That is an opinion editorial by Robert Corridor, a content material creator and small enterprise proprietor.

The favored thought amongst Bitcoiners is that bitcoin adoption might be a seamless transition to a bitcoin customary. Whereas I want this had been the case, governments won’t quit their energy to print cash and management the financial affairs of what they think about to be their slaves with no battle.

Bitcoin as a financial community grows by leaps and bounds yearly. An estimated 106 million individuals worldwide personal Bitcoin, and customers make round 300,000-500,000 transactions in the present day. Adoption numbers will proceed to develop as bitcoin matures and solidifies itself within the market of concepts.

I can guarantee you that governments are additionally intently monitoring these developments. As bitcoin adoption grows, you must count on governments to make use of a number of ways to scare you away from proudly owning it or create tax legal guidelines designed to punish bitcoin holders. You also needs to count on outright confiscation and the specter of being thrown in jail.

If bitcoin has been remotely in your radar, there’s a excessive probability that you’ve heard detrimental tales about bitcoin within the mainstream press. The media spreads worry, uncertainty and doubt (FUD) about Bitcoin to cease you from being eager about studying extra about it. The powers that be use refined advertising and marketing methods and narrative management to implant an concept about bitcoin in your thoughts earlier than you have got an opportunity to do your analysis.

Listed below are just a few examples of FUD from well-known media publications:

“Why Bitcoin Is Unhealthy For The Setting” (Worry)

“Cryptocurrency Fuels Development Of Crime” (Uncertainty)

“The Brutal Reality About Bitcoin (Doubt)”

All this took was a fast search on the web to search out these tales. That is governments’ major weapon to discourage bitcoin adoption, which has in all probability labored for a time — however that is not the case. With inflation raging worldwide and governments buckling underneath the stress of forex debasement and a robust greenback, individuals will begin in search of a greater strategy to retailer their wealth.

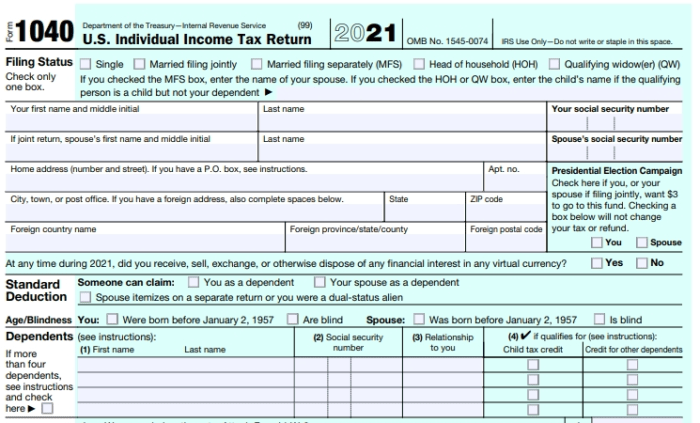

This sort of financial atmosphere is ripe for bitcoin adoption on a large scale. This may lead governments to additional put stress on their residents who personal bitcoin. As soon as governments perceive they can not cease their residents from adopting bitcoin, they most probably will attempt to revenue from it by creating confiscatory tax legal guidelines to profit from bitcoin’s worth features. Do not suppose it may occur? It’s already a coverage in India.

Steal From The Center Class

As lately as Could, Democrats and the Biden administration had been contemplating a tax on unrealized features.

“Biden’s Tax On Unrealized Beneficial properties Will Hit Far Extra Taxpayers Than He Claims

India taxes digital belongings at 30 p.c.

“India’s Cryptocurrency Business Reels As New Tax Hammers Buying and selling”

“Philippine President Marcos Jr. Pushes Tax On Digital Companies”

As you may see, this international pattern seems to be like it should escalate in future years.

If You Cannot Beat It, Ban It.

Banning is the final, and most heavy-handed device governments will use to discourage bitcoin adoption. That is when you may inform they’re terrified of bitcoin. They may go legal guidelines outlawing bitcoin possession and criminalizing its possession. Quite a few nations across the globe have gone this route, most notably China.

Nigeria is one other instance of how governments will assault Bitcoin. They’ll inform monetary establishments to dam any transactions associated to bitcoin. This may disrupt bitcoin adoption for some time, however is unlikely to stall bitcoin adoption for lengthy.

The state of affairs that many Bitcoiners in America fear about is a 6102-type government order that might ban the possession of bitcoin.

Sadly, there’s a precedent for one thing like this to happen. On April 6, 1933, President Franklin D. Roosevelt signed Govt Order 6102, “forbidding the hoarding of gold coin, gold bullion and gold certificates throughout the continental United States.”

This basically banned the non-public possession of gold in the USA. Govt Order 6102 demanded that each citizen give up their gold to the Federal Reserve by Could 1, 1933. Violators of this government order had been topic to a $10,000 effective, which quantities to $209,000 in in the present day’s {dollars}, and a 5-10 yr jail time period.

That is the one factor that ought to hold each Bitcoiner up at evening. What’s stopping them from doing one thing like this sooner or later? The precedent has been set. I am undecided they would want a pretext to grab your bitcoin aside from we’re going bankrupt and wish to keep in energy.

The federal government is aware of who owns bitcoin or may discover out comparatively rapidly with the assistance of the cryptocurrency exchanges. The Know Your Buyer (KYC) laws make it straightforward to see the place you reside and the way a lot bitcoin you have got.

In case you are not conversant in shopping for non-KYC bitcoin, now could be the time to find out how to take action. There are just a few platforms that make it straightforward to purchase and promote bitcoin with out the federal government seeing your each transfer.

HodlHodl and Bisq make the most of the ability of multisig custody to make this occur. It’s also possible to purchase KYC-free bitcoin from ATMs as nicely. For an in-depth walkthrough on how one can purchase bitcoin from an ATM or to make use of Bisq take a look at this text by Bitcoin Journal contributor Econoalchemist.

Bitcoin companies must abide by KYC laws created by the federal authorities. These guidelines adversely influence the lives of harmless individuals they declare to be defending. I’ve been personally impacted by KYC guidelines and laws. I received’t title the businesses in query however I’ve had accounts closed, or been unable to open accounts with sure companies for causes that had been by no means defined to me. If this will occur to me, it might probably definitely occur to anybody.

The facility of The State is actual and shouldn’t be taken flippantly. The Bitcoin revolution is actual and occurring in actual time however there are questions that it is advisable to ask your self. My query to you is: What is going to you do if the federal government makes it unlawful to personal Bitcoin? Are you going to show over your bitcoin to the state? Are you prepared to danger going to jail on your bitcoin? Are you going to go away?

What is going to you do in the event that they outlaw bitcoin and also you want meals and shelter for your loved ones? Are you prepared to work in a black market? I do not suppose these are questions that the typical Bitcoiner is asking themselves — however they need to.

The world is unstable, and who is aware of what the longer term holds for any of us? It’s higher to have a plan now versus being caught flat-footed.

Within the meantime, proceed to remain humble and stack sats.

This can be a visitor submit by Robert Corridor. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.