Be part of Our Telegram channel to remain updated on breaking information protection

Solana’s Worth has dropped 9% of its value during the last month, as its infrastructure has had one other massive failure and one in all its buying and selling strategies has been hacked for $100 million. As an final result, 63% of an advisory group misplaced religion within the blockchain.

SOL’s current destructive development is per the corporate’s longer-term downward spiral. Nonetheless, why has the worth of the SOL foreign money been declining, and whether or not the SOL foreign money additionally has a future?

Right here, we analyse a number of Solana pricing forecasts for 2022 and past, in addition to the mission’s most up-to-date developments.

What precisely is Solana? The ecosystem of Ethereum options

In distinction to many different well-known blockchains that perform these days using proof-of-work (PoW) or proof-of-stake (PoS) strategies, Solana was among the many first to supply a proof-of-history (PoH) technique, permitting the blockchain to run swiftly whereas being secure and decentralised.

Solana was based in 2017 by Anatoly Yakovenko, a former Qualcomm (QCOMM) engineer and Dropbox (DBX) developer, with fellow colleague Greg Fitzgerald with the aim of making an open-source initiative that created a brand new, sturdy, peer-to-peer blockchain.

The Solana blockchain, in accordance with its PoH algorithm, can deal with 2,000 transactions per second, making it a contender to Ethereum (ETH), the second-largest crypto by market capitalization.

Attributable to its interoperability utilizing good contracts, which permit for the creation of decentralised apps, Ethereum has emerged because the main firm for decentralised finance (DeFi). Nonetheless, the blockchain’s recognition has made it pricey and sluggish to make use of, encouraging the rise of rivals similar to Solana.

In line with the platform’s official net web page, it’s “the world’s quickest blockchain in addition to the quickest rising cryptocurrency ecosystem, with dozens of initiatives spanning DeFi, Web3, NFTs, and extra.” It’s not solely quick, however its regular bills are often lower than $0.00025.

What’s the goal of the SOL coin?

Solana runs by itself cryptocurrency. Contained in the Solana community, SOL is used for staking in addition to to pay processing charges and any transactions.

In line with statistics, the full amount of SOL tokens exceeded 510 million on the time of publishing this text, together with over 357 million cash in circulation.

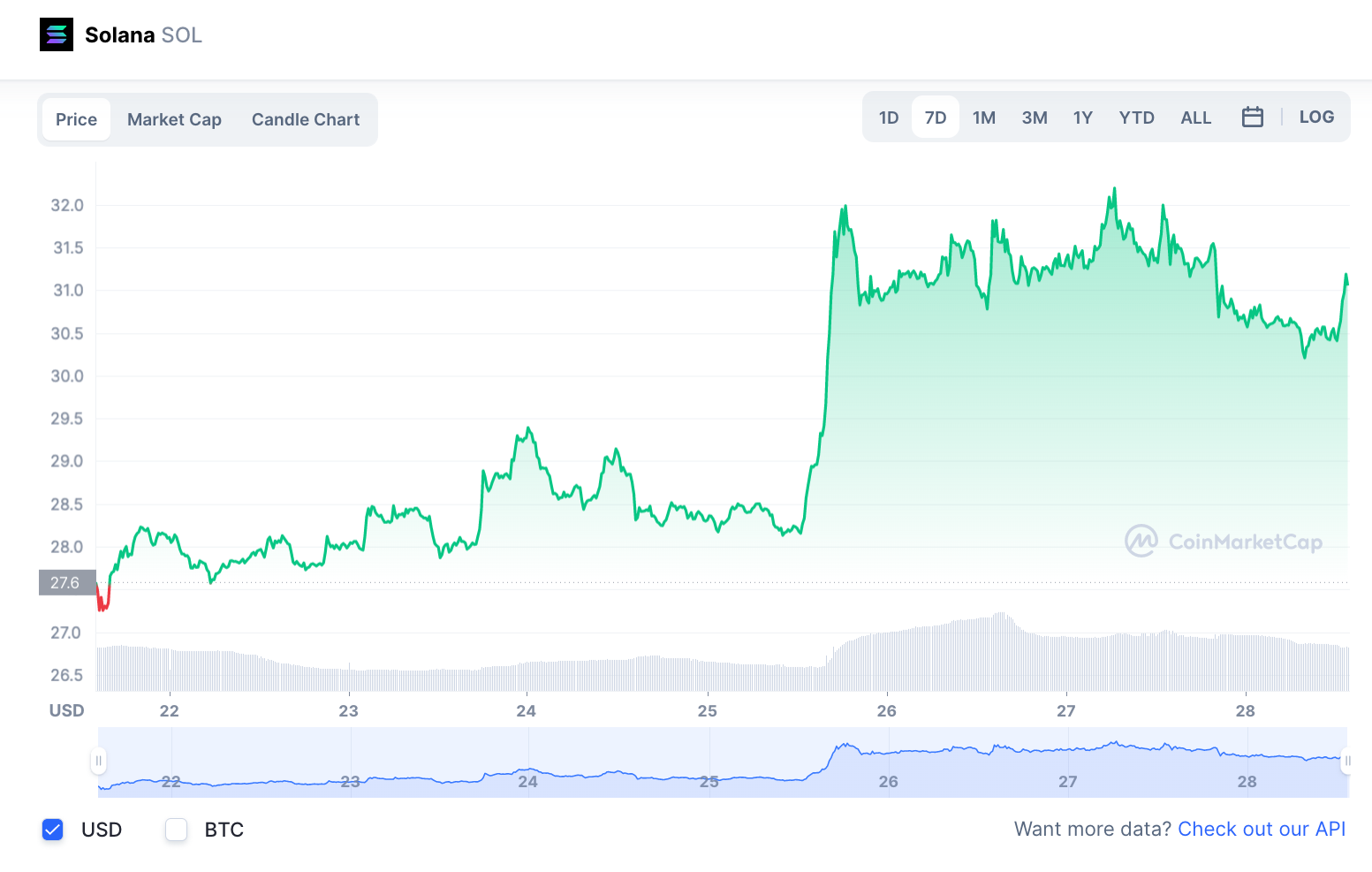

With the cryptocurrency buying and selling at little greater than $28, SOL had a market worth of greater than $11 billion, rating this the ninth largest cryptocurrency, trailing Cardano (ADA) & Ripple (XRP) (XRP).

Solana’s Worth Forecast for 2022-2030

As of October 27, 2022, CoinCodex’s elementary SOL coin analysis was bearish. In line with the location’s transient SOL crypto value projection, the coin might need dropped by 8% reaching $28.98 beside November 26.

What’s the future potential for the SOL coin? WalletInvestor, an algorithm-based forecasting software, painted one other bleak picture in its Solana value estimate for 2022. The coin was anticipated to fall under $2.97 in a 12 months, in accordance with the web site. It was additionally predicted that it’s going to plummet beneath $0.50 by the shut of 2027.

Solana cryptocurrency value prediction from DigitalCoinPrice stays optimistic. Primarily based on previous developments, the crypto knowledge firm predicted that the Solana value may attain $51.21 by 2023, rising above $32.17 in 2022. Its Solana value forecast for 2030 had the foreign money rise to $174.30.

CoinPriceForecast’s Solana coin value estimate was likewise optimistic, albeit with a a lot shallower rising trajectory. In line with the forecast, the coin could be value $39.66 even by finish of 2022. In line with the location’s Solana value forecast for 2025, the worth might need dropped to $38.81 even by the shut of the 12 months.

In 2022, the common value, in accordance with PricePrediction’s SOL value projection, could be $35.40. Primarily based on its AI- powered scientific investigations, the location’s Solana value estimate for 2030 stated that the worth may then speed up to $752.18.

What to contemplate whereas investing

When looking for SOL token value predictions, consider that cryptocurrencies are nonetheless extremely unpredictable, making it difficult to anticipate what a coin’s value will likely be inside a number of hours, a lot alone a long-term objective value. In consequence, each specialists and algorithmic predictions can and do make errors.

Should you’re pondering buying cryptocurrency cash or tokens, you need to persistently accomplish your personal analysis. Consider probably the most newest market dynamics, statistics, elementary and technical evaluation, and knowledgeable opinions earlier than making any buying and selling choices. Keep in mind that previous outcomes are not any assurance of future outcomes, and simply by no means commerce utilizing funds you can’t danger dropping.

SOL in Information Currently

SOL has recently struggled because of a large assault on a Solana-based mortgage system. $100 million was stolen from the DeFi community Mango Markets by a hacker, who’s now retaining it hostage till the protocol settles the dangerous debt.

Its whole worth locked (TVL) on the Solana community has dropped for the reason that Mango Markets breach. It fell from $1.32 billion on October 10 to $862 million three days later.

This revelation comes after one other community breakdown, making it a tough month for Ethereum’s opponent. As acknowledged by the Solana validator stakewiz.com, the community fell down on October 1 as a consequence of a “misconfigured node.”

In line with a lately up to date survey, 33% of an advisory group had misplaced religion within the blockchain because of these community disruptions. One other 30% of these polled had been uncertain.

This has resulted in destructive pricing motion for SOL this month. It was valued at $31.48 as of October 27, dropping 9% from the earlier month.

SOL, alternatively, had risen within the quick time period, rising 7% within the previous seven days. This got here after it was revealed that Tulip & UXD, two protocols affected extra by the Mango Markets breach, had obtained their lacking cash and had been up and working.

Learn Extra:

- Early Stage Presale Dwell Now

- Doxxed Skilled Staff

- Use Instances in Business – Offset Carbon Footprint

Be part of Our Telegram channel to remain updated on breaking information protection