Digital property supervisor CoinShares says most institutional traders imagine one crypto asset has essentially the most development potential this yr.

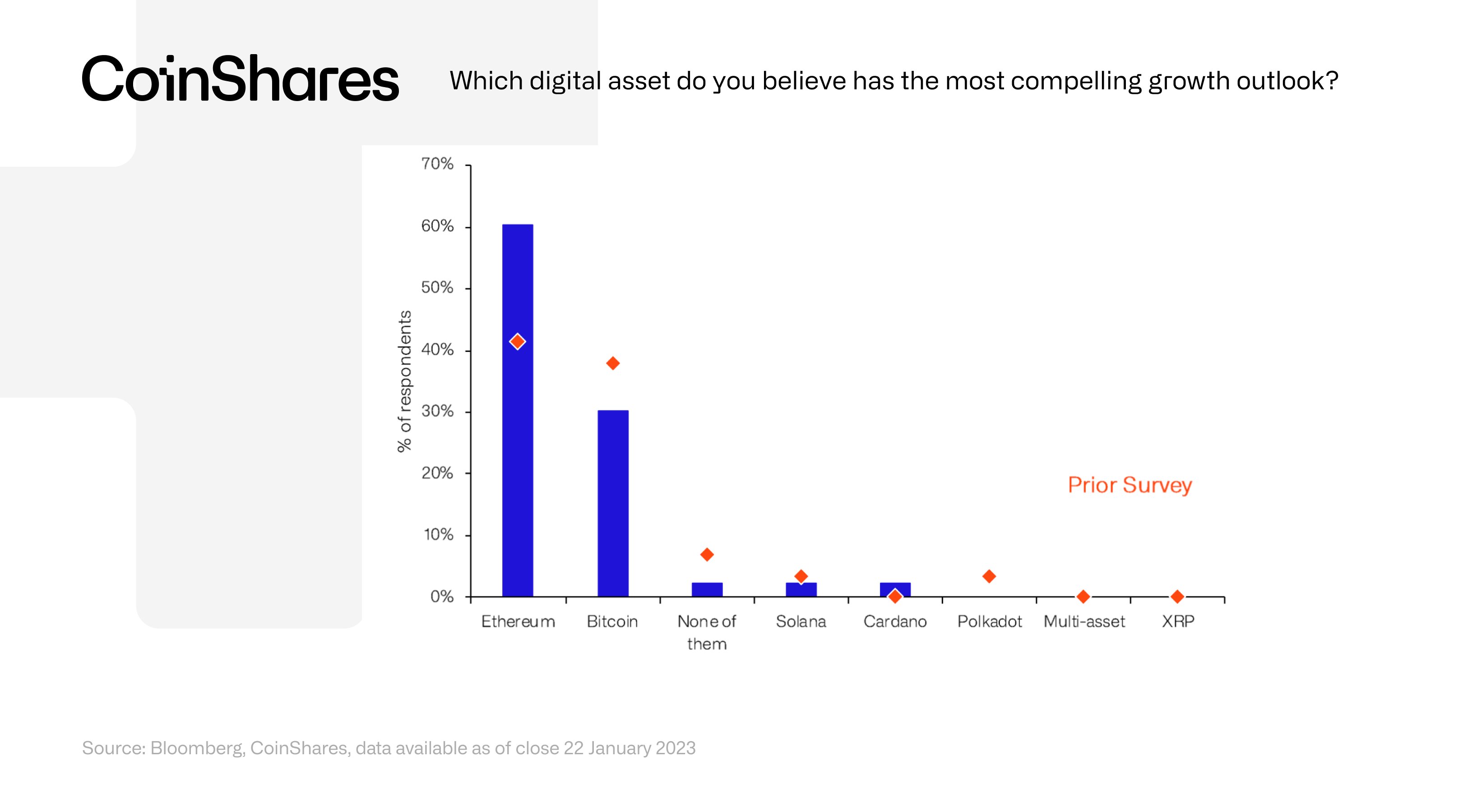

Within the newest Digital Asset Quarterly Fund Supervisor Survey, CoinShares says there’s a 20% improve in bullish sentiment amongst traders for sensible contract platform Ethereum (ETH).

“Ethereum has seen a dramatic rise in investor sentiment, with a file 60% of survey respondents believing it has essentially the most compelling development outlook.”

Nearly 30% of these surveyed mentioned Bitcoin (BTC) had essentially the most compelling development outlook.

The survey relies on 43 responses from traders who cowl $390 billion of property underneath administration.

The sentiment behind Ethereum jumped considerably for the reason that October 2022 survey, when solely 40% of these surveyed believed ETH had essentially the most compelling development outlook.

CoinShares says Ethereum could also be headed for a “comeback” this yr after experiencing an outflow of $401 million in 2022.

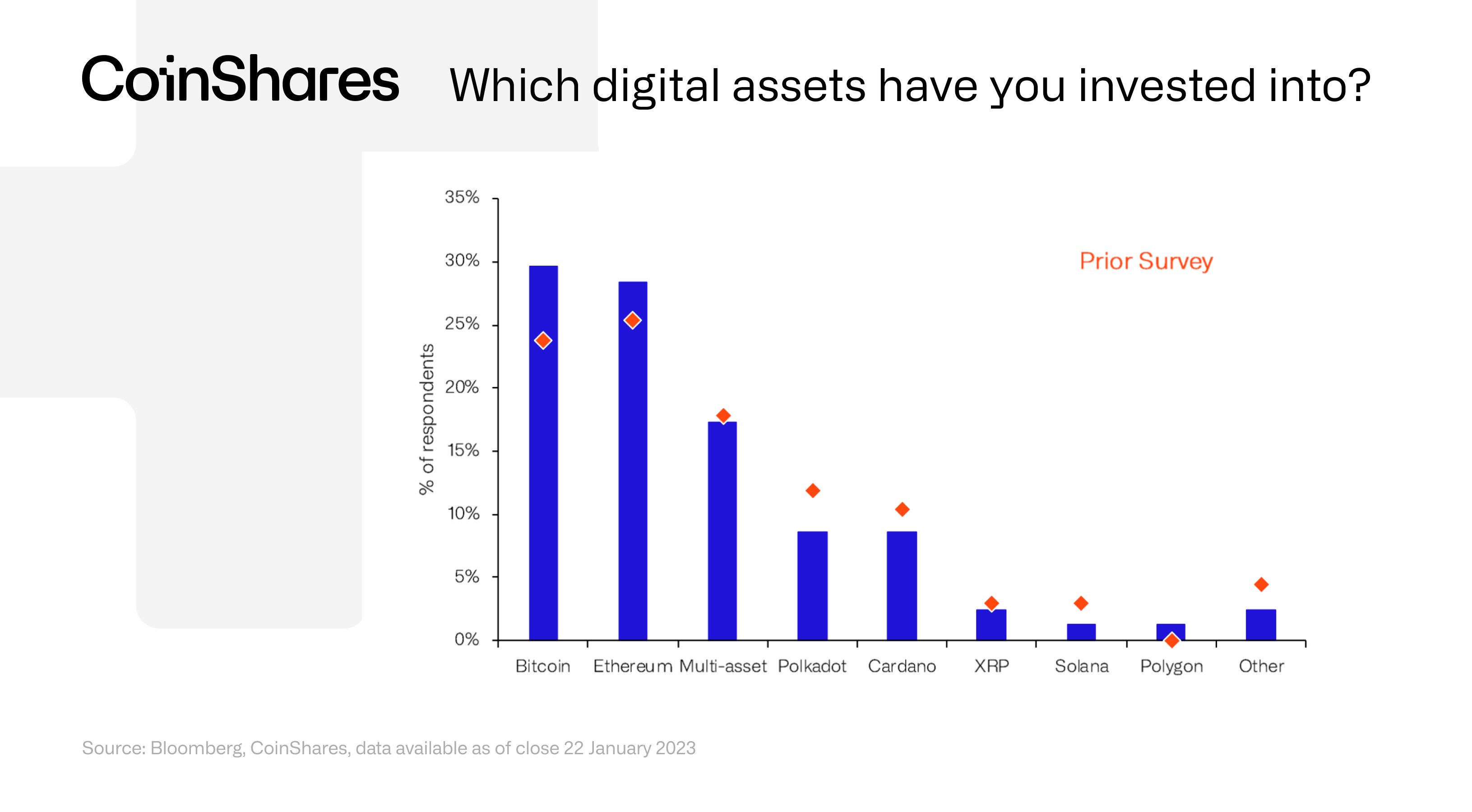

Per the survey, traders have been principally investing in Bitcoin and Ethereum within the final quarter, which can have “come on the expense of altcoin opponents to Ethereum.”

“Motion speaks louder than phrases, so it’s value noting what investments respondents made within the final quarter. Bitcoin and Ethereum have solidified their main positions in opposition to different cash.”

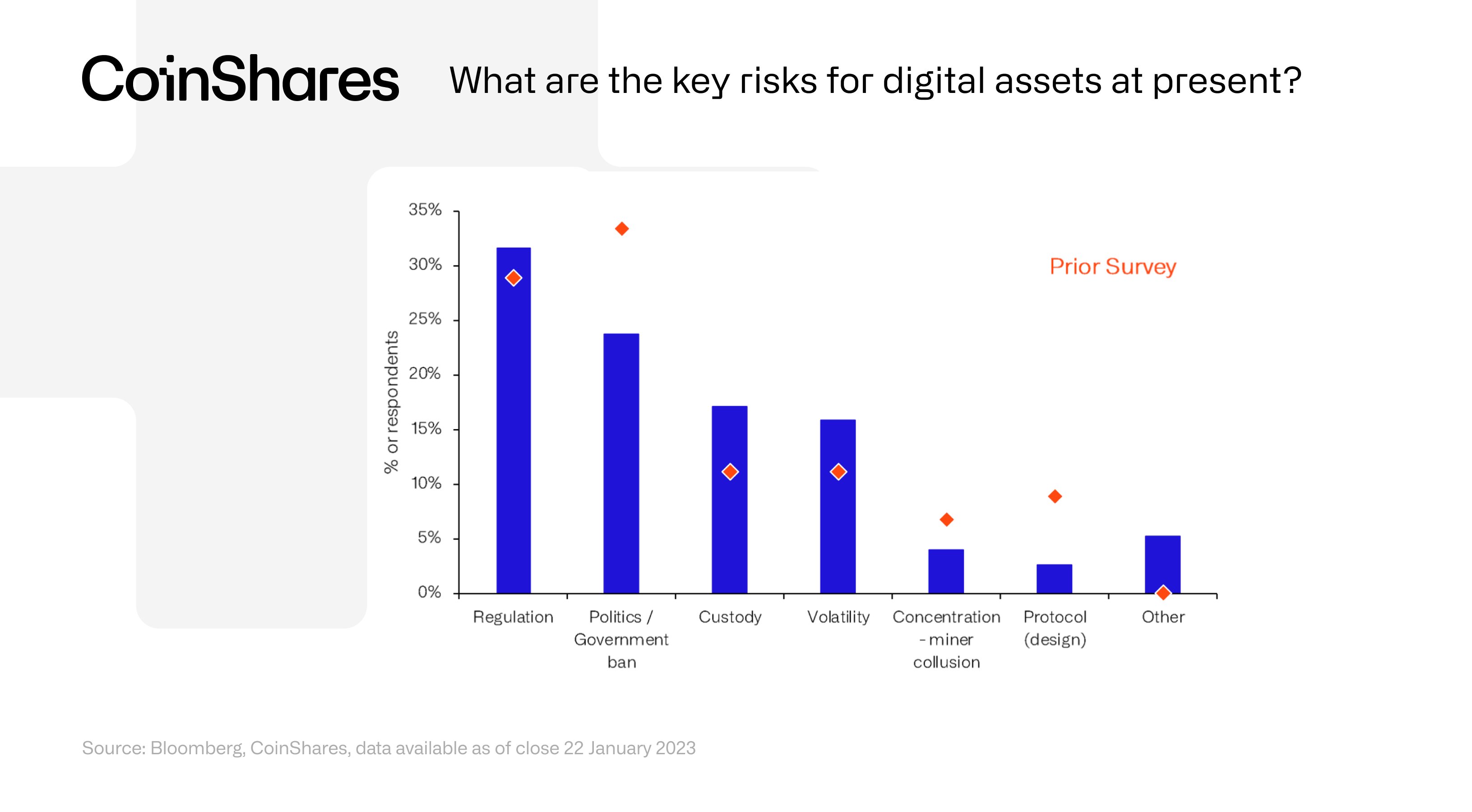

Buyers are additionally much less involved about an outright ban on crypto for the reason that final survey.

“Regulatory considerations have elevated, though far few count on political blockers and a authorities ban. This implies traders see regulation being the answer quite than an outright ban.”

At time of writing, Ethereum is altering fingers at $1,595.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney