Blockchain analytics agency Glassnode says that the newest market downturn plunged thousands and thousands of Bitcoin (BTC) underwater.

Glassnode says that Bitcoin’s drop from the current high of $30,900 in mid-April sunk a further 2.71 million Bitcoin into loss territory, about 14% of the whole BTC circulating provide.

The most recent market dip elevated the whole Bitcoin provide underwater from 3.96 million BTC to six.67 million BTC, in response to the analytics agency.

“The -14.6% transfer downwards from the native high of $30,900, to our present spot worth of $26,400 has propelled 2.71 million BTC into an underwater place, equal to 14% of the circulating provide. This raises the whole provide in loss throughout the aforementioned interval from 3.96 million to six.67 million BTC, a 68.4% enhance.”

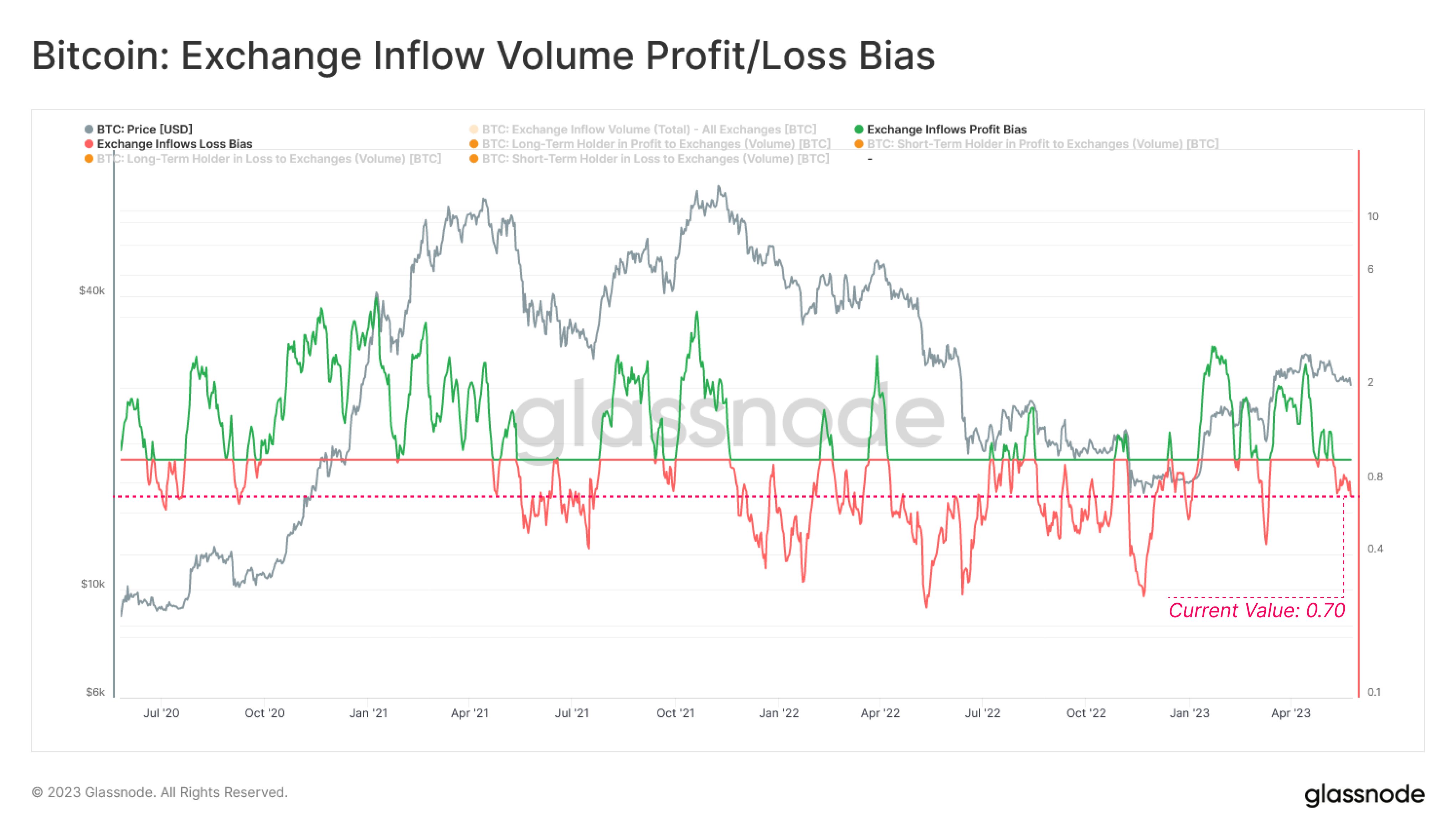

Glassnode additionally notices that extra of the Bitcoin flowing onto crypto exchanges is at a loss primarily based on the revenue/loss ratio, which compares the variety of cash sitting at a loss to these at a revenue.

“When assessing the revenue/loss ratio (bias) of Bitcoin deposit quantity to exchanges, we be aware a present unfavourable bias of 0.7, suggesting cash are flowing into exchanges at a loss.”

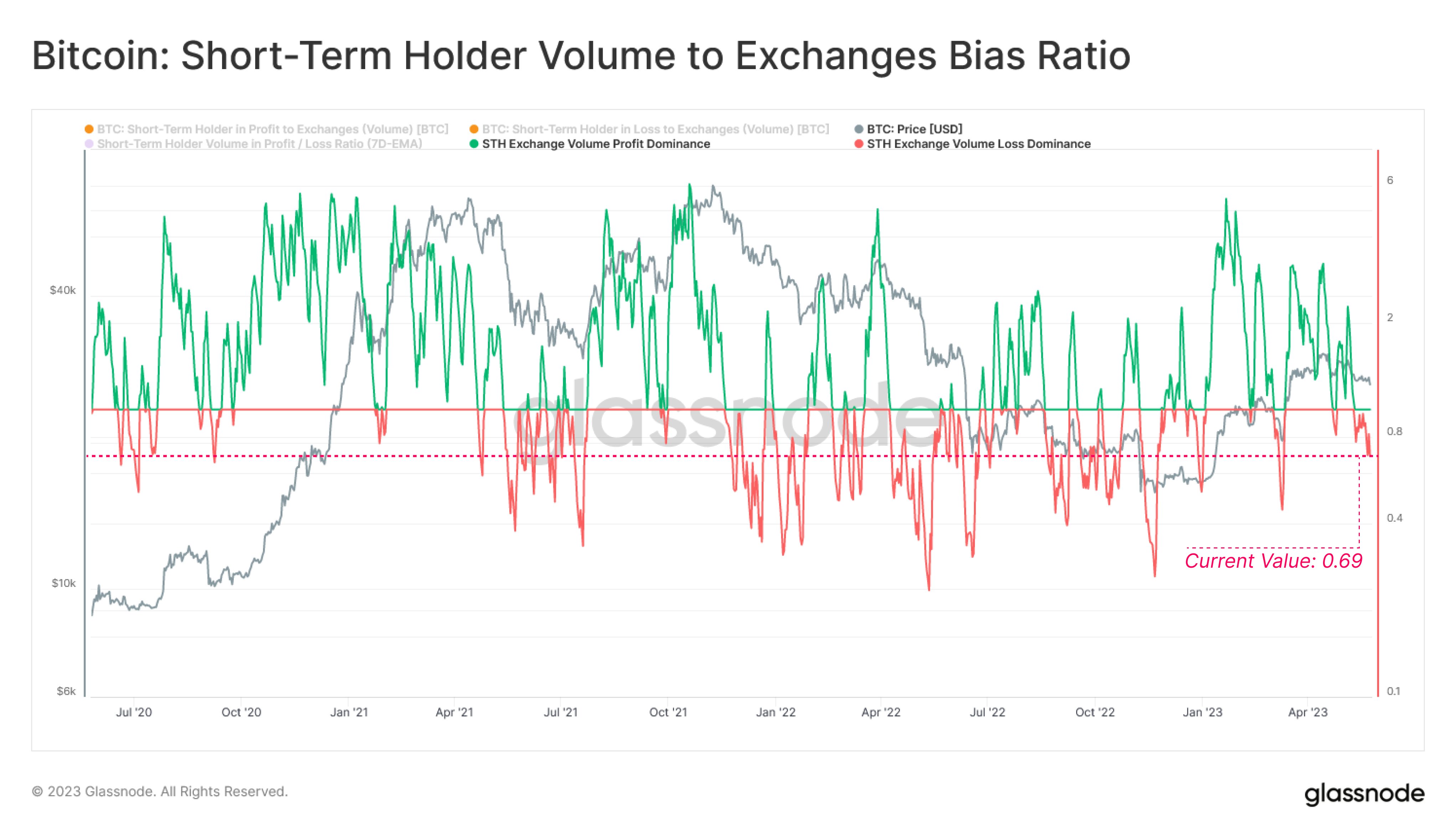

In line with the analytics agency, short-term holders (STH) of Bitcoin, not long-term holders (LTH), are seemingly accountable for many of the current influx of BTC to exchanges.

“Breaking down the alternate influx bias by brief and long-term holders, we be aware that LTHs are recording a constructive bias of 1.73, experiencing worthwhile inflows. The converse is true for STHs, recording a unfavourable bias of 0.69, a worth just like the market-wide bias of 0.7, suggesting STHs are at present dominating alternate inflows.”

Bitcoin is buying and selling for $26,717 at time of writing, up 0.9% throughout the previous 24 hours.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney