Historical past means that the present Bitcoin (BTC) correction could possibly be the ultimate fakeout to the draw back earlier than the crypto king explodes on a brand new macro bull run, in line with an analyst.

The pseudonymous analyst often called TechDev tells his 417,000 X followers that if previous cycles are an indicator of what’s to come back, Bitcoin’s current crash to the $25,000 stage may act as a spring for a brand new growth up.

“Both the months forward shock the market but once more, or this time is actually completely different.”

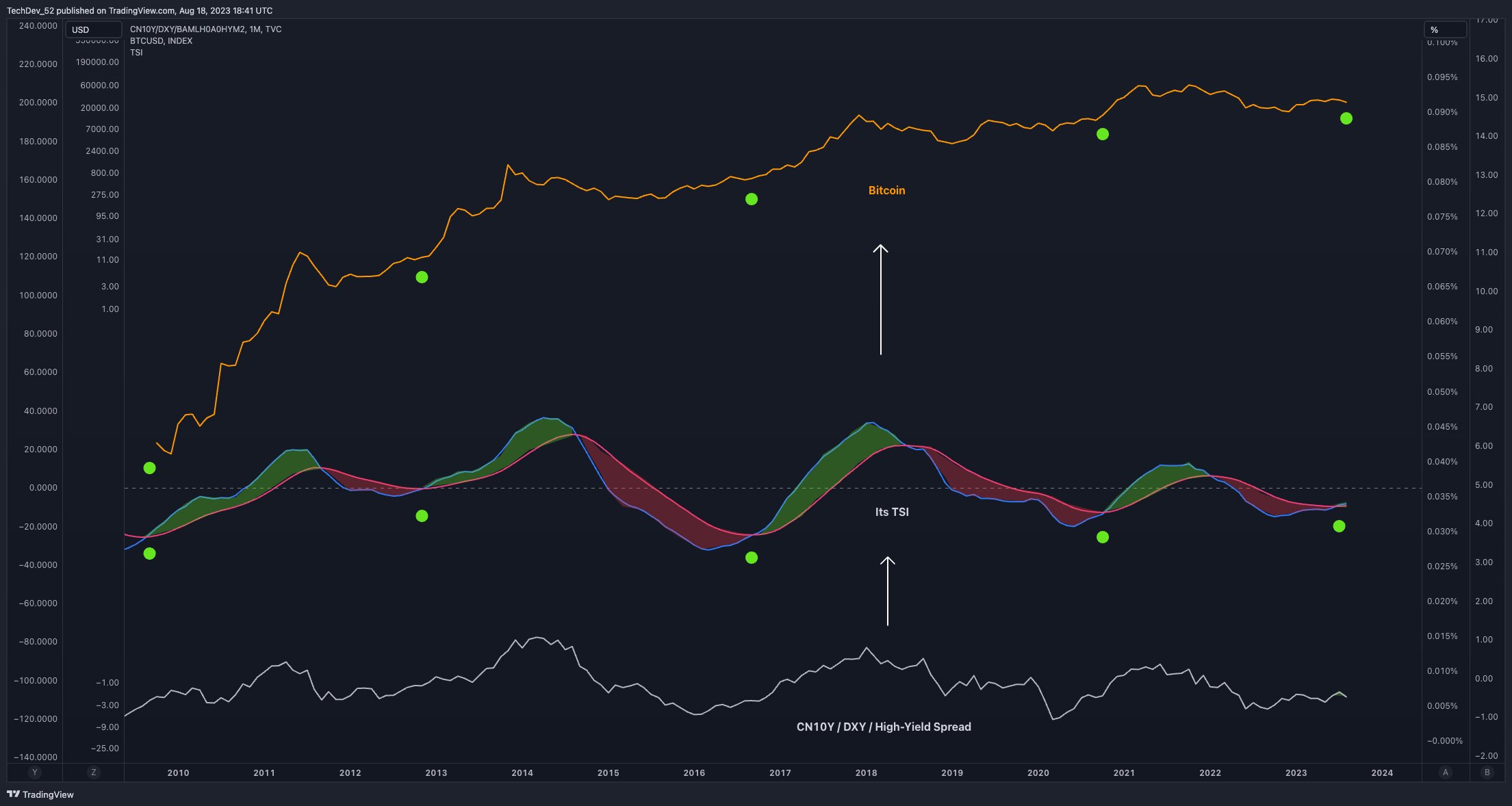

The dealer has been identified to observe the worldwide liquidity cycles, which he portrays by pitting the Chinese language 10-year bonds (CN10Y) in opposition to the US greenback index (DXY). TechDev’s chart seems to be utilizing the true energy indicator (TSI) to gauge the momentum of the CN10Y versus the DXY.

TechDev’s chart means that the TSI is flashing a bullish cross, a technical studying that can also be current firstly of earlier Bitcoin bull markets.

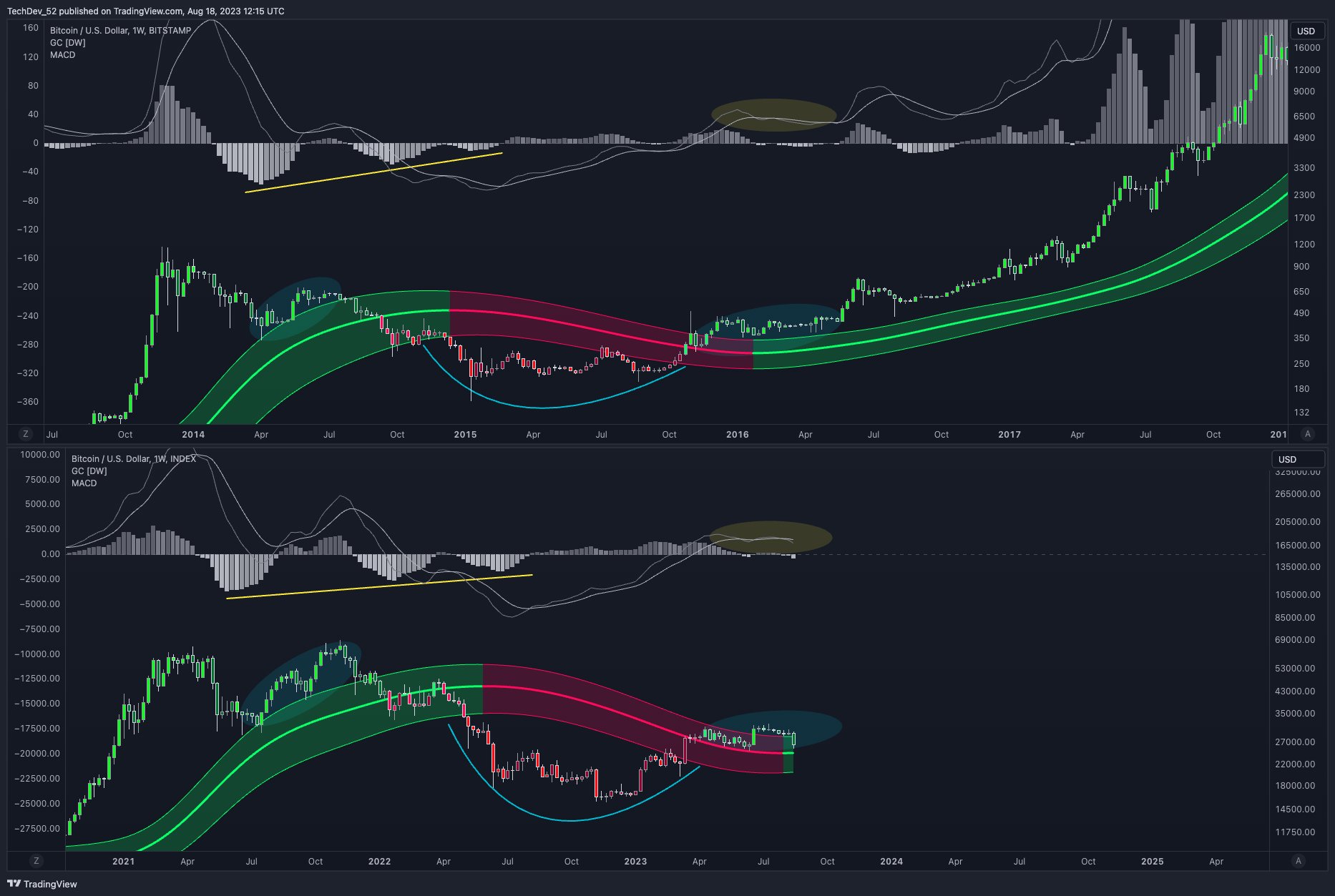

TechDev can also be basing his evaluation on the supertrend indicator, which generates bull and bear alerts primarily based on whether or not the worth breaks earlier open or shut ranges throughout a given interval.

He says that an optimum situation for Bitcoin could be a run-up to the two-month supertrend stage of round $50,000, represented by the crimson line on the chart, earlier than testing assist close to $30,000 or so after which launching right into a parabola.

In response to TechDev, the transfer will allow Bitcoin’s two-month chart to drop to the assist space of the Bollinger bands width (BBW) indicator, a stage which signaled the beginning of the 2017 and 2020 bull markets.

Merchants use the BBW indicator to gauge an asset’s volatility.

Says TechDev,

“Need to see a transfer as much as two-month supertrend + retest to finish two-month compression.”

The analyst additionally makes a comparability between now and 2016, the place BTC spent a number of months above the Gaussian Channel testing it as assist whereas consolidating earlier than shifting into a transparent uptrend.

Primarily based on the comparability, BTC could also be repeating its 2016 restoration by consolidating simply above the Gaussian Channel for a prolonged time period earlier than grinding as much as all-time highs.

The Gaussian Channel is an indicator that makes an attempt to outline the development of an asset.

Says TechDev,

“Keep above Gaussian Channel middle.”

At time of writing, Bitcoin is price $26,116.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney