That is an opinion editorial by Mickey Koss, a West Level graduate with a level in economics. He spent 4 years within the infantry earlier than transitioning to the Finance Corps.

I’m going to make use of the California Public Staff Retirement System (CalPERS) as a proxy to your common pension system. In accordance with investopedia, the CalPERS invested roughly a 3rd of their cash into bonds with a goal annual return for the fund at 7%. Bonds are known as fastened revenue due to their predictable coupon funds. They’re used for revenue, not capital positive aspects.

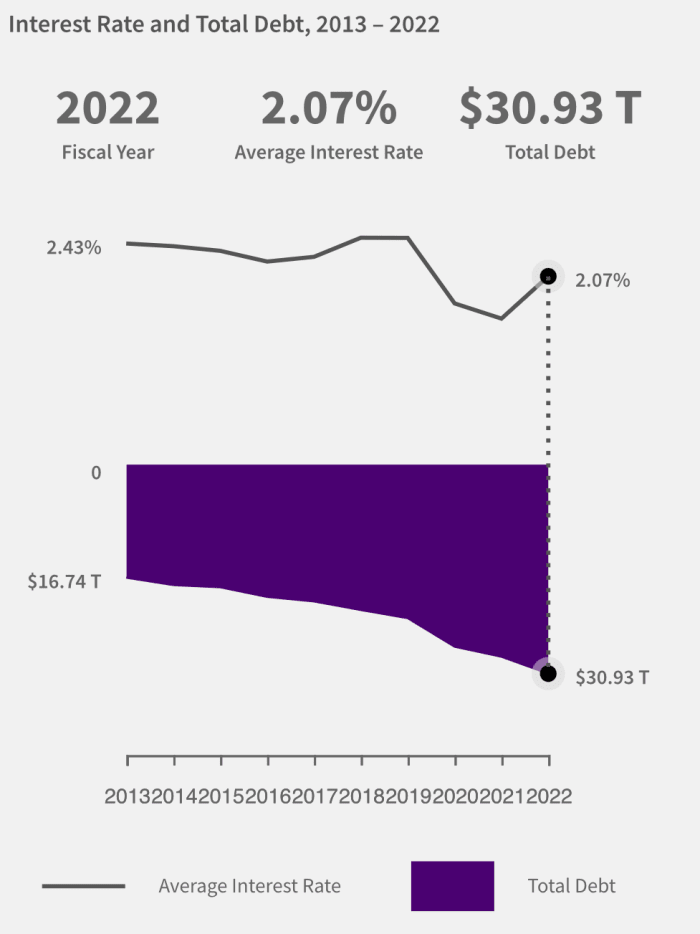

Treasury Common Curiosity Charges as of September 30, 2022

Recycling a chart from one in all my earlier articles — let’s assume the weighted common of coupon charges on authorities bonds is 2% to simplify some math (as a result of it’s in response to the Treasury). At a 2% revenue fee on a 3rd of your cash, meaning pension funds have to make 9.5% annual returns on the remainder of their cash, yearly, with out fail or they run the danger of not having the ability to fund their pension funds. There isn’t any room for error.

So what occurs while you begin to really feel the stress however have to preserve shopping for bonds by mandate, regardless of the shortage of revenue? You begin to lever up your positions, a way that almost blew up the pension area within the UK just some weeks in the past.

The Washington Put up has a reasonably good roll up of the state of affairs however in essence, pensions have been pressured to lever their positions to extend yields and money flows due to the prevalence of quantitative easing and low rates of interest.

Channeling my spirit animal, Greg Foss, by levering a place 3x you may enhance your yield from 2% to six%, however leverage cuts each methods. A 50% loss turns into 150% and begins consuming into your different positions and investments. That is precisely what occurred within the U.Okay., necessitating a bailout to forestall pension fund liquidations and systemic impression to the banking and lending system.

Enter bitcoin, stage left. As a substitute of leveraging positions to extend yield I feel pension funds might be pressured to undertake various investments like bitcoin to assist develop their fiat denominated asset base and repair their payouts to pensioners.

I wrote an article not too long ago concerning the debt spiral idea. Whereas central banks are elevating charges proper now, they’ll’t preserve going without end, inevitably placing pension funds proper again into the low-yield atmosphere that precipitated the systemic issues earlier than.

Bitcoin has no threat of liquidation. Bitcoin doesn’t require leverage. As a substitute of constructing dangerous bets, perpetuating the tradition of ethical hazard and socialized losses, pension funds can use bitcoin as an uneven alternative with the intention to bolster their returns.

I see this as an inevitability as an increasing number of asset managers come to the belief that it’s their obligation to return pensioners what was promised. As soon as one units the priority, the dominoes will fall. Don’t be final.

This can be a visitor publish by Mickey Koss. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.