Whereas the Ethereum neighborhood prepares for the upcoming Shanghai onerous fork in March, the event staff for the liquid staking undertaking Lido revealed plans to create an in-protocol withdrawal function. Lido’s staff is looking for neighborhood suggestions on the proposal that will enable withdrawals after the Shanghai improve is accomplished.

Lido Dominates Defi Economic system With $7.9 Billion in Complete Worth Locked, Group Prepares for Shanghai Withdrawals

As of the time of writing, the decentralized finance (defi) liquid staking protocol Lido is essentially the most dominant defi protocol right this moment, when it comes to whole worth locked (TVL). Statistics from defillama.com present that Lido’s $7.92 billion TVL dominates the $46.56 billion TVL held in defi right this moment by roughly 17.01%.

Lido is the biggest holder of staked ethereum because the protocol instructions round 29% of the staked ether provide. Lido’s ethereum spinoff token STETH is the thirteenth largest market valuation within the cryptocurrency financial system with $7.73 billion. Moreover, Lido has a governance token known as lido dao (LDO), which has a market capitalization of round $1.96 billion on Jan. 25, 2023. The day prior, Lido’s improvement staff revealed a proposal regarding withdrawals after the Shanghai improve.

Ethereum builders are decided to make the Shanghai onerous fork occur this March and the primary focus is permitting staked withdrawals. “The design proposed by Lido on the Ethereum Protocol Engineering staff addresses these challenges with the in-protocol withdrawal requests queue,” the Lido staff explains in a abstract of the withdrawals panorama by way of the Lido protocol. “The method must be asynchronous, as a result of asynchronous nature of ethereum withdrawals,” the Lido builders add.

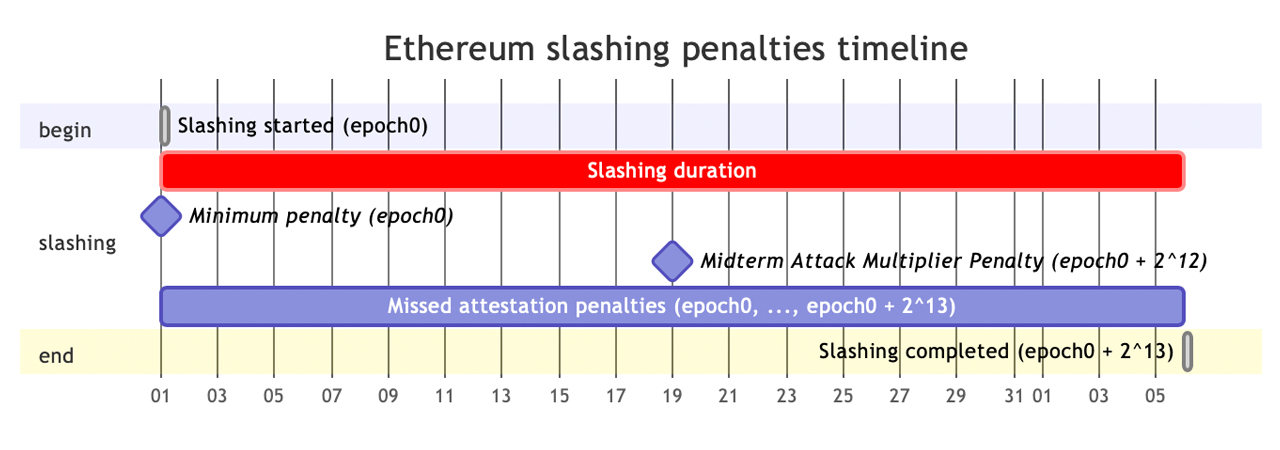

The Lido builders clarify there can be numerous modes of withdrawals together with a “turbo” function and a “bunker” function. Additional penalties and slashing can be codified for validators that break the foundations. The abstract explains how slashings have an effect on a person’s withdrawal request success.

“We’re looking for the neighborhood’s suggestions to ensure that our proposal takes all vital issues under consideration and to determine any potential enhancements,” the Lido staff particulars. “Your suggestions is invaluable to create a proposal that’s efficient, environment friendly, and honest for all stakeholders.”

What are your ideas on Lido’s proposal for in-protocol withdrawal requests and the upcoming Shanghai onerous fork? Do you suppose this function can have a big affect on the crypto and defi market? Share your opinions within the feedback beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.