As we conduct analysis into Proof-of-Stake (POS) and develop a suggestion for Zcash, an excellent key space is how the issuance schedule for brand spanking new ZEC would work together with PoS safety. On this put up, we take a step again from PoS itself, and analyze how issuance and costs help long-term community sustainability. We introduce a proposal, which we name the Zcash Posterity Fund (ZPF), for modifying ZEC issuance with a purpose to enhance long-term monetary sustainability of the community, whereas sustaining the 21M ZEC provide cap and approximate issuance price. This proposal is impartial from PoS or any consensus protocol suggestions and might be adopted with the present PoW consensus protocol with the identical advantages and downsides. We will likely be gathering suggestions from throughout the Zcash ecosystem about this proposal.

We consider this proposal might be a helpful precursor to a few promising strains of growth for ZEC:

- Enhancements to transaction price mechanisms can use the Zcash Posterity Fund to enhance resilience and predictability of the community.

- A transition to PoS can depend on this proposal to make sure key properties of the provision and issuance schedule are preserved.

- New performance resembling Zcash Shielded Belongings can use this proposal for brand spanking new price mechanisms which have good incentive alignment for ZEC sustainability.

As a result of all three of those nascent enhancements are underway, we wish to float this proposal now to see if it will possibly profit all three efforts.

Moreover, this proposal introduces a strategy to direct funds in the direction of sustaining the community into the long run, so adopting the proposal earlier permits that funding mechanism to start accruing worth earlier.

The core innovation of Bitcoin which all cryptocurrency inherits is that the community funds itself. In Bitcoin, Ethereum, and plenty of public crypto networks, the built-in funding is paid out to dam producers. In Zcash, this funding is cut up between block producers and the Zcash Improvement Fund, which contributes to schooling, expertise growth, and different actions that help and improve ZEC.

Usually, funding to help a community can both come from throughout the protocol itself, for instance in mining rewards, or from different sources, resembling when a company has raised capital elsewhere and funds growth work on the protocol or merchandise.

Exterior funding is vital and may have a big affect. Nevertheless, there’s no assure when or the place these sources will seem, that these funding sources have incentive alignment with ZEC holders, or that they may stay as reliable sources of funding over an extended interval. For all of those causes, we consider it’s vital for ZEC customers to deal with sustaining or bettering the intrinsic sustainable funding mechanisms within the protocol itself.

This put up and the Posterity Fund proposal deal with the sources and quantities of community funding and are agnostic as to the recipients, so they’re relevant to the present mining & Dev Fund construction of ZIP-1014, or future adjustments to infrastructure & growth funding, consensus mechanisms, or different adjustments to funding recipients.

We suggest a change to the Zcash issuance system we name the Zcash Posterity Fund to assist cut back uncertainty about the long run sustainability of Zcash whereas sustaining the important thing properties we consider most ZEC customers prioritize. The proposal maintains these properties (together with their advantages and downsides):

- The 21M ZEC provide cap,

- A disbursement price that repeatedly halves each 4 years,

- A non-discretionary issuance price.

In the meantime, this proposal would change these excessive degree options from the present Zcash design:

- The halving epochs would get replaced by a easily declining disbursement curve,

- Charges which deposit into this mechanism can be distributed over time in block rewards.

Zcash Posterity Fund definition

The particular excessive degree definition of the Zcash Posterity Fund proposal is as follows:

If the proposal is activated, a brand new Fund can be completely managed by the protocol. (There aren’t any personal keys, wallets, people, or organizations controlling this protocol-managed Fund.)

The preliminary steadiness of the Fund when created is the same as the variety of not-yet-issued cash, or equivalently 21M ZEC minus the present excellent provide.

Ranging from the block of activation, the present block reward guidelines now not apply, and as an alternative block rewards come from ZPF Disbursements.

The proposal doesn’t outline the recipients of disbursements, which ought to stay unchanged if this proposal is accepted. In the meantime, the proposal does prohibit the quantity of disbursement:

- Disbursements could also be not more than a set share, X%, of the Fund’s present steadiness in a given block.

- The parameter X% is calculated from the block goal time in order that with none incoming Fund deposits, the steadiness of the Fund reduces to half over a 4 12 months interval.

- If future adjustments to consensus guidelines alter the block goal time, or different features of transaction finalization timing, these adjustments should replace this X% parameter to suit the “4 12 months half life” rule to the very best sensible approximation for that new protocol.

- Future consensus adjustments mustn’t alter the steadiness of the Fund aside from by instituting new deposits from the extant provide.

- Future consensus adjustments mustn’t improve the disbursement price X% past the “4 12 months half life” rule.

The ultimate piece of the ZPF proposal is that it now turns into doable to switch Funds from the circulating provide again into the Fund by way of Deposits. Future protocol-enforced price mechanisms could require charges to do that. This base proposal isn’t particular to any specific deposit mechanisms.

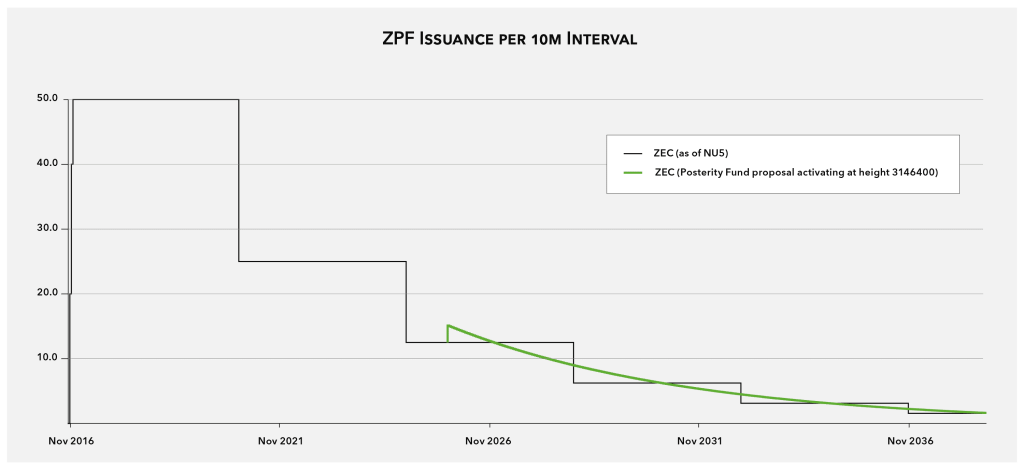

Visualizing adjustments to issuance & provide schedules

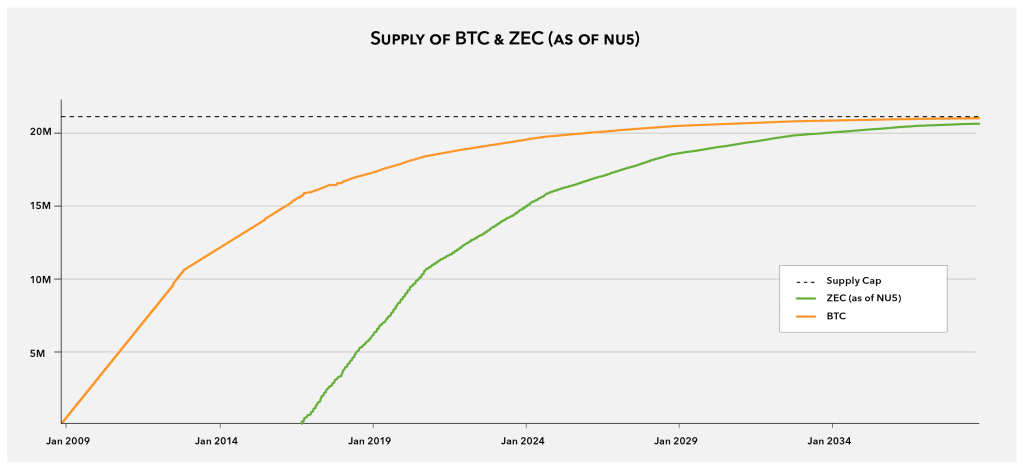

If this variation have been adopted and there have been no deposits, the disbursements would alter issuance away from halvings right into a clean curve. We are able to visually examine present issuance to disbursements with out deposits for a hypothetical activation top:

This makes use of a hypothetical activation top after the second halving.

If there are important deposits into the Fund, the slope of the disbursement curve can be elevated above the road proven. In any interval with out deposits, the curve would proceed to have the identical price of exponential decay with a damaging slope.

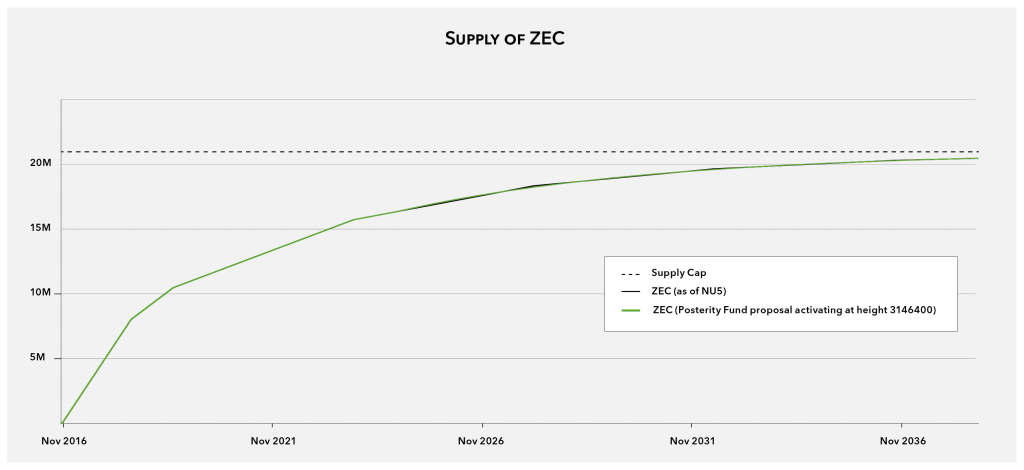

The affect on the general provide schedule within the absence of deposits is barely seen at a very long time scale:

This chart makes use of the identical hypothetical activation top because the earlier chart.

Within the presence of deposits, the provision will at all times be equal or lower than the road above. With ample deposits the provision progress price may even turn out to be damaging throughout that interval.

The Posterity Fund and sustainability

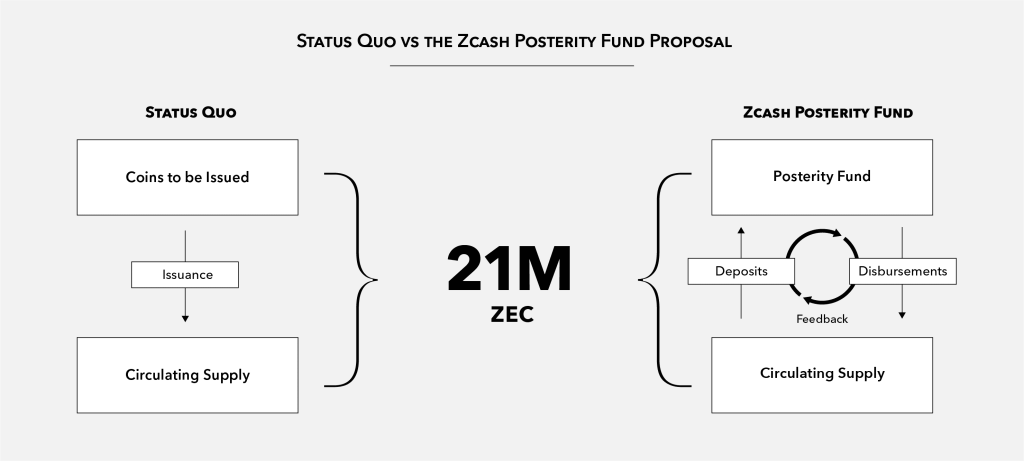

The important factor of the Posterity Fund is to allow deposits from the circulating provide, which permits a suggestions loop from present utilization to future funding:

Each the established order and this proposal have a capped provide of 21M. We are able to consider the proposal as introducing a single new factor, deposits, which allow a suggestions loop between the circulating provide and future funding.

This doesn’t “remedy” long run sustainability by itself, nevertheless it supplies a framework that focuses the issue of sustainability on discovering ample sources of deposits to keep up the community. If over longer time scales of years, the speed of deposits is the same as or bigger than payouts, the system can run indefinitely. In the meantime, if over shorter time spans of months or much less, the deposits are beneath the payout price, the protocol can climate that interval for fairly a while.

Sustainability of the established order

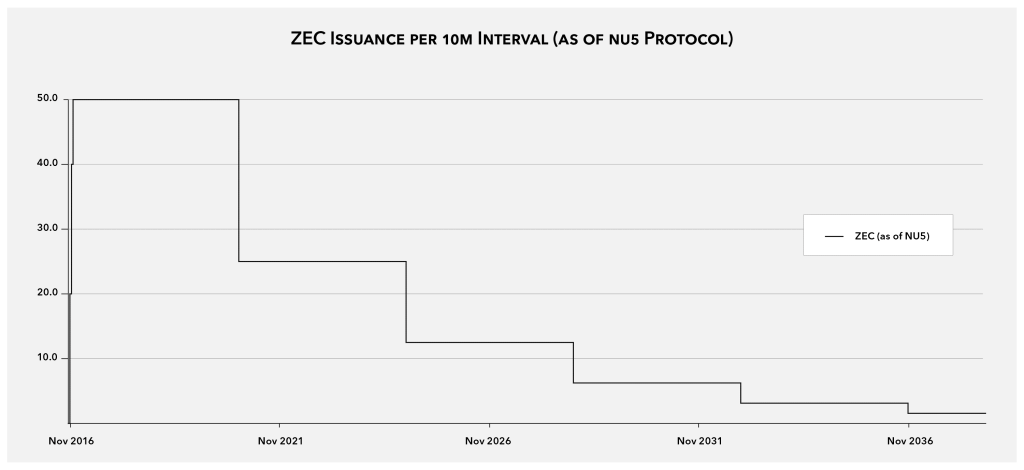

To date the Zcash community funds itself utilizing the Bitcoin design. New cash are issued on a schedule that approaches a restrict of 21M items over time:

The issuance over time follows the Bitcoin halving schedule design:

Challenges with the established order

As newly issued cash are circulated to customers, the quantity of future issuance is depleted to keep up the 21M ZEC cap. As this quantity dwindles, community funding should come from different sources and the one different present supply is transaction charges paid on to miners.

Transaction charges are depending on transaction demand, which is extremely unpredictable. We consider transaction demand can typically turn out to be dominated by exterior occasions resulting in spikes or troughs of utilization. This can be ameliorated when there’s a massive diffuse community of customers, however even on the scale of world economies there are extrinsic occasions that trigger fee demand to fluctuate in a extremely correlated, but unpredictable, style. Anchoring the operation of the community to the unpredictability of transaction demand makes it troublesome to foretell how resilient the community will be, which interferes with long run dedicated planning. That is vital for customers and particularly for the community infrastructure operators themselves, who have to determine the right way to make investments capital into infrastructure enhancements.

A further wrinkle for Proof-of-Work and probably different non-finalizing protocols, typically referred to as “price sniping”, is that with direct charges as the one income supply, there’s a miner incentive to rollback blocks with massive price transactions to place these charges into their very own block. This might derail protected progress of the chain.2

The Zcash Posterity Fund proposal addresses this uncertainty by smoothing out disbursements over time. Whereas it doesn’t assure that deposits will likely be sufficient to keep up or develop the Fund steadiness to maintain the community indefinitely, it removes brief time period uncertainty concerning the price of disbursements. This permits customers, infrastructure operators, and growth fund recipients to decide to long term plans which makes the community itself extra resilient.

These sorts of issues, and this sort of proposal, are additionally current in Bitcoin and have been mentioned all through its historical past. The Bitcoin OpTech publication summarizes a current dialogue about these points amongst Bitcoin builders.

Sustainability of deposits

The Zcash Posterity Fund design reduces community sustainability to a query of ample deposits. If deposits over a while interval are higher than disbursements, the community is “paying it ahead” and supporting future operation and growth. If these deposits are smaller than the disbursements, the community is depleting its assets to proceed its present operation and growth. So with this framework, the important thing focus for community sustainability is discovering a design and utilization that contributes ample deposits over time on common.

Deposits can come from numerous charges for utilizing the community. A simple instance can be to require a portion of present transaction charges to be deposited into the Fund with the rest going to the miner.

If this proposal have been adopted, the neighborhood may observe the development of whether or not or not deposits over a protracted sufficient time window outpace disbursements. If they’re beneath disbursements and there’s concern concerning the Fund steadiness dwindling too low3, the neighborhood would have some period of time to seek out sources of bigger deposits.

Discovering extra deposits would possibly come from a wide range of methods. We observe that for any set of options, performance, and use instances, rising the community capability would decrease transaction charges on common, which may entice extra utilization of the present use instances. As long as the present use instances have some traction and a few price of natural progress restricted solely by value, rising community scalability could typically be a very good choice. Other than that basic technique, rising utilization by bettering current merchandise and use instances, creating performance for brand spanking new use instances, and advertising and marketing to potential new customers of current use instances could all be good methods.

Now that we’ve shared this proposal, our intent is to collect neighborhood suggestions and carry out market analysis on this proposal. If the proposal appears to have large help, we’d construct on that understanding in a number of methods:

- We’d tailor our Proof-of-Stake analysis with an assumption that the Zcash Posterity Fund would constrain the design of issuance. With out apparent help for the Posterity Fund proposal, the right way to adapt ZEC issuance to PoS protocols stays a extra open ended query.

- We’d start refining this high-level proposal right into a concrete Zcash Enchancment Proposal.

- We could produce a follow-on proposal for altering transaction charges to enhance resilience, UX, and privateness, much like this proposal (Zcash ticket #3473).

- We’d encourage new protocol proposals that affect ZEC tokenomics to contemplate integrating some type of deposit mechanism. The distinguished instance is Zcash Shielded Belongings.

Do you might have suggestions or questions on this proposal? Tell us by discussing on this discussion board put up devoted to the Zcash Posterity Fund proposal.

- All the issuance/disbursement and provide charts have been generated utilizing this code.

- This concern was first expressed to me by Greg Maxwell at Scaling Bitcoin in Montreal. This concern could also be particular to any dynamically accessible protocol, and could also be addressed by finalizing protocols. It might even be addressed by completely different price mechanisms as this text proposes.

- When the fund steadiness is massive, it’s in all probability acceptable to permit disbursements to outpace deposits: we are able to consider this as utilizing a portion of the max provide to subsidize a decrease value of utilization (e.g. decrease transaction charges) for the present customers to stimulate adoption and progress.