Be part of Our Telegram channel to remain updated on breaking information protection

Scalable DeFi and NFT initiatives can profit from the spectacular Solana blockchain. The platform, which has a profitable native token known as SOL, is among the many high Layer 1 blockchains. If HODLERs know the way to use the SOL token, it may be fairly worthwhile.

Not the most effective of concepts to go away your token idle. Prime crypto merchants have due to this fact mastered the artwork of staking their tokens to generate passive revenue. On this article, we’ll talk about the way to stake solana to make some extra cash. Let’s first outline what staking is, although.

Staking: What Is It?

A Proof-of-Stake blockchain, like Ethereum and Solana, makes use of staking to validate transactions and defend its community. Customers should lock up their cash within the Proof of Stake consensus technique in an effort to have the privilege of validating the following block.

These customers sometimes obtain a compensation for validating that’s based mostly on the transaction charges taken from that block. Subsequently, locking extra cash will increase a consumer’s probabilities of validating a block and receiving extra rewards.

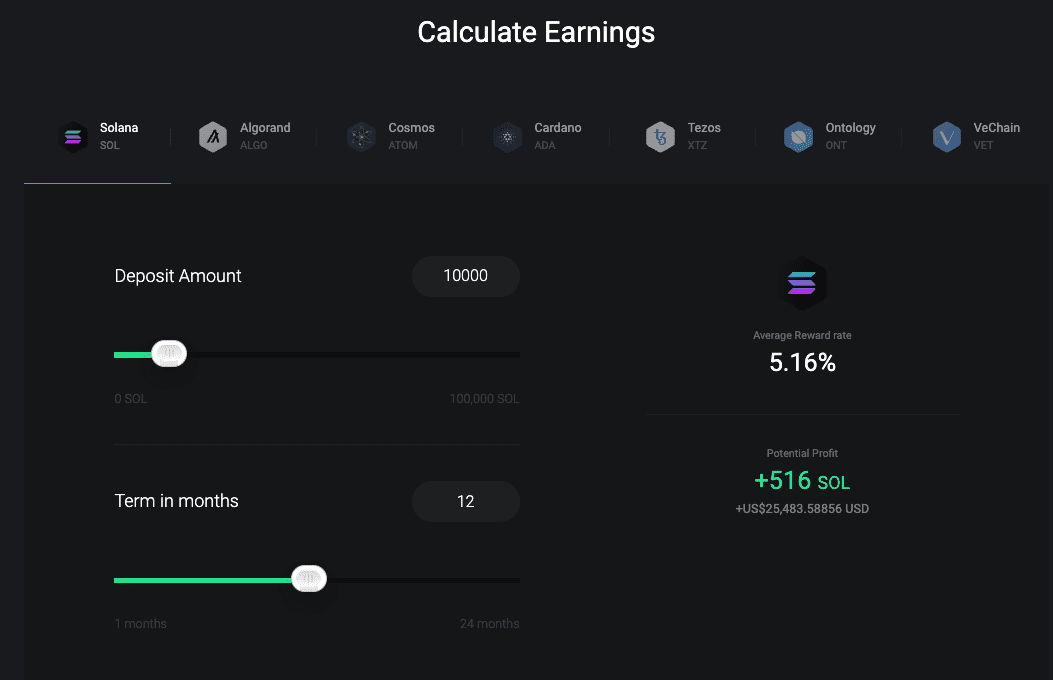

Now we have compiled right here the perfect areas to stake Solana SOL cash in 2022. Staking Solana SOL cash is a incredible approach to generate passive revenue, however SOL, like all crypto property, could also be fairly risky.

Please conduct your individual analysis earlier than deciding the way to stake your SOL tokens and making any investments. Staking cryptocurrency carries some danger.

The next are a few of the finest locations to stake Solana at the moment:

- Coinbase

- Binance Change

- Kraken

- Huobi Change

- Exodus Pockets

- Phantom Pockets and Nano Ledger

Coinbase

Probably the most well-known cryptocurrency platforms on the earth, Coinbase, launched Solana staking in June 2022. For novices, staking SOL on Coinbase is a wonderful different since you don’t should trouble about establishing validators and you can begin with simply $1.

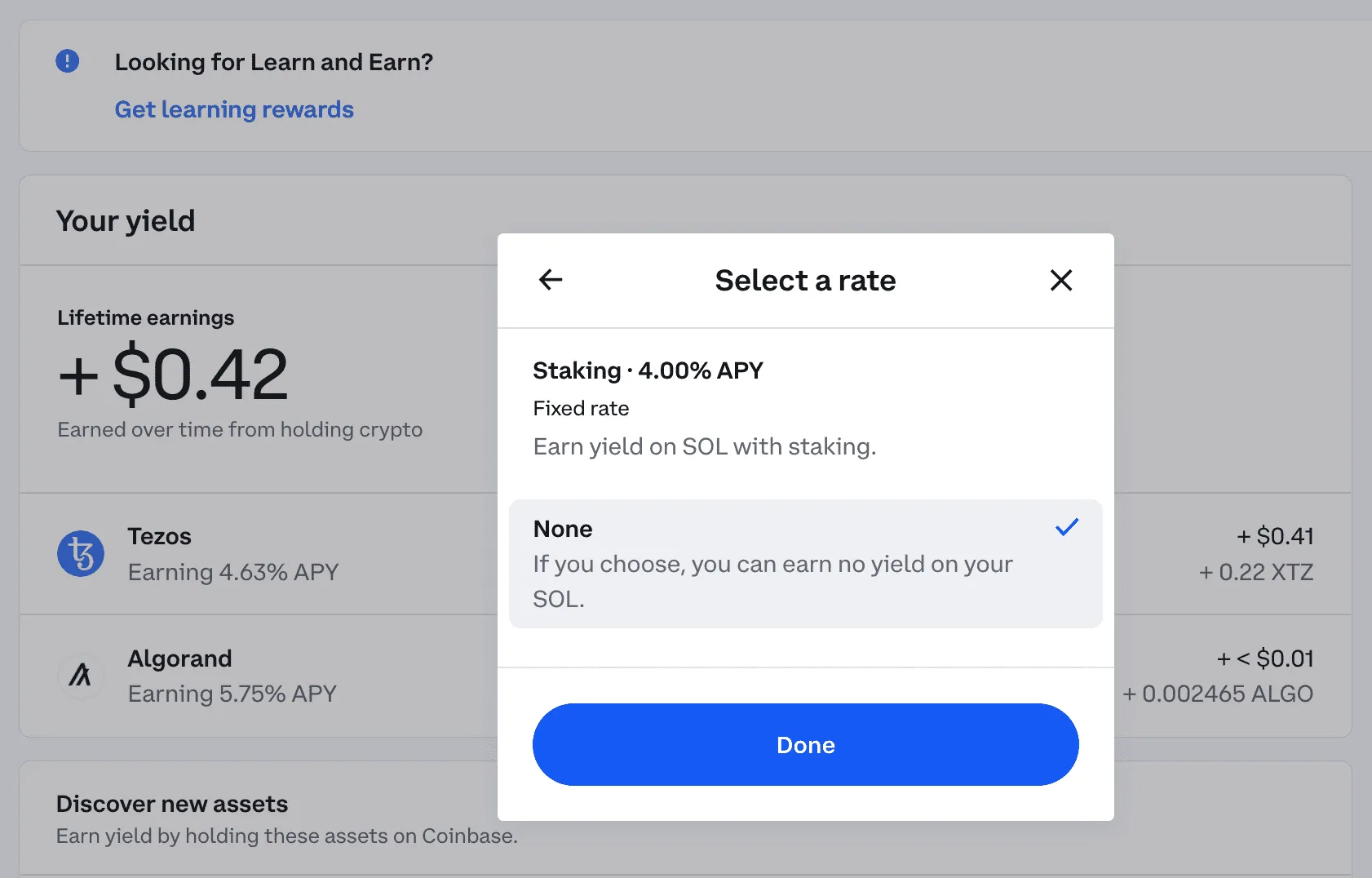

Once you stake Solana on Coinbase, incentives will start to accrue robotically each three to 4 days. SOL’s APY on Coinbase is at the moment about 4% APY, though this fee is topic to alter. For rookies, Coinbase makes it comparatively easy to get began with cryptocurrency, however there’s a price. A 25% staking cost is required when staking Solana on Coinbase.

4% APY Coinbase Solana Staking Price

Conclusion: Coinbase makes it extremely easy to stake Solana, however you’ll get a decrease fee than its rivals. If you have already got an account and don’t thoughts not getting the most effective rate of interest, Coinbase may be price your consideration.

Binance

The most important cryptocurrency trade on the earth, Binance, supplies merchants with a variety of buying and selling decisions, robust liquidity, and a few of the lowest prices out there. The cryptocurrency trade, which Changpeng Zhao based in China in 2017, moved to the Cayman Islands. The American model of Binance.com, Binance.US, supplies customers with fewer buying and selling choices and options for cryptocurrency.

Relating to staking SOL, there are a number of options obtainable on Binance.com. Sadly. Customers of Binance.US are unable to stake Solana and should go for one of many different choices listed on this tutorial.

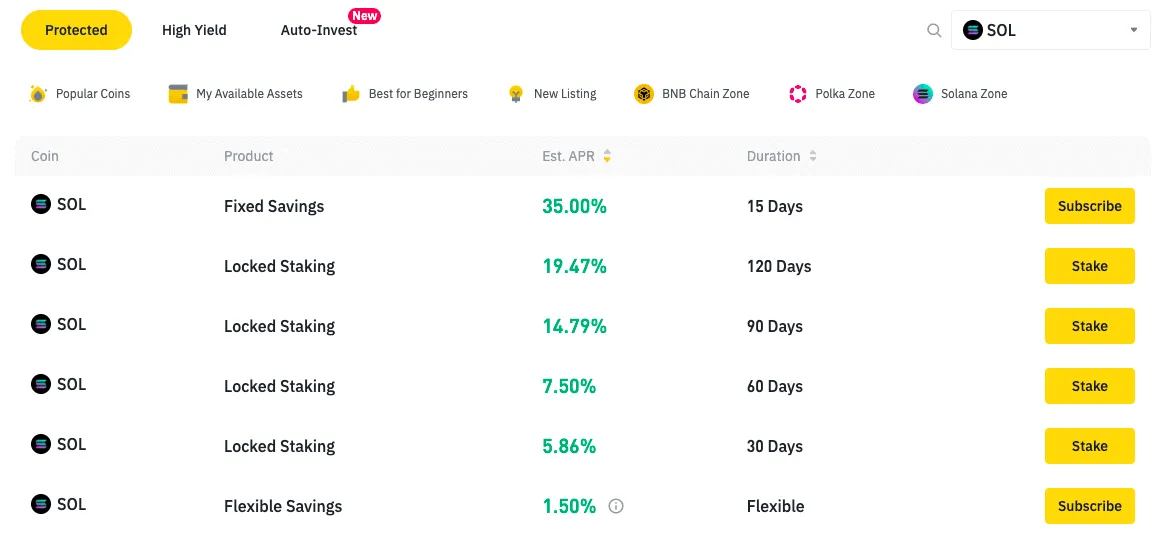

Among the best Solana staking charges are offered by Binance to its customers. These promotions, nevertheless, are solely obtainable for a restricted interval. Ideally, it’s best to lock up your SOL tokens for 30, 60, or 90 days in an effort to stake Solana on Binance Earn. Typically talking, you’ll earn extra curiosity in your tokens the longer you retain them locked up. Simply be conscious that the rates of interest do change and that these subscriptions do expire.

The next are the staking charges for the Binance Solana SOL token:

- 30 Days Locked Staking 5.86%

- 60 Days Locked Staking – 7.50%

- 90 Days Locked Staking – 14.79%

- 120 Days Locked Staking – 19.47%

- 15-Day Fastened Financial savings: 35%

- 1.50% for Versatile Financial savings

Though Binance calculates its staking curiosity on daily basis, you’ll forfeit any collected curiosity if you happen to finish the lock-up interval earlier than it has completed.

As much as 35% APY at Binance Solana Staking Price

Conclusion: Staking entails quite a lot of hazards, equivalent to chopping, malicious assaults, and so forth. Staking on Binance supplies safety in addition to a decent APY. Really, no cryptocurrency platform is totally completely secure. Nevertheless, Binance is the trade chief as a secure trade and one of many high locations to stake SOL.

Huobi World

A crypto-to-crypto trade known as Huobi World was established in China in 2013 and has now moved to the Seychelles. Huobi is accessible within the majority of countries all over the world, however not in the US.

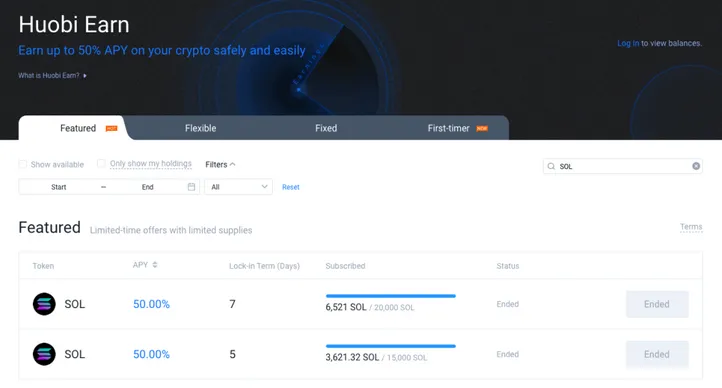

Compared to Binance, Huobi World Solana staking provides lesser rates of interest. On their Huobi Earn characteristic, they supply a couple of staking options, together with Fastened, Versatile, and First Timer investing prospects.

It was once doable to make about 5.35% APY by staking SOL on Huobi, which is considerably lower than a few of its rivals. Huobi does run particular gross sales and has offered SOL at charges as excessive as 50% APY for a brief time period.

Huobi World Solana Staking Price: 4.60% APY

Conclusion: We consider you may get higher charges elsewhere if you wish to stake Solana on an trade.

Kraken

Kraken is a popular possibility for cryptocurrency traders due to its excessive degree of safety and cheap buying and selling charges. Regardless of having a U.S. base, Kraken might have numerous limitations relying on the place you might be.

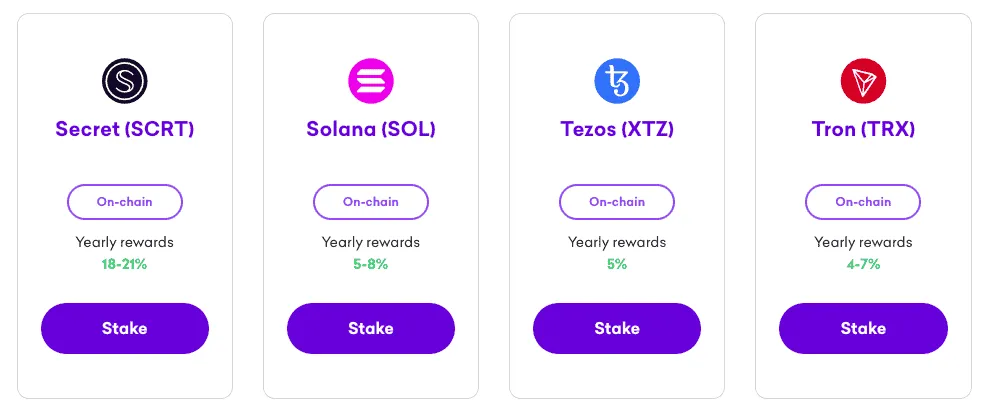

One of many 14 tokens that traders can stake is Solana; the others embrace ETH, DOT, and ADA. It’s possible you’ll trade for these on Kraken for currencies like USD, EUR, GBP, and BTC if you happen to don’t have SOL. After receiving your SOL tokens, you’ll be able to start to stake them to start incomes 6-8% APY. It’s essential to deposit not less than 0.2 SOL in an effort to stake Solana on Kraken. There aren’t any lockup durations to stake SOL, in distinction to different choices on this checklist, and you may withdraw your tokens everytime you select.

Regardless of our distaste for the Kraken trade’s consumer interface and total consumer expertise, they do make staking cryptocurrency comparatively easy. Though we consider Kraken to be one of many most secure exchanges, we don’t stake Solana on Kraken.

5-8% APY Kraken Solana Staking Price

Conclusion: If you have already got a Kraken trade, it’s best to take into consideration staking SOL tokens there.

Exodus Pockets

You can even retailer and stake your SOL tokens in Exodus, a free desktop and cell pockets. You’ll be able to stake various tokens underneath the Rewards web page, together with Solana, which has an anticipated staking length of 4 days and an APY of 5.23%.

You’ll be able to trade for SOL inside the Exodus pockets if you happen to don’t have any to stake. Simply bear in mind that due to the large spreads, this gained’t be the most affordable approach to commerce your tokens. It does, nevertheless, indicate that you’re free from the necessity to ship and commerce your tokens from one platform to a different.

With Exodus, you’ll be utilizing the Everstake API supplier to stake SOL.

Solana Staking Price in Exodus Pockets: as much as 5.23% APY

Conclusion: Exodus is an excellent pockets, and regardless that its Solana staking charges are on the low facet, it’s nonetheless preferable to stake Solana there moderately than on a cryptocurrency trade.

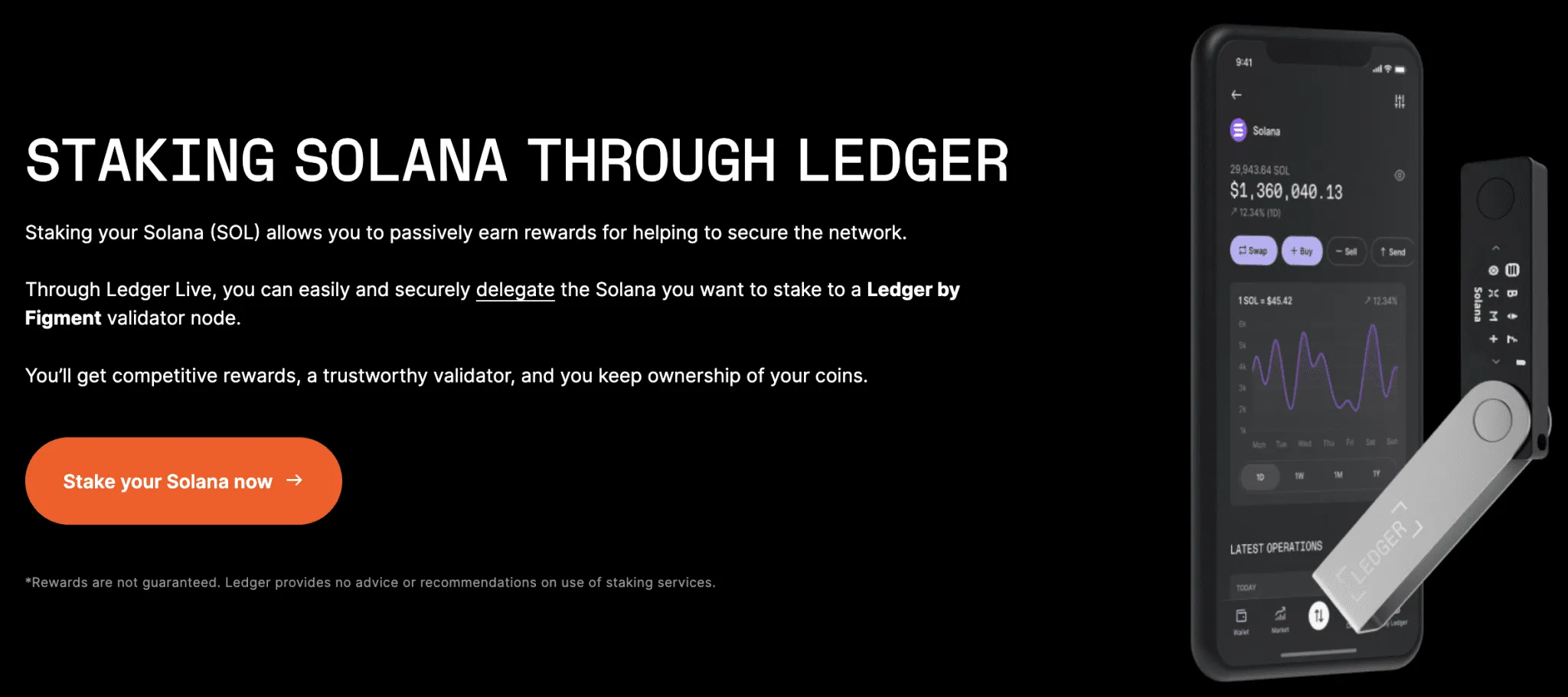

Phantom Pockets & Nano Ledger

The Phantom Pockets, which is similar to Metamask in fashion, is Solana’s non-custodial pockets. With entry to their personal keys, customers can securely retailer and stake SOL tokens utilizing Phantom Pockets. Moreover, Phantom will be related to a Ledger {hardware} pockets for added safety.

It’s essential to choose a validator from an inventory that’s proven to you while you stake your SOL within the Phantom Pockets. Researching these Validators is essential as a result of you’ll be relying on them to seize your curiosity. All the main points, such because the validator’s fee fee and the variety of energetic delegators, will probably be damaged down earlier than you stake along with your validator.

Solana Staking Price for Phantom Pockets: 6-8% APY

Conclusion: Many people mix the Ledger Nano {hardware} pockets with the Phantom pockets to stake Solana. You’ll be able to choose your individual validators, and that is possible the most secure strategy to stake SOL. Though it gained’t be the best approach to stake Solana, it’s price trying into in case you have the time.

Is SOL Staking Protected?

On a number of Proof-of-Stake networks, there’s a mechanism generally known as “slashing.” Any process generally known as “slashing” includes the destruction of a portion of the stake assigned to a validator as a result of validator’s dangerous conduct.

In consequence, validators are inspired to chorus from taking such acts as a result of they’ll earn much less cash because of having much less stake assigned to them. Being lower can be considered as a reputational danger for dropping out on current or potential traders.

Slashing additionally places token holders in danger since they will lose a few of the tokens they’ve delegated to a slashed validator. Slashing may encourage token house owners to solely delegate their tokens to validators they take into account to be reliable moderately than to delegate all of their tokens to at least one or a small group of validators.

Slashing isn’t a default motion on Solana. If an attacker stops the community, they may be sliced when it begins up once more.

The Greatest Method to Choose a Solana Validator

There are some things to consider whereas deciding on a Solana validator, such;

- Fee Price: Selecting a lesser fee fee is suggested as a result of it should have an effect on your advantages.

- Uptime: It’s crucial to decide on a validator whose uptime for his or her providers is close to to 100%.

- Measurement: Some customers wish to delegate to smaller validators to assist the community grow to be extra decentralized and to extend the long-term price of your SOL funding. Whereas some favor the larger validators as a result of they consider within the energy of numbers.

- Values: Have in mind validators who’re devoted to enhancing Solana by aiding with the platform’s app growth, instruments, or coaching assets.

Associated

Sprint 2 Commerce – Excessive Potential Presale

- Lively Presale Stay Now – dash2trade.com

- Native Token of Crypto Alerts Ecosystem

- KYC Verified & Audited

Be part of Our Telegram channel to remain updated on breaking information protection