The worldwide cryptocurrency market dimension was valued at $1.49 billion in 2020 and is projected to achieve $4.94 billion by 2030. In response to the most recent estimates, there are greater than 17000 cryptocurrency tokens out there on the earth. A rise within the want for operational effectivity and transparency in monetary cost techniques, information safety, and improved market cap are the main elements that drive the expansion of the worldwide cryptocurrency market. The variety of altcoins available in the market has exploded, and with Ethereum hitting its all-time highs in 2021, the longer term seems promising as extra adoption of blockchain know-how takes place.

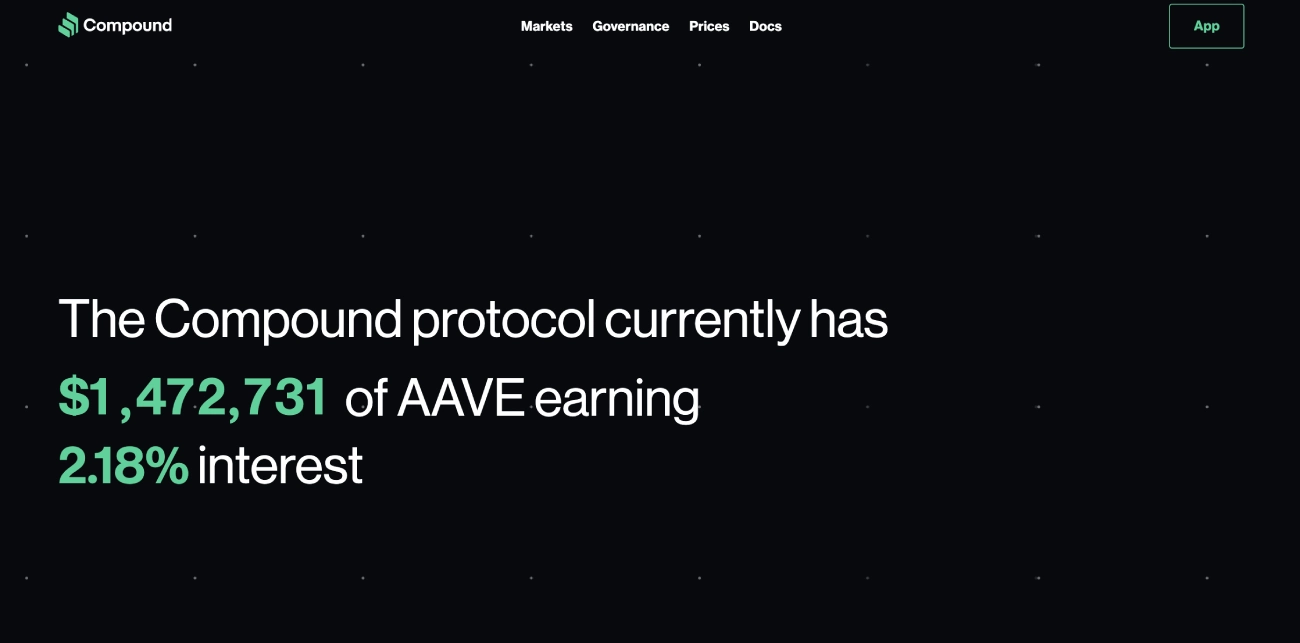

One such DeFi protocol and altcoin with large potential is Compound (COMP). Compound is an open-source platform for decentralized lending operating on the Ethereum community. It collateralizes crypto belongings to offer varied monetary providers and is powered by COMP, its native ERC-20 token.

Verify the Compound present worth, market cap rank, circulating provide, buying and selling quantity, historic costs, and many others., together with in-depth info on a number of of the largest and fastest-growing cryptocurrencies on CoinStats, the most effective crypto platforms round.

Learn on for our final information on the Compound community and learn to purchase Compound in a couple of easy steps.

Let’s bounce proper in!

Step #1: Choose a Crypto Change

Compound Coin (COMP) tokens can be found on a rising variety of cryptocurrency exchanges. Go to the market web page on CoinStats to view the change platforms supporting COMP. Examine the exchanges’ safety, consumer expertise, charge construction, supported crypto belongings, and many others., to decide on the one with the options you want, equivalent to reasonably priced transaction charges, top-notch safety, excessive buying and selling quantity, an intuitive platform, round the clock customer support, and many others. Additionally, take into account whether or not the cryptocurrency change is regulated by the Monetary Business Regulatory Authority (FINRA) and permits you to purchase COMP utilizing your most well-liked cost methodology.

To commerce cryptocurrencies, you need to use a centralized or decentralized crypto change, so let’s look into the small print of every sort under.

Centralized Change

A centralized crypto change or CEX, equivalent to Coinbase, eToro, Binance, and many others., capabilities as a intermediary between patrons and sellers and costs particular charges for utilizing their providers. Most crypto transactions are performed on centralized exchanges, permitting customers to purchase and promote cryptocurrencies for fiat currencies such because the US greenback or digital belongings like BTC and ETH. Centralized exchanges require their customers to comply with KYC (know your buyer) and AML (anti-money laundering) guidelines by offering some info and private identification paperwork. Nevertheless, the downside of buying and selling on a CEX is that it’s extremely susceptible to hacking or cybersecurity threats.

Decentralized Change

Then again, a decentralized change (DEX), like Uniswap, SushiSwap, Shibaswap, and many others., is a non-centralized different to a centralized change and isn’t ruled by any central authority. As an alternative, it operates over blockchain and costs no charge aside from the fuel charge relevant on a selected blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use good contracts to let individuals commerce crypto belongings while not having regulatory authority. They deploy an automatic market maker to take away any intermediaries and provides customers full management over their funds. This methodology is safer since no safety breach is feasible. Nevertheless, decentralized exchanges are much less user-friendly by way of interface and foreign money conversion. For example, they don’t at all times permit customers to commerce crypto with fiat foreign money; customers must both already personal crypto or use a centralized change to get crypto. One other disadvantage of decentralized exchanges is that it has failed to attain liquidity ranges akin to centralized exchanges. It additionally takes longer to seek out somebody trying to commerce with you as DEX engages in peer-to-peer commerce, and if liquidity is low, you’ll have to simply accept concessions on worth and shortly promote or purchase low-volume crypto.

You’ll be able to listing something on a DEX, which suggests you may have entry to new, in-demand belongings whereas additionally taking over extra danger.

Step #2: Create an Account

After you’ve chosen a cryptocurrency change that fits your funding wants, you need to register with the change utilizing a sound electronic mail or cellular quantity. A hyperlink shall be despatched to your tackle, and you need to click on it to confirm your account. As soon as the account is activated, you need to create an elaborate password, and also you’re good to go.

Some exchanges have strict KYC and AML necessities, and with a purpose to get verified, you need to present private info equivalent to:

- Full identify

- Residential tackle

- Date of Beginning

- ID Doc.

In some circumstances, you may additionally have to add a selfie or endure video verification to finalize the verification course of.

As soon as your id verification is full, it’s beneficial to activate two-factor authentication (2FA) for an additional layer of safety.

Step #3: Deposit Funds

The subsequent step is to deposit funds into your account. Many crypto exchanges assist fiat currencies like USD, EUR, and many others. Merely choose your most well-liked deposit methodology, equivalent to a financial institution switch, wire switch, credit score or debit playing cards, e-wallets, PayPal, and many others., and the foreign money you want to deposit. Faucet on “Deposit Funds,” enter the quantity you wish to deposit and click on “Deposit.”

Some deposit strategies are extraordinarily quick, whereas others, relying on the quantity, require a affirmation from authorities. Bear in mind to judge the charges of various deposit strategies since some have bigger charges than others.

Linking your debit card to your crypto account is advantageous because it permits you to make on the spot or recurring purchases, however bear in mind that it attracts an extra charge.

It’s often free to make a financial institution switch out of your native financial institution accounts, however you must nonetheless double-check along with your change.

COMP could be traded for one more cryptocurrency or a stablecoin; the buying and selling pairs differ between exchanges. So, you need to seek for COMP on the spot market to pick out a pair from the listing of obtainable buying and selling pairs.

Step #4: Purchase COMP

Observe the steps under to position a market order to purchase COMP immediately on the present market worth:

- Click on the search bar, enter COMP, and choose “Purchase COMP” or the equal.

- Choose a buying and selling pair you want to purchase COMP in opposition to.

- Select the cost methodology, the foreign money you want to use, and enter the quantity of COMP or the fiat quantity to be spent. Most exchanges will robotically convert the quantity to indicate you what number of COMP tokens you’ll get.

- Double-check the transaction particulars and click on “Verify.”

- The COMP tokens shall be displayed in your stability as soon as the transaction is processed.

You may as well place a restrict order indicating that you just wish to purchase COMP at or under a particular worth level. Your dealer will ask you the variety of cash you want to purchase and the utmost worth you’re able to pay for every when you’ve positioned an order. The cash will solely seem in your pockets in case your dealer fulfills your order at or under your requested pricing. The dealer could cancel your order on the finish of the day or go away it open if the value will increase over your restrict.

Should you’re planning to maintain your newly bought cash for an prolonged interval, we extremely suggest securely storing them in a {hardware} pockets.

To commerce COMP on spot markets, go to the Commerce web page and seek for the COMP pairs ( COMP/USD or COMP/USDT). Choose the buying and selling pair and test the value chart. Click on “Purchase COMP,” choose the “Market,” enter your quantity or select what portion of your deposit you’d prefer to spend by clicking on the share buttons. Verify and click on “Purchase COMP.”

Congratulations on including Compound Coin (COMP) tokens to your crypto portfolio!

Step #5 (Elective): Retailer COMP

Whereas your COMP tokens could be saved in your brokerage change pockets, consultants extremely suggest storing your valuable cash away from change wallets, as these is likely to be inclined to hacks and interference.

We extremely suggest creating a personal pockets with your individual set of keys. Relying in your investing preferences, you would possibly select between software program and {hardware} wallets:

Software program Wallets

Should you’re trying to commerce COMP recurrently, software program or scorching wallets supplied by your chosen crypto change will swimsuit you. The energy of software program wallets lies of their flexibility and ease of use. A software program pockets is probably the most easy-to-set-up crypto pockets and allows you to simply work together with a number of decentralized finance (DeFi) purposes. Nevertheless, these wallets are susceptible to safety leaks as a result of they’re hosted on-line. So, if you wish to preserve your personal keys in a software program pockets, conduct due diligence earlier than selecting one to keep away from safety points. We suggest a platform that gives 2-factor authentication as an additional layer of safety.

Examples of software program wallets embrace CoinStats Pockets, MetaMask, Coinbase Pockets, Belief Pockets, and Edge Pockets, amongst others.

{Hardware} Wallets

{Hardware} or chilly wallets are often thought of the most secure option to retailer your cryptocurrencies as they provide offline storage, thereby considerably decreasing the dangers of a hack. They’re secured by a pin and can erase all info after many failed makes an attempt, stopping bodily theft. {Hardware} wallets additionally allow you to signal and ensure transactions on the blockchain, supplying you with an additional layer of safety in opposition to cyber assaults. These are extra appropriate for skilled customers who personal giant quantities of tokens.

Ledger {hardware} wallets are arguably probably the most safe {hardware} wallets letting you securely handle your digital belongings. The Nano X is designed for superior customers and affords extra space for storing and superior options than Ledger Nano S, designed for crypto novices.

A {hardware} pockets is dearer than a scorching pockets, with costs ranging between $50 – $200.

Examples of chilly wallets are Trezor Mannequin T, Ledger Nano X, CoolWallet Professional, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

Step #6 (Bonus Step): Monitor COMP Tokens

The crypto market is risky, and managing your portfolio may get tough in case you maintain a number of belongings. Using a portfolio tracker will aid you preserve observe of your COMP tokens and all of your crypto investments from one platform always. CoinStats affords the most effective crypto portfolio trackers available in the market; you’ll find extra info right here.

You may as well monitor the revenue, loss, and liquidity of COMP throughout a number of exchanges on CoinStats.

CoinStats helps over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It affords charting instruments, analytical information, superior search options, and up-to-date information. Right here you may have the chance to attach an infinite variety of portfolios (wallets and exchanges), together with:

- Binance

- MetaMask

- Belief Pockets

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To attach, go to the CoinStats Portfolio Tracker web page and:

- Click on Add Portfolio and Join Pockets.

- Click on the pockets you wish to connect with (e.g., Ethereum Pockets).

- Enter the pockets tackle and press Submit.

Historical past of Compound

The Compound protocol is constructed on the Ethereum community and is powered by COMP, its native token. COMP is an ERC-20 token designed to reward customers for his or her participation and permit its holders to vote on choices regarding the way forward for the software program.

The Compound (COMP) decentralized finance (DeFi) protocol goals to allow utterly decentralized and autonomous borrowing and lending by means of decentralized purposes. It permits customers to deposit funds they personal into lending swimming pools to earn curiosity on their deposits when different customers borrow them. As soon as lenders deposit cryptocurrency, Compound awards them a brand new cToken, i.e., cETH, cDAI, and cBAT, which may then be traded with out restriction. Nevertheless, they’re solely redeemable for the cryptocurrency locked within the protocol for which it represents.

The Compound protocol runs this complete course of by way of the usage of good contracts, permitting customers to withdraw their deposits at any time they select.

The protocol goals to revolutionize the finance and lending trade by eradicating the necessity for any middlemen or monetary establishments appearing as intermediaries. Compound was the primary platform to introduce yield farming to the market in 2020.

The co-founders of Compound (COMP) are veteran entrepreneurs Robert Leshner and Geoffrey Hayes.

What Is Compound?

The Compound protocol acts as a lending platform/lending pool that connects lenders with debtors utilizing a mix of highly effective good contracts on the Ethereum blockchain.

Compound rewards lenders with its ERC-20 COMP tokens primarily based on the quantity of cTokens held of their wallets and a pre-determined charge. The extra liquidity a selected token has, the decrease the rate of interest generated. Lenders can even take out a mortgage in another cryptocurrency supported by the Compound protocol.

The lending, borrowings, or repayments of money owed on the platform are incentivized by rewarding customers with the Compound tokens. COMP can be a governance token, and every holder of the Compound (COMP) tokens has voting rights in proportion to their holdings. This empowers the customers to take part within the decision-making processes of the platform.

Customers can even get their palms on the Compound tokens on varied cryptocurrency exchanges. The marketplace for Compound tokens and Compound customers has grown by leaps and bounds over the previous few years.

COMP tokens have a complete provide of 10 million and can be found to commerce on many decentralized and centralized cryptocurrency exchanges equivalent to Binance Futures, Binance, Coinbase Professional, and many others.

In response to an evaluation by CoinStats, the COMP token has a market cap of 937 million USD, with $142.88 per token on the time of writing. It has a buying and selling quantity of round $79 million. The value of COMP token reached an all-time excessive of $855.2 on the twelfth of Could 2021, and since then, it has come down by greater than 60 %.

Now, let’s look into methods of shopping for Compound.

Purchase COMP on Binance

One of many best methods of shopping for Comp is on Binance. Binance is amongst exchanges providing the bottom charges within the trade and excessive liquidity, permitting you to promote and purchase digital belongings quickly to make the most of market potentialities.

To purchase Compound (COMP) on Binance, you must create a retail investor account on the platform and confirm your id by importing id proof paperwork. As soon as the retail investor accounts are created and verified, Binance will allow you to purchase Compound (COMP) or another crypto of your alternative both by way of digital belongings or fiat deposits utilizing a credit score or debit card and financial institution switch.

Compound (COMP) is out there on Binance in 3 buying and selling pairs, specifically COMP/USDT, COMP/BUSD, COMP/BTC. Subsequently, you’ll need to first purchase Bitcoin, USDT, or BUSD by way of peer-to-peer buying and selling, a financial institution switch, or a credit score/debit card to buy COMP. You would additionally use the CoinStats app comparability service to pick out what asset you wish to commerce COMP in opposition to.

After getting chosen the asset you want to commerce COMP in opposition to, e.g., USDT (TETHER), the subsequent step is to buy the required quantity of USDT wanted for buying COMP. After you’ve added USDT(TETHER) to your pockets, go to COMP/USDT commerce and purchase as many cash as you want. As soon as the transaction is accomplished and your order has been fulfilled, the brand new cash must be displayed in your pockets.

Purchase COMP on Coinbase

Coinbase is the biggest cryptocurrency change in the USA, supporting roughly 100 cryptocurrencies. Coinbase charges, then again, is likely to be perplexing and better than a few of its rivals. Whereas Coinbase’s security measures are interesting, cryptocurrency buying and selling is very risky, so at all times consider the danger.

This change at the moment permits buying and selling for residents of the USA, besides Hawaii.

Right here is purchase COMP on Coinbase:

Create a Coinbase Account

Should you don’t have a Coinbase account already, you want first to arrange an account and confirm your id. As soon as your account is verified, you’re free to purchase COMP and different cryptocurrencies to construct your crypto portfolio.

Hyperlink a Cost Methodology

After getting created your Coinbase account, the subsequent step is to hyperlink a cost methodology to your account. Select your favored fiat foreign money and cost methodology starting from credit score debit playing cards to financial institution or wire transfers, and many others., relying in your nation. There aren’t any transaction charges on financial institution transfers; nevertheless, you gained’t be capable to withdraw your funds for five days.

Purchase Compound (COMP)

After including funds to your account, click on on “Withdraw” and enter the quantity you wish to purchase Compound for, then go to “Commerce” to decide on your market, e.g., in case you are shopping for from the US, choose “COMP-USD.” Then enter the quantity of COMP you wish to purchase and click on on buy. Your COMP tokens ought to then be mirrored in your Coinbase pockets.

Different Exchanges

Along with Binance and Coinbase, there are loads of cryptocurrency exchanges the place one should purchase, promote, and commerce Compound. The steps for getting COMP or different cryptocurrencies on varied platforms are similar to Binance and Coinbase. Most of those exchanges permit for buying crypto belongings by way of credit score/debit card or a financial institution switch. The buying and selling charges on exchanges could differ, so be certain to match them earlier than deciding the place to purchase Compound(COMP).

Storage of Compound Tokens

When you’ve efficiently managed to purchase COMP, the subsequent query is the place you must maintain COMP. Most customers go away their crypto on the exchanges’ wallets, i.e., Binance’s and Coinbase’s scorching wallets. Main exchanges equivalent to Coinbase and Binance preserve most of their customers’ tokens offline to keep away from hacks. Nevertheless, if you wish to put your thoughts comfy and preserve your cryptocurrencies as safely as attainable, a {hardware} pockets is maybe the most suitable choice.

Sorts of Cryptocurrency Wallets

There are two types of wallets: Software program Wallets or scorching storage wallets (digital) and Chilly Storage wallets, also called {Hardware} Wallets (bodily). Each have their benefits and downsides:

Software program Pockets: A software program pockets, also called a Scorching Pockets, is related to the web always. A number of software program wallets can be found free of charge obtain from the App Retailer or Google Play. Take into account some great benefits of the CoinStats Pockets, which helps you to purchase or observe your crypto from a single place.

Though software program wallets supply substantial safety, they’re nonetheless susceptible as a result of they provide on-line storage.

{Hardware} Wallets: {Hardware} wallets, also called Chilly Wallets, are a safer different. A {Hardware} pockets is a safe type of storing your personal keys offline, thereby decreasing the probabilities of a hack. Keep in mind that recovering your funds is likely to be unattainable in case you lose your personal key.

The preferred {hardware} wallets are Ledger Nano X, Ledger Nano S, Trezor Mannequin T, and many others.

There is no such thing as a proper or mistaken reply in terms of figuring out which crypto pockets is right for you. The perfect possibility for you is outlined by your typical buying and selling patterns and the extent of safety in your circumstances.

Disclaimer: The data contained on this web site is supplied to you solely for informational functions and don’t represent a suggestion by CoinStats to purchase, promote, or maintain any safety, monetary product, or instrument talked about within the content material, nor does it represent funding recommendation, monetary recommendation, buying and selling recommendation, or another sort of recommendation.

Cryptocurrency is a extremely risky market, do your unbiased analysis and solely make investments what you may afford to lose. Efficiency is unpredictable, and the previous efficiency of COMP is not any assure of future efficiency.

There’s a excessive danger concerned in buying and selling CFDs, shares, and cryptocurrencies. You need to take into account your individual circumstances and take the time to discover all of your choices earlier than making any funding.