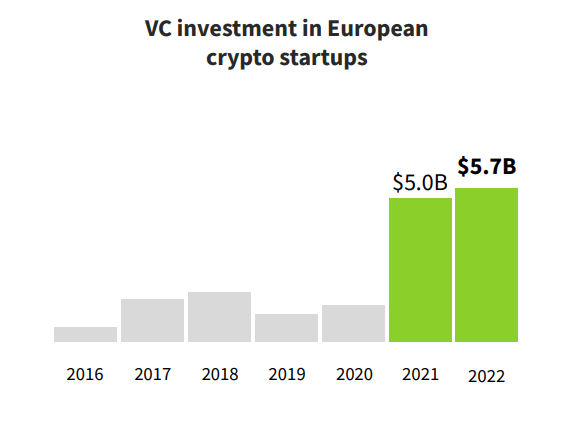

The crypto trade in Europe defied the bearish traits of 2022 and noticed a file degree of funding. Startups within the crypto area raised over $5.7 billion in 2022 whereas world and U.S. enterprise funding within the trade contracted. This can be a notable improve from the $5 billion E.U. firms raised in 2021.

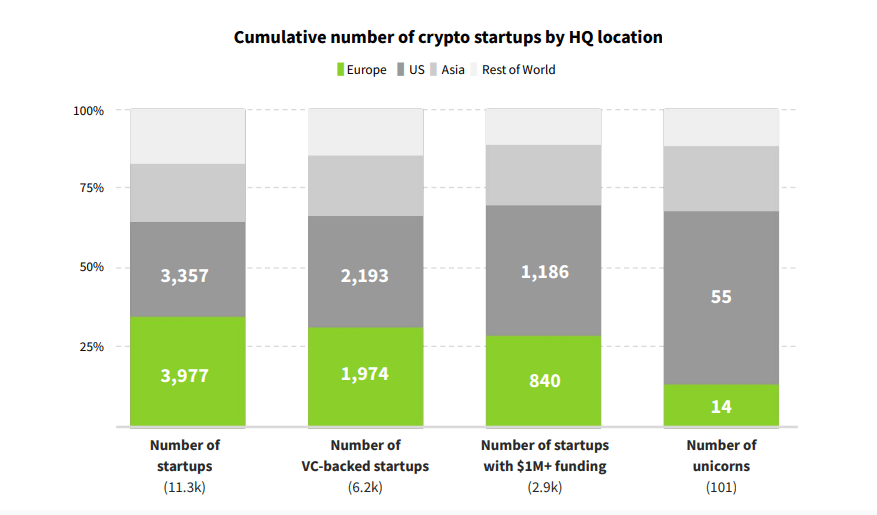

In response to knowledge from RockawayX and Dealroom, Europe has the biggest variety of startups engaged on blockchain and crypto options — surpassing each the U.S. and Asia. The vast majority of them are early-stage, small-to-mid-sized firms with modest funding. Additional alongside the startup funding journey, the U.S. leads the way in which because it has the biggest variety of unicorns.

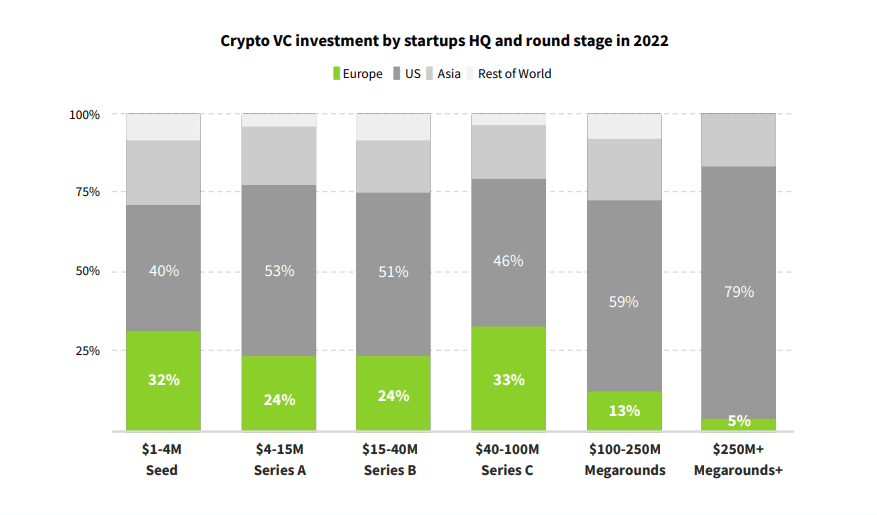

Whereas European firms accounted for 20% of the entire world early-stage crypto startup funding, U.S. firms dominated funding rounds exceeding $100 million.

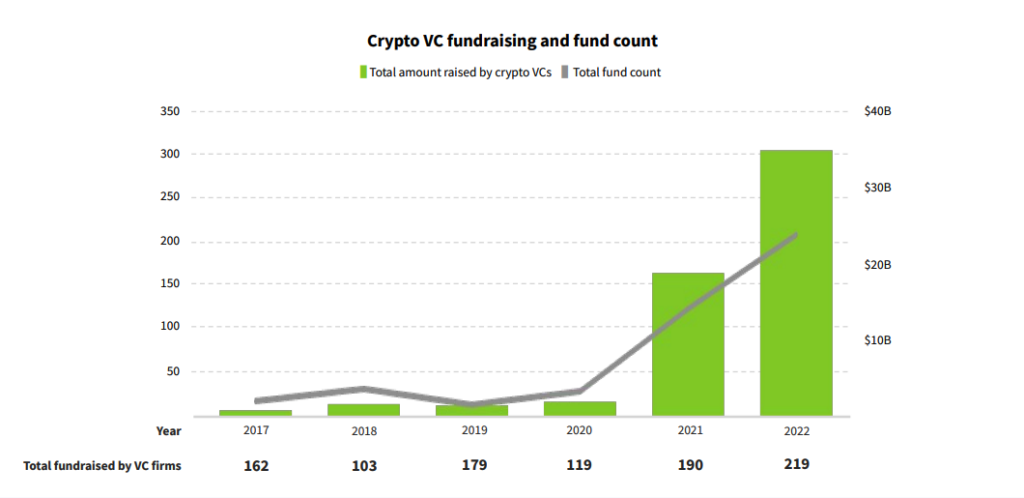

In 2022, crypto VC funds collectively raised over $35 billion, pushing crypto firms into the forefront of enterprise capital. Regardless of $35 billion accounting for less than round 16% of the entire VC fundraising final yr, it nonetheless represents the best quantity ever raised within the trade.

The continuing bear market is but to scare traders. Viktor Fischer, the CEO of RockawayX, mentioned that each market cycle — be it a bear one or a bull one — will increase VC exercise.

“Prior to now, VC funding remained comparatively steady, and even moved counter-cyclically, throughout crypto value downturns. Investments made when digital asset costs had been depressed materialized in tech and utilization traction alongside “bull market” value recoveries.”

Fischer famous that a few of the most notable firms within the crypto area immediately — together with Uniswap, OpenSea, Dapper Labs, and Sorare — had been funded and launched throughout the 2018 crypto winter.

Samantha Bohbot, RockawayX’s chief development officer, mentioned that the most important distinction between investing in bull markets and investing in bear markets is the pace of execution.

“As traders, we see the slowdown change the way in which offers play out. The place fundraises had been as soon as quick — oversubscribed and frantically closed, typically in days after the method kicks off — raises usually stretch months now.”

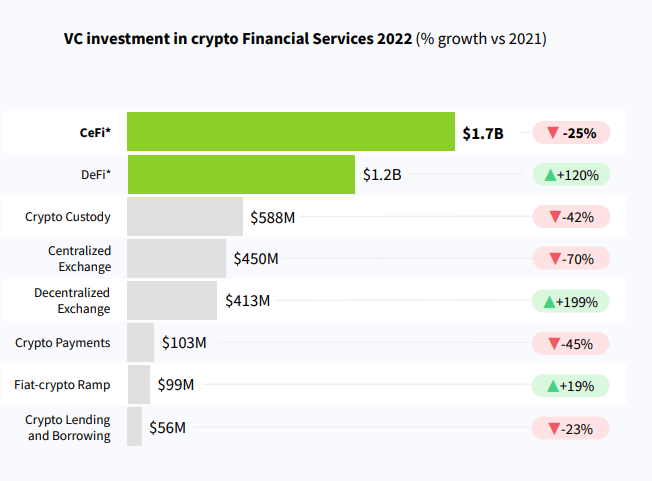

Whereas decentralized finance (DeFi) noticed a 120% improve within the quantity raised, centralized finance (CeFi) nonetheless leads the way in which in the case of VC investments.