In 2018 myself and my good buddy and colleague Kyle Crystal of Lakeshore Technical Evaluation wrote a collection of White Papers on the historical past, building and use in technical evaluation of Andrews Pitchfork that was printed within the Society of Technical Analysts of their quarterly publication. Over the subsequent a number of weeks I will likely be publishing these within the Markets Compass Substack Weblog.

It’s the authors’ intent in penning this preliminary weblog put up is to attract a timeline that serves to explain the evolution of Median Line Evaluation and briefly contact on those that have contributed to the event of what we all know at this time as Andrews Pitchfork. In additional blogposts I’ll dig deeper into building and evaluation of Andrews Pitchfork. The historical past of Andrews Pitchfork might depart impatient merchants bored and chomping on the bit for the Development and Evaluation sections however researching and understanding the event over tons of of years left the authors with a deeper understanding of why this time and worth device is invaluable.

Though the technical methodology often known as Median Line Evaluation as we all know it at this time is rightly attributed to Dr. Alan Andrews, it needs to be recognized that it discovered its genesis tons of of years earlier than his time. That stated, it was he who introduced it ahead to the examine of shares, bonds, currencies and commodities and his in depth evaluation and research are the idea of what’s now known as Andrews Pitchfork. It has been elaborated on since his passing by a number of of his college students who studied immediately with him and by a lot of discovered and gifted technicians who’ve, refined, and studied it in live performance with different indicators. It has been stated his disciples who have been grain merchants have been accountable for attaching the moniker Andrews Pitchfork to the method. It’s my intention on this “Half One” to inform a short historical past of the event of what we imagine is an underutilized technical device that belongs in each analyst’s toolbox.

No that’s not an image of Roger Daltry. Sir Issac Newton was unquestionably one of the sensible scientists to have ever lived. He was born prematurely on Christmas Day 1642 (Julian Calendar) in Woolsthorpe close to the village of Colsterworth, seven miles south of Grantham in Lincolnshire County, England. He was named after his father who had died 3 months earlier than he was born and was so tiny nobody anticipated him to reside. His mom remarried and forged him apart when he was three to be raised by his grandfather. When his stepfather died, he returned to his mom’s facet when he was 10 years of age along with her stepson and two step daughters shifting again to his household’s dwelling in Woolsthorpe.

When he was twelve his mom despatched him away once more however this time it was to attend King’s Faculty in Grantham. He boarded within the dwelling of an apothecary in a small attic room. It was throughout this era that he developed into what Richard Westfall in his ebook on Newton known as “A Sober, Silent, Considering Lad”. He developed an curiosity in science and fervour for chemistry residing above that apothecary store.

After a tough begin at King’s Faculty he started to excel academically which led to Newton discovering himself at Trinity Faculty in Cambridge in 1661. It was his time at Cambridge that he developed an extended record of scientific understanding. What follows are two of the numerous discoveries that have been part of the genesis of what turned Median Line Evaluation.

Most of those that have been accountable for the Scientific Revolution studied Hermeticism. These three wisdoms of the entire universe, alchemy, astrology, and theurgy performed a significant position within the development of physics, astronomy, arithmetic and pure sciences. There are three main Airtight texts or doctrines (there are 47 scared texts in whole which can be recognized of) which were attributed to Hermes Trismegistus, a syncretic mixture of the Greek god Hermes and the Egyptian god Thoth. Of the three main teachings we flip our consideration to The Emerald Pill which can have been one of many earliest alchemical works that survives and was translated quite a few instances by many alternative authors from many cultures. Our focus is on a later translation of the textual content by Sir Issac Newton. In his translation, the second verse states, “That which is beneath is like that which is above, that which is above is like but which is beneath”.

Evidently, Newton performed an essential half within the Scientific Revolution, a lot in order that “Newtonian” got here for use to explain the our bodies of data that owed their existence to his theories. In 1669 Newton started work on what is taken into account one of many best scientific books ever written, Philophiae Natrualis Principia Mathematica which was lastly printed in 1687. The tile of the ebook was shortened to Principia, or Ideas in English. The ebook contained Newton’s well-known three legal guidelines of movement together with quite a few different scientific theories. It’s one among three legal guidelines of movement that have been derived by Newton from Johann Kepler’s Legal guidelines of Planetary Movement and his research of The Emerald Pill that was the dawning of the Newton’s Third Legislation, which brings the historical past of median line evaluation ahead. The Third Legislation states that “for each motion, there may be an equal however reverse response”.

Roger Babson was born in Gloucester, Massachusetts on July 6, 1875. His father was Nathaniel Babson, a dry-goods service provider within the metropolis; and his mom was Nellie Sterns whose mom owned a millinery retailer. His was a typical childhood of that interval, though he relates, he was an unruly youngster that suffered whippings by the hand of his trainer as did most youngsters who “acted up” throughout faculty. The primary statistics that Babson compiled even at that early age, have been the file of thrashings that numerous girls and boys acquired in the course of the faculty yr. His rating was forty-seven. This was a doubtful begin, however a begin nonetheless to a famend profession as a statistician, bond dealer, businessman, economist, and author that spanned many years and left a legacy and place of notoriety within the historical past of economic markets. In his detailed ebook titled “Actions and Reactions An Autobiography of Roger W Babson” there are a quite a few shared experiences of his youth, his school life and enterprise profession. We is not going to reiterate all of them, however we’ll share people who we really feel had an affect on his later enterprise years. It was his founding of Babson’s Statistical Group and his long-standing relationship with a professor of engineering, George F. Swain, whom he studied underneath on the Massachusetts Institute of Know-how the place Babson acquired his coaching as an engineer from 1895-1898 and the place the 2 males’s friendship was cast. It’s their philosophical connection that pursuits us and their growth of the conventional or median line.

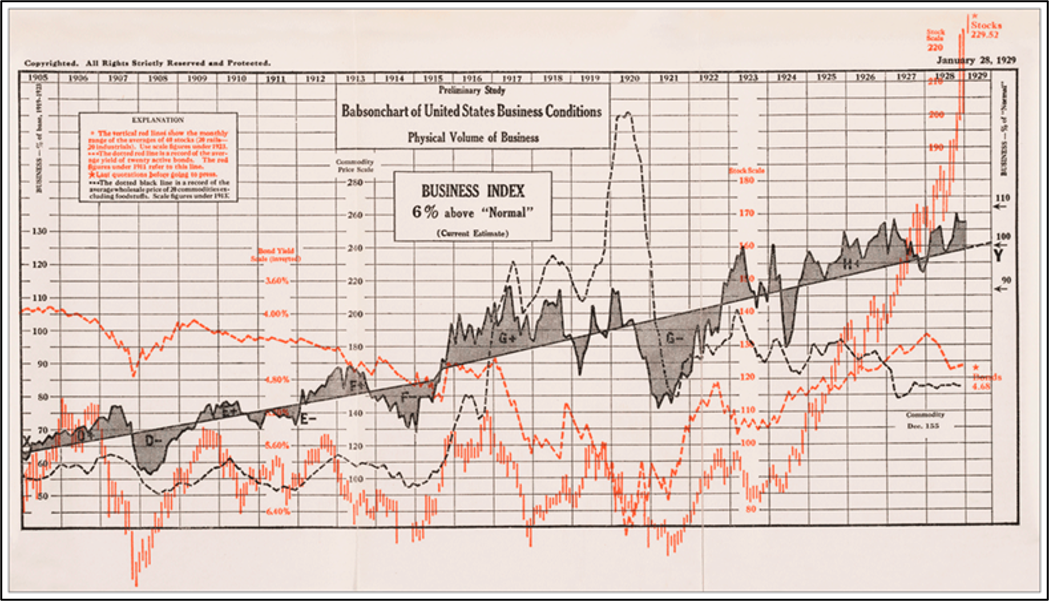

Babson was in New York promoting his bond statistical analytical analysis on the day of the 1907 inventory market crash and was shocked by the massive losses collected by supposed discovered and skilled market professionals. On the time, he had been finding out Benner’s Prophecies of Future Ups and Downs in Costs and How Cash is Made In Safety Funding, believing that there have to be have been a strategy to forecast financial and market adjustments in a extra proactive and fewer reactive method. With these two books and his personal amassed statistical information in hand he sought out his former professor and buddy George Swain. Each concluded that there was the idea in these two books and Babson’s collected information that, when utilized correctly, might forge a brand new technique of forecasting. It was Professor Swain who launched and drew a “regular line” via the historic information within the Babson’s Composite Chart of pig iron, corn and, hogs that will normalize the unstable “zig-zagging” index Babson had been growing. (chart beneath). He additionally advised that Newton’s Third Legislation of Motion and Response might apply to this and different financial indicators, because it does to physics, chemistry, and astronomy. Thus, was the origin of the well-known Babsoncharts that have been built-in into Babson’s Statistical Group’s publications and later analytically led to his well-known well timed prediction of the 1929 crash that was printed in New York Journal.

It was Babson’s additional devotion to the work of Sir Issac Newton that later induced him to create of the Gravity Analysis Basis on the suggestion of Thomas Edison. This suggestion was simply accepted as was revealed in a later essay he wrote known as Gravity- Our Enemy Quantity One, he indicted his want to beat gravity stemming from the childhood drowning of his youthful sister: (“She was unable to battle gravity, which got here up and seized her like a dragon and acquired her to the underside”). It was at one among Babson’s seminars years later that he carried out that illustrated how Newton’s Third Legislation could possibly be utilized to the inventory market when he met Alan Andrews. They turned hardened associates and Babson taught Andrews his motion and response strategies. Out of respect of Babson’s research that he shared with Andrews, he later named his median line course the Motion-Response Course in acknowledgement of his mentor’s teachings.

Though Alan Andrew’s date of start stays unknown, we do know he handed on in 1985. Little is thought of his private life, spouse or youngsters. His father owned a dealer/vendor the place he traded for shoppers and his personal account and is alleged to have made a big amount of cash within the Nice Melancholy. Alan’s father despatched him to engineering faculty at Massachusetts Institute of Know-how after which on to Harvard. The story goes that after he graduated, his father challenged him to make a million {dollars} in a single yr whereas working at his father’s brokerage agency. He didn’t accomplish his father’s job in a single yr, however in two years had made a million {dollars} buying and selling commodities. Andrews later turned a lecturer in civil engineering on the College of Miami in Florida. After he retired, he returned to his roots and determined to not solely handle his personal investments however to show others. He started publishing a weekly advisory publication that he bought by subscription that targeted on his buying and selling strategies and included suggestions for the approaching week. He additionally created the FFES (Basis for Financial Stabilization) Case Examine Course making use of rules of mathematical likelihood to the manufacturing of income from prognostication. It detailed numerous median line strategies and different strategies that together with fan strains which he known as Horn’s of A lot. He bought the course for the tidy sum of $1,500 in the course of the 1960’s and 1970’s. He additionally held seminars and one-on-ones that have been attended by New York and Chicago pit merchants. Andrews additionally typically included his pupil’s observations and research into his work, cautious to call strategies such at Schiff Adjusted Median Line (named after Jerome Schiff a New York dealer who introduced it to his consideration) and Hapogian Traces named after one other one among his college students Dr. Hapogian.

It has not been the authors’ intention to instruct readers within the Historical past of the Growth of Median Line Evaluation on the development of Median Traces or to delve into different guidelines or analytical idiosyncrasies of the completely different strategies or functions of Andrews Pitchfork. These will likely be mentioned within the weblog posts that observe over the subsequent few weeks.