get this far. The exchanges’ belongings have been extremely commingled, and their books and information are incomplete and, in lots of circumstances, completely absent.” He harassed that the knowledge supplied by the debtors was preliminary and topic to alter.

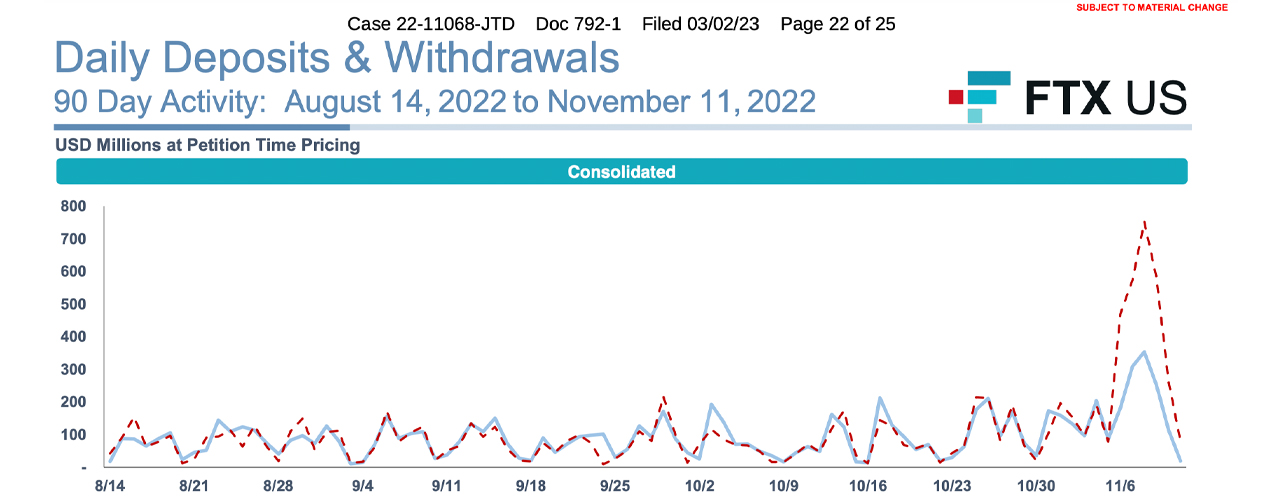

One fascinating facet of the most recent debtors’ presentation is that ftx token (FTT), the corporate’s alternate coin, is assessed as a Class B Asset. Whereas BTC and ETH are Class A Belongings, SOL, MATIC, UNI, SHIB, PAXG, WBTC, and WETH are additionally thought-about A-class belongings. The report additionally highlights the every day deposits and withdrawals made 90 days previous to the chapter petition date.

Moreover, the alternate’s shortfall doesn’t embrace Alameda Analysis belongings, which include $956 million price of solana (SOL) and aptos (APT), $820 million held at third-party exchanges, $185 million in stablecoin belongings held in chilly storage, and $169 million in bitcoin (BTC) held in chilly storage.

What do you suppose the fallout of FTX’s important shortfall might be for stakeholders? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Sergei Elagin

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.