On Nov. 2, Coindesk sparked crypto historical past’s largest collapse but after it launched the non-public monetary paperwork of Alameda Analysis, a VC and buying and selling agency owned by FTX founder Sam Bankman-Fried and intently tied to the alternate.

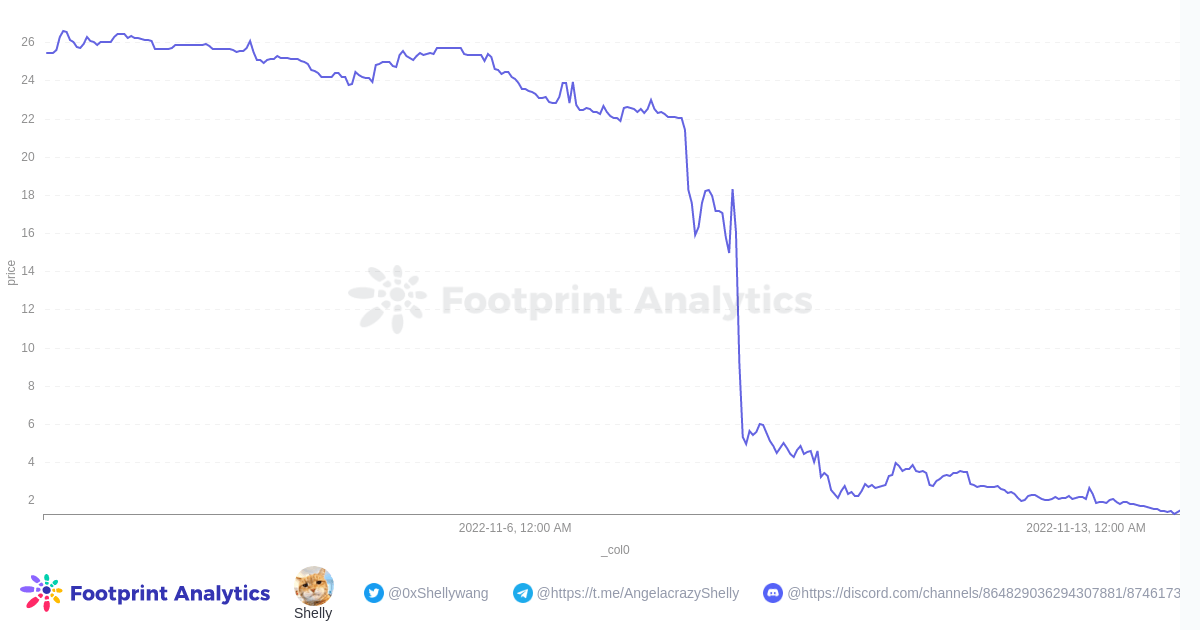

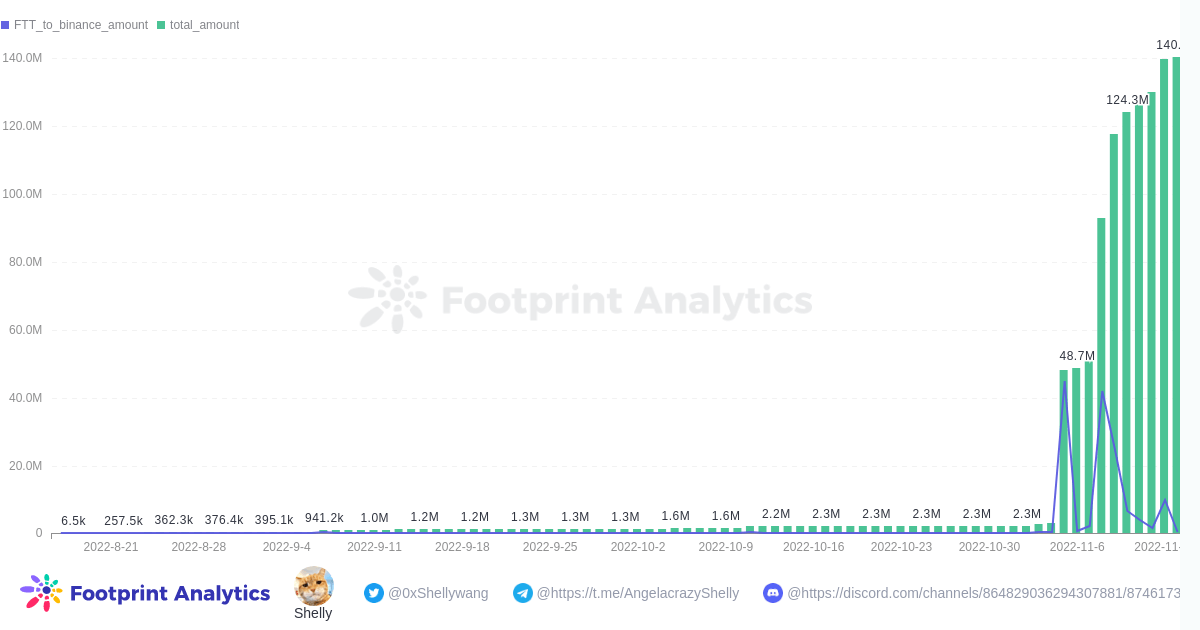

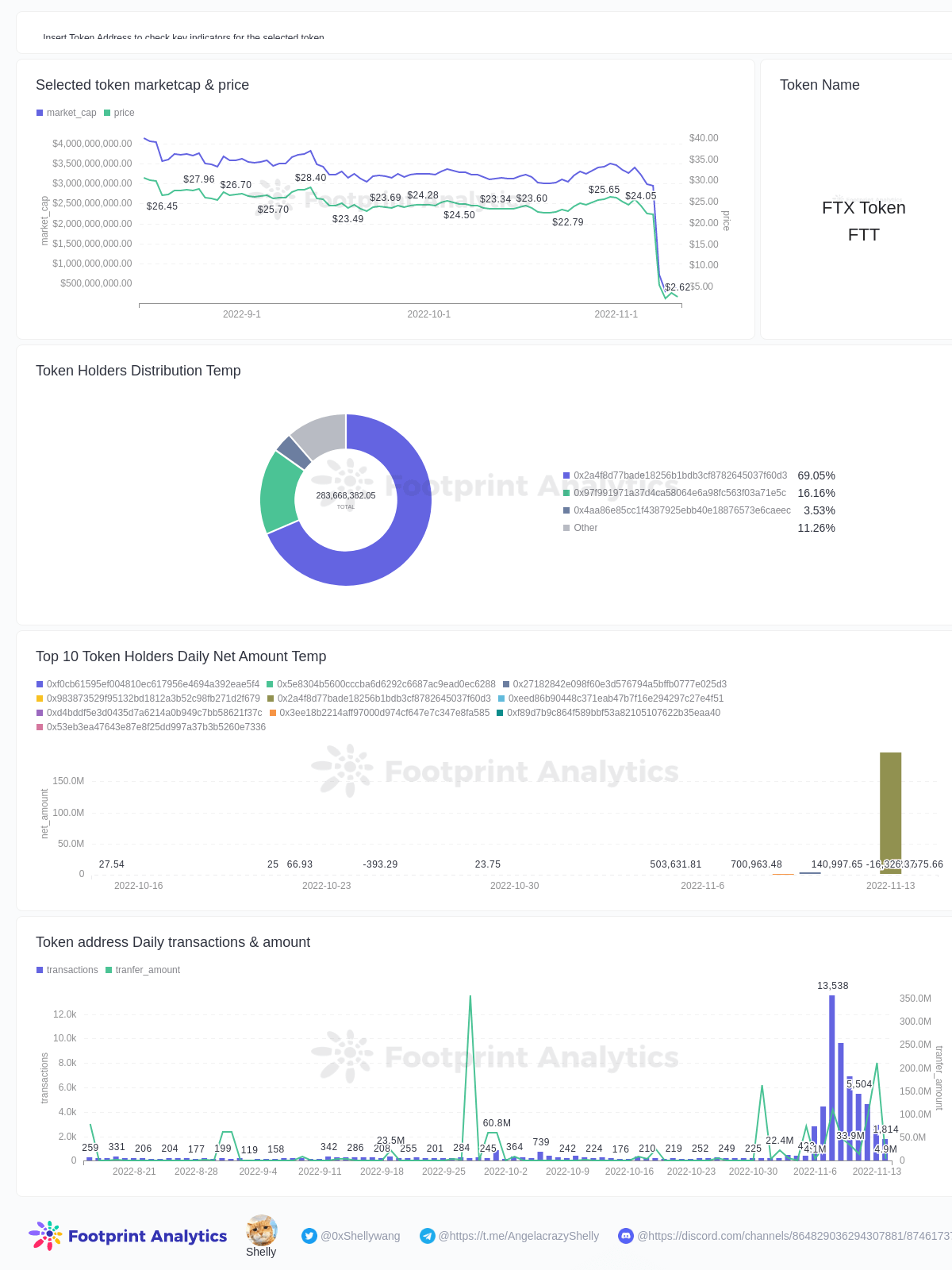

Within the ensuing week, 140M FTT flowed to Binance, and the token fell from $26 to beneath $2. This triggered a run on FTX, a supposed “hack” draining $473 million from the reserves, and the declaration of chapter by the world’s second-largest buying and selling platform.

Abstract of occasions

- Nov. 2: Coindesk releases Alameda’s non-public monetary paperwork.

- Nov. 6: Binance founder CZ posts that Binance will dump all FTT cash on its e-book within the coming months. Alameda CEO Caroline Ellison affords to purchase all of Binance’s FTT holdings at $22.

- Nov. 6: FTT experiences its first sharp drop (10% down) and goes again to $24 after Ellison’s supply.

- Nov. 8: FTX Worldwide suspends withdrawals.

- Nov. 8: FTT plummets to $5

- Nov. 8: Binance broadcasts it may be interested by buying FTX.

- Nov. 11: Acquisition terminated.

- Nov. 11: FTX information for chapter and customers’ funds disappear.

How the FTX collapse impacts your complete crypto market

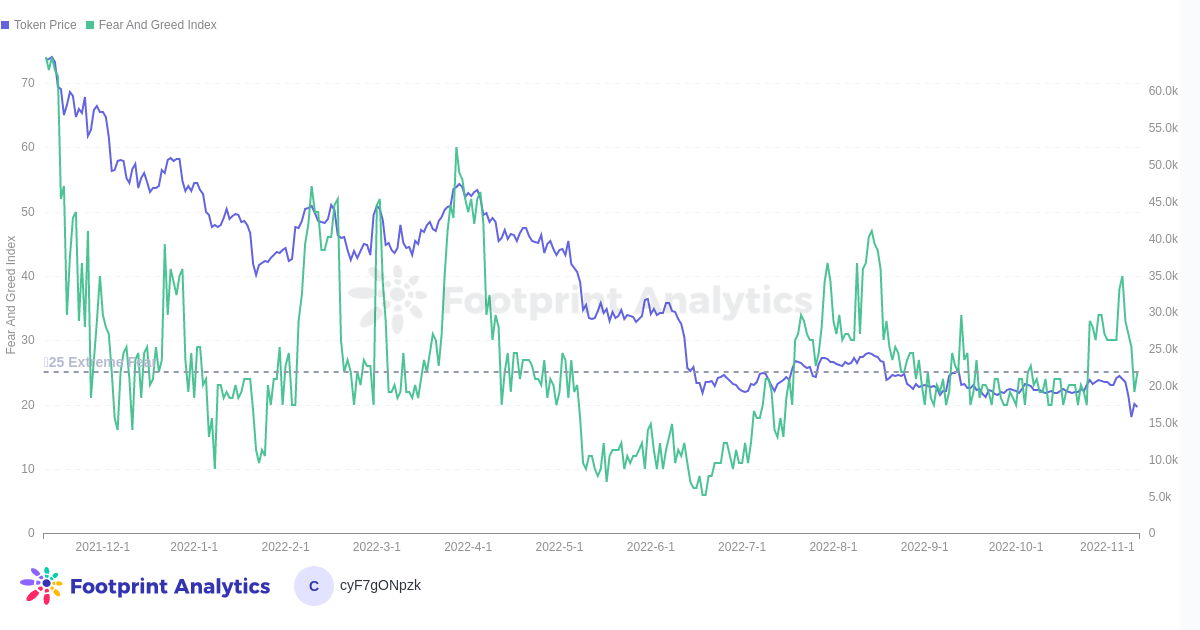

The collapse of FTX put the market as soon as once more right into a state of utmost concern, with BTC falling right down to its lowest stage of the yr at $16,000.

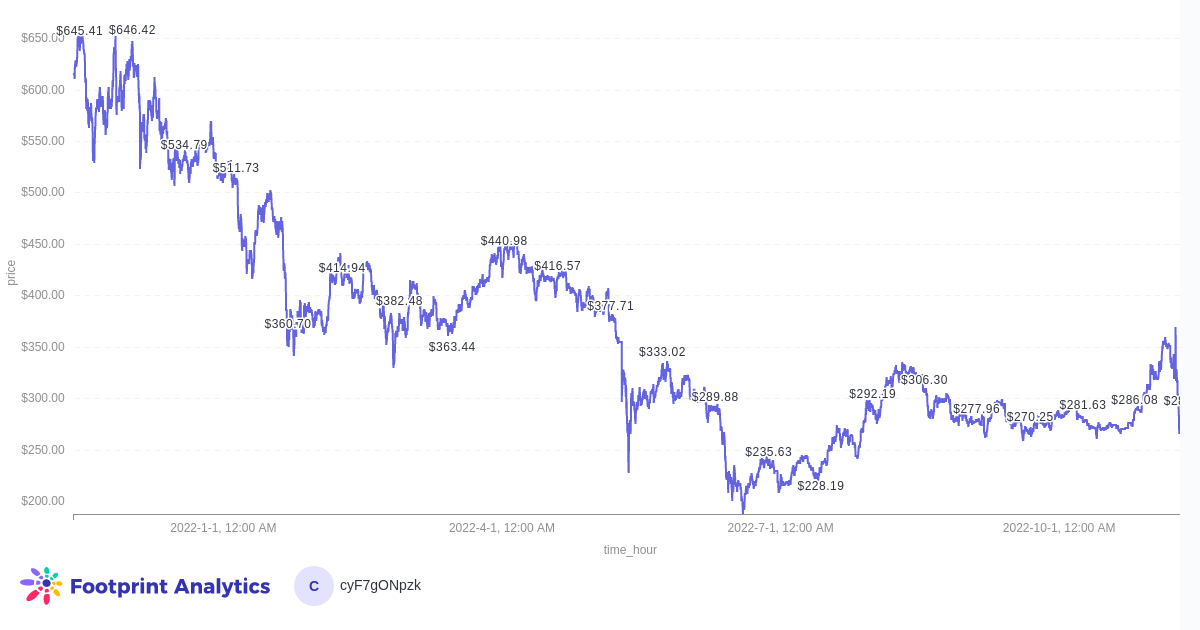

At first look, it could look like Binance got here out because the winner on this scenario, with numerous memes jokingly displaying CZ because the genius mastermind behind his prime competitor’s fall. Whereas BNB jumped to $368 for a brief time frame on Nov. 8, it shortly dropped again right down to a close to 3-month low of $264. The scenario has made your complete business seem extraordinarily reliable, and centralized exchanges will really feel the brunt.

What on-chain knowledge may have informed us

Earlier than the collapse of FTX grew to become imminent, there have been severe on-chain indicators that indicated hassle forward.

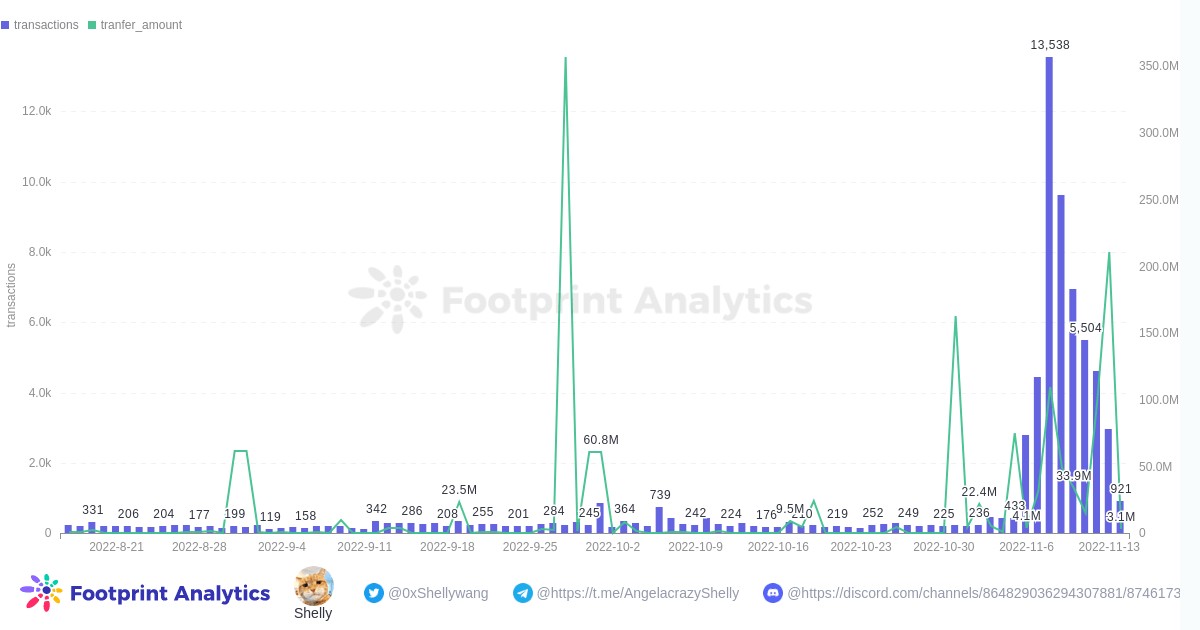

On Nov. 5, 75M FTT was transferred off FTX, indicating a sell-off after this incident. We additionally witnessed two main dumps on FTT on Nov. 8 & Nov. 13, with round 110M and 211M, respectively.

Greater than 140M of FTT tokens have been transferred to Binance from Nov 2 to Nov 8. The soar in transaction quantity started on the fifth and sixth, with round 45M and 42M, respectively.

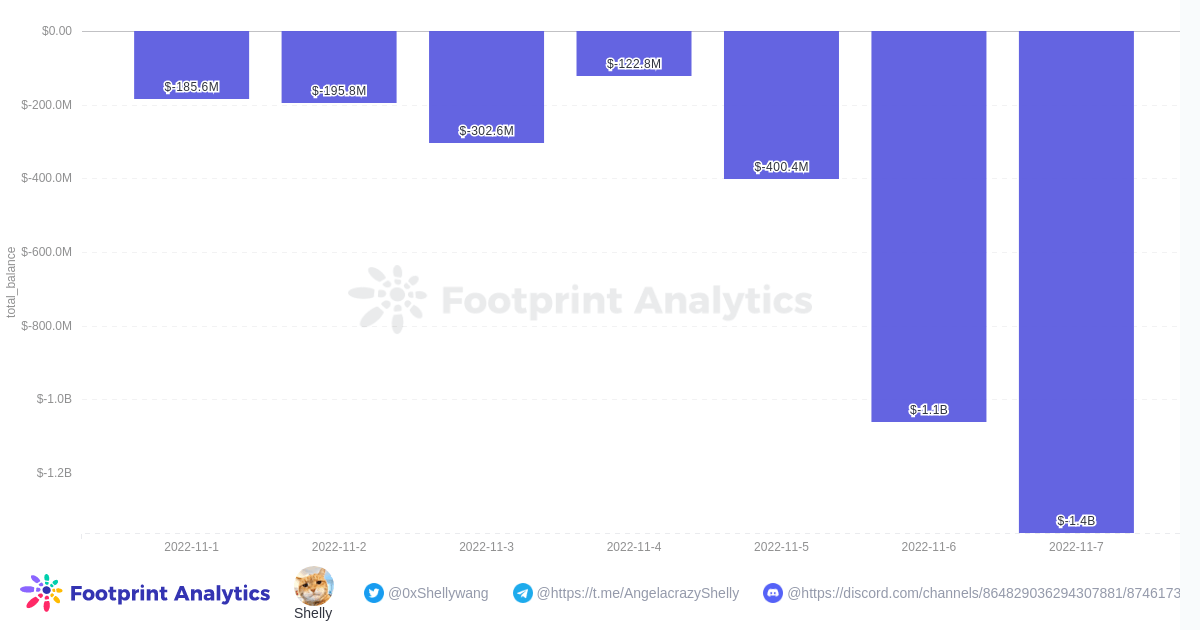

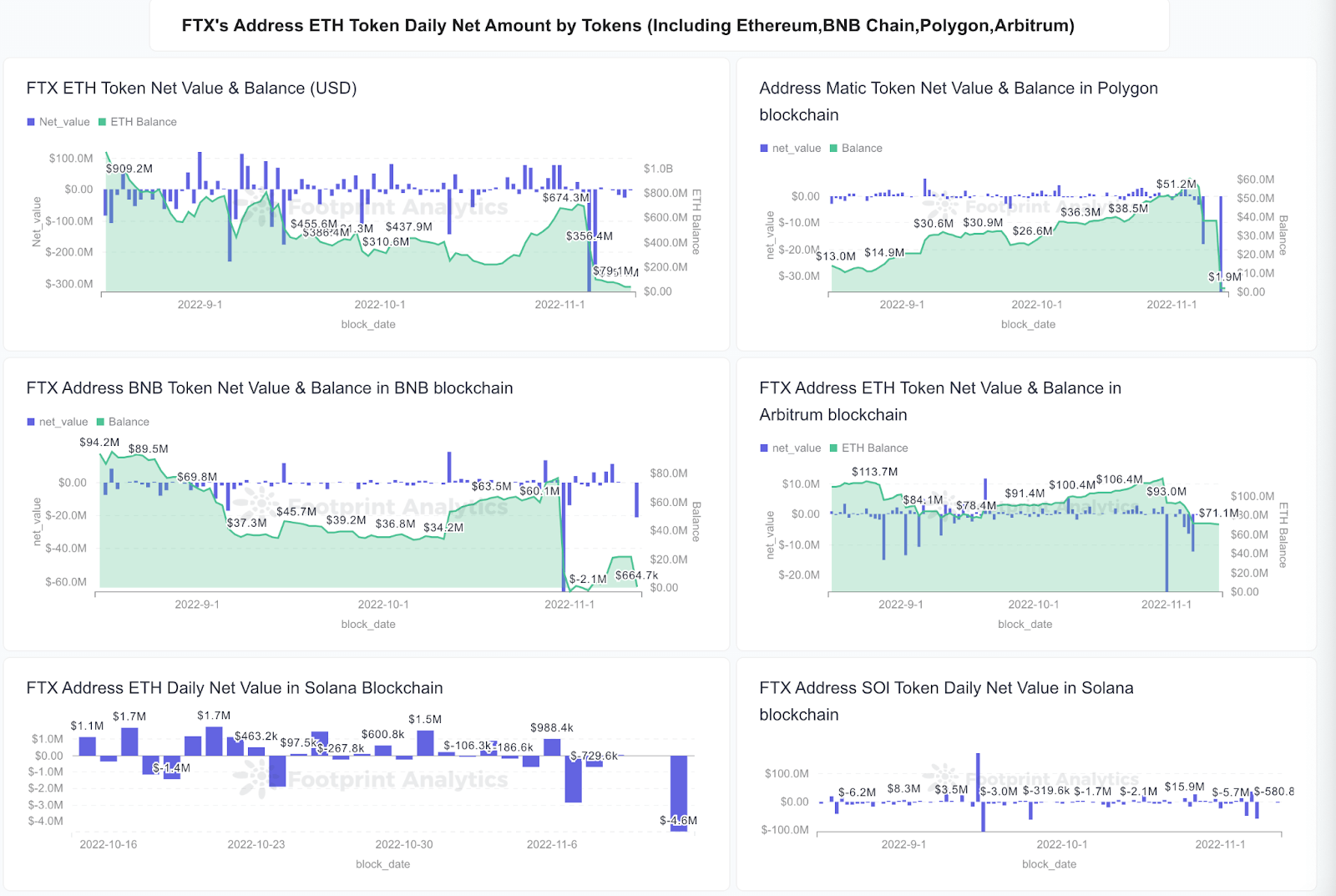

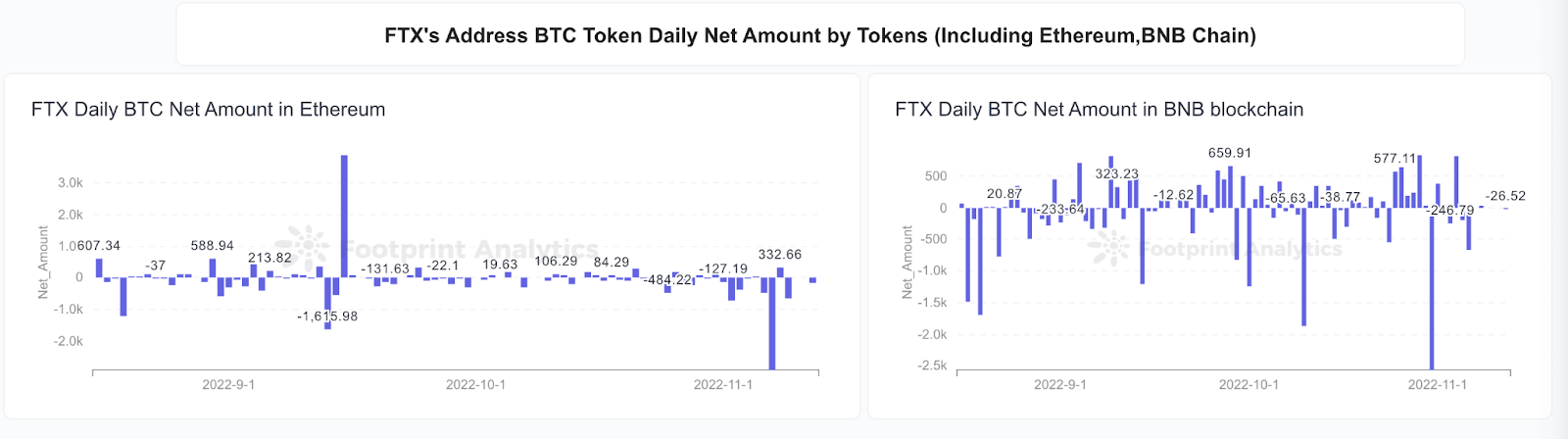

Greater than $1.4B has drained from FTX’s Ethereum stability.

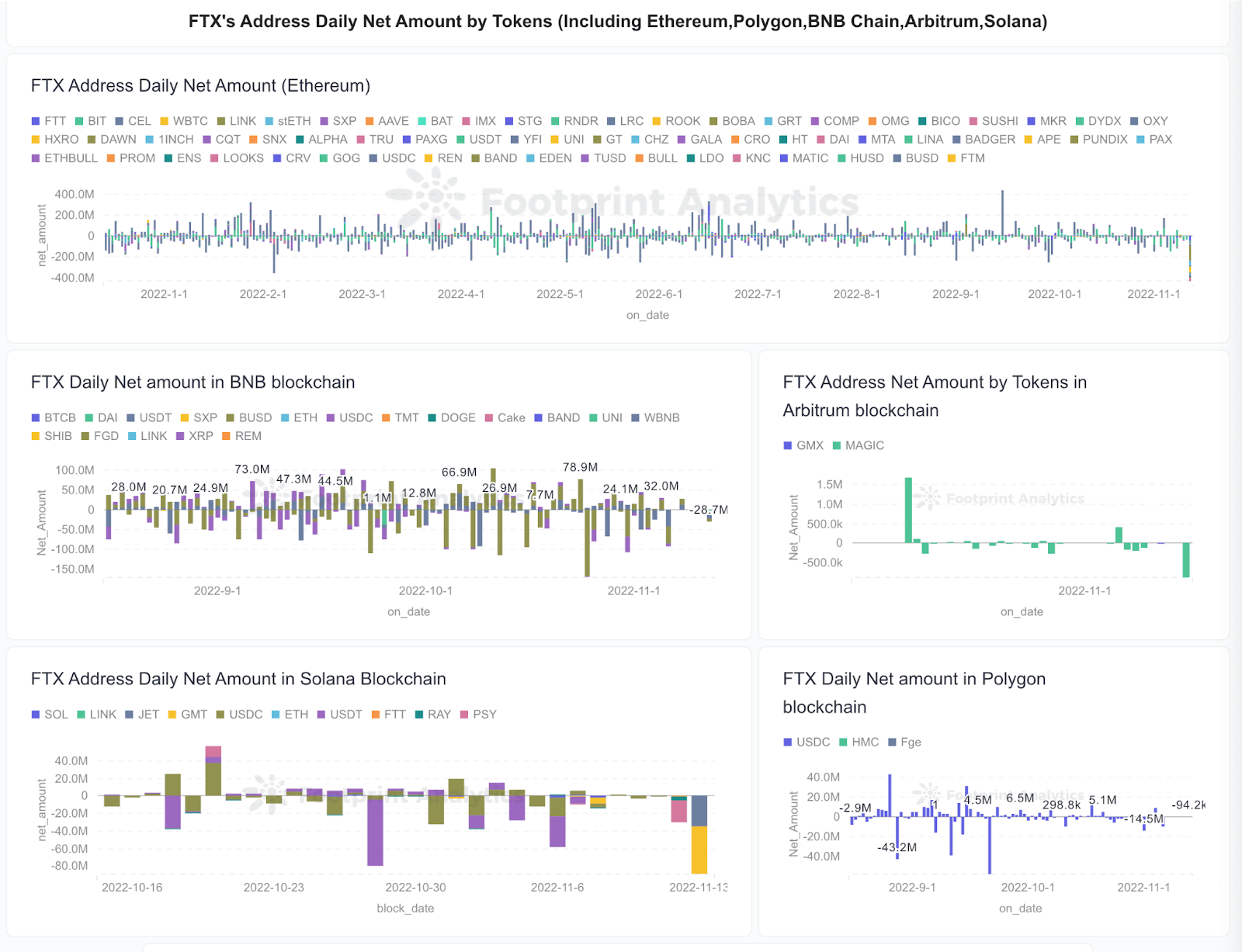

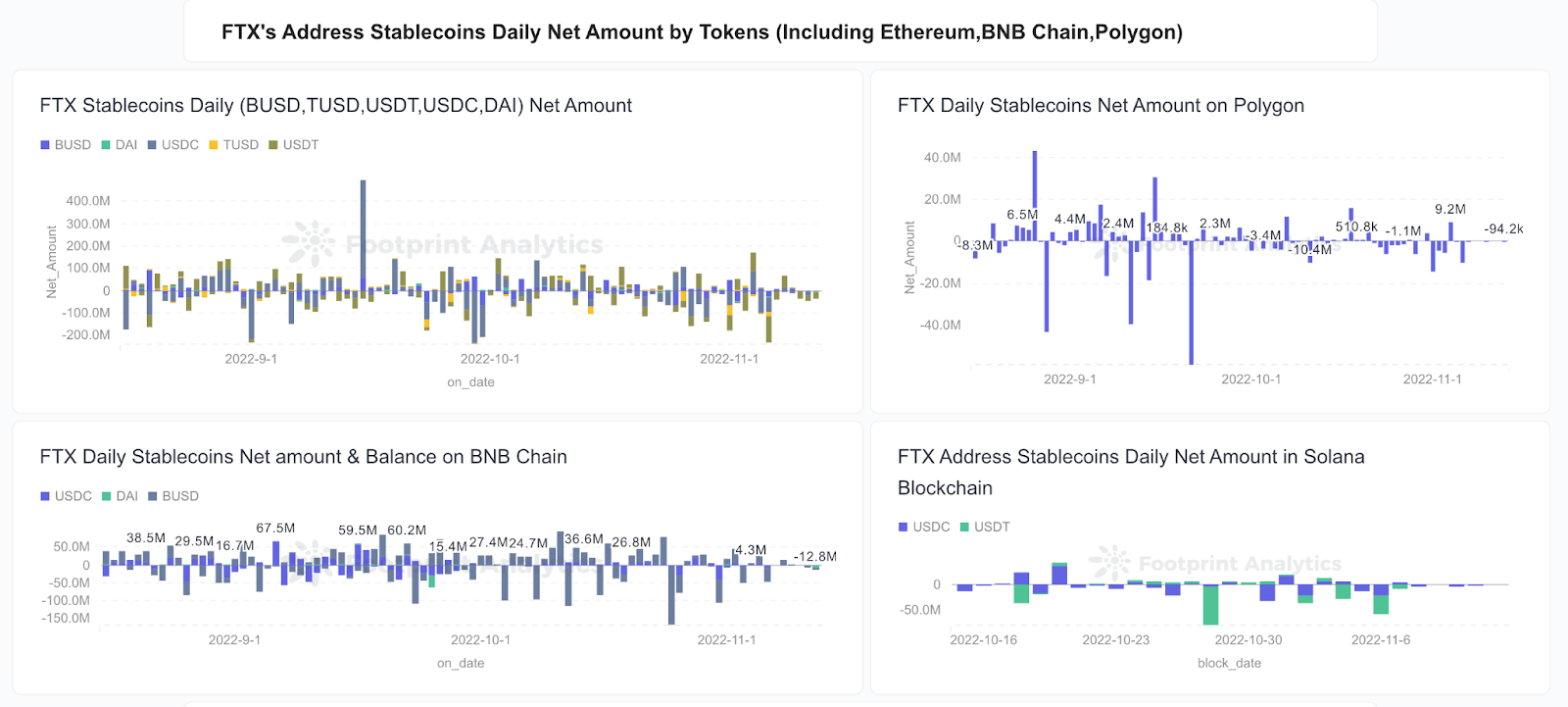

FTX’s main tokens stability dropped considerably.

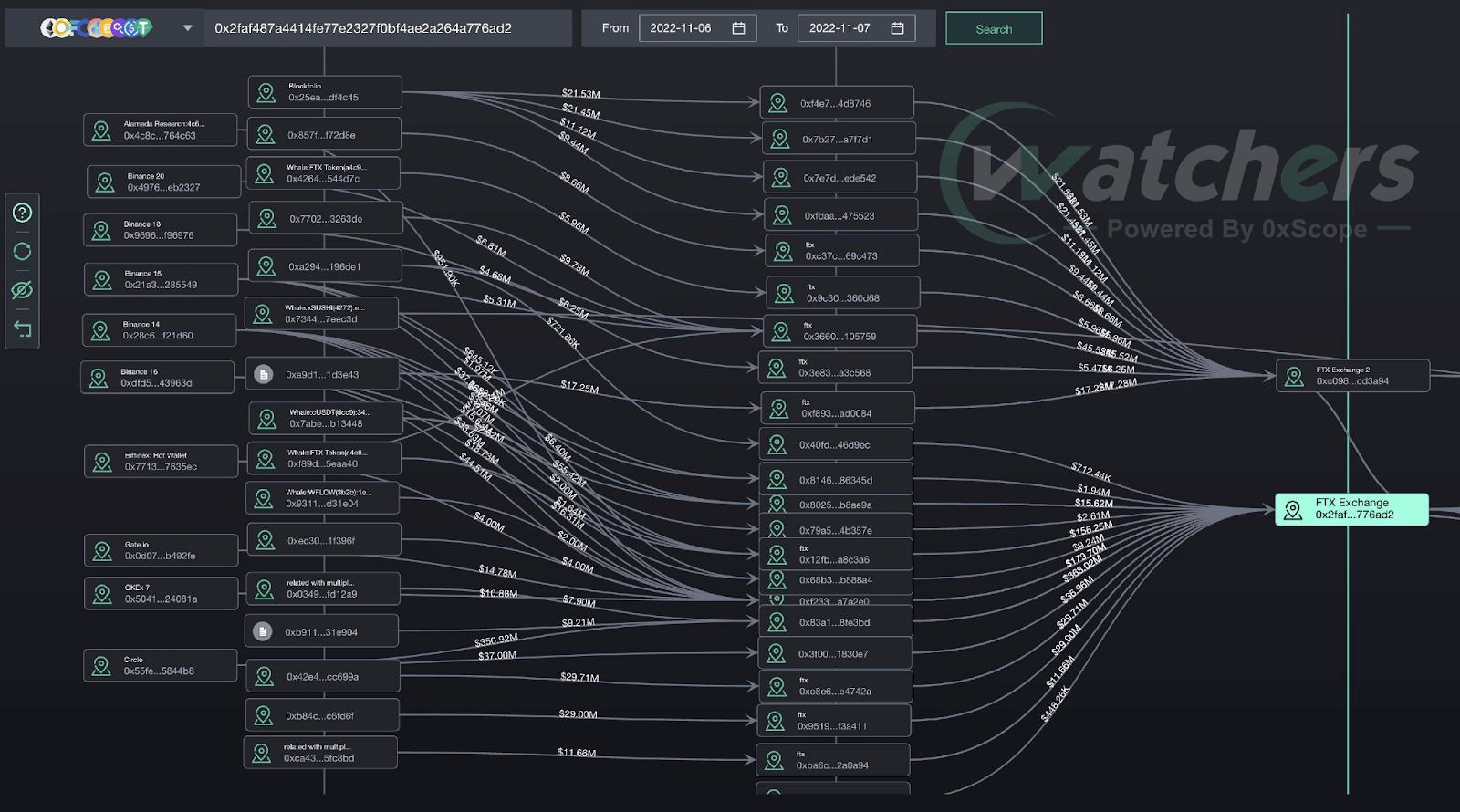

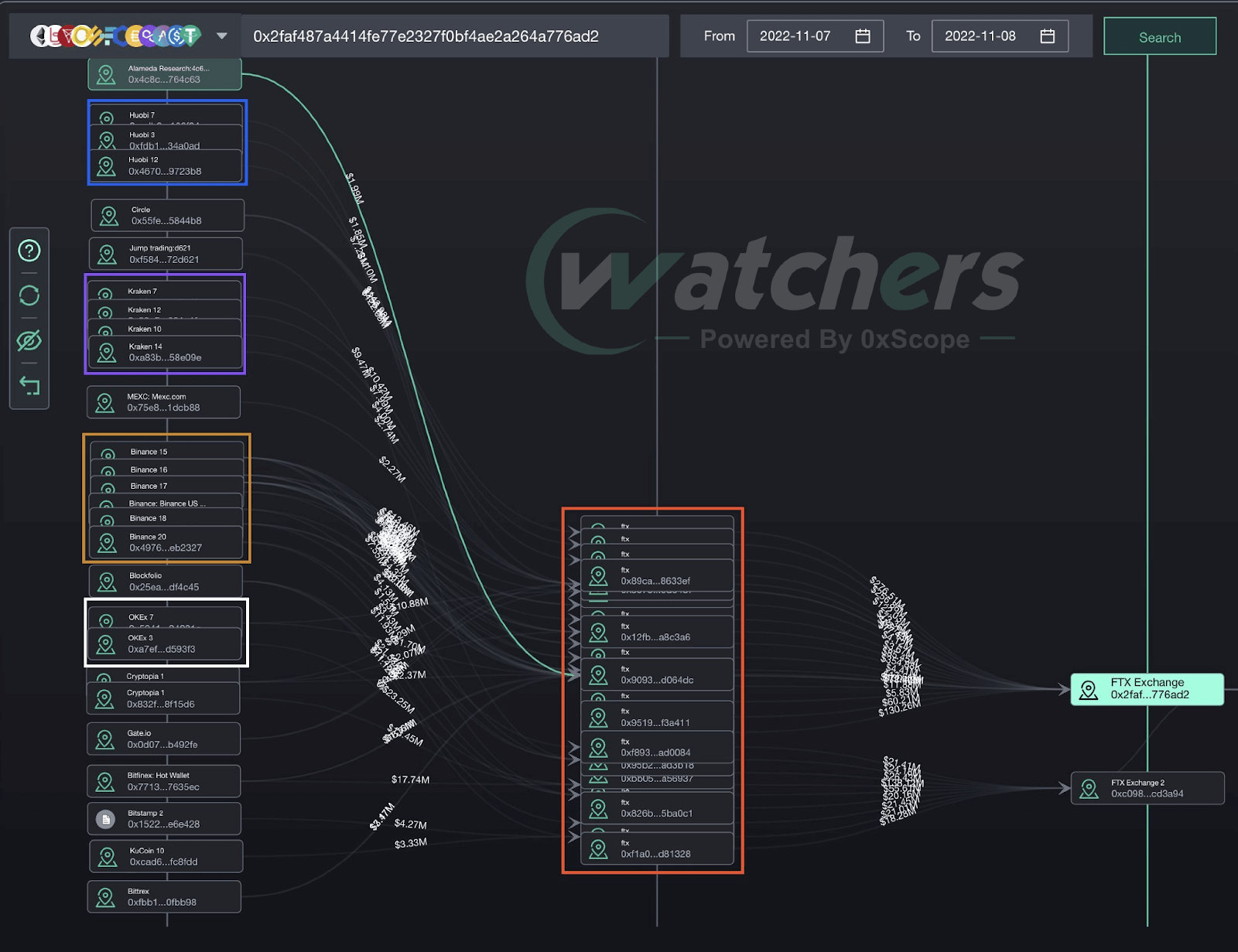

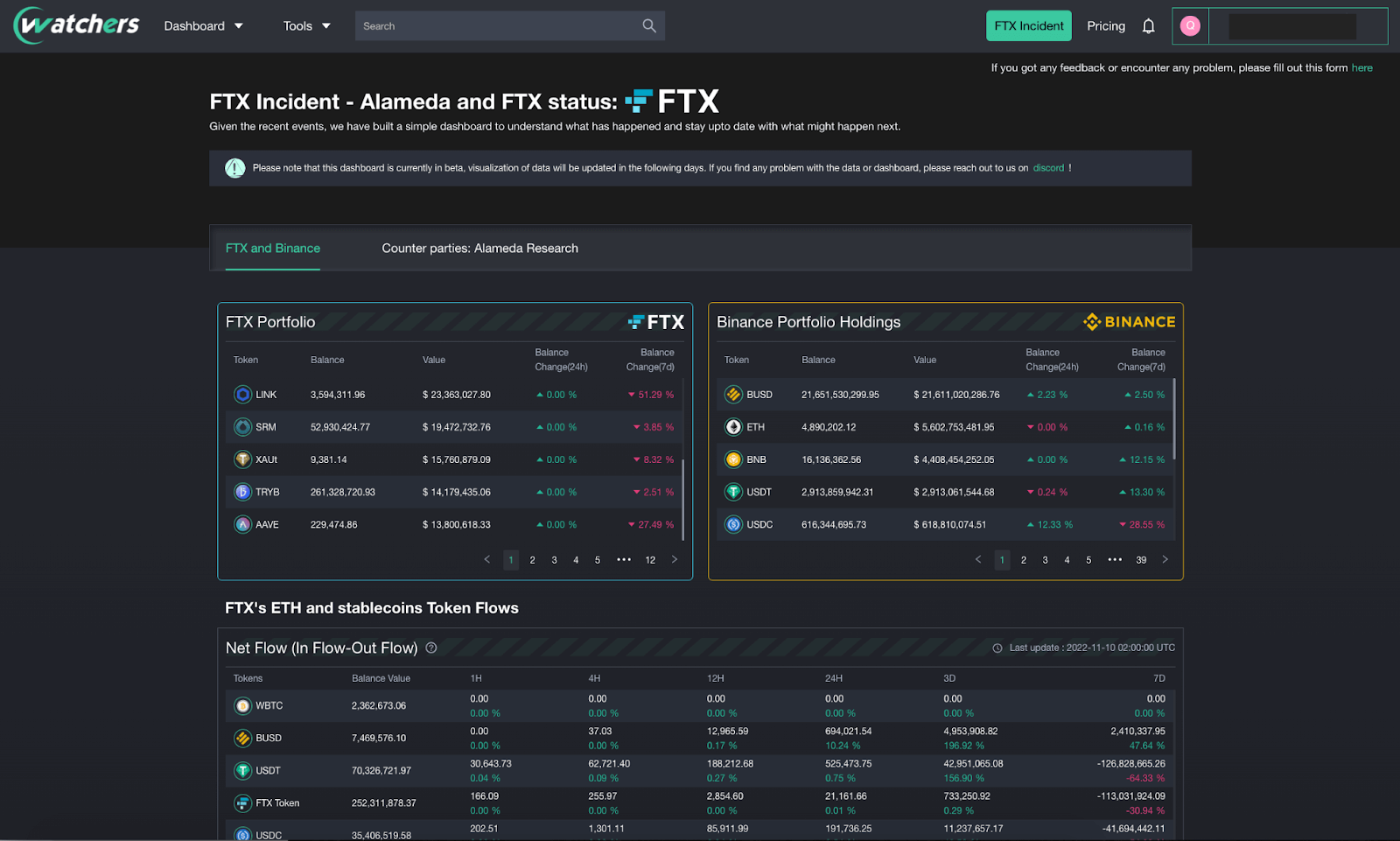

Based on 0xScope, most funds to FTX come from different exchanges, particularly Binance.

As no retailer would deposit their cash at the moment, this must be FTX’s personal capital, and we haven’t discovered any chilly pockets switch inside two days.

So this sign strongly results in a risk that FTX transfer consumer’s deposited cash to different exchanges for various objective (Market Making by Alameda) and by no means have an chilly pockets for emergency objective.

Nov seventh.

Nov eighth.

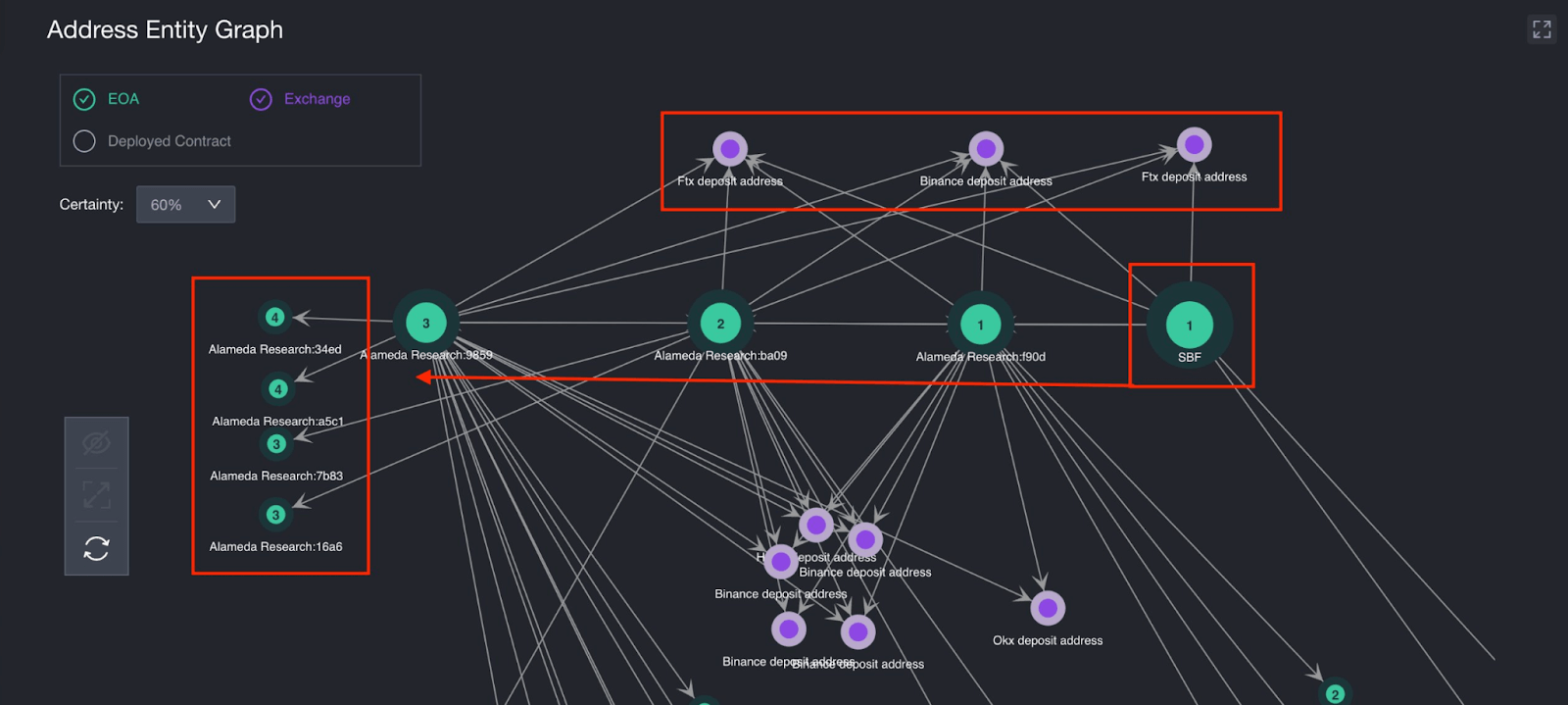

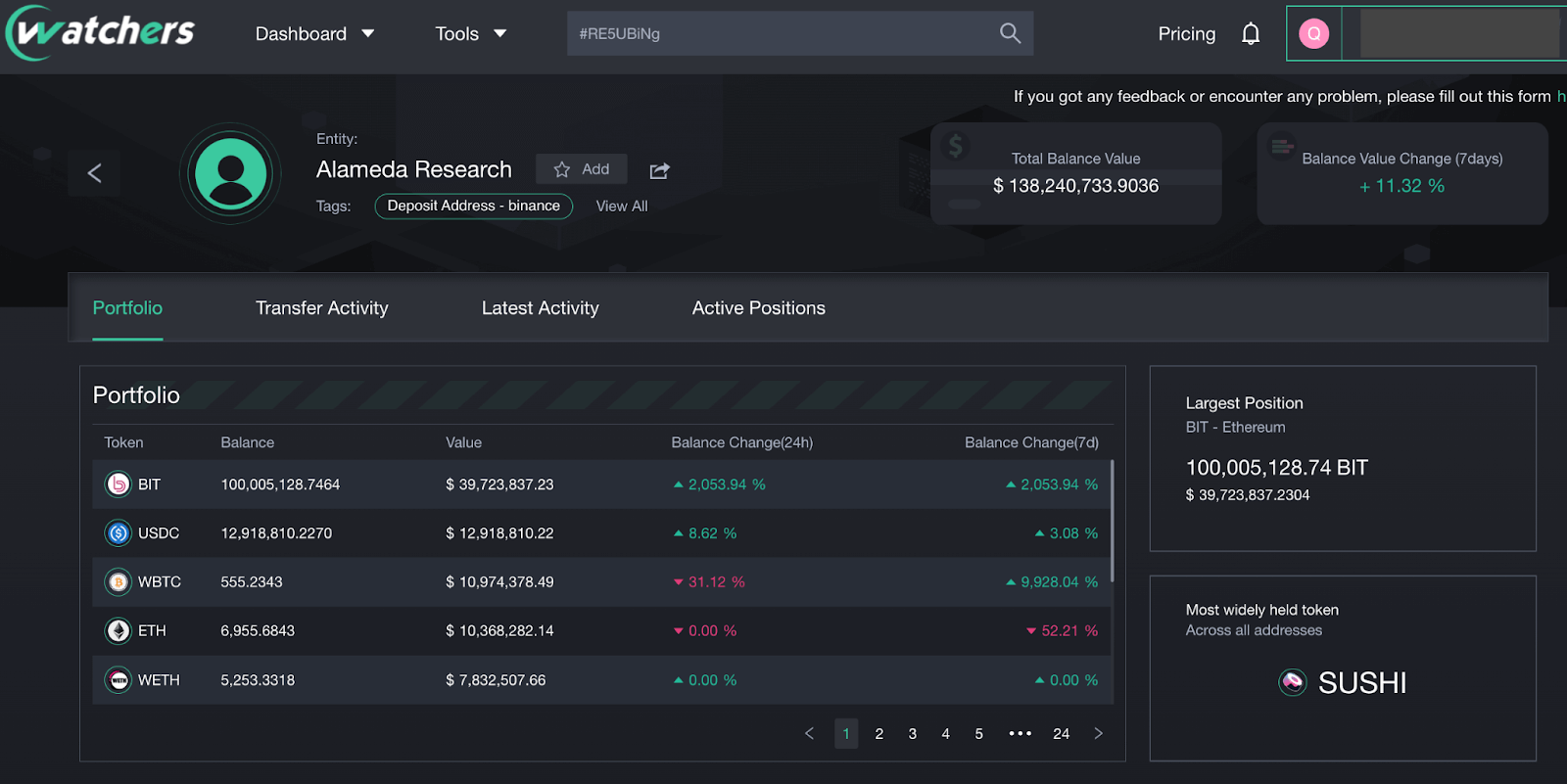

An extended-term mixture of property and accounts for each SBF people and Alameda additionally tracked by 0xScope’s entity graph.

As proven within the graph, SBF’s handle shares three Binance/FTX deposit addresses with at the very least 7 different tagged Alameda Analysis addresses.

This course of can apply to any handle; the use case could possibly be discovering a connection between a set of chosen addresses, and figuring out handle teams, even typically, you need to use this device to search out the addresses you already forgot.

This means that inside Alameda, there isn’t any distinction between SBF and the corporate. SBF controls Alameda’s funds and account to do no matter he desires to.

By monitoring the on-chain knowledge, it’s doable to identify early warning indicators and hold your funds protected, regardless of which CEX or DEX you utilize. Within the case of FTX, a number of key indicators pointed to a lack of confidence within the platform and insiders scrambling to get funds out.

Use on-chain knowledge to trace and hold your property safe

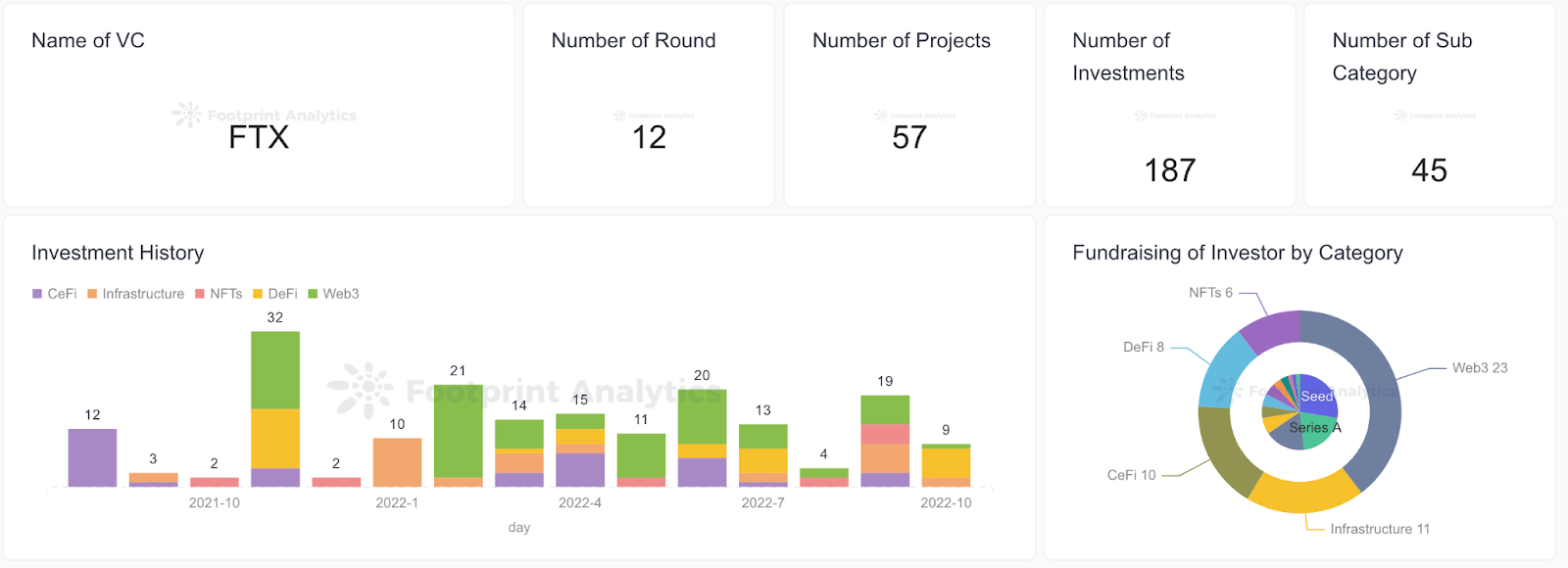

FTX has invested in additional than 57 tasks in 187 investments. You possibly can verify the particular tasks within the dashboard beneath.

Some important indicators to watch your tokens embrace:

Monitor funds from different CEX pockets addresses

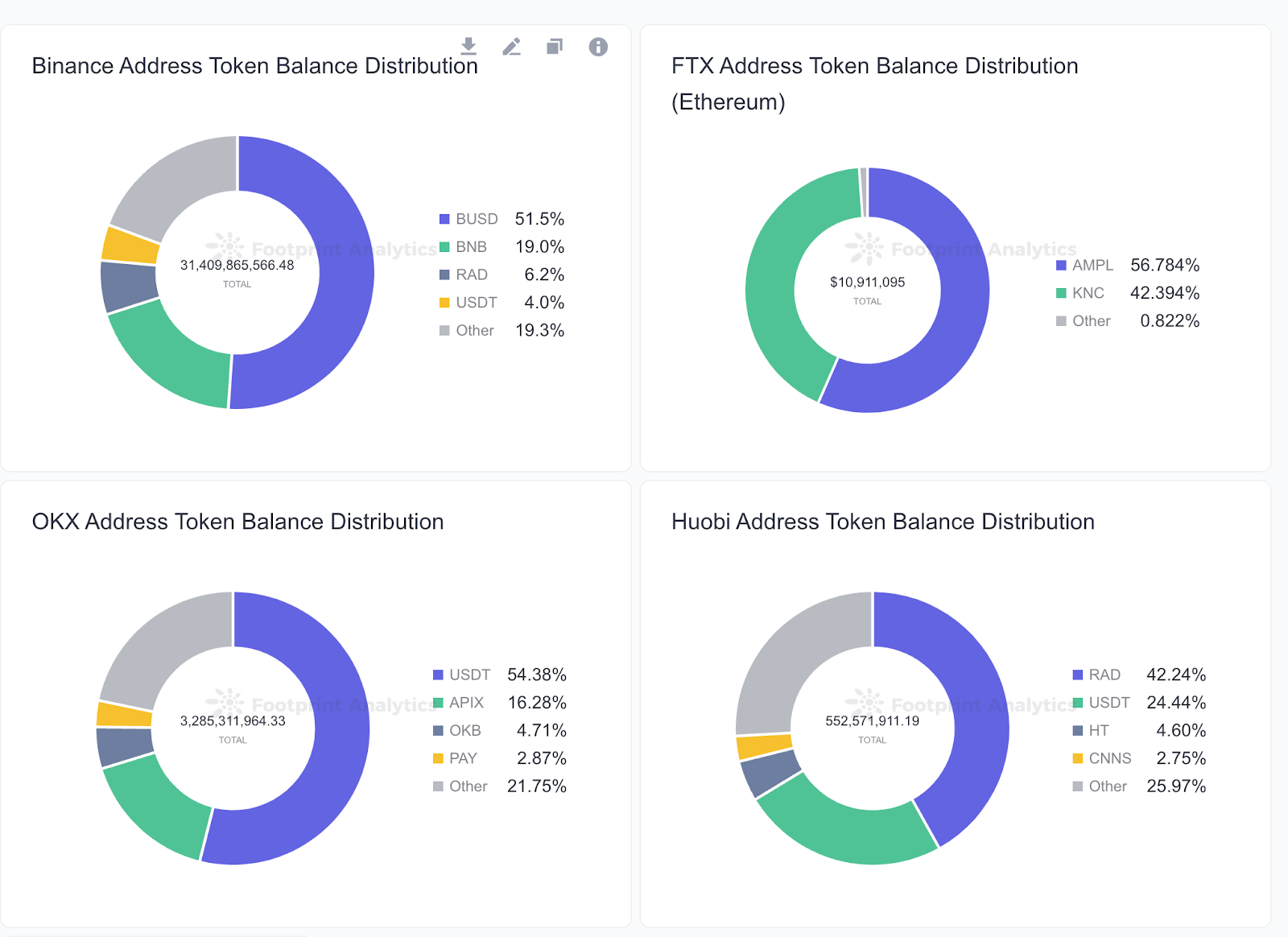

In a tweet Nov. 9, CZ mentioned all cryptocurrency buying and selling platforms ought to do Merkle Tree reserve proofing. Banks function on fractional reserves. Binance will quickly begin doing proof of reserves, with full transparency. A number of exchanges have since printed the addresses of their corresponding reserve wallets.

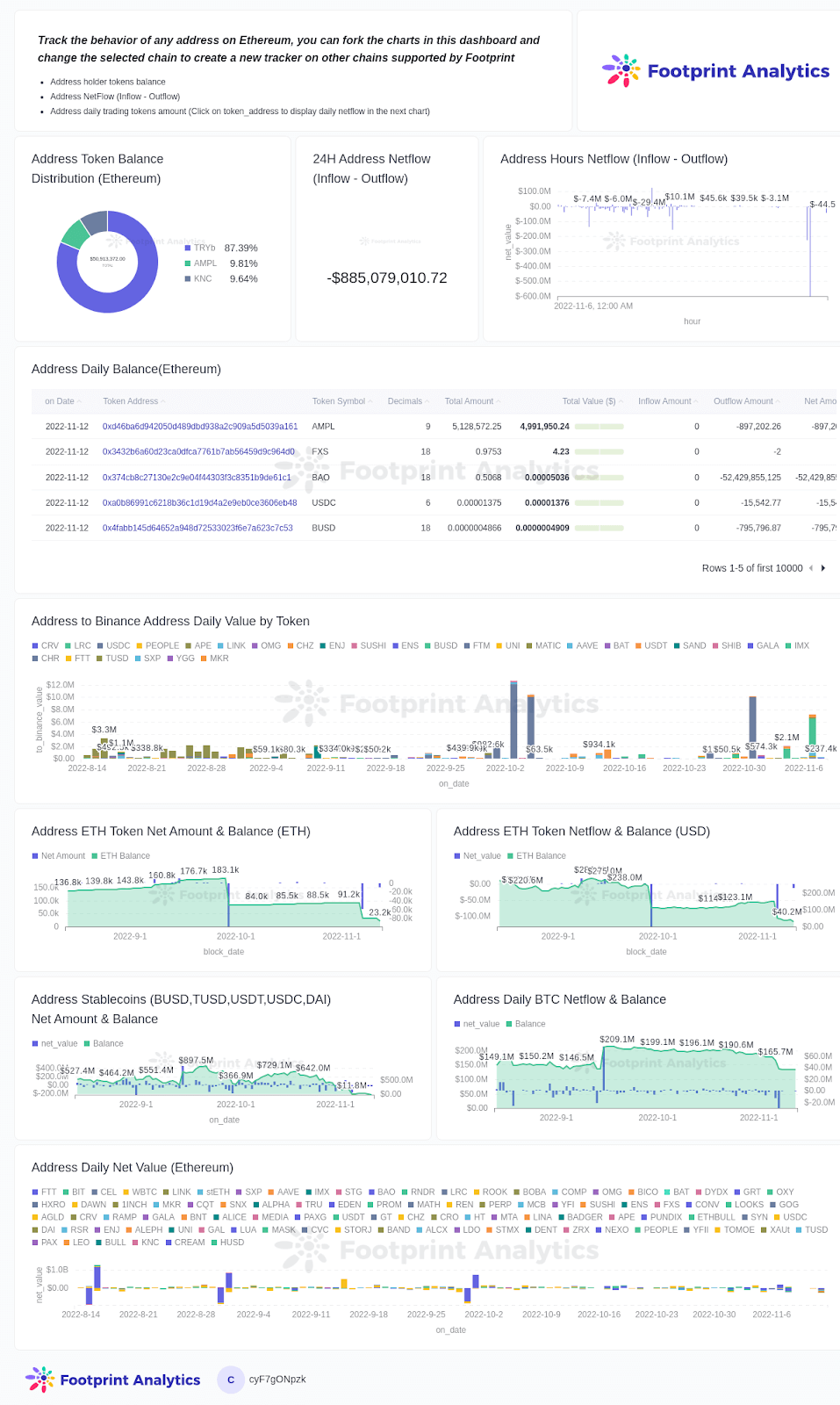

Footprint has constructed some dashboards in keeping with the introduced pockets addresses by FTX and Binance. You can too verify the reverses on the addresses introduced by totally different exchanges.

Customers also can enter chosen addresses to watch the next modifications within the pockets:

- Token stability distribution

- 24H internet stream

- Pockets each day internet stream and each day stability

And with the upcoming SQL API supported by Footprint, everybody can customise their very own pockets trackers on their web sites.

Clusters of addresses underneath the identical entity to trace associated transactions are additionally obtainable on 0xScope’s Watchers. 0xScope tagged a number of addresses containing KuCoin, Binance, Gate, OKex, MEXC, Kraken, Huobi, Circle & FTX, Alameda,and many others, connecting them with clustering entities to indicate the entire image how cash flows via totally different curiosity events. Customers also can enter personalized dashboards to watch and analyze the weird fluctuations out there and set a reminder or alert.

This piece is contributed by Footprint Analytics & 0xScope group in Nov 2022 by Sabrina

Knowledge Supply: Footprint Analytics Dashboards

The Footprint Neighborhood is a spot the place knowledge and crypto fanatics worldwide assist one another perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or some other space of the fledgling world of blockchain. Right here you’ll discover lively, numerous voices supporting one another and driving the group ahead.

0xScope is the primary Web3 Data Graph Protocol. It solves the issue that Web3 knowledge analyzes addresses as an alternative of actual customers by establishing a brand new identification normal —— the brand new Scope Entity from the information layer. And it unifies the requirements of various kinds of Web2 knowledge and Web3 knowledge by using its data graphing functionality, which tremendously reduces the problem of information acquisition and improves knowledge penetration potential.