Curve Finance is an Automated Market Maker (AMM)-based decentralized change (DEX) that connects customers excited by swapping stablecoins. The platform’s AMM allows customers to commerce stablecoins from a liquidity pool without having to search out patrons and sellers. The protocol ensures low charges and minimal slippage by figuring out the perfect routes for change.

CRV is the Curve DeFi protocol’s native utility token and governance token.

This overview will look into Curve DAO options and supply potential buyers with a tutorial on how one can purchase CRV.

Let’s get began with a straightforward step-by-step information on shopping for CRV!

Key Takeaways

- Curve Finance is an Automated Market Maker (AMM)-based decentralized change (DEX) that allows customers to commerce stablecoins from a liquidity pool without having to search out patrons and sellers.

- The system allows minimal slippage and low charges by discovering the most effective routes for customers’ swap requests.

- You should purchase Curve DAO tokens on centralized and decentralized cryptocurrency exchanges by registering an account and depositing funds.

- Curve liquidity swimming pools incentivize customers to turn into liquidity suppliers by depositing their tokens into the swimming pools to maintain the worth passable and get rewards.

- Curve fees low buying and selling charges whereas additionally offering environment friendly fiat financial savings accounts for liquidity suppliers.

- Curve ensures buyers keep away from risky crypto property whereas nonetheless incomes high-interest charges from lending protocols by specializing in stablecoins.

Step#1: Select a Crypto Trade

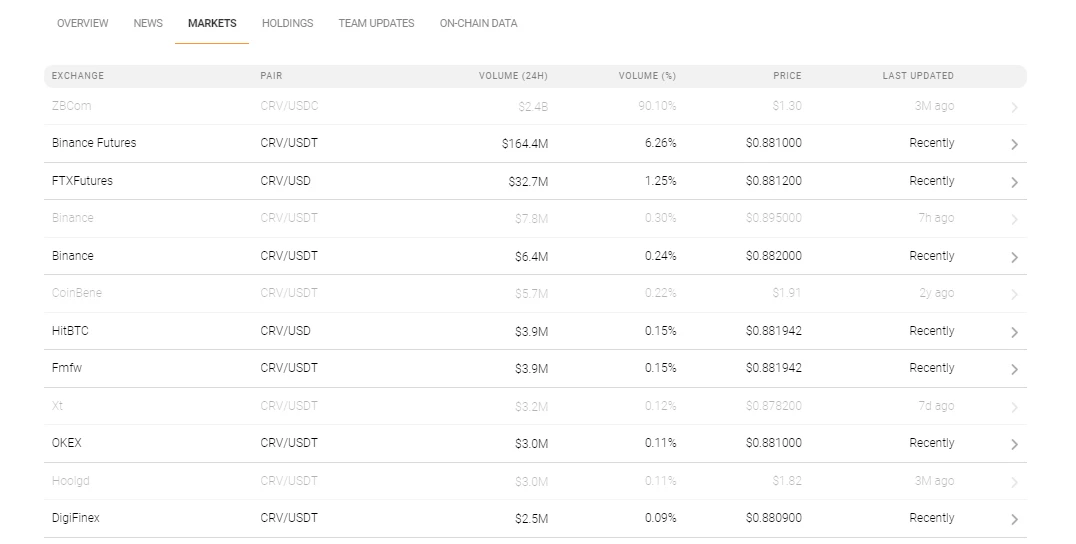

Curve DAO token is obtainable on a number of cryptocurrency exchanges. Go to the market web page on CoinStats to view the change platforms supporting CRV. Examine the exchanges’ safety, consumer expertise, charge construction, supported crypto property, and many others., to decide on the one with the traits you want, reminiscent of inexpensive transaction charges, an intuitive platform, round the clock customer support, and many others. Additionally, take into account whether or not the cryptocurrency change is regulated by the Monetary Business Regulatory Authority (FINRA) and permits you to purchase crypto utilizing your most popular fee methodology.

Within the crypto world, any dealer is confronted with the preliminary selection between centralized and decentralized crypto exchanges, so let’s look into the small print of every sort under.

Centralized Trade

A centralized crypto change or CEX, reminiscent of Coinbase, eToro, Binance, and many others., is ruled by a centralized system and fees particular charges for utilizing their companies. Most crypto buying and selling takes place on centralized exchanges, permitting customers to convert their fiat currencies immediately into crypto simply. Centralized exchanges require their customers to observe KYC (know your buyer) and AML (anti-money laundering) guidelines by offering some info and private identification paperwork. Nevertheless, a CEX holds your digital property on its platform whereas trades undergo – elevating the danger of hackers stealing the property.

Decentralized Trade

However, a decentralized change (DEX), like Uniswap, SushiSwap, Shibaswap, and many others., shouldn’t be ruled by any central authority; as a substitute, it operates over blockchain and fees no charge aside from the fuel charge relevant on a specific blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use sensible contracts to let individuals commerce crypto property without having regulatory authority. They deploy an automatic market maker to take away any intermediaries and provides full management over the funds to customers. Decentralized exchanges are much less user-friendly from an interface standpoint and when it comes to foreign money conversion. As an illustration, they don’t at all times enable customers to deposit fiat cash in change for crypto; customers need to both already personal crypto or use a centralized change to get crypto. It additionally takes longer to search out somebody trying to commerce with you as DEX engages in peer-to-peer commerce, and if liquidity is low, you will have to simply accept concessions on value and shortly promote or purchase low-volume crypto.

For instance, we’ll reveal the method of shopping for CRV on the Binance change under.

Step #2: Create an Account

To purchase Curve DAO token CRV on Binance, you should register with the change via your Google account, a legitimate electronic mail tackle, an Apple account, or a legitimate cellular quantity. A hyperlink will likely be despatched to your tackle, and you should click on it to confirm your account. As soon as the account is activated, you should create an elaborate password, and also you’re good to go.

Binance doesn’t require new customers to endure KYC (know your buyer) verification immediately by offering further paperwork. Nevertheless, KYC verification lets you take full benefit of the platform’s companies for lowers charges.

To get verified, you should present private info reminiscent of:

- Full title

- Residential tackle

- Date of Delivery

- ID Doc.

Generally, you may additionally must add a selfie or endure video verification to finalize the method. As soon as your identification verification is full, it’s really helpful to activate two-factor authentication (2FA) for an additional layer of safety.

Step #3: Deposit Funds

The following step is to deposit funds into your newly created Binance account to purchase CRV tokens. Binance helps a number of deposit strategies, reminiscent of a credit score/debit card, a wire switch, financial institution deposits out of your checking account, and third-party funds, reminiscent of Simplex. The charges for purchasing crypto via the strategies described above differ, so you must examine them earlier than making a purchase order is extremely really helpful.

You may as well hyperlink your crypto pockets to purchase curve DAO token CRV along with your digital property.

Merely choose your most popular deposit methodology, reminiscent of a financial institution switch, wire switch, credit score or debit card, e-wallets, PayPal, and many others., and the foreign money you want to deposit. Faucet on “Deposit Funds,” enter the quantity you need to deposit and click on “Deposit.”

Some deposit strategies are extraordinarily quick, whereas others require affirmation from authorities relying on the quantity. Bear in mind to judge the charges of various deposit strategies since some have extra important charges than others.

NOTE: Binance requires customers to finish KYC for fiat transactions.

Step #4: Purchase Curve DAO Token CRV

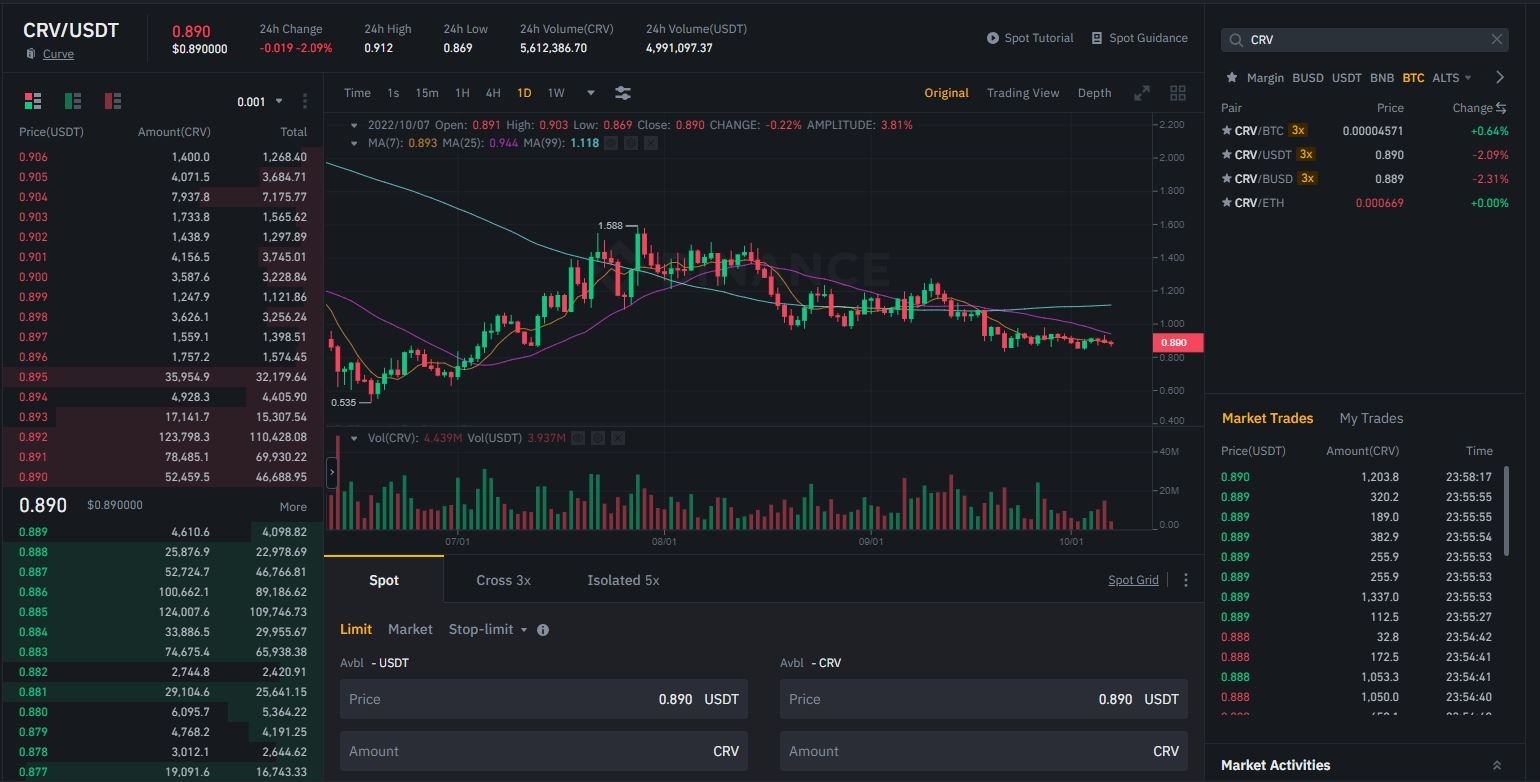

Binance gives the next Curve DAO CRV buying and selling pairs: Bitcoin (BTC), Ethereum (ETH), Tether Stablecoin (USDT), and Binance USD (BUSD).

- Go to Markets and seek for CRV.

- Choose a buying and selling pair you want to purchase CRV in opposition to.

- Enter the variety of CRV tokens you want to purchase and click on on Purchase CRV.

- The order will likely be stuffed immediately for the market value, and your newly bought tokens will likely be mirrored in your spot pockets. NOTE: Earlier than shopping for CRV, take into account that Curve DAO, or crypto property typically, are extremely risky.

Curve DAO Token Use Instances

Congratulations! Now you’re the proud proprietor of Curve DAO. Right here’s what to do along with your crypto property:

Retailer CRV

Whereas your CRv tokens may be saved in your brokerage change pockets, specialists extremely advocate storing your valuable cash away from change wallets, as these is likely to be inclined to hacks and interference.

We extremely advocate creating a personal pockets with your personal set of keys. Relying in your investing preferences, you may select between software program and {hardware} wallets:

Software program Wallets

If you happen to’re trying to commerce CRV usually, software program or scorching wallets out of your chosen crypto change will swimsuit you. The energy of software program wallets lies of their flexibility and ease of use. A software program pockets is essentially the most easy-to-set-up crypto pockets and allows you to simply work together with a number of decentralized finance (DeFi) purposes.

Nevertheless, these wallets are weak to safety leaks as a result of they’re hosted on-line. So, if you wish to maintain your personal keys in a software program pockets, conduct due diligence earlier than selecting one to keep away from safety points. We advocate a platform that gives 2-factor authentication as an additional layer of safety.

Examples of software program wallets embody CoinStats Pockets, MetaMask, Coinbase Pockets, Belief Pockets, and Edge Pockets, amongst others.

{Hardware} Wallets

{Hardware} or chilly wallets are normally thought-about the most secure solution to retailer your cryptocurrencies as they provide offline storage, thereby considerably lowering the dangers of a hack. They’re secured by a pin and can erase all info after many failed makes an attempt, stopping bodily theft. {Hardware} wallets additionally allow you to signal and ensure transactions on the blockchain, supplying you with an additional layer of safety in opposition to cyber assaults. These are extra appropriate for skilled customers who personal giant quantities of tokens.

Ledger {hardware} wallets are arguably essentially the most safe {hardware} wallets letting you securely handle your digital property.

Examples of chilly wallets are Trezor Mannequin T, Ledger Nano X, CoolWallet Professional, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

Get Impressed

By locking up CRV tokens, you possibly can vote on Curve DEX protocol choices, reminiscent of DEX operations, charge construction modification, burning schedules, creating new liquidity swimming pools, and many others., and suggest protocol updates. The longer the CRV token is locked up, the extra voting energy token you’ll have. CRV is paid to Liquidity Suppliers as pool rewards and incentives primarily based on the dimensions of their pool share.

Stake Curve DAO CRV

You may as well earn rewards along with your Curve DAO token by staking it as a substitute of idly storing it in a crypto pockets. Many widespread cryptocurrencies provide staking choices.

NOTE: Because the crypto market is extremely risky, staking is a high-risk endeavor. Nevertheless, it guarantees excessive rewards as properly.

Staking is like proudly owning a financial savings account in a financial institution. With crypto staking, you lock a certain quantity of cash on a platform that helps CRV-staking, like Binance, to obtain annual yields (APY).

Monitor CRV

The crypto market is risky, and managing your portfolio may get tough should you maintain a number of property. Using a portfolio tracker will make it easier to maintain monitor of your Curve DAO token and all of your crypto investments from one platform always. CoinStats gives top-of-the-line crypto portfolio trackers available in the market; yow will discover extra info right here.

You may as well monitor the revenue, loss, and liquidity of Curve DAO throughout a number of exchanges on CoinStats.

CoinStats helps over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It gives charting instruments, analytical information, superior search options, and up-to-date information. Right here you’ve the chance to attach a limiteless variety of portfolios (wallets and exchanges), together with:

- Binance

- MetaMask

- Belief Pockets

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To attach, go to the CoinStats Portfolio Tracker web page and:

- Click on Add Portfolio and Join Pockets.

- Click on the pockets you need to connect with (e.g., Ethereum Pockets).

- Enter the pockets tackle and press Submit.

Now that you’ve got a greater thought of how one can purchase Curve DAO and what to do with it, it’s excessive time to current the digital asset and the platform it represents.

Professional-Tip

We extremely advocate storing your valuable cash away from change wallets in safe {hardware} or software program wallets. You may as well earn rewards along with your Curve DAO token by staking it as a substitute of idly storing it in a crypto pockets.

What Is Curve DAO?

Curve Finance is a blockchain-based decentralized change (DEX) constructed on Ethereum and primarily based on an automatic market maker (AMM) precept. It’s a non-custodial monetary platform that allows cryptocurrencies to be swapped utilizing liquidity swimming pools as a substitute of getting patrons and sellers by connecting customers with change protocols.

The system allows minimal slippage and low charges by discovering the most effective routes for customers’ swap requests. In so doing, Curve makes use of liquidity swimming pools, i.e., shared funds backed by digital tokens locked in sensible contracts. Liquidity swimming pools incentivize customers to turn into liquidity suppliers by depositing their tokens into the swimming pools to maintain the worth passable and get rewards. Curve fees low buying and selling charges whereas additionally offering environment friendly fiat financial savings accounts for liquidity suppliers. Furthermore, it ensures buyers keep away from risky crypto property whereas nonetheless incomes high-interest charges from lending protocols by specializing in stablecoins.

Curve additionally launched a decentralized autonomous group (DAO) with CRV as its native token.

Curve DAO Founders

The Curve DAO platform was based by Michael Egorov, CEO of Curve DAO, a Russian scientist and cryptocurrency professional. The CRV token was launched in 2020 and have become one of many widespread asset swimming pools for swapping Bitcoin and stablecoins.

Egorov has prior expertise with cryptocurrency-related firms and can be the founding father of the decentralized financial institution and loans community LoanCoin. In 2015, he co-founded and have become CTO of NuCypher, a cryptocurrency enterprise constructing privacy-preserving infrastructure and protocol.

Curve’s crew participates within the CRV allocation construction and receives tokens in accordance with a two-year vesting schedule, which is part of the preliminary launch plan.

In August 2020, Egorov awarded himself 71% of governance by locking a considerable amount of CRV; nevertheless, he later known as the act an “overreaction.”

What Makes Curve Distinctive?

Curve DAO stands out due to its know-how and technical capability, which makes Curve.fi a well-liked DeFi change. The AMM working mannequin connects customers with the most effective routes for his or her exchanges and allows them to swap tokens and stablecoins on the preferrred charges. Curve entails small low buying and selling charges and minimal slippage because of its deal with stablecoins. Furthermore, customers can retrieve their tokens from the platform at any time.

CRV is Curve Finance’s native utility and governance token used for governance, LP rewards, boosting yields, and token burns. By locking up CRV tokens, customers vote on Curve DEX protocol choices, reminiscent of DEX operations, charge construction modification, burning schedules, creating new liquidity swimming pools, and many others., and suggest protocol updates. The longer the CRV token is locked up, the extra voting energy token holders have.

CRV is paid to Liquidity Suppliers as pool rewards and incentives primarily based on the dimensions of their pool share. You may as well purchase CRV token or earn it when depositing property right into a liquidity pool.

Curve DAO Token As we speak

Curve DAO each day buying and selling volumes stood round $220 million in early October 2022.

Moreover, Curve DAO offers a variety of companies, reminiscent of yield farming and liquidity mining. As mentioned earlier, it takes crypto volatility out of the image, as stablecoins are much less inclined to market fluctuations.

NOTE: Whereas the assertion above is true, stablecoins should not resistant to liquidity points, as demonstrated by the Terra implosion earlier this 12 months. We extremely advocate merchants take into account the dangers whereas investing in Curve DAO token or some other crypto asset.

Curve DAO Token CRV

The overall CRV provide is 3.03 billion tokens, of which 62% is distributed to liquidity suppliers. The remaining tokens are distributed as follows: 30% goes to shareholders, 3% – to firm workers, and 5% – to a group reserve. The shareholder and worker allocations include a two-year vesting schedule.

The crew opted in opposition to CRV pre-mine, and round 750 million had been in circulation a 12 months after its launch.

Steadily Requested Questions

Is Curve DAO Token a Reliable Funding?

If you wish to purchase Curve tokens, the funding is safe sufficient. The platform has been round for over two years, and the creating crew is obtainable on social media. The undertaking is instrumental for individuals buying and selling or holding stablecoins.

Can I Purchase Curve Tokens With Financial institution Switch?

Sure, a number of crypto exchanges allow customers to purchase Curve DAO tokens with fiat cash. Nevertheless, not all fiat currencies is likely to be out there on a given change. Additionally, an additional swap is likely to be required to purchase Curve.

Which Cryptocurrency Trade Ought to I Select for Buying and selling Curve DAO Token?

As talked about earlier, the Curve DAO token is obtainable on a number of platforms. Each, Centralized and Decentralized exchanges function varied CRV buying and selling pairs, enabling you to decide on a cryptocurrency change in accordance with your comfort and choice. Whereas our overview introduced Binance for example, different exchanges like Kraken, Coinbase, Uniswap, and many others., provide CRV pairs.

Is CRV Thought-about a Dangerous Funding?

Cryptocurrency investments are dangerous because of their volatility. The overall rule of thumb is to not make investments greater than you possibly can afford to lose. Nevertheless, as with different widespread cryptocurrencies like Bitcoin, Ethereum, or XRP, the cash have utility, which their worth stems from.

Conclusion

Curve DAO has established its place within the crypto ecosystem. The platform focuses on offering buyers entry to stablecoin buying and selling. The Curve DAO token is the platform’s utility and governance token.

Hopefully, this overview gave you a clearer understanding of what Curve is and how one can purchase Curve DAO token.

If you wish to find out about decentralized finance and how one can take advantage of it, learn our information “What Is DeFi.” To learn to handle your portfolios, go to our “Crypto Portfolio Trackers.”

Disclaimer: The data contained on this web site is offered to you solely for informational functions and doesn’t represent a advice by CoinStats to purchase, promote, or maintain any safety, monetary product, or instrument talked about within the content material, nor does it represent an funding recommendation, monetary recommendation, buying and selling recommendation, or some other sort of recommendation. This isn’t a advice to make use of a specific funding technique.

Cryptocurrencies are speculative, advanced, and contain important dangers – they’re extremely risky and delicate to secondary exercise. Efficiency is unpredictable, and previous efficiency is not any assure of future efficiency. Contemplate your personal circumstances, and acquire your personal recommendation earlier than counting on this info. Cryptocurrency is a extremely risky market, do your unbiased analysis and confirm the character of any services or products (together with its authorized standing and related regulatory necessities) and seek the advice of the related Regulators’ web sites earlier than making any choice.

There are important dangers concerned in buying and selling CFDs, shares, and cryptocurrencies. It’s best to take into account your personal circumstances and take the time to discover all of your choices earlier than making any funding.