With the crypto financial system experiencing important good points over the previous week and the worth of ethereum rising 11.9%, the market capitalization of Lido’s staked ether has elevated to $10.3 billion. This current enhance has propelled the token’s total market valuation to the ninth-largest place, in accordance with the crypto market capitalization aggregation web site coingecko.com.

Lido Finance’s TVL Dominates Defi with a 21.59% Share

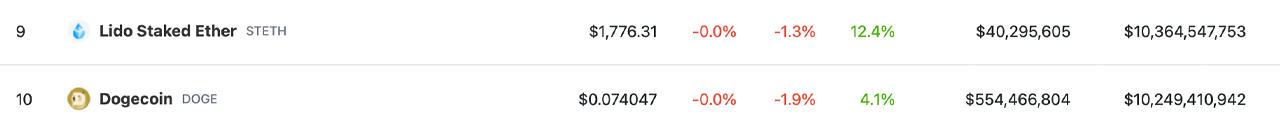

The worth of liquid staking tokens related to ethereum (ETH) has elevated considerably during the last week following ether’s 11.9% good points towards the U.S. greenback. Particularly, Lido’s staked ethereum token, STETH, now has a market capitalization above the $10 billion vary, reaching $10.36 billion on Monday, March 20, 2023. In keeping with coingecko statistics, STETH’s market valuation now ranks ninth, with dogecoin’s (DOGE) market capitalization holding the tenth place.

Above STETH is the market valuation of polygon (MATIC) at $10.42 billion. At present, there’s a circulating provide of round 5.8 million STETH, and over the previous 24 hours, the token has recorded $22.35 million in world trades. Probably the most energetic exchanges coping with STETH on Monday are Bybit, Gate.io, and Huobi. STETH has gained 12.4% this week and 4.6% over the previous 30 days.

At present, Lido Finance’s web site estimates that STETH stakers are receiving round a 5.9% annual share price (APR) by staking the token. On the time of writing, Lido is the biggest decentralized finance (defi) protocol out of the $49.01 billion whole worth locked (TVL) on Monday. Lido’s TVL accounts for 21.59% of the complete quantity of worth locked in defi. Within the final seven days, defillama.com statistics present that Lido’s TVL has elevated by 8.9%, and over 30 days, it has grown by 17.07%.

Defillama.com explains that on Monday, 7.83 million ETH value $13.98 billion is staked in liquid staking protocols at this time. Lido’s STETH represents 74.51% of the mixture. Coinbase’s Wrapped Ether token protocol has $2.1 billion in whole worth locked, or 1.16 million Ethereum. It’s the second-largest liquid staking challenge by way of TVL.

Whereas STETH is proven on coingecko.com because the ninth-largest coin by market cap, this isn’t the case with different crypto market aggregation websites like coinmarketcap.com. As a result of it’s an artificial model of Ether, some crypto market aggregation websites don’t embrace STETH within the prime ten, regardless of its capitalization dimension.

What are your ideas on the rising market capitalization of STETH and its function within the rising liquid staking ecosystem? Do you assume STETH will proceed to climb up the rankings of the highest cryptocurrencies? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons