Be a part of Our Telegram channel to remain updated on breaking information protection

Nestcoin, a startup main crypto and Web3 actions in Africa, has been linked to the collapsed FTX change. With FTX’s chapter continuing, Nestcoin has laid off at the very least 30 staff, whereas the salaries of the remaining staff have been lowered by 40%.

FTX associates in Africa are counting losses

The CEO of Nestcoin, Yele Bademosi, made the revelation in a letter despatched to traders. He additionally acknowledged that the corporate custodied property with FTX. FTX prospects have been unable to withdraw their funds from the platform because the change filed for chapter.

Bademosi additionally stated that the corporate’s sister firm of FTX, Alameda Analysis, invested in a $6.45 million funding spherical. Alameda had a lower than 1% stake in Nestcoin. The opposite African corporations the place FTX and Alameda invested embrace Bitnob, chipper Money, Jambo, Mara, and VALR.

There’s additionally hypothesis that Alameda and FTX may need required portfolio corporations to carry their property on the FTX change as a part of the phrases of funding. Nonetheless, if these phrases existed, they by no means utilized to all corporations, as some may need rejected the supply.

Many retail prospects and crypto corporations custodied their crypto property in FTX due to the platform’s 8% annual rate of interest. This advertising and marketing approach allowed it to draw African customers and compete with large exchanges equivalent to Binance. FTX has round 100,000 prospects in Africa.

Within the final two years, FTX grew its presence in Africa as crypto adoption within the continent elevated as a result of a scarcity of banking entry. Some studies have stated that FTX had deliberate to create a regional workplace in Nigeria earlier than its collapse.

The FTX chapter submitting included BTC Africa, the father or mother firm of AZA Finance, a Kenya-based fee automation and settlement platform. Nonetheless, FTX retracted this assertion in a tweet and eliminated AZA Finance and its subsidiaries from the submitting.

FTX change chapter listening to begins

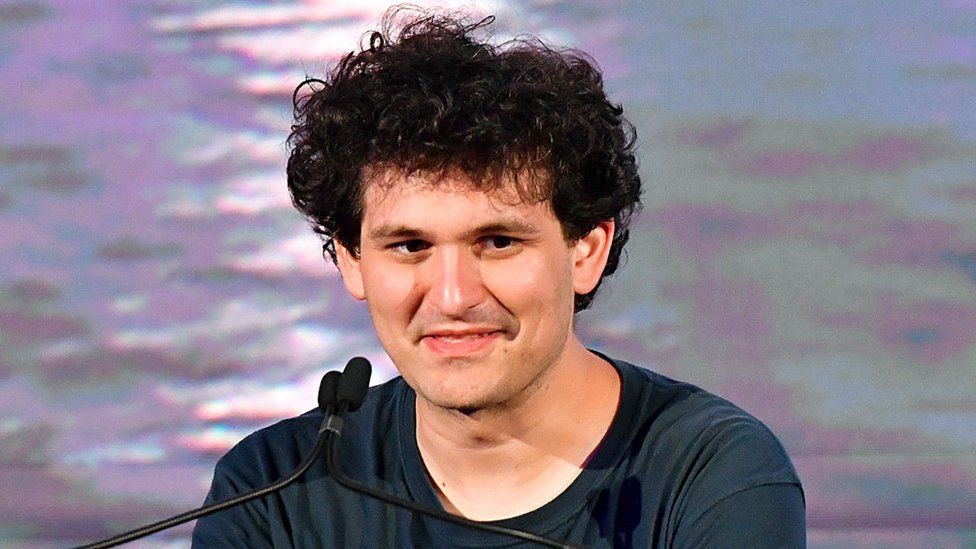

The demise of the FTX change has brought on notable results throughout the cryptocurrency market. The chapter submitting exhibits that it owes greater than 1,000,000 to collectors. The previous CEO of FTX, Sam Bankman-Fried, used buyer funds to assist Alameda Analysis.

The demise of this change will appeal to extra regulatory consideration to the sector. In Nigeria, the place FTX was pushing operations, cryptocurrency transactions utilizing licensed banking establishments are prohibited. The nation even launched a central financial institution digital foreign money (CBDC) to tame the usage of non-public cryptocurrencies. The collapse of FTX may intensify a crackdown on the crypto market.

Earlier than its collapse, FTX had a valuation of $32 billion. Nonetheless, after a financial institution run on the change, it wanted greater than $8 billion in rescue funds. The chapter submitting has revealed that cash was both lacking or stolen from the platform. Moreover, FTX executives additionally bought actual property properties within the Bahamas.

Bankman-Fried has since come ahead to say that he regrets submitting for chapter. In keeping with him, he might have managed to lift the wanted funds if he had not given in to the strain.

Associated

Sprint 2 Commerce – Excessive Potential Presale

- Energetic Presale Stay Now – dash2trade.com

- Native Token of Crypto Indicators Ecosystem

- KYC Verified & Audited

Be a part of Our Telegram channel to remain updated on breaking information protection