That is an opinion editorial by Archie Chaudhury, a blockchain fanatic and former winner of high prize on the 2021 MIT Bitcoin Expo.

When Satoshi Nakamoto first revealed the Bitcoin white paper in October of 2008, the world was reeling from a monetary disaster brought on by the irresponsibility and negligence of the establishments that managed our monetary system. Hedge funds, central banks and different highly effective brokers had been all too joyful to put over-leveraged bets on the financial system, and to revenue from the financial losses incurred by the working class when these bets collapsed.

Governments, in a determined try to hold these establishments alive, spent lots of of billions of {dollars} in bailouts and different financial injections as an alternative of guaranteeing the well-being of the common citizen. Bitcoin was Satoshi Nakamoto’s reply to state-backed cash; it was a imaginative and prescient for a decentralized digital forex that would present the effectivity of on-line banking, the relative pseudonymity of bodily money, and the shortage of gold.

In contrast to earlier makes an attempt at creating digital money, Bitcoin was not backed by or managed by a singular entity or social gathering, however moderately by an nameless developer (builders?), a set of faceless discussion board guests and a small on-line group that believed in utilizing cryptographic software program for privateness and independence from authoritarian powers. Nakamoto’s final aim was to create an asset that was autonomous, decentralized and was not inclined to the greed or will of anyone particular person. October 31, the day Satoshi Nakamoto formally introduced their white paper to the Cypherpunks Mailing Checklist, has come to be referred to as “Bitcoin White Paper Day” and is widely known as a casual declaration of independence from corrupt state-backed cash, heard the world over. The aim of this text is to replicate on how far we’ve come since then, and the way a lot work stays to be completed in an effort to accomplish Nakamoto’s objectives.

The Bitcoin that we use right now is vastly completely different from the Bitcoin that Satoshi Nakamoto and his fellow contributors created within the late 2000s and early 2010s. Past the quite a few technical upgrades and laborious forks, the community itself has grown considerably, with an increasing number of folks taking the proverbial “orange capsule” and deciding to make use of bitcoin in some capability.

There may be one other manner through which Bitcoin has modified: the core community, and asset (BTC), is considered extra as a retailer of worth moderately than a platform for micropayments. Certainly, there was a big cultural schism throughout the Bitcoin group that led to this modification: the well-known, and aptly titled, “Blocksize Wars” roughly 5 years in the past led to this modification, with forks equivalent to Bitcoin Money and later Bitcoin SV being created by group members who believed in scalability over all else, and the core Bitcoin chain being upheld by members who sought to protect decentralization and to take a look at various strategies equivalent to Layer 2 cost channels to help scalability. The Lightning Community, which is the most well-liked cost channel, has slowly gained recognition, just lately reaching a capability of 5000 bitcoin.

Regardless of these adjustments, the core technological tenets espoused by Nakamoto in 2008 (Nakamoto Consensus with proof-of-work mining and a static most provide of 21 million) stay fixed. This isn’t solely due to a technological or financial purpose; in reality, it has been argued that altering Bitcoin’s underlying consensus mechanism or provide cap might result in elevated efficiency and adoption respectively. Reasonably, Bitcoin’s consistency in these areas will be attributed to the philosophy of its underlying group, who imagine strongly in shortage, safety and decentralization over all else.

In the meantime, bitcoin is being utilized by folks all over the world to stave off unruly financial situations. Bitcoin’s pure shortage makes it enticing for residents the place corruption has led to unrestricted inflation. This adoption has even led some governments, equivalent to El Salvador, to declare bitcoin a nationwide forex, a transfer that will have been unfathomable to Nakamoto and Bitcoin’s authentic contributors.

Maybe essentially the most attention-grabbing factor to take from Bitcoin’s progress over the previous couple of years is that it has occurred with out a central chief: not like various belongings which are extra akin to decentralized software program platforms, bitcoin capabilities purely as cash, with key “coverage” choices being made by a group. There is no such thing as a Bitcoin group or consultant solely accountable for selling adoption, neither is there a central “chief scientist” that has a big affect on key protocol-level choices. Whereas there are definitely main influences throughout the group, the protocol as a complete doesn’t have an organizational construction to steer both adoption or growth. In reality, Bitcoin’s lack of hierarchy ought to be a aim for different distributed ledger initiatives who, whereas maybe decentralized to a sure diploma, are nonetheless largely influenced by a singular entity or particular person.

Whereas Bitcoin has definitely grown from its humble beginnings as a white paper and a pair hundred strains of scrappy code, it nonetheless has an extended technique to go whether it is to realize the formidable objectives mentioned by Nakamoto and different early adopters of their electronic mail chains and discussion board posts. From a technical standpoint, the Bitcoin group must proceed constructing know-how that not solely permits additional scalability and safety, however maybe extra importantly, additionally helps make the community extra decentralized. Probably the most staunch mottos that Bitcoin group members have adopted is the time period “Don’t belief, confirm.” That is, after all, in reference to operating a full Bitcoin node and never counting on information from exterior third events, equivalent to node suppliers. Community optimization, rollups, and different scalability analysis has been proposed by numerous people within the Bitcoin group as a manner for the community to concurrently scale whereas reducing the associated fee it takes to run a full node. A latest report, revealed by John Mild by way of analysis funded by the Human Rights Basis, Starkware and CMS Holdings, offers extra element about rollups-related scalability analysis.

Regardless of its roots in know-how, Bitcoin has advanced through the years to turn into one thing extra: it’s now a group, a community, if you’ll, of like minded-individuals who all have some various levels of perception in a singular concept. Bitcoin is now not a software program, aware of solely builders, coders or these with a extremely technical background, and this marked shift also needs to sign further non-technical priorities for the Bitcoin group to handle over the subsequent decade.

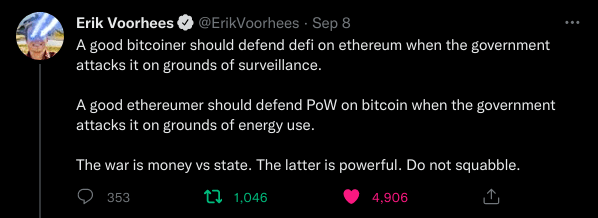

Extra effort must be spent on educating most people and making them conscious of not solely Bitcoin’s know-how, but in addition the failures of the legacy monetary techniques that they use right now. Extra effort must be spent not solely on touting bitcoin’s economics and know-how, but in addition drawing on distinctions between bitcoin and different cryptocurrency platforms. Lastly, extra effort must be made among the many cryptocurrency group as a complete to return collectively when the elemental rules that Satoshi Nakamoto and his fellow cypherpunks believed in are threatened by authoritarian governments, whatever the platform that’s being attacked.

Whereas discussions round various blockchain networks have at all times been tribalistic to a level, the latest pattern has been to advertise the success of your platform over all else, and even chide or insult platforms who face potential regulatory scrutiny. Whereas believing that bitcoin is essentially the most sound digital asset when it comes to economics/development, and stepping into arguments about mentioned perception is okay, and will even be inspired, celebrating when another platform is threatened with regulatory motion or censorship goes in opposition to what Bitcoin is basically all about.

The cypherpunks, Satoshi Nakamoto and a majority of Bitcoin’s group all imagine in the concept sooner or later, there could be a digital peer-to-peer forex utterly unbiased of any authorities, middleman or biased social gathering. Whereas we definitely have numerous disagreements in regards to the professionals and cons of our respective know-how, belong to completely different “maximalist” teams, and normally have various beliefs, all of us in the end belong to an area that was motivated by the thought of a censorship-resistant and non-partisan digital asset/community. We’d do nicely to keep in mind that elementary precept as we proceed to work on Bitcoin over the subsequent 14 years.

Tweet from Erik Vorhees on the sanctioning of Twister Money and potential BTC regulation by ESG proponents.

This can be a visitor submit by Archie Chaudhury. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.