There are dozens of technical indicators for Foreign currency trading which will assist establish market tendencies, level to approaching reversals and decide oversold or overbought ranges. Having this info could also be important for making buying and selling selections. So it’s crucial to choose the simplest Foreign currency trading indicators for optimum outcomes.

On this article, we’ll check out 4 fashionable technical indicators for Foreign currency trading and doable mixtures. By studying about these instruments and testing them, you possibly can choose probably the most appropriate devices in your buying and selling strategy.

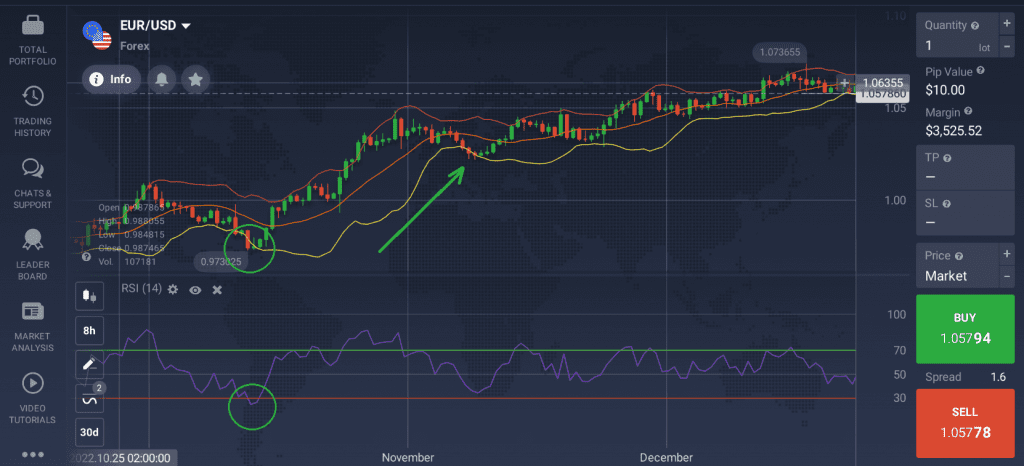

The Transferring Common

The Transferring Common is an easy device that many merchants use of their technical evaluation for Foreign exchange market. It’s a trend-following indicator. The principle objective of the Transferring Common is to decide the pattern route (upward or downward).

✍️

When the worth chart crosses the Transferring Common line from under, it might level to an upward pattern. Quite the opposite, if the worth chart crosses the Transferring Common line from above, it’d point out a downward pattern.

The Transferring Common could also be used by itself and together with most sorts of technical indicators for Foreign currency trading.

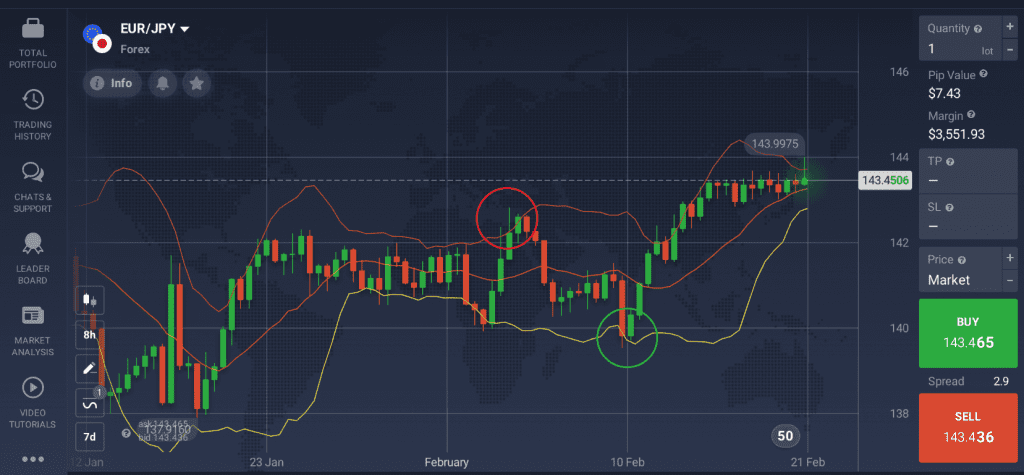

Bollinger Bands

The Bollinger Bands indicator consists of three strains: a easy Transferring Common (orange) and a pair of bands (purple and yellow) that seem above and under the Transferring Common line. Its goal is to decide the overbought and oversold ranges, which can point out an upcoming pattern reversal.

✍️

If the worth chart reaches the highest band, it might point out that the asset is overbought. This can be adopted by downward motion.

Conversely, if the worth chart will get nearer to the decrease band and touches it, this would possibly counsel that the asset is oversold. On this case, the worth might flip upward.

A pattern reversal might happen when the candlesticks of the worth chart cross the Transferring Common line.

The Bollinger Bands will not be the simplest Foreign currency trading indicator if utilized by itself, however it is perhaps fairly helpful mixed with different instruments, such because the RSI.

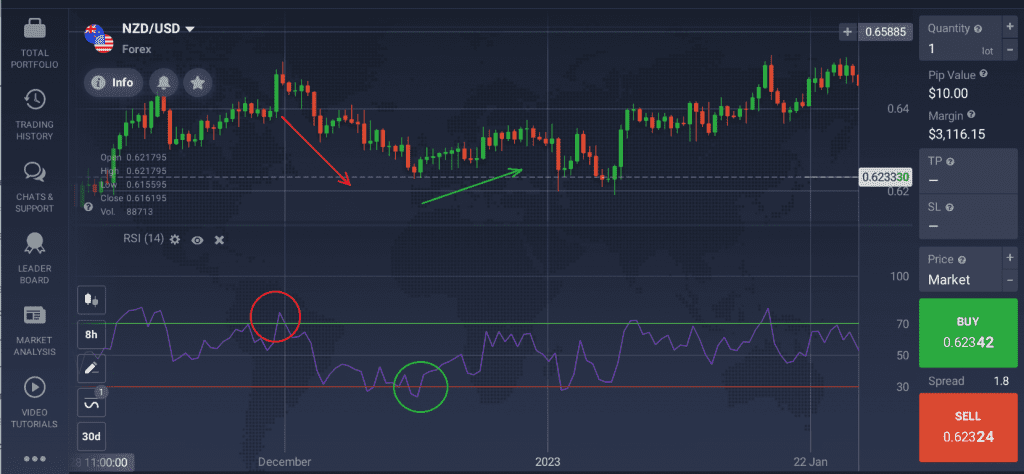

The Relative Power Indicator (RSI)

The RSI is an oscillator which may assist merchants asses the pattern power and spot potential reversals. It strikes on a scale from 0 to 100, offering details about the overbought and oversold ranges.

✍️

The asset could also be thought-about overbought, if the RSI bottom line strikes above 70. At this level, merchants would possibly anticipate a bearish pattern to observe, with the worth happening.

Quite the opposite, every time the RSI line crosses 30, the asset is perhaps seen as oversold. That’s when merchants might anticipate a reversal to a bullish pattern.

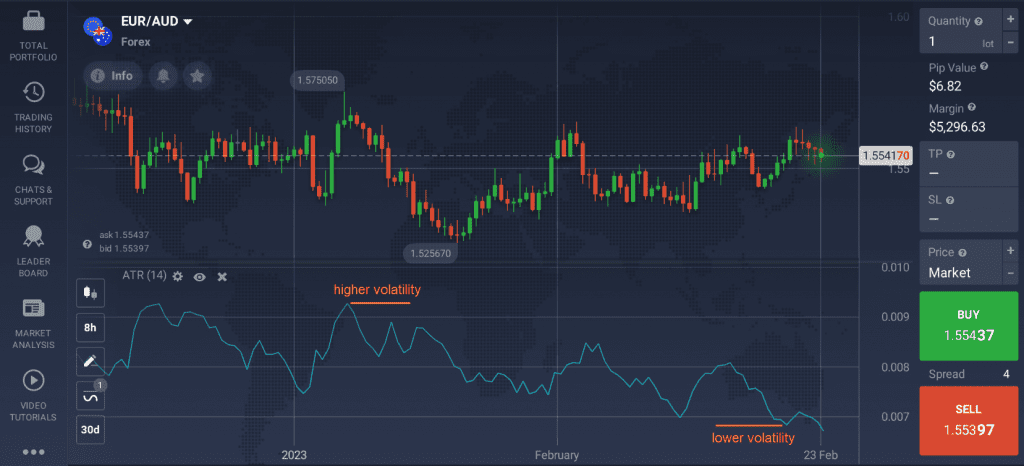

The Common True Vary (ATR)

The ATR indicator is an efficient device generally utilized in technical evaluation for Foreign exchange market. It could help merchants in measuring market volatility – an necessary consider figuring out whether or not the present pattern will proceed.

✍️

When market volatility is rising, the ATR line goes up. As worth adjustments following greater volatility might supply new buying and selling alternatives, some merchants would possibly see this second as such a possibility.

If market exercise is reducing, the ATR line will go down accordingly. As soon as merchants be taught to evaluate the market volatility, they are able to select the optimum entry and exit factors.

Parabolic SAR

This indicator’s primary goal is to assist decide the pattern route and level to potential reversals. It’s displayed on the worth chart as a collection of dots under or above it.

✍️

If the Parabolic SAR dots are above the worth chart, it might point out a following bearish pattern. As soon as the dots transfer under the chart, an upcoming bullish pattern is perhaps anticipated. Having this info might supply some insights into belongings’ worth actions and level to buying and selling alternatives.

The Parabolic SAR might also supply extra insights into Foreign exchange market exercise when utilized in mixture with different indicators, such because the Transferring Common.

Easy methods to Mix Finest Technical Indicators for Foreign exchange Buying and selling?

There are fairly a couple of Foreign exchange indicators that work properly collectively. Making use of a number of instruments on the identical time might supply extra accuracy and supply extra details about asset costs. Right here is an instance of a preferred Foreign exchange indicator combo.

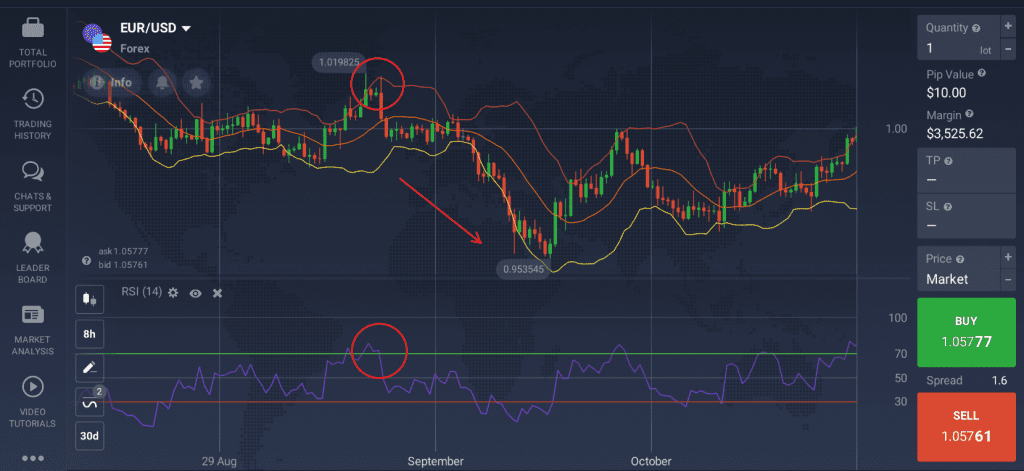

RSI + Bollinger Bands

Combining these 2 technical indicators would possibly assist merchants discover the suitable second to open an extended (BUY) or a brief (SELL) place relying on their desire.

If the worth chart crosses the decrease line of the Bollinger bands, whereas the RSI crosses the oversold degree and strikes upward, it might point out a bullish pattern.

As soon as the candlesticks attain the highest line of the Bollinger bands with the RSI on the overbought degree, it’d sign a bearish pattern.

Take into account that no technical indicator for Foreign currency trading or their mixtures can supply 100% correct outcomes, so be sure to use the suitable Cease-Loss and Take-Revenue ranges to handle your trades.

Publish Views: 1