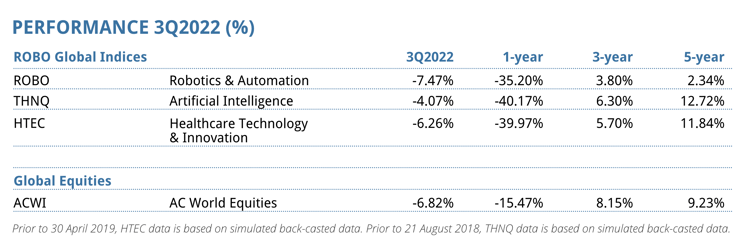

The ROBO World indices declined in keeping with international equities in Q3 within the face of excessive inflation and jumbo price hikes to finish the quarter 42%-50% under their all-time highs in 2021. The Robotics & Automation Index (ticker: ROBO) misplaced 7%, the Synthetic Intelligence Index (ticker: THNQ) dropped 4%, and the Healthcare Expertise & Innovation Index (ticker: HTEC) declined 6%. Valuations have compressed properly under long-term historic averages. On this report, we talk about main developments and massive movers throughout our portfolios.

Webinar Transcript:

Jeremie Capron:

Hiya everybody and welcome to ROBO World’s October 2022 investor name. My title is Jeremie Capron, I am the director of analysis and I am speaking to you from New York. And with me at this time my colleagues Invoice Studebaker and Zeno Mercer. We’ll begin with a quick reminder of what we do at ROBO World after which we’ll share some ideas about what’s taking place within the markets. After which we’ll take a better have a look at every of the three index portfolios, ROBO, THNQ and HTEC. And naturally we’ll be taking your questions, so be at liberty to kind them into the Q and A field on the backside of your display.

So let me begin with this fast overview of ROBO World. We’re analysis and funding advisory firm that is centered on robotics, AI and healthcare applied sciences. And we handle three major index portfolios which are tracked by almost $3 billion in property. These are primarily in ETFs. And our first index portfolio is ROBO, that was the primary robotics and automation index and it began virtually 9 years in the past in 2013. And the second is THNQ, T-H-N-Q, that’s the synthetic intelligence index. And the third one is HTEC, the healthcare know-how and innovation index. And you may see right here the annualized returns since inception of every index as of the tip of September, 2022.

So these portfolios, they mix analysis with the advantages of index investing within the ETF wrapper. They’re composed of greatest in school firms from all world wide. The small, mid and enormous caps that we analysis and we rating on varied metrics, and the best scoring shares make it into the portfolios. Then we rebalance each quarter and the result’s portfolios which have a really low overlap with broad fairness indices like DSNP 500 or the NASDAQ and different international fairness indices.

Okay, so let’s discuss what we’re seeing within the markets. And the elephant within the room right here is that the world’s greatest firms on the forefront of robotics, of AI, of healthcare know-how as represented by the ROBO international indices, they’re now buying and selling 40 to 50% under their 2021 highs. Sure, a whole lot of shares are on sale proper now. World equities are down greater than 25% this yr, however these should not your common shares right here. Once more, we’re speaking concerning the know-how and market leaders. They’re firms which are usually very worthwhile and rising a lot quicker than the financial system. In reality, once we have a look at their stability sheets, we discover {that a} majority of the businesses within the ROBO, the AI and the healthcare tech index, they’ve additional cash than debt. And they also have a constructive internet money place.

And extra importantly, many of those firms are relative beneficiaries of the present surroundings. When you consider the issues that we face at this time within the international financial system, we’ve the labor shortages, we’ve rising prices throughout the board. The one clear and simple response from enterprise leaders is automation and enterprise leaders and firms are making it a prime precedence. In reality, and Invoice will come again to that shortly, demand for automation at this time is at document highs and rising and there may be extra demand for robots and automation that suppliers can provide.

And on the similar time, this down market in equities, we consider is giving buyers a possibility to spend money on these firms at a reduction. In reality, the three portfolios are actually buying and selling considerably under historic common valuations and we’ll come again to that. So let us take a look at robotics and automation first, and for that I will move it on to Invoice Studebaker.

Invoice Studebaker:

Good morning everybody. Thanks for the time and curiosity. Jeremie, thanks for the introduction. Simply to observe up on Jeremie’s feedback, we definitely know that the third quarter was a tough interval for buyers. And September was a robust illustration of simply how tough it may be to be centered on the long term horizons, significantly when the market is continually being tripped up by a confluence of points and occasions. And we perceive that these are difficult instances. Similtaneously Jeremie commented, the down market is giving buyers actually a welcome alternative to reap the benefits of deep reductions and spend money on firms that we see they’re delivering on the required automation applied sciences.

And we consider, as Jeremie additionally commented, that this has created an surroundings, it is sort of an ideal storm for buyers, to extend publicity to a supercycle for automation and demand for automation applied sciences, as I will remark shortly in additional element, has by no means been greater and the problems which are reducing fairness costs that we’re all considerably aware of, the labor shortages, the compressed margins, the provision chain bottlenecks and the necessity to scale back working prices are considerably rising the necessity for adoption. And as we doubtlessly go right into a recessionary surroundings, we expect companies are going to be very eager to need to spend on effectivity and automation.

As you’ll be able to see for the quarter, the ROBO index declined about 7%, which is an identical decline for international equities, which has resulted in valuations which have compressed properly under our historic averages. And the broad weak point was represented in 10 of our 11 sub sectors that we invested that had proven losses. And importantly although, as we glance into the fourth quarter past, we see an ideal alternative for buyers to sharpen their pencil and add to this, what we consider, is inevitable automation theme. That is on sale like a lot of the market.

And we see an enormous discrepancy as the place inventory costs are, inventory costs are 40, 50% off their all time highs regardless of the sturdy fundamentals of automation that we’ll contact on shortly. And lots of of our constituents actually are firing on all cylinders and may’t make sufficient to fulfill the demand. As you’ll be able to see right here on the valuations, the PE is 12% cheaper than our historic common. And I do need to underscore that our valuation relies on PE, many different tech exposures are primarily based on worth of gross sales, and in lots of circumstances are arguably over owned and overvalued. I do need to make the remark that lower than 3% of ROBO is within the S&P 500. So it is a distinctive publicity that also may be very beneath owned and underappreciated by a lot of the market and we expect that is a chance.

Subsequent slide please. So from an EV to gross sales standpoint, you’ll be able to see that we’re buying and selling fairly near parity to historic valuations. So ROBO is buying and selling round 2.7 instances EV to gross sales. Once more, the context of the place know-how trades, I imply, Adobe simply made a purchase order of an AI asset for 40 instances trailing EV to gross sales. In order that hopefully offers you some context that I’d not say that we’re hardly overvalued. Particularly, I believe our valuation of our portfolio has advanced fairly considerably through the years and has turn into a lot growthier, in order that’s sort of skewed the valuation of the upside. So I’d argue that even at 2.7 instances relative to the previous, our valuation is fairly low cost.

And simply as a construct on to that, what we have seen right here available in the market, we have had three consecutive quarter declines within the ROBO index and that is actually sort of an unprecedented growth since we launched the index again in 2013. And it is solely akin to the again check going again to ’08, ’09. And importantly although, earnings estimates, I do know that that is possibly sort of the elephant within the room, that individuals assume the earnings estimates are going to come back down dramatically. We definitely haven’t seen that but. For 2022 and 2023, earnings estimates have solely been minimize by about one to three% of the final three months and simply 6% over the past yr. And this I believe is a mirrored image of the power and demand for automation applied sciences and options.

And actually importantly, the flexibility for ROBO firms to deal with rising prices and provide chain challenges. Many of those firms have been round for a few years and have had the talent set to adapt to and handle completely different financial environments and to have the ability to move on and costs. And I believe importantly, the income estimates have seen really constructive upgrades over the past three and 12 months and level to a few 12% gross sales progress for 2022 and about 9% for 2023. Though the market is skeptical that estimates will not come beneath extra strain, that up to now has been the report card.

Subsequent slide please. In order Jeremy sort of alluded to, ROBO is designed to be diversified, it is designed to be invested in the very best of breed know-how firms globally throughout the ecosystem of the know-how. So what makes the robotic or automation work? After which the purposes, the place is automation being deployed? Sadly, this drawdown, as everyone knows, has been considerably violent and excessive and has resulted in probably the most vital drawdown we have seen. Even if 50% of the portfolio has what we see as an actual worth, that being uncovered to industrial automation, logistics automation, healthcare. To not point out, as Jeremie alluded to, that roughly round 60% of portfolio has a internet money place and no debt. So these firms are properly positioned to climate the storm, like they did throughout Covid.

And this trade is importantly traditionally grown the highest line two to 3 instances that of the market and we count on that to proceed. To not point out yr so far, FX has been about an 800 foundation level headwind and the transfer within the greenback actually has been considerably parabolic and we expect there may be prone to be a reversion of imply and there may very well be a good tailwind as we start to maneuver into 2023 and past.

By way of the massive inventory strikes, we have had a pair fortunes to the upside, not sufficient after all, iRobot was up 57% within the quarter, as a lot of you might be conscious, they’re a frontrunner in client robotics and so they agreed to be acquired by Amazon in an all money transaction for 1.7 billion. This does importantly symbolize the twenty eighth takeout since we launched ROBO again in 2013. And whereas we won’t forecast what the MA surroundings’s going to appear like, a lot of our firms are, once more, leaders of their trade. And as asset costs come down, we expect that they definitely turn into extra favorable within the eyes of strategic and monetary consumers.

Luminar Expertise additionally had an honest transfer to the upside. They’re a frontrunner in lidar know-how for automobiles and vans. The inventory was, I believe the efficiency was considerably supported by the conviction of insiders. The CEO did buy upwards of $6 million within the quarter. However importantly what’s actually shifting the inventory is their industrial success with bulletins. They introduced partnerships with Mercedes and Nissan, which intend to combine their know-how in most of their autos by 2023, or I am sorry, 2030. So we do count on to see extra progress right here on the industrial entrance.

Then by way of the sectors that we actually stay extremely convicted on, one space to spotlight is industrial automation. And an earlier touch upon that Jeremie additionally did is that industrial automation actually is firing on all cylinders to fulfill demand. And Yaskawa, which is a big industrial robotic producer, simply introduced just lately that their orders have been up 34% yr over yr. Fanuc, which is the biggest industrial robotic producer, has been fairly vocal about their backlog, which now could be in extra of 1 yr. Importantly, Teradyne, which additionally performs a key function in industrial automation, has final quarter talked about their industrial automation progress was up 29% yr over yr. We count on that to proceed once they announce their outcomes quickly. They’re one of many largest producers of collaborative robots via their buy of Common Robots, which is a Dutch firm. That enterprise has additionally actually been firing on all cylinders. That enterprise final quarter noticed robotic gross sales really up 30% on a 55% comp.

So enterprise actually stays fairly robust and wholesome. These asset costs are definitely fairly fascinating for buyers to check out. And general, for those who have a look at robotic density, and in order that’s trying on the variety of robotic installations per 100 individuals, consider it or not, the worldwide common is only one.2 robots per 100 staff. And so we’ve an extended method to go by way of the place penetration charges are going. Simply to place that in context, the US has roughly 2.5 robots per 100 staff. China can be 2.5, however they’ve grown from 0.5 to 2.5 in 5 years. So fairly superb progress there. Japan’s about 4, Germany’s 4 and Korea is 9.

So this all is within the context of a world surroundings the place international manufacturing employs about 500 million individuals globally. So if robots are stealing our jobs, they are not doing an excellent job of it and we expect there may be vital progress within the years forward. That is it for my ready marks. I suppose I will move it on to-

Moderator:

Thanks Invoice. Hey Invoice, earlier than we transfer on, we’ve a selected query to ROBO from the viewers round why we embrace Nvidia however not Micron or Intel or STM. May you converse to that?

Zeno Mercer:

Certain. Hello. Hey everybody. Zeno right here masking THNQ at this time. And okay, might you repeat that query? It was round possession?

Moderator:

Sure. In order that they’re asking within the ROBO Index, we embrace Nvidia however not Micron or Intel or STM. So might you speak concerning the distinction between ROBO and THNQ and the place these firms would fall?

Zeno Mercer:

Proper, okay. I believe the best way we have a look at it isn’t solely, sure, these are all concerned in parts of sort of trendy society, robotics, AI, however we’re searching for firms which have maybe probably the most funding or publicity to those areas. And I am really going to cowl in a video later, however I might say some issues now, at their current AI day, they’re closely invested not solely within the chips however the software program facet of issues. And at that time we contemplate them extra of an AI and robotics play. I imply, they’ve software program particularly for it and we simply have stronger conviction round it going ahead. Clearly firms like Micron are making huge investments and are necessary to society, however we’re making an attempt to get publicity to particular areas and never simply make investments on the whole firms within the house. I imply, we are able to cowl extra later after I speak extra about Nvidia for a bit.

Yeah, we are able to go to the subsequent slide. Reflecting on the quarter, the THNQ index was down 4%, really outperforming international indices and the S&P, and we’re down 47% since November 2021 excessive. So the AI house has been underperforming even whereas fundamentals have been enhancing in some ways. And I will get to that. From a valuation standpoint, Ford EV gross sales are persevering with downward and so they’re really on the quarter finish, they’re at 4.6, which is under March 2020 lows. Even whereas adoption progress, digitization and lots of huge developments and tailwinds are coming, not solely now however 2023 and past. And we’ll cowl that. And among the huge issues that occurred is we had earnings deceleration this yr all the way down to 11.2%. So general our firms grew, however this was down from 27.9% in 2021. Clearly it was a really huge yr for income.

And the present forecast proper now could be a stronger rebound again within the low twenties for 2023, 2024. So proper now, I imply, this has been a tough yr. Individuals have been sort of reorganizing and determining what strikes they will make, however sure areas of the financial system are seeing and have huge backing for continued funding over the subsequent a number of years and quarters. So I believe it is necessary to assume and know that AI is turning into an rising proportion of company authorities spend and it is also an enabler of GDP progress and price financial savings. So there’s each progress facets and deflationary facets which are concerned right here and we’ll cowl that.

Subsequent slide. Yeah, so we really had, regardless of the index being down, we had outperformance, we had 79% beat prime line expectations and 85% beat earnings. And I believe round 87% are anticipated to be worthwhile subsequent yr. So for those who’re eager about these firms, we’ve excessive pricing energy, they’re essential gamers to the financial system, whether or not it is funding spend from the Fortune 500 trying to digitize their merchandise or make new merchandise and even simply discover price financial savings throughout provide chain, operations, issues like that. And even simply utilizing AI as a core product and to extend the product growth, whether or not actual world world merchandise or digital merchandise, options. So there’s developer operations, cybersecurity, numerous angles there.

Many firms even have raised steerage within the index similar to Samsara, which really raised 3 times this yr regardless of their very own provide chain issues. That is prime line and backside line. From huge information and analytics, we really noticed a standout from firms like Alter X, which is seeing 50% yr over yr progress and 90% gross margins. And regardless of everybody being afraid of, oh, what is going on to occur with spend, and the place cash goes is shifting this yr, I believe we’re all seeing that. And Alter X is seeing their largest pipeline in historical past for digitization automation of bringing in information and determining what to do with it and discovering methods to streamline capabilities with elevated labor price, inflation.

So these firms present very excessive ROI and that is why once we’re setting up and reevaluating the index and rebalances, we’re taking a look at what firms are enablers proper now. And that is each the infrastructure facet and the precise utility facet which are really getting used at this time. It is the provision and demand. And also you would not construct semi chips, there is not a cause, and I will get to this subsequent, concerning the CHIPS Act, if there weren’t an necessary side coming down the road for that. And most of these chips, the chips being produced there aren’t going to be coming on-line till 2025 and past.

So we are able to really go to the subsequent slide now. I suppose I already coated the outperformance right here, however it was, regardless of points within the financial system, it was a really robust quarter and we noticed fairly stable reassuring steerage from many areas. I believe one of the troubled areas is on client, regardless that our client index or the buyer sub sector and e-commerce have been the very best performing this final quarter, they’d oversold in Q2.

So for those who’re sort of searching for 1 / 4, I imply you are going to have shifts there, however that is why we even have publicity and make allocations of those completely different areas. Going to speak about Semi actual fast, I believe one of many largest issues that occurred was two issues. A, we handed the CHIPS Act and we additionally had US commerce restrictions, Semi efficiency regardless of the CHIPS Act being handed, regardless of Europe additionally declaring they need to double manufacturing of Semi chip capability themselves, getting away from Asia manufacturing area, our Semi index was down 12%.

A part of it’s falling in lockstep with the financial system and every part else. A part of it’s sort of overblown fears round what’s taking place with the China commerce restrictions and likewise round client, PCs, Cellular. Apple introduced that they will not increase manufacturing of the iPhone 14. And we’ve some publicity there, however general that is PC and private. For those who’re speaking about cloud, AI, automotive and connectivity, which is the place we really attempt to allocate extra publicity to on that facet of issues, on the infrastructure facet, we’re really seeing robust demand and forecast. For example, Qualcomm, which is concerned in lots of, they’ve I believe $7 billion enterprise models. They’ve seen their automotive pipeline go from 19 billion to 40 billion in a single quarter. So the inflation discount act, all this stuff persons are making, we do not have full EVs but, at the least within the sense that they are not in every single place.

I imply, for those who have a look at proportion of autos on the highway, it is 0%, 0.001. Nonetheless, clever good autos that require extra processing, you have obtained EVs, they require extra semiconductor chips and processing connectivity and also you’re seeing a giant increase in demand spike there. So whereas we’re seeing a oversaturation in that phase, we’re seeing large progress. After which there can be one other improve cycle for wearables and issues like that, that that’ll come again on-line. Nevertheless it’s sort of smoothing out the method right here. And that additionally entails parts, sensors and pc imaginative and prescient.

By way of cloud demand, we’re seeing huge pull via nonetheless. Arista, which makes networking switches and software program for these huge cloud heart deployments from the massive tech firms and enterprise and others. They supplied very stable steerage in 2023 at their final name. So for those who’re trying via the noise and seeing what’s an indicator of issues to come back, it is continued funding on this house. And we have got a number of hundred billion greenback plus tailwinds coming via 2023 and past. And it could not be extra apparent how necessary it’s than once you get to the commerce restrictions.

However the CHIPS Act, simply to provide everybody an instance of how we have a look at the infrastructure house, they must make the semiconductors themselves, so you have got Nvidia, Intel, Samsung, gamers like that. You even have firms like LAMB Analysis and ASML, which make important parts to that. To make tiny three nanometer parts, you want very costly, very refined gear. I imply, it is among the most spectacular tech we’ve on the planet proper now. Every of those gadgets although have a few years pre-order, there is a backlog, and so they run $180 million per pop for ASML for instance, it is a Dutch primarily based firm.

As a proportion of spend, okay, as an instance there is a $50 billion Chips Act and lots of of billions coming on-line in manufacturing within the US for instance, not even speaking concerning the EU, one $17 billion plant in Texas, $10 billion of that’s going to semi manufacturing gear. So simply to provide you a scale, and I do not assume the market’s actually reflecting that, semi’s useless, lengthy stay semi, persons are like, “Oh, PC, gaming,” there’s a lot approaching board. I believe that is one thing to bear in mind once you’re sitting right here eager about what’s snug and what’s really going to get cash within the subsequent couple of years.

China restrictions, Nvidia, Nvidia’s had a tough yr, gaming’s down after which the China commerce restrictions have come on board. They are not set to start out for some time till subsequent yr, 3Q subsequent yr. And it really leaves them with some wiggle room. So it is not essentially they can not promote into China, they simply cannot promote particular chips and issues. Really rumors are saying that they are really getting a whole lot of orders and persons are stockpiling proper now. So take that as you’ll. However I believe in the end it simply exhibits how necessary these are and that there is going to be elevated emphasis and funding right here.

One other factor I wished to speak about briefly is the Tesla robotic. That was a fairly large deal for a lot of, within the sense that it introduced consideration to the house. Elon has that impact. He centered on EVs, he principally made the EV market. Robots although are already a giant market, clearly that is why you guys are all right here is making an attempt to grasp and listen to that and from our angle. So what I believe goes to occur right here is A, client robots have very low penetration. In reality, it is principally null. You do have extra automation in semi and automative and manufacturing, however it’s one other market that basically is not being appreciated is the robotic house and AI house having the ability to visualize and principally, they must function within the digital world to have the ability to function within the bodily world. That is going to take elevated computation and funding in cloud, AI, connectivity.

So I believe that is the takeaway there. I do not actually need to make a projection on when will Tesla robotic be in individuals’s houses if it should, et cetera. However I believe it is simply one thing to bear in mind.

Yeah. So talking of latest issues, we have got a brand new addition. We added CrowdStrike this quarter. So CrowdStrike for individuals who do not know, is an American cybersecurity firm that was based in 2011. That they had their first product in 2013. They have been on a roll right here. We have been watching them for a while and so they’ve actually confirmed resilient. And once we’re eager about making an addition to an index, we have a look at a lot of issues, We have a look at their market and know-how management and we additionally have a look at what are they investing in, have they got a pipeline of merchandise which are going to proceed to make them acquire market share and develop their addressable market.

Proper now they have been rising, their 5 yr progress price is 94% anticipated to hit 1.5 billion this yr and a pair of.2 billion subsequent yr. So their AI enabled cybersecurity options are trusted worldwide, with a TAM addressed estimated to be $75 billion and that is rising to 125 billion with new merchandise. They’ve a 97% retention price and so they turned worthwhile in 2021. So this is not just a few progress story. Their EPS is projected to develop 50% over the subsequent a number of years. Going again to funding, they’ve 25% of their income investing within the R&D and in merges and acquisitions. They’re making good acquisitions, they’re investing, we’re very assured that they will proceed to be a frontrunner in AI enabled cybersecurity.

At this level, I will move it on to Jeremie to debate our healthcare index.

Jeremie Capron:

Okay, thanks Zeno. So HTEC is the healthcare know-how innovation index that we launched in 2019. And in the previous couple of years we have seen the convergence of robotics, AI and life sciences that has enabled some breakthrough advances. And we consider that healthcare is the one huge financial sector that is going to be profoundly reworked by know-how over the approaching decade. And so we construct the HTEC index utilizing an identical recipe to the ROBO index. Meaning the index portfolio consists of the very best in school firms from world wide which are reworking the healthcare trade throughout 90 areas you can see on this pie chart. So there’s robotics, which is about robots within the working room, within the pharmacy, in hospitals and so forth.

And you’ve got information analytics, which is about firms utilizing software program to derive insights from the information that we now gather round sufferers. The info from medical trials, the information from medical imagery and AI is more and more utilized in diagnostics and drug analysis and automating, or it is extra about augmenting the work of clinicians, augmenting the pace and accuracy of a diagnostic. After which you have got telehealth, which is about decentralized medication, like distant physician affected person visits that we’re now all aware of, however it’s additionally about wearable gadgets for the monitoring of glucose ranges or cardiac exercise and so forth.

You’ve got genomics after all with firms offering the instruments to decode the genome and corporations creating early most cancers detection options. You’ve got firms with gene enhancing know-how and even artificial biology the place we create artificial genes. After which lastly you have got a bunch of medical and surgical devices like 3D printed implants, you have got coronary heart pumps, miniature coronary heart pumps, neurovascular instruments and so forth. So it is a fairly numerous basket of at present 78 firms, huge and small.

In reality, almost half of the businesses within the portfolio are small and mid caps, however they’ve one factor in widespread, which is know-how and market management of their respective sectors. And on the subsequent slide you’ll be able to see that the portfolio carried out very properly in 2019, 2020 and 2021 earlier than that sort of indiscriminate promoting basically minimize in half. And so the HTEC index has now declined 50% from its excessive of February 2021. And within the meantime, the income has grown by greater than 30%. So income grew by 22% final yr. And this yr we’re going to see a further 12% and subsequent yr we’re taking a look at 10% gross sales progress, 2023. So HTEC is now buying and selling on 3.9 instances ahead enterprise worth to gross sales. That is on the median for the basket. And that compares to the excessive yr of seven.2 instances and the low within the Covid lockdown panic, that was 4 instances. So we are actually under the Covid lows by way of valuations and I believe that is a extremely necessary level to bear in mind.

So I need to contact on among the firms right here so that you get a greater sense of what is within the portfolio. And I’ll begin with among the prime performers in the course of the quarter. You may see Butterfly Community’s right here, that was up over 50% prior to now three months. So Butterfly’s in our diagnostic sector and it has developed the IQ ultrasound answer, that is an ultrasound system that’s 80% cheaper than conventional gadgets. It is small, it really works with smartphones and tablets and has a software program platform that’s subscription primarily based. In order that they’re increasing entry to ultrasound primarily based analysis dramatically. And it is rising very quick, about 30% per yr, with margins above 50% on the gross stage. So Butterfly has $300 million within the financial institution, so loads of room to proceed to scale and in the end we expect it is a very seemingly acquisition goal.

After which Penumbra right here, Penumbra is an organization in our medical system sector. They’ve developed very progressive surgical devices for neuro and vascular situations. So it is about stroke remedy and eradicating clots and thrombectomy and coiling programs. And Penumbra’s tech is superior to the standard stent method, so that they’re additionally rising quick, like 15, 20% a yr. And so they have higher than anticipated margins once they reported and so they’re speaking about accelerating progress and procedures into the rest of the yr. They’re making aggressive positive aspects. Additionally they have quite a few merchandise arising over the subsequent 18 months.

And AxoGen, you’ll be able to see right here, which was up greater than 40%, that is in a regenerative medication sector. AxoGen has developed an answer to restore the bodily harm to nerves, peripheral nerves. And they also’re capable of restore feeling and performance of nerves. Principally it is a nerve graft and it is the one off the shelf human nerve allograph available on the market. And AxoGen additionally had higher than anticipated income final quarter. And the administration commented that they count on the gross sales progress to return to mid teenagers by the tip of the yr.

And eventually, I wished to the touch a bit of bit on genomics and precision medication, which collectively account for a few quarter of the portfolio. And you may see on this slide some examples of firms in HTEC, among the know-how and market leaders which are actually powering the genomics trade. And we expect genomics is totally a revolution and it is taking place now. It is a revolution as a result of genomics allows a very new method to medication and the early detection of illness. It is not solely hereditary illness but additionally persistent illness like most cancers. And since it additionally allows customized remedy, customized remedy that means individualized remedy versus the present mannequin of massive pharma the place you have got a one measurement matches all sort of molecule that price billions of {dollars} to convey to market. Right here we’re speaking about therapies which are tailor-made to the person.

And the explanation why this revolution is going on now could be as a result of we now have inexpensive gene sequencing know-how and the price of sequencing the human genome is declined dramatically from billions of {dollars} with the primary human genome mission a long time in the past to now beneath $1000. And if there’s one firm that is been main the cost by way of driving down the price of gene sequencing, that’s Illumina, which is the market chief. They’ve greater than 20,000 machines put in worldwide. They’ve greater than 75% market share globally. And final yr they grew income by 40%. And about two weeks in the past they launched the brand new NovaSeq X, which is the brand new sequencing platform that might take sequencing prices down by greater than half to just some hundred {dollars}. And the final time we noticed such a big price decline, that drove fivefold enhance available in the market measurement for genomic sequencing.

And that is what allows genomics testing. And I discussed the early detection of the ailments like most cancers. So Natera for instance, is the market chief in prenatal DNA testing. They’ve a non-invasive check for abnormalities and Natera is now pushing into most cancers screening and implant rejection testing as properly. Veracyte, that is one other firm that is reworking the diagnostic of most cancers utilizing DNA know-how. They’re working in thyroid and lungs and breast most cancers testing. They’re rising the accuracy of diagnostic and avoiding pointless surgical procedures for sufferers.

And I additionally spotlight Twist Bioscience right here. Twist is the chief in DNA writing. So it is the synthesis of genes which they do with a silicon chip to fabricate wide selection of artificial DNA at a low price. They now have 1000’s of shoppers together with pharma firms, together with analysis facilities, but additionally industrial firms, chemical firms, agricultural firms.

And eventually I need to contact on Alnylam. Alnylam is an efficient instance of precision medication and individualized remedy. They pioneered the RNA interference therapeutics, we name that RNAI. And so they simply obtained their fifth approval in lower than 4 years for the remedy of polyneuropathy illness referred to as ATTR. And this remedy that they are arising with might attain billions of {dollars} in gross sales. So once you examine that to the market cap of Alnylam at this time, there’s I believe fascinating discrepancy.

So in complete there are 18 firms in our genomics and precision medication phase and so they account for round 25% of the HTEC portfolio. And I hope you perceive that there our portfolio development course of right here is de facto about diversification, offering publicity not solely to small areas like genomics, precision medication, however to all areas of the healthcare trade the place know-how is making a distinction.

All proper, so I will pause right here. I believe we have coated a whole lot of floor, I actually need to take a few of your questions and I see we’ve a query about earnings trajectory for our portfolios. What’s the anticipated earnings progress for this yr and subsequent? And I believe we are able to begin with ROBO. I will touch upon ROBO after which Invoice and Zeno can touch upon the opposite portfolios. However basically we expect we will shut 2022 with about 15% EPS progress for ROBO. So final yr we had greater than 40% EPS progress. This yr we’re nonetheless taking a look at 15, which is considerably forward of what you’d count on for the S&P 500, significantly for those who exclude the vitality sector from the S&P 500. We’re principally taking a look at a compression in EPS for this yr for the broad market. For ROBO, it is 15%. And for subsequent yr, we’re taking a look at about the identical, so 15 to 17% is the anticipated EPS for ROBO in mixture for subsequent yr. Zeno, do you need to touch upon AI?

Zeno Mercer:

Sure, Hello. Yeah, so by way of EPS progress for the THNQ index and its members, I will sort of cut up it into utility and providers and the infrastructure part. Infrastructure has been a bit smoother this yr and we noticed 29% EPS progress in 2021, this yr we have seen and projecting for the complete yr, 22%. So a slight pull down. On the flip facet on utility and providers, we noticed 29% final yr and seven.9% this yr, with eCommerce and client being the largest laggards. However that is anticipated to rebound within the following yr respectively, client and e-commerce to 25% and 64%.

And I believe trying 2023 and past, the projections are taking a look at 11.6 this yr. General THNQ index is trying to get again into the twenties progress for EPS, so 20.4 after which even greater clip in 2024 and past. I believe among the standouts inside that will be community and safety, which is rising at 49% this yr and anticipated to nonetheless keep higher twenties, low thirties subsequent yr. So that you’re seeing some rebound in some areas and others are simply going to see continued power for EPS.

Invoice Studebaker:

Jeremie, simply to fall on to your feedback, possibly nearly revenues for ROBO, I believe importantly, that is form of the elephant within the room, everybody thinks there’s going to be a reasonably dramatic discount in estimates. Clearly we have not seen that occur. That may be a danger. Income progress ROBO is basically anticipated to be about 13% this yr and subsequent yr a bit of over 8%, which is in keeping with its historic averages. So even when there may be strain from the broader markets, we do count on our indices to typically develop two to 3 instances to that of the market, which traditionally they’ve. So we really feel fairly good about the place these companies are positioned as we go into 2023 and past.

Jeremie Capron:

Okay, thanks Invoice and Zeno. And I see we’ve a query about potential ESG points with the genome oriented firms, particularly governance issues. So right here at ROBO World, we take ESG very severely. We launched our ESG coverage in 2017, so occurring 5 years now. And we have improved the coverage constantly through the years, primarily given the pool that we had from a few of our European buyers. And so the coverage at this time is extraordinarily full and you’ll find all the main points on the web site and it is actually centered on excluding firms that fail sure requirements that we have established in keeping with the Febelfin requirements over in Europe. It is one of many strictest requirements. So we have a look at environmental efficiency, governance and social points after all. We use our personal inside analysis to judge every firm that is in our funding universe, however we additionally use exterior help from maintain analytics that helps us flag any potential points or controversies as they come up.

Now by way of query across the genome, I believe it is an space the place we’re seeing a whole lot of debate, whereas isn’t any debate is round utilizing genomics for early detection of illness as a result of the idea right here is that you’ll be able to decide up a illness earlier than it turns into an unlimited downside by way of your potential to remedy, after all, and your chance of survival, but additionally by way of the price to the healthcare system. And so there appear to be unanimous view throughout the trade and coverage makers round the truth that genomics in diagnostics is a no brainer. And so we do not count on any points there. The place some points might doubtlessly come up I believe is round gene enhancing as a result of right here we’re making modifications into the human DNA. In lots of circumstances we’re making modifications into cells in order that it will probably produce particular proteins and proteins that may assist combat in opposition to a illness.

And it’s nonetheless very early days. Immediately there isn’t any FDA authorised gene enhancing primarily based remedy. However in 2020 we noticed the primary dosing of a human affected person with such an method and we had some pretty promising outcomes with that and that is why you have seen the gene enhancing shares carry out very well in 2020 and first half of ’21. Now they’ve come down a good distance, however I believe that is the place we have to pay a bit of extra consideration.

And the final remark I’d make round that’s that clearly we have seen a change within the trajectory on the FDA by way of how briskly they have been approving gene therapies and cell therapies. So for a very long time till I would say round 2019 or so, there was reluctance by the FDA to quick monitor this analysis. However at this time it has been a transparent acceleration and whereas there’s solely a handful of gene and cell therapies authorised available in the market at this time, there is a backlog of a number of lots of of these at present in medical trials. And so we count on the raft of approvals over the subsequent a number of years.

So I will cease right here once more, if you wish to convey up any questions, please kind them into the Q and A field. There is a query concerning the autonomous system, sub sector, I believe Invoice, you may need to take that. It is at present at 0%, was once considerably greater than that, Invoice, you need to give some colour.

Invoice Studebaker:

Yeah, that is proper, it’s 0% proper now. And we did have one constituent in there, which was iRobot, clearly taken out. And simply because an organization is faraway from an index, we do not robotically simply put one thing in, as Jeremie talked about within the earlier a part of the presentation, we’re trying to establish firms that we expect are leaders of their trade, firms which have a technological mode round their enterprise, have dominant market shares. In order that’s a extremely necessary standards for what we’re searching for.

And we do count on the buyer sector to start to evolve. Clearly we’re fairly enthusiastic about Tesla’s ambitions right here and I believe as the worth factors come down, because the use circumstances broaden, I believe we will see a pure evolution within the client sector, however we’ve not had a whole lot of progress there but. With regard to your query, I suppose you have been commenting about Group Gorge and one other entity in Spain. Once more, I believe the necessary attribute about what we’re making an attempt to do at ROBO is put in leaders within the trade. Whereas these firms could have some ambitions in robotics, they’re clearly not getting there but. Group Gorge in France particularly, not solely would we query their market share in technological management, there’s a liquidity concern for firms to go in our index, they must have a minimal market cap and minimal liquidity per day. And each of these firms would fail these screens. So I do not, Jeremie, another ideas, however that is.

Jeremie Capron:

Invoice, there’s one other query about FX attribution for ROBO yr so far. I do know you touched on that earlier. Do you need to repeat that?

Invoice Studebaker:

Yeah, clearly it has been a giant headwind. It has been round 800 foundation factors since we launched yr so far, it is most likely about 12, 1300 foundation factors since we launched in 2013. So we have really absorbed that moderately properly, we definitely would hope that that will turn into a tailwind. There have been years the place FX has been a tailwind and whereas we won’t anticipate that, we definitely do not hedge for it. And we expect over time there’s a reversion in imply that usually occurs in forex markets. And on condition that the best way the index is constructed, we’re making an attempt to establish firms that we’re detached to the place they’re positioned. It simply so occurs about 45% of our index is in North America and about 55% internationally. And once more, an important attribute for us is defining who the market leaders are, trade leaders, know-how leaders, and we’re detached to what we area they’re in.

Jeremie Capron:

Okay. Now we have one final query concerning the turnover that we see within the index. I will take that. So basically the turnover comes primarily from the quarterly rebalancing. The index itself is fairly secure by way of the constituents. Now after all the weightings can change on the margin because the scoring evolves, so we rating every firm in our analysis universe and the rating drives a legibility into the portfolio and to some extent the place measurement.

Scores evolve every time the analysis crew interacts with the corporate or there is a company motion, there’s new details about market management or know-how management. Additionally the income publicity to the issues that we’re going after, the scores will transfer, however the major driver of turnover is de facto the rebalance when each quarter we return to that rating pushed weighting. And in order that drives about 25 to 35% turnover in a typical yr, so 4 rebalances per yr. However the modifications by way of constituents actually should not that significant. In reality, each quarter you will usually see one or two new inclusions or exclusions on the basket of about 80 firms. That is the place the turnover comes from.

Zeno Mercer:

I will add one thing to the THNQ index actual fast. Considering via THNQ, we’ve 71 index members and this previous quarter we had 4 takeouts, one addition. Final yr we had 5 or 6 takeouts from M&A alone. And one of many takeouts was iRobot, which was additionally within the THNQ index. There’s not that a lot overlap, however that was one, it was in AI and ROBO play. So I simply wished so as to add that we’re making strikes there. And I believe what we have thought of lots recently is simply because the entire market is down, we’re trying to verify we seize the businesses which are stable and never simply following in tandem, however we’ll be sure that they will develop market share, have invested correctly, have resilient management going ahead and to the subsequent quarter and past. So. Yeah.

Jeremie Capron:

All proper. Effectively, I believe we’re occurring the hour, so I need to thank all people for becoming a member of us at this time and remind you you can join a biweekly e-newsletter on the web site roboglobal.com, the place we share a few of our analysis and insights into firms and sectors, robotics, AI, and healthcare know-how. And we very a lot stay up for chatting with you once more sooner. Thanks.