Bloomberg Intelligence crypto market analyst Jamie Coutts predicts PayPal’s new PayPalUSD (PYUSD) stablecoin can have a huge effect on Ethereum (ETH).

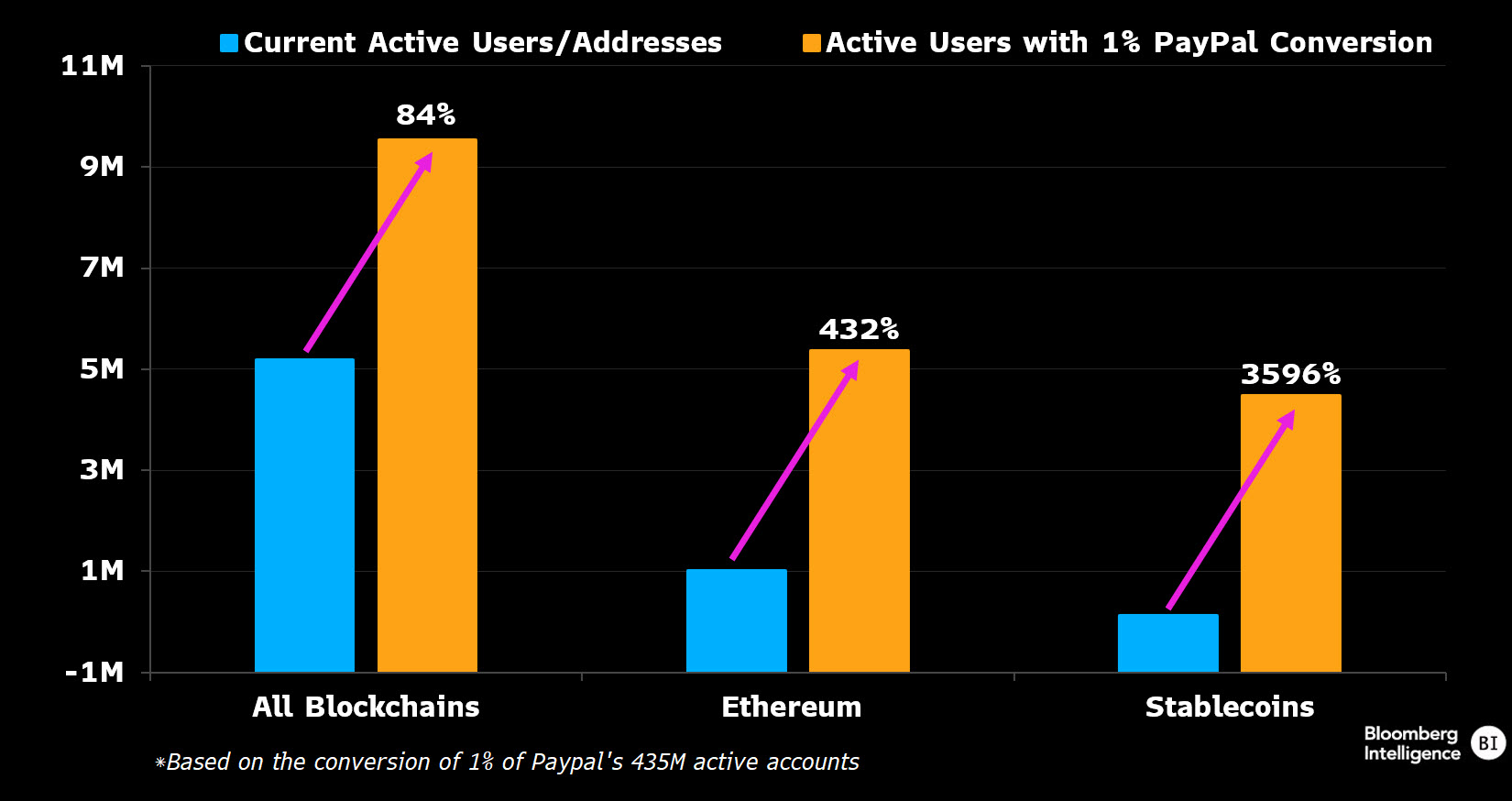

Coutts says that there’s huge progress potential for Ethereum even when only a small proportion of PayPal’s current buyer base adopts the stablecoin, which goals to maintain a 1:1 peg to the US greenback and is constructed on Ethereum.

“The PayPal announcement will not be priced in.

PayPal has 435 million lively accounts vs. Ethereum Layer-1/Layer-2 lively addresses 1 million.

If 1% convert a greenback steadiness to PYUSD (4.35 million) and start to make use of it then the ramifications for the Ethereum ecosystem and ETH, the asset, are huge.”

Coutts additionally says that he’s bullish on the layer-1 (L1) good contract platform after an enlargement of layer-2 (L2) initiatives had much less of an opposed affect on ETH’s financials than he anticipated.

“The twin shock of sooner L2 adoption and fewer than anticipated cannibalization of the L1 financials has our confidence in Ethereum’s potential to accrue extra worth than various L1s over the cycle.”

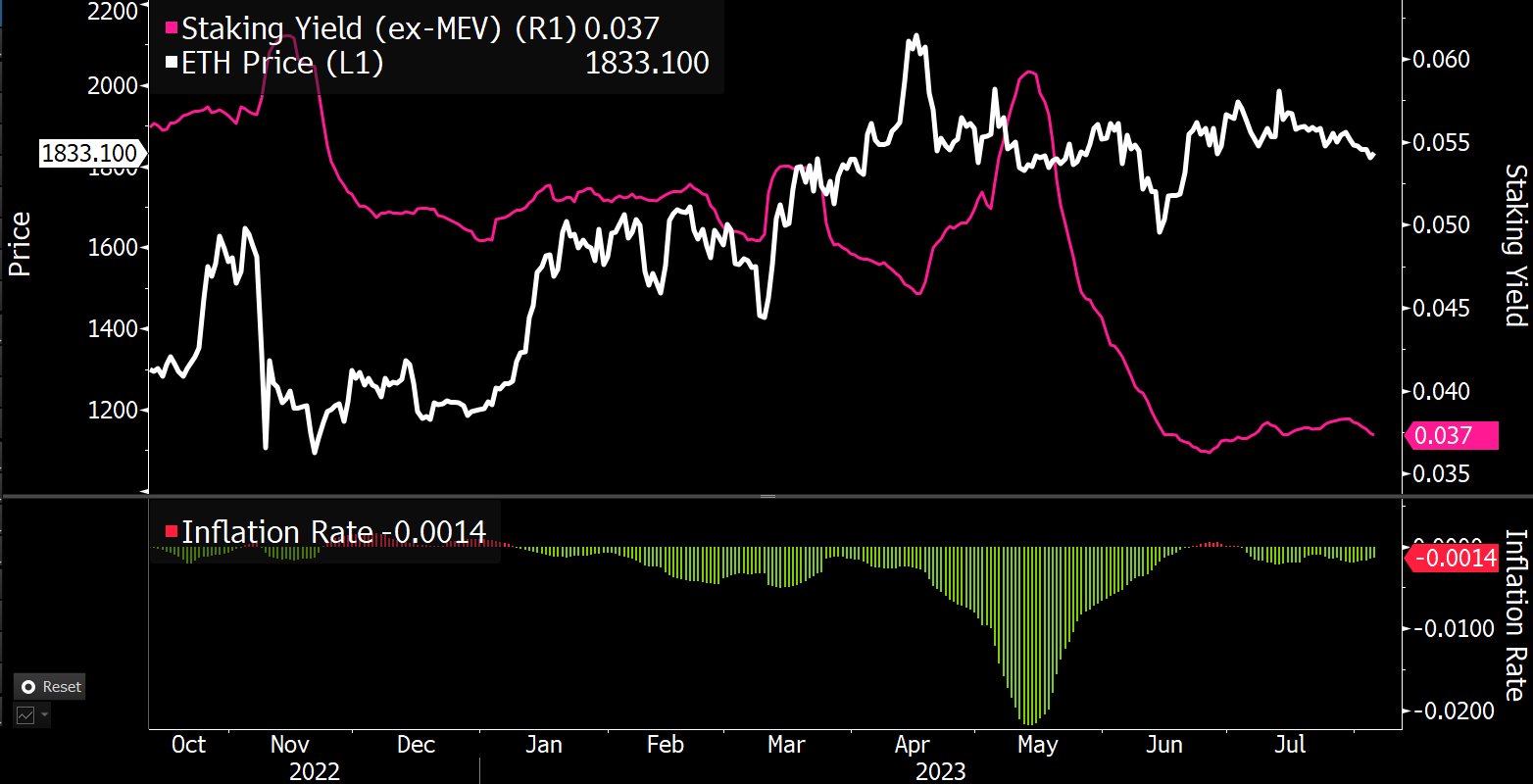

The analyst says ETH’s sideways worth motion doesn’t inform the complete story of all that is occurring within the ecosystem, together with community improvement and elevated Ethereum staking.

“Flat Worth Masks Enhancing Worth Accretion:

1. Community is again on a progress trajectory pushed by rising L2s, much less extreme financial tightening

2. Principally deflationary regardless of bear market (pre-merge inflation was 4%+)

3. Regardless of cooling exercise, ETH staked accelerated up 38% in three months.”

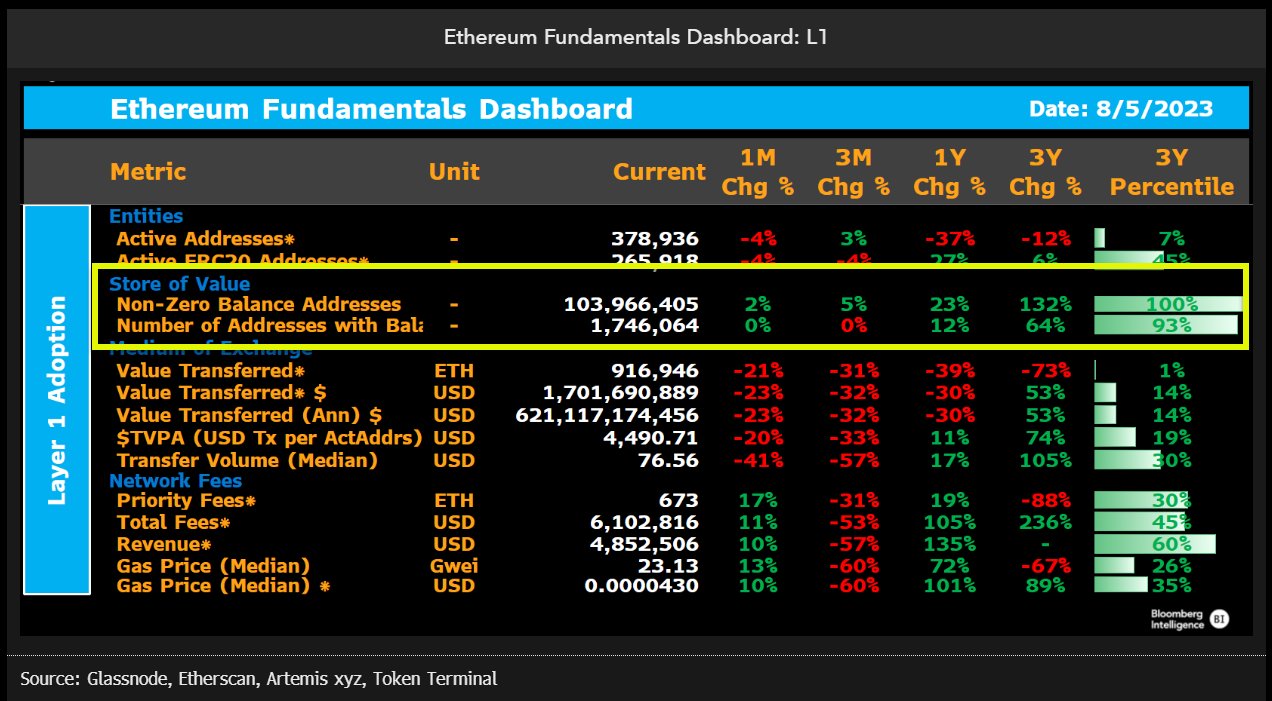

In keeping with Coutts, ETH accumulation is rising throughout the stalled crypto market.

“Whereas exercise is down, buyers are nonetheless demonstrating aggressive accumulation conduct. The entire variety of non-zero steadiness addresses exceeds 100 million, with over 1.7 million wallets containing at the very least one ETH.”

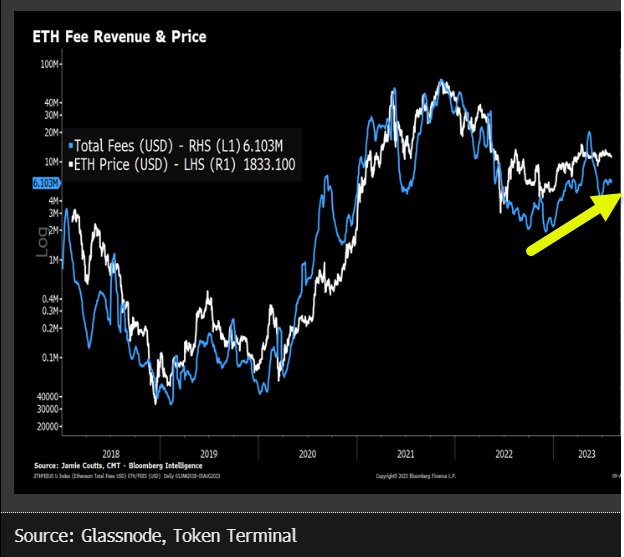

Coutts notices that ETH’s community is producing 3x the quantity of income in comparison with the fourth quarter of 2022.

“Relying in your framing, greenback worth of the community’s GDP/income, whereas down considerably from 2021, has elevated 3x from the fourth quarter 2022 low and is now outpacing the value. L1 generates roughly $6 million in payment income per day – 80% is burnt (buyback) and the remaining paid to validators (div).”

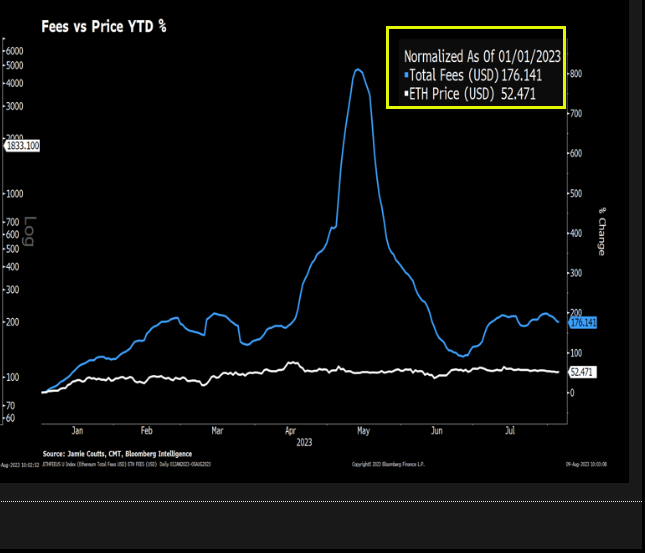

He additionally notes that the rise in charges is just like a 2020 sample that led to an ETH bull run.

“2023 charges have climbed 176% vs. the value, up 53%. The connection between the 2 was instructive for the final bull market when charges outpaced worth in 2020 after a two-year decline.”

Ethereum is buying and selling for $1,850 at time of writing, down 0.1% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses chances are you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney